We always advocate focusing on one's personal watch list of stocks rather than getting bogged down with news which is mostly pointless in terms of your investment/trading profits. Alternatively, some prefer to use our Focus List.

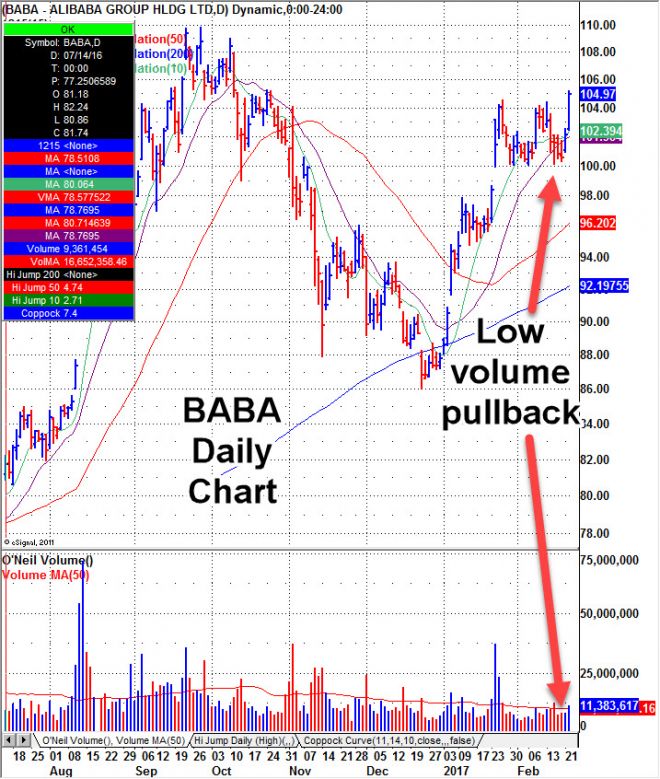

This is a list that tends to grow during market uptrends. It can, however, also grow during market pullbacks as some leading names will have constructive pullbacks to logical areas of support on lower volume such as BABA in Feb-2017:

New names are typically added on constructive pocket pivots, buyable gap ups, or low volume pullbacks (or what we call VDU or 'voodoo' set ups). If either are extended relative to the stock's chart, as a general rule, we advise members to wait for pullbacks so their entry points will carry less risk. Of course, some prefer to buy on strength and don't mind paying a higher price knowing their risk will also be elevated. The upside to such tactics is one avoids missing out on a stock that cannot wait to move higher. That said:

**All investors should always know their exit points BEFORE buying a stock**

Risk management is the most important rule when it comes to investing. It is up to each investor to determine their 'pain points' when trading their accounts as such points are unique to each person. We have written extensively on this topic in our FAQs and reports.

Though markets have not had meaningful corrections in quite some time (as of this writing 2-22-17), our companion list to the Focus List we call the Short List can also grow during weak market rallies that occur after sharp corrections. During such periods, stocks that have had sharp corrections followed by weak rallies into logical areas of resistance can make excellent short-sale candidates. That said, we tend to focus on those short-sale candidates on a thematic basis. The shorting of stock tends to have very short holding times as stocks tend to take the stairs up but the elevator down, especially over the last few years. So for practical purposes, we tend to favor those that we believe have put in major tops such as Apple Computer (AAPL) back in 2012: https://www.marketwatch.com/story/does-apples-pe-mean-it-must-trade-higher-2012-12-13

As to our Focus List which covers the long side, it is dynamic thus changes as needed in real-time. Here is one of many examples of our Focus List which is published every weekend (typically on a four-week time delay for non-members): https://www.virtueofselfishinvesting.com/reports/view/market-lab-report-focus-list-review-for-the-week-ended-february-10-2017. As new names are added or subtracted during the week in real-time or after hours, only those stocks that make it through our rigorous screening process appear on the list. Such stocks must have reference standard risk/reward characteristics, and continue to show constructive price/volume action.

Whether you use your own list or our Focus List or both, go through your list each night, then note the stocks on the list that are at potential buy points as well as where lower risk buy points would occur on pullbacks. Raising your awareness of where these buy points are on the chart keeps you prepared to act if the stocks in question approach these specified buy levels during the trading day.

The number of stocks on our Focus List can also be used as a barometer for internal strength in the stock market. Indeed, our list grows or shrinks in real-time and correlates well with the strength or weakness in US stock markets.