by Dr. Chris Kacher

The Fed's next move

The Powell pivot begins. Dec 1: “It would be premature to … speculate on when policy might ease.” Dec 13: Rate cuts are something that “begins to come into view” and “clearly is a topic of discussion.” What a difference two weeks can make. I also found it interesting when he said, "We dont think about political events." In reality, he is frontloading a series of rate cuts before the election in November 2024 to boost the odds of a Biden victory. Every incumbent US President has won re-election 11 times out of 11 if the US economy was not in recession within two years of an upcoming election.

A number of factors have contributed to the overall bullish environment. We had a strong jobs report. Markets rallied on the news as they did the prior time when the payrolls number came in above expectations. This time, however, unemployment ticked back down to 3.7% from 3.9%. The gig economy is alive and seemingly well. Many have been seeking multiple income streams. The index of aggregate weekly payrolls for private-sector workers, which combines hiring, wages, and hours, ticked up in November as monthly wage growth firmed along w/hours worked. The index is up 5.4% over the last year, the second lowest reading in 2023 (October was +4.9%).

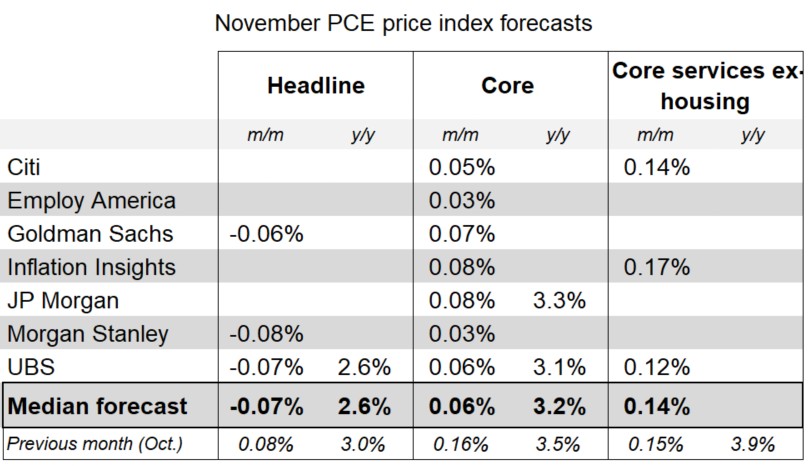

So wage inflation is moderating as are inflationary indicators including the PCE which is the Fed's preferred measure. In Wednesday's testimony, Powell said he expects core PCE YoY to come in at 3.1%, quite a bit below the consensus of 3.5%.

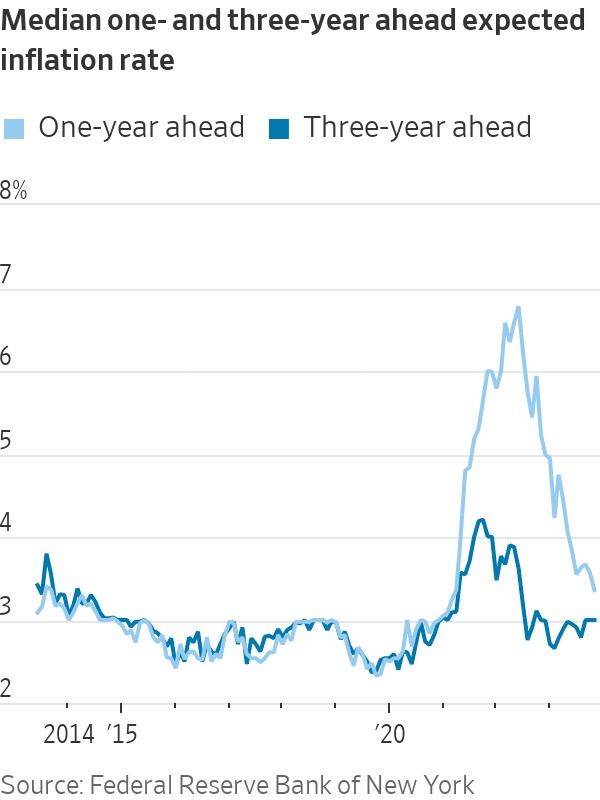

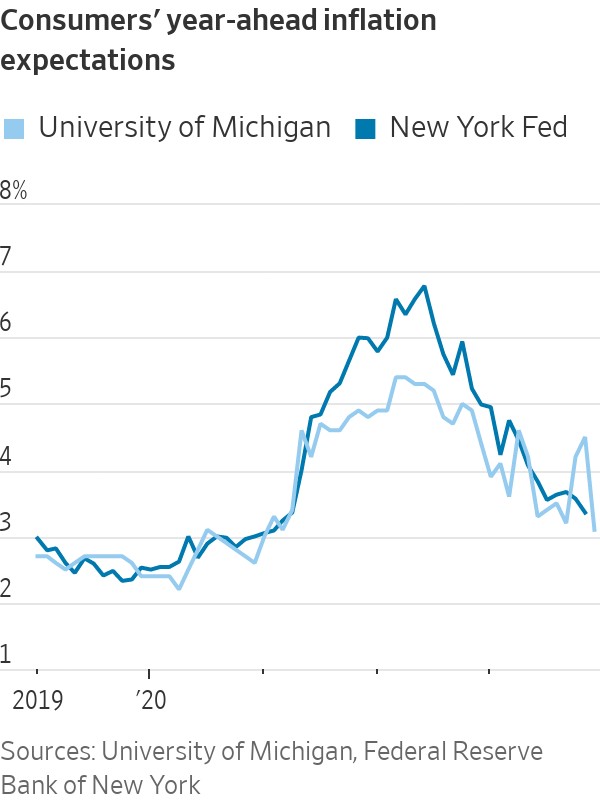

We also have year-ahead inflation expectations which declined to 3.4% last month the New York Fed's consumer survey, their lowest level in 2½ years. Three-year-ahead expectations remain at their pre-pandemic level.

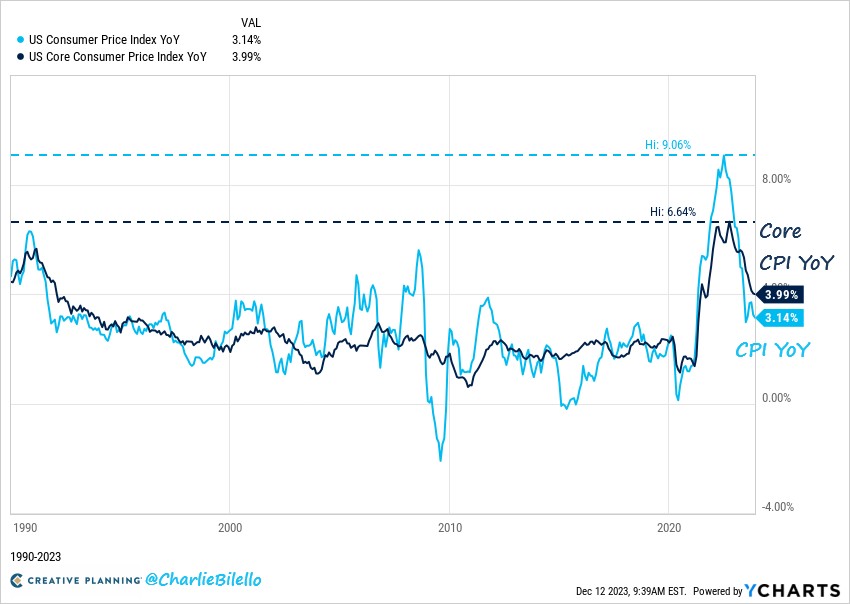

CPI came in as expected, and US Core CPI (ex-Food/Energy) moved down to 4.0% YoY, the lowest core inflation reading since September 2021.

PPI and core PPI both came in under estimates:

PPI 0.0% MoM, Exp. 0.0%

PPI Core 0.0% MoM, Exp. 0.2%

PPI 0.9% YoY, Exp. 1.0%

PPI Core 2.0% YoY, Exp. 2.2%

Based on the Nov CPI and PPI, headline PCE inflation likely declined last month. Core PCE inflation is projected to have been a very mild 0.06% in Nov. This could lower the 12-month core PCE index to 3.1%. The 6-month annualized rate would fall to 1.9%, below the Fed's target.

This all suggests Powell will be able to maintain his dovish stance on rates since he spoke in late October. CME FedWatch predictive markets suggest the first rate cut will come in March 2024 with 5 additional cuts bringing the FFR to 3.75-4.00% by Dec 2024 for a total of 6 cuts, though that runs neck-and-neck with a seventh rate cut in 2024 which would bring the terminal rate to 3.50-3.75%. Goldman Sachs predicts a terminal rate of 3.25-3.5%. The predictive markets are betting on 157 bps of ECB and 122 bps of BoE rate cuts in 2024. Of course, this is data dependent.

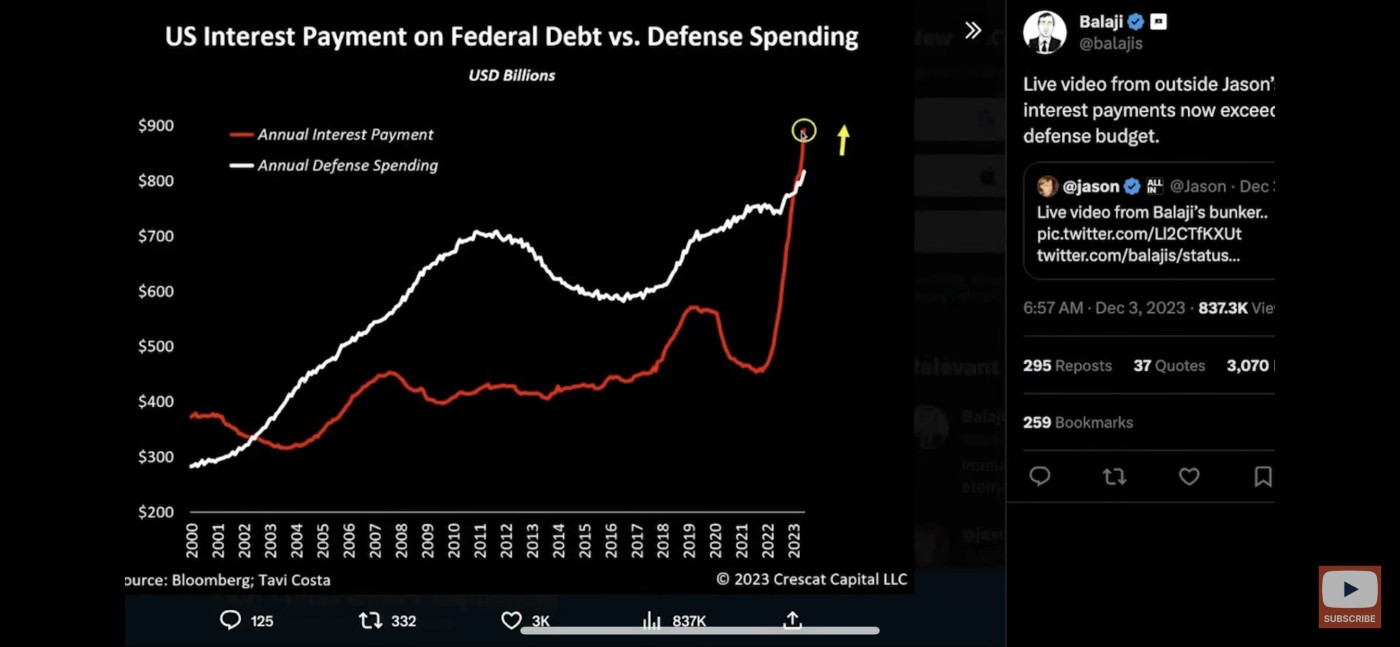

Stealth QE and global QE remain in uptrends. This is no surprise given how interest payments on record levels of debt is going vertical and surpassing annual defense spending in the US.

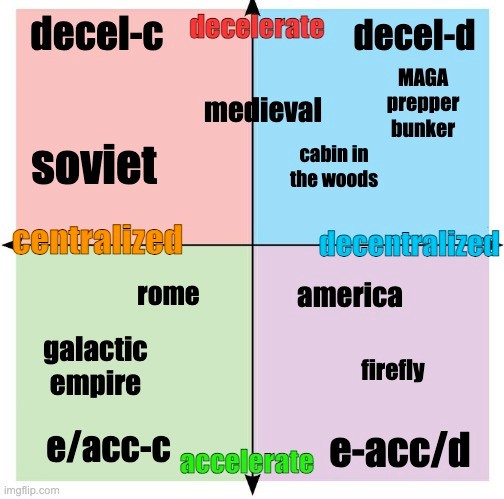

Stock and crypto markets have been rallying. Leading AI-meme stocks represented by the acronym MMANGA (Microsoft, Meta, Amazon, Nvidia, Google, and Apple) continue to show strength as they approach new all-time or 1- to 2-year highs. Of course, nothing goes up in a straight line so opportunistic trades on both the long and short side of the market should continue to present. While stocks remain deeply overvalued, there is the ExpoTech e/acc factor brought about by AI technologies which are dramatically improving the landscape. When taken together with stealth QE, this could enable stock and cryptocurrency markets to continue their uptrends.

The e/acc of AI

The combination of Web3/metaverse, AI, and blockchain technologies hold great potential to create decentralized systems that are far superior to existing centralized systems. Together, they form effective accelerationism or e/acc which is a set of ideas and practices that seek to maximize the probability of the technocapital singularity. AI and large language models (LLMs) can lead to a post-scarcity technological utopia. This concept is similar to my coining of ExpoTech (technologies growing at an exponential rate) back in 2017 when blockchain started to provide larger utility, and when AI started to gain traction in the news on almost a daily basis.

A few principal reasons are driving the rapid emergence of AI today. While computational power has been doubling every 1 to 2 years for the past 50+ years based on Moore's Law, only recently has computational power reached a level capable of efficiently running today's advanced deep learning algorithms. Further, global data has been doubling roughly every 2 years, much of which is used for training large language models (LLMs) used in generative AI.

Meanwhile, the cost of training AI systems has sharply declined by 99.5% from 2017 to 2022, making AI training massively more economically viable. In consequence, substantial capital from venture funds, corporations, and governments is being invested into the space. According to Stanford University's AI Index Report, corporations invested a staggering $190 billion in AI last year, marking a 13x increase over the past decade. PwC estimates that AI has the potential to contribute $15.7 trillion to the global economy by 2030.

For decades, AI has been steadily integrated into various sectors, from healthcare to manufacturing. However, the recent development of generative pre-trained transformers (GPTs) by OpenAI and Alphabet has truly transformed the digital landscape. This is similar to the transformative "User Interface Moment" brought about by Mosaic in 1993 and Netscape in 1994 which enabled millions to become acquainted with the internet and democratized web creation and consumption. ChatGPT has become a defining User Interface Moment for AI. Built upon OpenAI's GPT-3.5 and GPT-4 LLMs, ChatGPT has made it effortlessly intuitive for anyone to leverage the power of these advanced models. The result? A staggering 100 million users embraced it in just two months, marking a significant epoch in late 2022.

And these advancements show no signs of slowing down. As of this writing, OpenAI’s GPT-5 is on the near-term horizon, and recently, Google launched its next-generation foundation model known as Gemini. Simultaneously, new AI models like Liquid Neural Networks by liquid.ai are in development, promising substantial improvements beyond today’s generative pre-trained transformers.

Alphabet CEO Sundar Pichai said, “Artificial intelligence could have more profound implications for humanity than electricity or fire.” Indeed, by the end of this decade, companies that embrace AI utility will be light years ahead of those that dont.