Market Lab Report

by Dr. Chris Kacher

The Web3 Evolution Will Not Be Centralized™

On interest rates

The Federal Reserve minutes made it clear most Fed officials still see serious inflation risks that may require more interest rate hikes. The federal funds rate (FFR) stands at 525-550 bps. Some believe that persistent economic strength together with stubbornly high inflation from here on will force the Fed to hike rates in the coming months. Some have predicted the FFR in the 5-7% range. But unless the economy gets even stronger which is unlikely, appreciably higher rates, ie, more than one or two rate hikes, are also unlikely. Indeed, $2 trillion worth of Treasury bonds will be issued over the next two quarters. QE is endless, so interest rates will likely fall in 2024. Rates dont have to rise to attract buyers because the US is still the world's economic leader, so the Fed can just buy its own bonds via QE. When the US suffers, it will suffer less than other countries, and when it wins, it will win more than other countries.

Of course, should rates in the US appreciably rise as once predicted then retracted by Goldman Sachs, then bonds become more attractive, making equities less attractive, sparking a further selloff in the stock market. But given the recent Fitch downgrade of US credit, bonds are already more attractive than stocks. The latest PPI came in at 0.1% over estimates for both normal and core sending long bond yields higher.

Stagflation?

Stanley Druckenmiller has predicted a repeat of the stagflationary 1970s, but this is unlikely because the 1970s did not have so many exponentially growing technologies at hand. Such ExpoTech greatly boosts productivity which suggests that growth will be above expectations, though not sufficiently strong to create an even stronger economy, but perhaps an economy that does not fall into recession as quickly as some have predicted. Meanwhile, while the rate of inflation could remain stubbornly high due to certain components such as food, it is likely to continue its fall though at a slower pace. This would keep rates elevated for a prolonged period, ie, further out than the currently predicted rate reductions. At present, the CME FedWatch futures are now predicting that rates will start being reduced one Fed meeting later in May 2024 instead of in March 2024.

As for recession, unemployment remains at multi-decade lows due to technology via online employment on many levels which spurs the gig economy. This is also likely to postpone recession while making it less severe when it does hit.

Debt-to-GDP

Everything is relative. Every country is struggling more than the US. US debt-to-GDP while on the rise is still lower than a number of major countries. The US still has fuel in its tank for at least another decade before the BRICS become an issue and the dollar's sovereignty is threatened. Ray Dalio's deep study of market cycles going back hundreds of years did not take into account ExpoTech because it never existed in its current form, thus while we may be at the 11th hour in the long term debt cycle, this hour may last much longer than anyone predicts.

One caveat

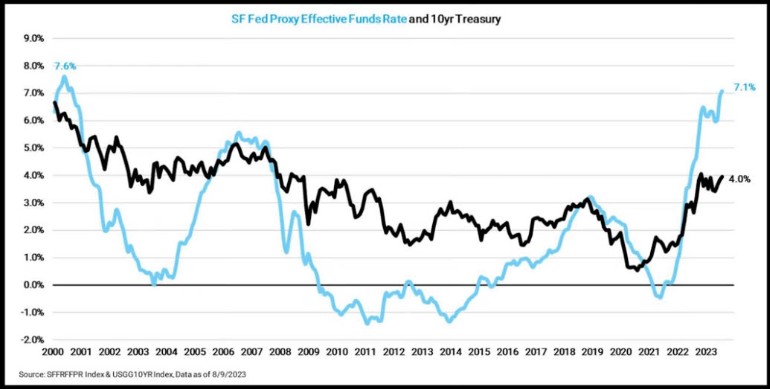

The effective funds rate is at 23 year highs far above the yield of 10y Treasurys. This can cause a credit crunch as borrowing for essentials such as auto or home loans or if one wishes to expand their business sits at this rate. CME FedWatch Futures believes the Federal Reserve will overtighten as they have done in prior cycles. The lagging effects of these high rates haven’t yet been felt, but FedWatch Futures is betting the economy will contract which will force the Fed to lower rates starting in May 2024.

Another major issue is disinflation. Air tickets are down -18% year-over-year while China recently posted actual disinflation. China reported CPI -0.3% this past week. When a major economy suffers, it impacts the global economy. With disinflation, more products are available at lower prices so companies earn less which impacts salaries.

One pernicious scenario is if inflation remains stubbornly high in sectors such as food due to supply chain issues. This would force the Fed to keep rates at elevated levels for longer than the market currently expects which will worsen the effects of recession.

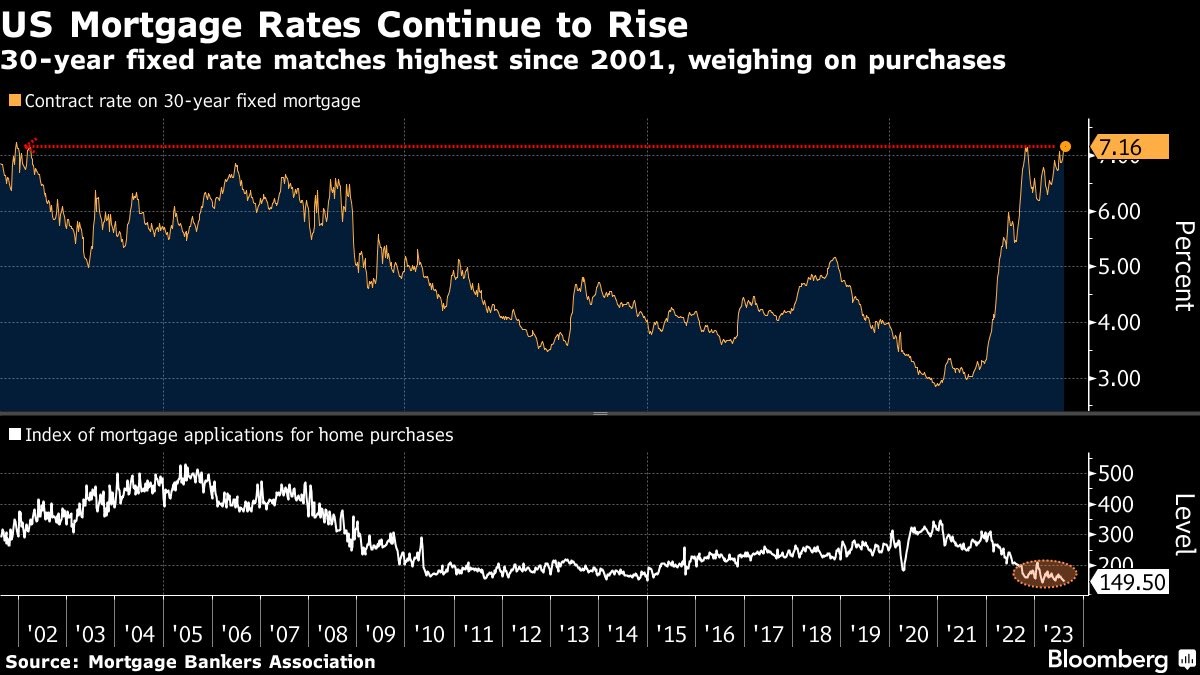

Also, US housing market rates haven’t been this high in 20+ years. Existing homeowners are unlikely to sell their home for a new one that would carry a much higher mortgage. Thus, the inventory of available homes for sale will drop. Higher long bond rates become more attractive to investors which would pressure the stock market.

This may force the Fed to cut rates sooner than later though if the economy remains strong, this probably isn’t until Q2/Q3 2024.

Markets

Major averages and AI-meme stocks continue to show distribution. The NASDAQ Composite and S&P 500 violated their respective 50dmas for the first time since March. Among the $1 T+ tech AI-meme juggernauts, MSFT and AAPL remain firmly below their 50dmas while GOOGL struggles to keep its BGU intact. Since GOOGL traded sideways to slightly below its BGU for more than 6 trading days, this is a sign of weakness. META and AMZN BGUs have been invalidated. NVDA violated its 50dma for the first time this year. It is due to report earnings on August 23.