When we created VoSI, our intention was to only provide a market timing service, which we refer to as the Market Direction Model (MDM). As we built our site, we added four other services included under the same price, with the idea that offering as much quality content as possible would create a service that is second-to-none. We have been more than pleased with the response of our members and the growth of the service since launch date. Still, having all these services brings confusion to a few.

So for added clarity, here are some basic tips:

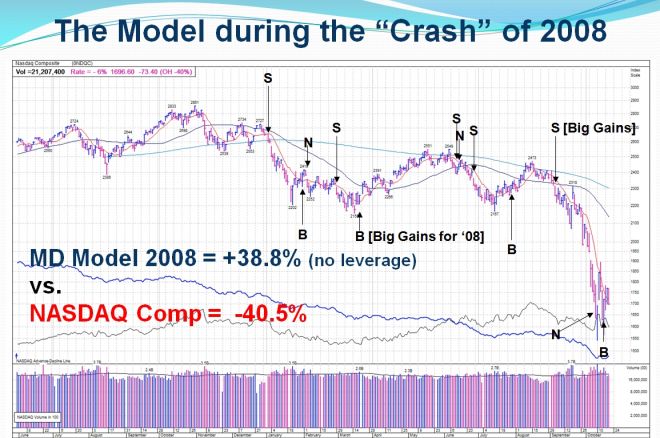

1) If you have little to no time to watch the markets, or have little experience in the stock market, the Market Direction Model (MDM) service is the most useful. If you are a conservative investor, on a buy signal, buy our recommended 1x ETF. On a sell signal, buy our recommended 1x inverse ETFs. In the figure below, a 38.8% return was achieved by using a 1x QQQQ ETF in 2008.

If you are a more aggressive investor, you could buy the 2x or even 3x ETF recommended equivalents.

If the model changes to neutral, sell your ETFs and go to cash. If the model changes to sell, sell your normal ETFs and buy the inverse ETF recommended equivalents.

Since the model only switches 12 to 20 times per year on average, your trading will be infrequent, typically 1-2 times per month, so using this service will only take a few minutes of your time each month.

For online brokerage accounts, we like Schwab even though they are not as inexpensive as deep discount brokers, but Schwab has impeccable customer service.

2) If you have a little more time such that you can read some of our reports from your favorite service, such as Pocket Pivot Review, and are able to place trades after the close or before the open, buy those stocks that are not extended beyond 1-2% above where we discuss them in our reports. In some cases, you might even be able to buy the stock cheaper than where we initially discuss it especially if the market opens lower the next day on momentary weakness. The Pocket Pivot Review offers actionable buy points for stocks you may already be following or which may be emerging leaders in their very early phases. Generally, one should use a 7-8% maximum stop-loss on any new position, and when applicable we will discuss potential guides for setting stops based on moving averages that we use when initially discussing a pocket pivot buy set-up.

3) Follow the Stock is intended to provide a real-time discussion of a stock or a small portfolio of stocks, usually 4-6, that we are following and commenting on. These are not intended necessarily as actionable ideas, although members certainly have the option of following along with the understanding that they will maintain proper stop-loss policies based on their own psychology and risk-tolerance.

If you have any questions, dont hesitate to email us.