Dr. K's Crypto-Corner

by Dr. Chris Kacher

Cryptotechnologies... Kryptonite for Governments™

Falsely Demonized Technologies: Nuclear Power

This recent well thought out essay https://www.scottadamssays.com/2019/09/23/a-message-for-children-about-climate-change/ brought me back to my days at UC Berkeley when I was working with Albert Ghiorso, Nobel Laureate Glenn Seaborg, and other notables at the 88" Cyclotron and the superHILAC at Lawrence Berkeley National Laboratory. Back then, even though we were involved in basic heavy element research and the first to create an atom of element 110 (Darmstadtium) and confirm element 106 which we named Seaborgium, there nevertheless was cultural backlash on us even though we were not involved in the nuclear power industry.

People have a tendency to lump in anything involving nuclear energy as bad. That said, the negative press surrounding nuclear power since the days of Three Mile Island has just been plain wrong. Thorium-based nuclear power reactors remain one of the cleanest and safest sources of energy because the reaction can easily be stopped and because the operation does not have to take place under extreme pressures. Compared to uranium reactors, thorium reactors produce far less waste and the waste that is generated is much less radioactive and much shorter-lived. Indeed, when it comes to falsely demonizing a technology, underhanded motivations lurk down the rabbit holes which aren't just deep but often multidimensional.

In an interview I gave just after the Fukushima nuclear reactor disaster, the number of listeners was north of 12 million. I was interviewed by George Noory who is the most widely syndicated radio talk show host. This was the second time I was interviewed by him. I was one of the few people who had a deep understanding of nuclear science having received a Ph.D. in nuclear physics from UC Berkeley as well as having 20+ years of experience in the world of finance and investments having been market legend William O'Neil's top performing portfolio manager and market analyst. In the interview, I cited a nuclear engineer from UC Berkeley who said the current high levels of radiation are "unlikely to be a long term health hazard, because these levels will drop." On the dangers of nuclear power, all of the plants around the world constitute about 20,000 cumulative years of operation while there have only been three nuclear reactor related accidents in the entire time nuclear reactors have existed. No one has died from nuclear power plants over the last 20 years. A 2012 United Nations committee report stated that none of the six Fukushima workers who had died since the tsunami had died from radiation exposure. Meanwhile, coal power plants are the "silent killer" because they affect the health of millions, but take years for their effects to become apparent. Moreover, nuclear energy has zero carbon emissions so it addresses climate change.

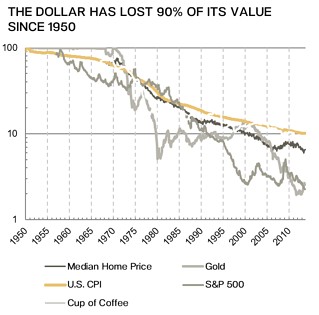

Falsely Demonized Technologies: Bitcoin

Today, we have the demonization of bitcoin's energy consumption, but this is a wrongheaded, short-sighted view also fueled by leftist motives. In 1971, the U.S. dollar held the title as the world's reserve currency. President Nixon then decoupled the dollar from gold. The U.S. could now print more money without limits for profit while other nations were indirectly penalized by an indirect taxation through dilution of total fiat, after all, most everything is interconnected, especially when it comes to currencies which could be thought of as the 'oil' (excuse the pun) in the economic engine. The printing of money in this case would devalue the U.S. dollar but devalue other currencies at a faster rate as the rest of the world was forced to prop up the dollar due to its being a reserve currency. That is a key factor. So the question then becomes how the U.S. maintains its reserve currency status. If history is any guide, the dominant military power controls the reserve currency, so the U.S. has always had a vested interest in keeping its military force stronger than any other. Through this form of implied force, other countries trade key commodities such as oil in U.S. dollars. These are called petrodollars which are paid to countries that export oil. The petrodollar system elevated the U.S. dollar to the world's reserve currency. In consequence, the U.S. enjoys persistent trade deficits and is a global economic hegemony. The petrodollar system also provides the U.S. with a source of liquidity and foreign capital inflows through petrodollar "recycling". This is why U.S. stock markets are the tallest standing midget.

It should therefore come as no surprise that there has been a leftist-driven, anti-nuclear power mandate in the U.S. despite nuclear power being far cleaner than oil for the environment and safer when it comes to the number of deaths from cancer. Coal kills more than 800,000 people a year from the effluent of coal plants. Meanwhile, nuclear power reactors have in total killed just a few thousand people in their entire history of operation. This includes the long term studies that resulted from Three Mile Island, Chernobyl, and Fukushima in terms of elevated cancer rates. The hard data show mainstream media grossly exaggerated the reality.

Big Guns Support Nuclear

Bill Gates is aggressively pursuing nuclear power for all the reasons cited earlier in this piece. He has developed a technology that enables the use of discarded uranium waste. China is a huge proponent of nuclear power thus was going to do a deal with Gates for his reactor technology as it was approved of by the U.S. government. But then the Trump trade wars began and the deal was quashed. One of Gates's close friends, Nathan Myhrvold, is fully on board nuclear power. Myhrvold is a quirky genius and has published work on how fast a dinosaur tail moves and a 5 volume, 2600 page book on bread. Those who have criticized him for his inanity miss the point. Myhrvold entered college at 14, majored in math, and earned a fellowship with Steven Hawking. Bill Gates and Nathan met in 1986 and became instant friends. There is connectivity in everything even if seemingly off topic. Of course, skipping ahead a dimension of dots may lose one's audience post haste, leaving many to assume one is a bit daffy. But as the title to one of Richard Feynman's excellent works says it all: "What do you care what other people think?"

Exit Oil, Enter Nuclear

When it comes to understanding a complex issue with many layers, rational voices of reason are rare. Education rarely teaches students how to think. Mainstream media drives irrational fears on numerous levels because it sells more papers. Since many typically only see an issue a couple levels deep out of say ten levels of depth, the media capitalizes on this weakness. As one of many examples, some fear flying as well as numerous other highly improbable catastrophes. Yet the same people are always behind the wheel of a car which carries far greater odds of a serious accident than all the improbable catastrophes stacked together.

Bitcoin, World's Reserve Currency?

But one great fear harbored by the U.S. government is any technology that can threaten the dollar's status as a reserve currency because the ramifications run deep. Nuclear power as well as sustainable energy is discouraged because it would impact the petrodollars oil generates thus weaken the stance of the dollar as the world's reserve currency. It should therefore also come as no surprise that leftist-driven mainstream media has implied bitcoin's carbon footprint is massive when the reality is that bitcoin accounts for a negligible % of world carbon emissions. The majority of the electricity used by bitcoin actually comes from clean sources, like wind, solar, and hydropower. The bitcoin network gets 74.1% of its electricity from renewables, making it more renewables-driven than almost every other large-scale industry in the world.

Oil, on the other hand, accounts for a whopping 15% of carbon emissions just for transport and about another 30% for food whose manufacturing is oil-based. The approximate tonnes of carbon emitted into the atmosphere stands at 9.7 billion, an all-time record.

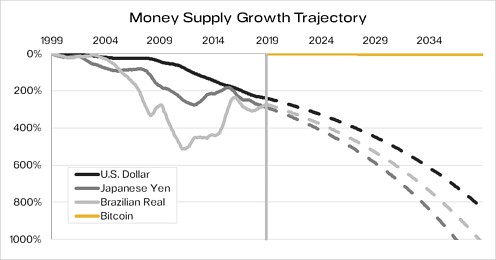

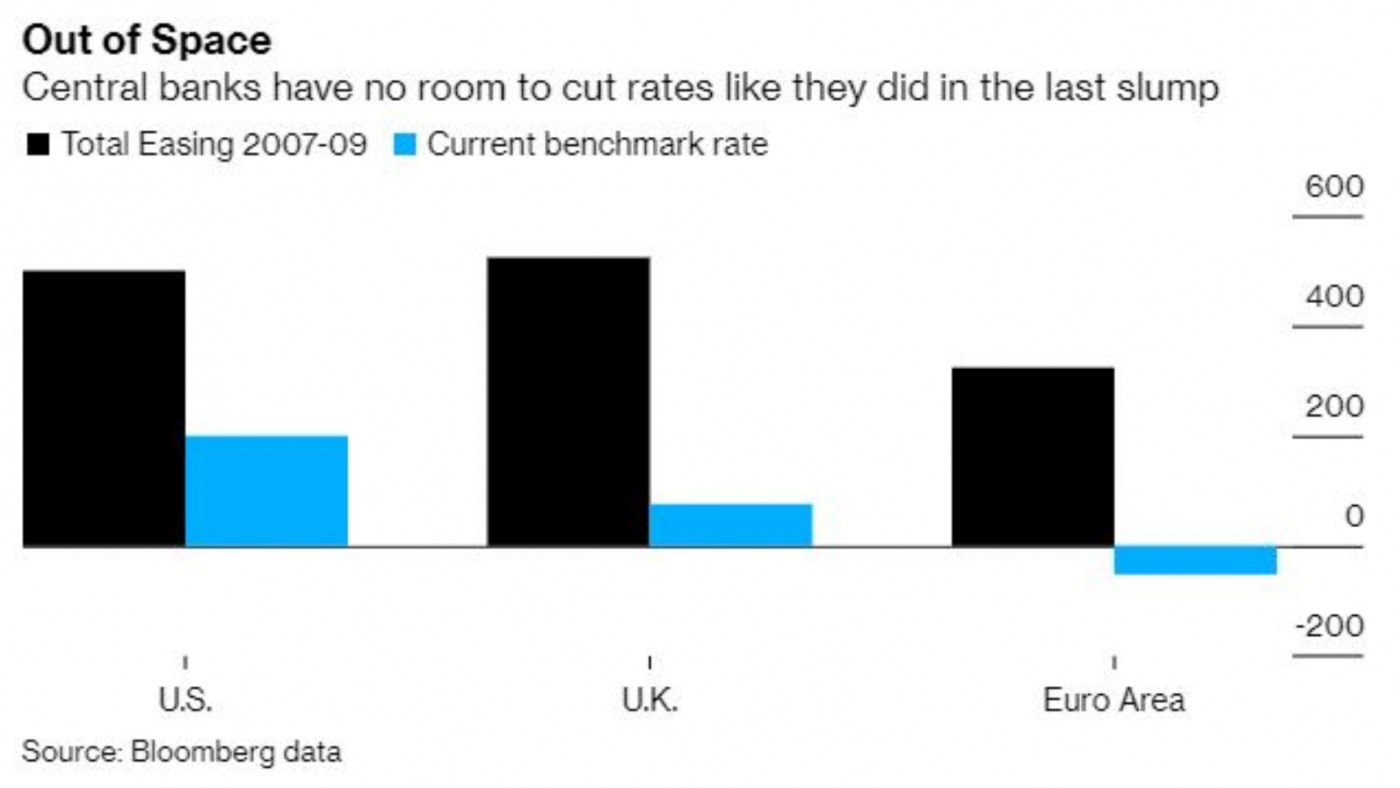

With quantitative easing pushing rates even more negative and debt to even higher record levels, bitcoin may have the chance in the coming years to claim status as the world's reserve currency. This possibility would be met with vigorous opposition by the U.S. government who would try to ban bitcoin, much as China has done. But due to bitcoin's decentralized nature, governments may have little choice given time. Should such a scenario arise, expect alternate forms of energy such as nuclear power to win as well as improved allocations of capital into exponential growth technologies and lower allocations to the U.S. military.

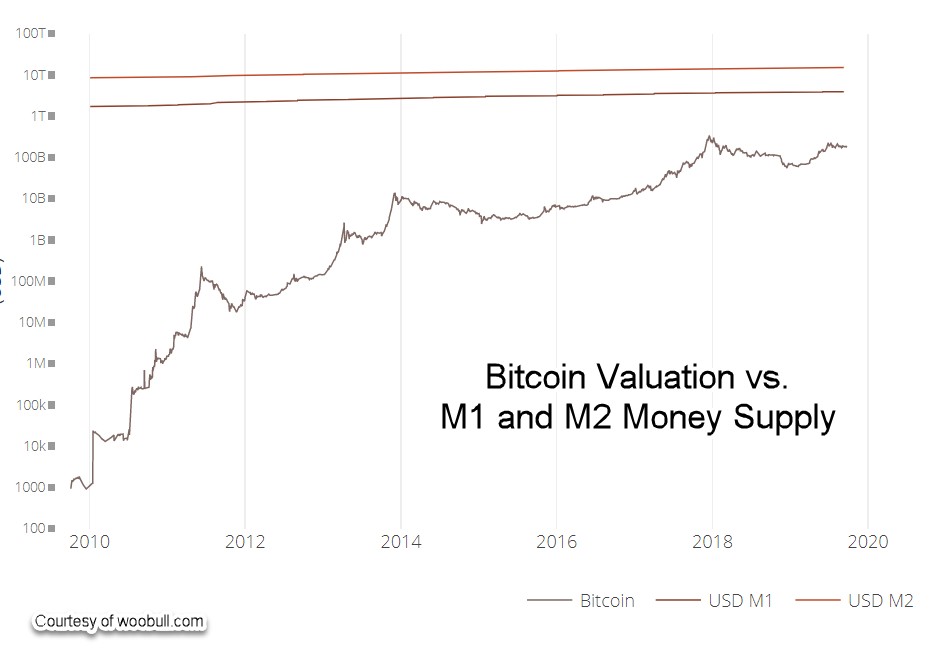

As bitcoin climbs in value and eventually reaches 6- then 7-figures in value, its market cap will be well into the trillions. At $1 million/btc, its value will be around $16 trillion. Should it keep its dominance around 50%, the whole cryptospace would be worth twice that amount which is not difficult to imagine given that stocks are valued at $70 trillion. The ex-CEO of NASDAQ has said he believes all stocks will be tokenized on the blockchain in 5 years. We also have $228 trillion in real estate, some of which will be tokenized. Furthermore, the number of far more efficient and cost-effective decentralized blockchain-based technologies that are coming online will displace the conventional ones because of the economic advantage. So the cryptospace which currently has a total valuation of only $225 billion is looking at a massive rise in the coming years.

Only a matter of time as shown below:

Source: Bloomberg M1 Money Supply data from Q2 1999 – Q2 2019

Projections based on 20-year CAGR

Source: U.S. Bureau of Labor Statistics, U.S. Census, Standard & Poor’s, World Gold Council, and Blockchain.info.

But even given the above, there are no guarantees. Should bitcoin fail as the world's reserve currency due to government intervention to insure central banks win such that monetary control is not forfeited, bitcoin could instead co-exist with the next reserve currency, much as gold once did prior to 1971 when it was pegged to the U.S. dollar. Bitcoin would then indeed become digital gold in a literal sense as the next reserve currency's value would be tied to bitcoin. The world would then once again have a reserve currency that was tied to an honest measure of scarcity. Like gold, bitcoin is decentralized and has no nationality, but unlike gold, it is private, secure, and censorship resistant. Bitcoin's supply level is fixed and transparent. This eliminates fears of the typical inflationary pressures associated with overproduction of gold that could diminish its value. Further, bitcoin is on a disinflationary supply schedule while the global supply of gold has increased by 1-2% annually over the last century. But the amount of gold could spike higher. Major advances in mining technology and space exploration could bring a surprisingly amount of gold supply onto the market.

In addition, bitcoin is seamless while gold is cumbersome in terms of storage and transport. Meanwhile, bitcoin transactions will eventually be instantaneous while storage in wallets or cold storage will become relatively hack-proof. Bitcoin is also counterfeit-proof unlike gold as discussed in this article: https://strategiccoin.com/why-bitcoin-is-superior-to-gold/

With gold valued at $8 trillion, it is conceivable that bitcoin's value would continue to soar with this tailwind in play should the world's fiat currencies debase from a neverending program of quantitative easing. Stay tuned.