by Dr. Chris Kacher

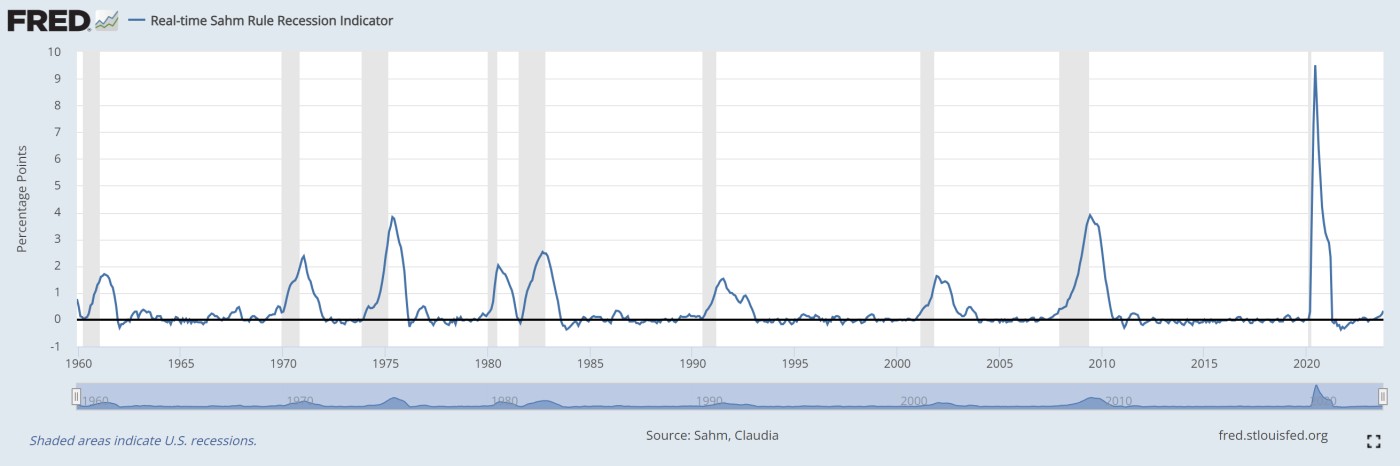

A tried-and-true indicator no longer applies?

The real-time Sahm Rule Recession Indicator signals the start of a recession when the three-month moving average of the national unemployment rate rises by 0.50 percentage points or more relative to the minimum of the three-month averages from the previous 12 months. It currently stands at 0.33. Unemployment bottomed at 3.4% earlier in 2023 and currently stands at 3.9%.

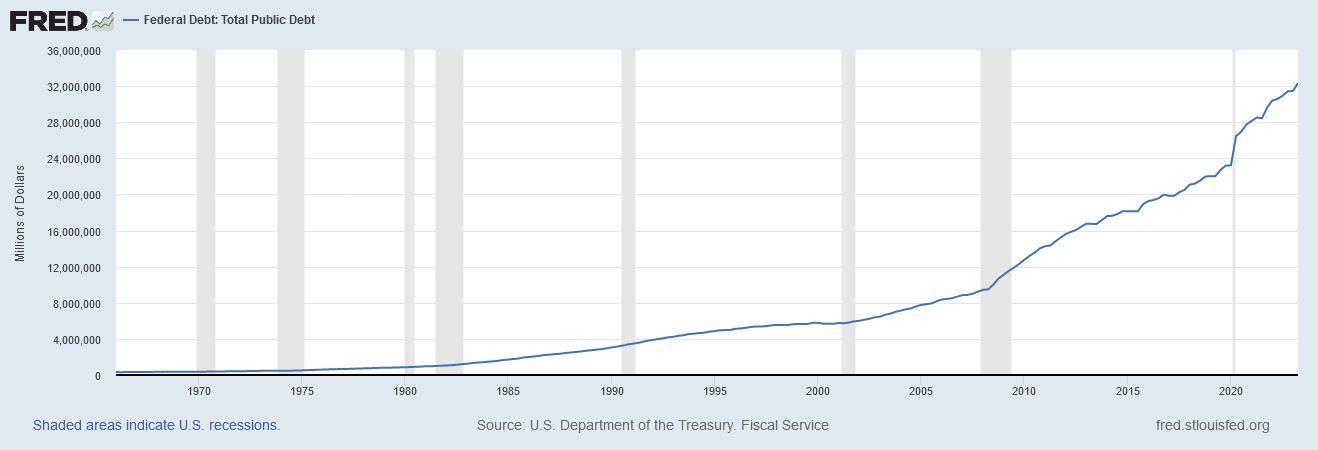

But while this led to recession in prior cycles, today's market offers one major difference: companies that are heavily exposed to technologies that are exponentially growing. In addition, we have record levels of debt which must be serviced along with the onerous $1 trillion+ annual interest payments and unfunded liabilities such as pensions and IRAs. Thus, stealth QE money printing has been ongoing. This applies to other major countries as well. Governments are broke and hunting for money.

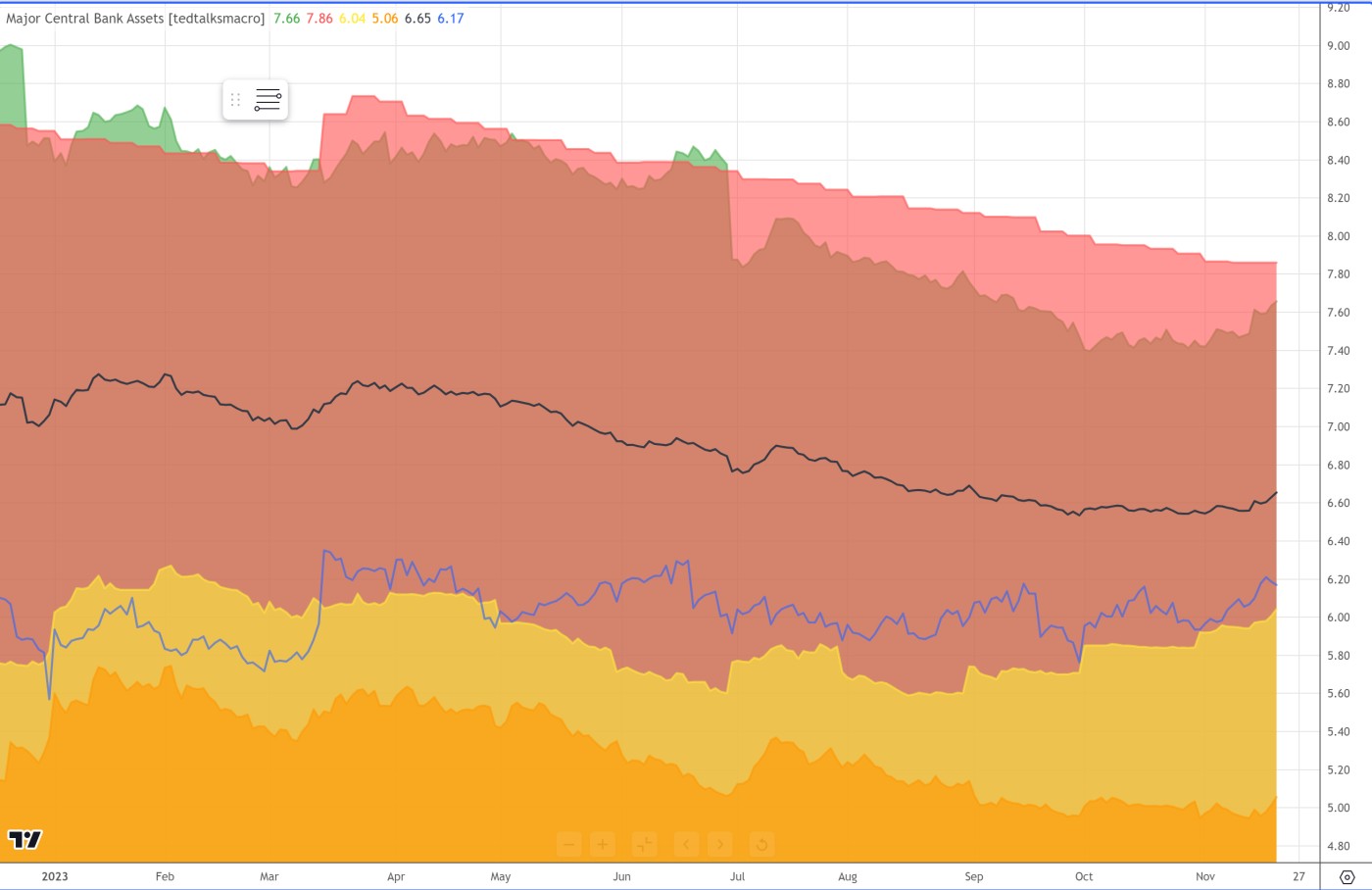

Indeed, global liquidity which had been in downtrends for most of this year started going sideways in October and is currently in an uptrend.

So while interest rates are on hold by all major central banks including the Fed, the BoE, and the ECB, this could be a replay of the Christmas crash of Dec 24, 2018 when the Fed stepped in and said they would cease tightening the balance sheet, ie, would halt rate hikes. This was the market low. Both stocks and crypto rallied in the ensuing months. Fed Chair Powell in his recent testimony suggested they are more likely to keep rates at current levels, reducing the odds of another rate hike.

We are not in an economy where inflation ticks higher based on the doctored data or starts to deeply falter. The former would force the Fed to hike rates at least one more time or while the latter would force them to lower rates in a hurry. Instead, the economy seems to be in a place of growth with moderating inflation based on the biased data. In consequence with all of the above, markets are rallying.

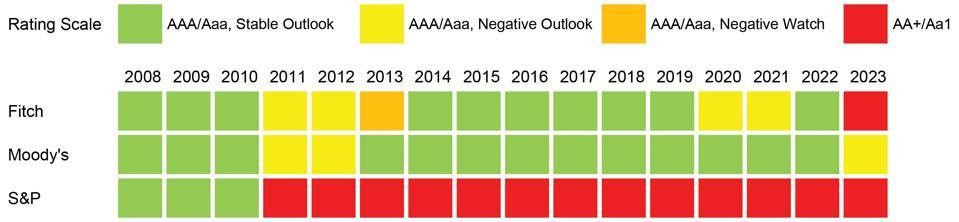

But for how long? The last Treasury auction was abominable. Yields for the 30-year bonds had to jump up 5.3 basis points from pre-auction trading to entice investors to buy them, the largest jump since 2016. Faith in Treasuries is degrading. The bond ratings agencies have downgraded US debt.

| |

| Source: Moody’s, S&P, Fitch Ratings. Chart by Hanlon Research. – Via Forbes |

If there's a continued lack of buyers, the Fed will have to buy the bonds themselves which means more quantitative easing (QE) and higher inflation on the way.