There is currently a fascinating disconnection between paper gold and silver and physical gold and silver. While gold futures (the paper variety) closed Friday at $1501 an ounce and silver futures at $12.63 an ounce, it is impossible to find physical gold bullion selling for less than $1600 an ounce as a run on supply has depleted most bullion dealers' inventories. In fact, gold and silver bullion dealers have reported the highest demand they've seen in 34-45 years.

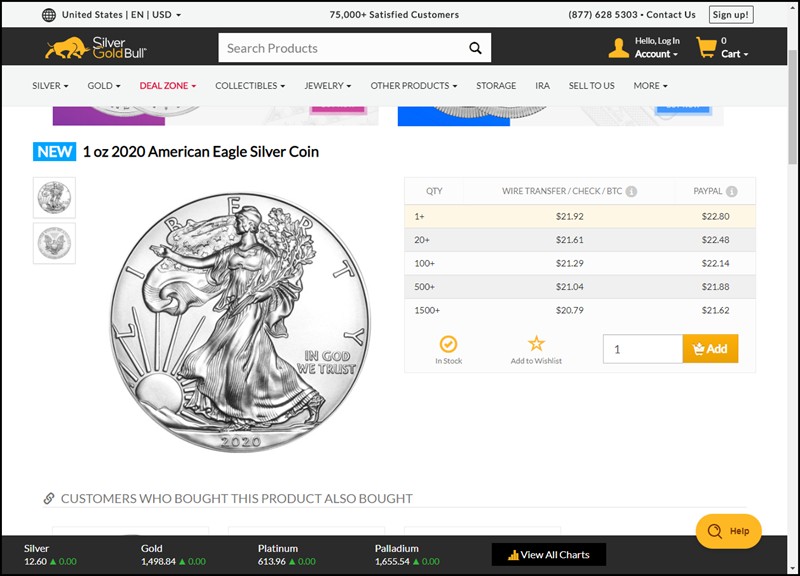

A perusal of precious metals websites shows gold bullion prices as high as $1697 an ounce, not even 1% off of paper gold's recent highs. Meanwhile, the situation with physical silver is even more absurd. While the paper variety sells for $12.63 an ounce on the nearest futures contract, you cannot find silver eagles for less than $20, with the highest price I've seen at $24 for a single one-ounce silver eagle coin.That is nearly 100% higher than the current futures price!

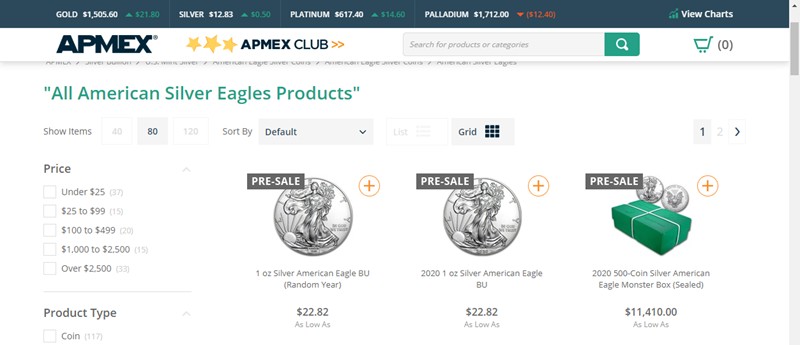

In some cases, dealers are offering future supplies in "pre-sales," as Apmex is.

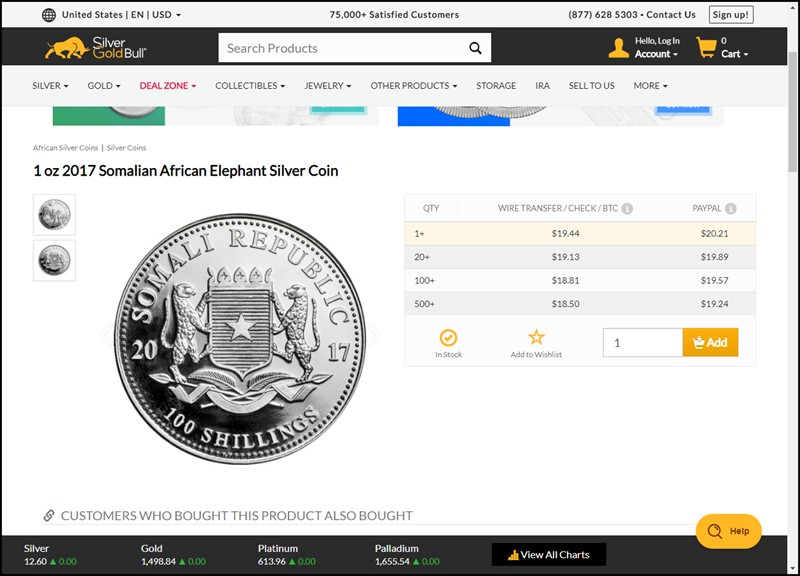

In some cases you can find silver "rounds" for as little as $17 a coin, still a hefty premium over paper silver prices, or coins issued by a sovereignty other than the U.S., China, Canada, South Africa, or Austria, such as the Republic of Somalia, where its 1-ounce silver coins can be had for $18.50 each, if you buy at least 500 coins and use a wire transfer or check vs. the alternative of using PayPal where the price per coin becomes much higher.

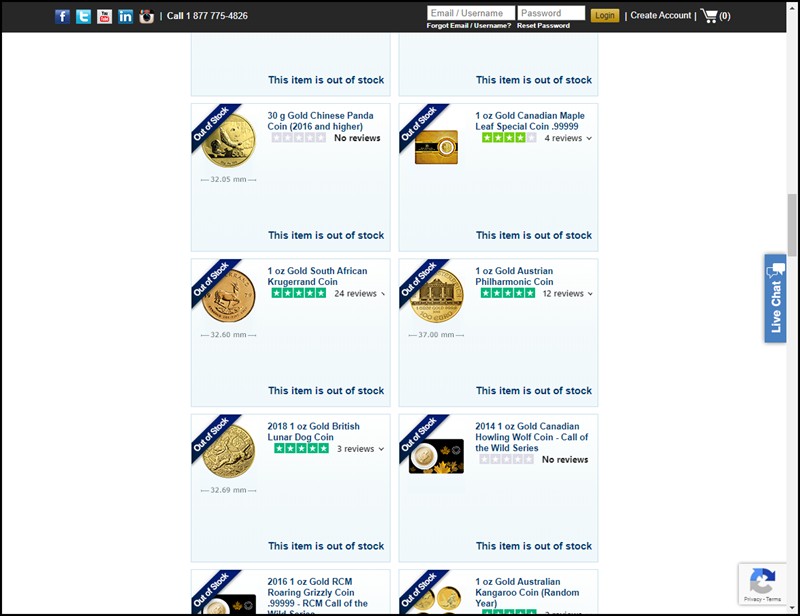

But as is the case with physical gold, in most cases they're simply "Out of Stock," as we can see on precious metals dealer Kitco.com's website:

So, the reality is that when it comes to precious metals, demand for physical metal vs. paper metal remains high, and prices have barely come off their recent highs where gold futures peaked at $1704.30 last week and silver futures at $19.45 way back in September 2019. In fact, as is obvious from the web pages above, physical silver prices well exceed the peak futures price from last year, with many dealers currently offering to buy physical silver at spot plus as much as 28% or more. Meanwhile, over the past month Bitcoin has declined nearly 50%.

Logically, one would assume that at some point paper gold and silver (and perhaps even Bitcoin) will have to play catch-up to the reality of the physical market, which is the real thing. The real thing seems to be what investors have a huge appetite for currently based on the fact that bullion dealers' inventories have been depleted, lock, stock, and barrel. But so far, that isn't happening as the intangible takes a back seat to the tangible. Meanwhile, the dollar becomes more and more just a worthless piece of paper, and at some point the chickens will have to come home to roost.

It's difficult to determine the precise reasons for the dislocation between paper and physical metals, but part of that may be related to the current collapsing of the global debt house of cards, and fears that fiat currencies and other intangibles like paper gold and silver, as well Bitcoin, another intangible, may offer less reliable safe havens than physical metals, which are tangibles. Thus it perhaps becomes a basic perception of value and safety in tangibles vs. intangibles, but nobody can know for sure.

This is going to become a fascinating situation to watch play out in real-time, and it may create some unusual opportunities across the board when it comes to alternatives vs fiat currencies. Currently, the dollar has been rising, and last week posted its sharpest seven-day upside move since "Black Wednesday" of 1992, courtesy of a global dollar shortage that results from the way cross-currency funding takes place, effectively creating a massive $12 trillion synthetic dollar short across the globe that now needs to be covered.

Trading and investing is all about seeking real trends, not wishful thinking or hype, and accepting the reality of what is occurring in real-time. Given a choice between owning paper gold and silver or physical, or even crypto-currencies, I'm happy to be long physical metals currently, but open to new trends as they develop in real-time, not in my imagination, in other areas that may potentially benefit from an influx of dollars once the current dollar shortage has run its course. I will continue to report on the precious metals situation as appropriate, so stay tuned for future editions of the Gilmo Glitter Report.