Market Lab Report / Dr. K's Crypto-Corner

by Dr. Chris Kacher

Quantum Poodles Bringing Billions to Blockchain™

Binance vs. Coinbase

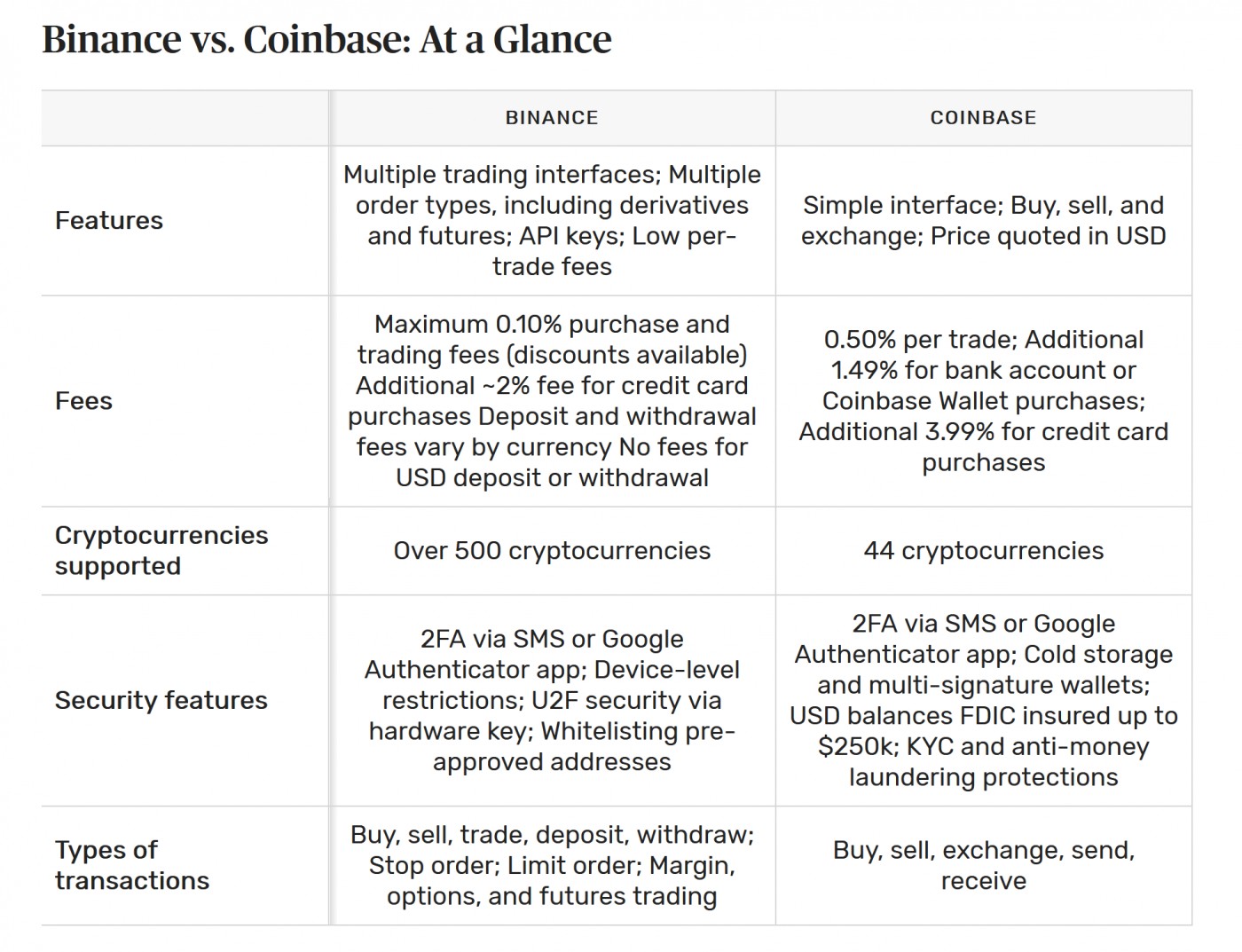

The ex-CEO of the NASDAQ said a few years ago that in 5 years, all stocks will be tokenized. He's not far off the mark. Binance exchange will list the Coinbase stock as a token on its exchange. When customers buy Coinbase stock, Binance which is on our cryptolist, then must buy the stock from the NASDAQ exchange to keep it at 1:1. Binance trades more than $50 billion daily vs. Coinbase which does not even trade $5 billion. Binance trades nearly 10 times the daily volume of Coinbase in addition to having its own blockchain called binance smart chain (BSC) which charges pennies on the dollar for transactions compared to ethereum. Thus many blockchain projects have moved to BSC. Further, Binance has the lowest trading fee percentage of 0.10%, while Coinbase fees range from 0.5% to 3.99%.

Binance offers over 500 cryptocurrencies vs. Coinbase which only offers 44 cryptocurrencies since U.S. regulations prevent Coinbase from trading cryptocurrencies which may be deemed as securities. The question is when regulations will permit Coinbase to list crypto securities. This will be a big boost for Coinbase.

Changpeng Zhao (CZ), the CEO of Binance, is one of the most forward thinking minds in crypto so it is no coincidence that Binance has become the leading exchange by far in the cryptospace. When Binance lists or invests in a coin, it tends to do very well. If history is any guide, their listing of Coinbase stock as a token will likely push the price of COIN higher. This move to tokenize stocks comes at the perfect time as it coincides with the first blockchain company listing on a major stock exchange. Both Binance and Coinbase are currently valued at around $70 billion. The listing of Coinbase stock as a tradeable token on Binance will ultimately push Binance tokens higher since what is good for Coinbase is good for Binance.

The question will be whether any regulatory overhang becomes an issue for Binance. CZ has played the political game well in terms of addressing U.S. regulatory concerns as well as befriending and placing certain individuals in higher political places within the U.S. The other question will be when Coinbase can start listing cryptocurrencies deemed as securities. This would certainly help it to partially catch up to Binance in terms of number of coins offered for trade.

A few recent FAQs

Q: Why do you think the market moves in a specific manner (not the future but the present)?

A: We discuss this in detail in our books and in the FAQs of this website. It is a complicated answer to a simple question since if it were easy, everyone would know what to do. The market is designed to fool the majority of investors at critical turning points. This is why trading sell volumes spike near major market lows and buy volumes spike near major market highs. Investors all too often, lets their emotions guide their trading. This accounts for the often sharp V-bottoms seen at major market lows as FUD rules the day and traders exit in a panic. Likewise, FOMO rules the day when it comes to major tops as traders rush in to buy for fear of missing out. This cycle repeats every time. In consequence, around 80% of investors lose money in stocks, options, and futures, 10% break even, and 10% make money.

Q: What are your thoughts to special issues (for example why does Fed Chair Powell influence something - more in detail)

A: We discuss this in detail in some of our Market Lab Reports. Naturally, easy or tight money policies can impact markets depending on where one is in the cycle. The answer is never simple. Monetary policy, inflation, interest rate curves, and the economy all influence market direction.

Q: Why does a specific formation wake your interest (why do you like a certain formations?)

A: Charts are human nature on parade. On a risk/reward basis, certain formations have shown themselves to be profitable such as Undercut & Rally. That said, the only constant when it comes to markets is change. The pocket pivot which I observed then formalized in 2005 continues to work, but the suggested entry point has changed. Back then, markets were not nearly as distorted or noisy so buying on strength was your best strategy. Stocks with sound pocket pivot price/volume structures and strong fundamentals would often not pullback if one did not buy on that day on strength. After 2008, the market changed due to distortions created by QE which affected entry points. By 2012-2013, buying on a constructive pullback was a better strategy as one's risk was reduced. Meanwhile, missing a trade became less likely as the noisier market often created entry points on pullbacks after the stock had its pocket pivot.