Bitcoin spot ETFs were launched on January 11, 2024. Initially rallying was met with aggressive selling due to GBTC holders who could finally exit their positions. Such holders hold over $25 billion in GBTC. This selling outweighed the initial buying of the spot ETFs. Even if just 20% of these holders end up selling GBTC, it is an appreciable amount. Over time, the amount of spot ETF buying will naturally outweigh any further selling by any investors who wanted to finally sell their GBTC.

Bitcoin miners staged aggressive reversals off recent peaks on January 11. But its 100-dma as detailed in our yesterday's VooDoo™ report created a nice swing buying opportunity just after today's market open.

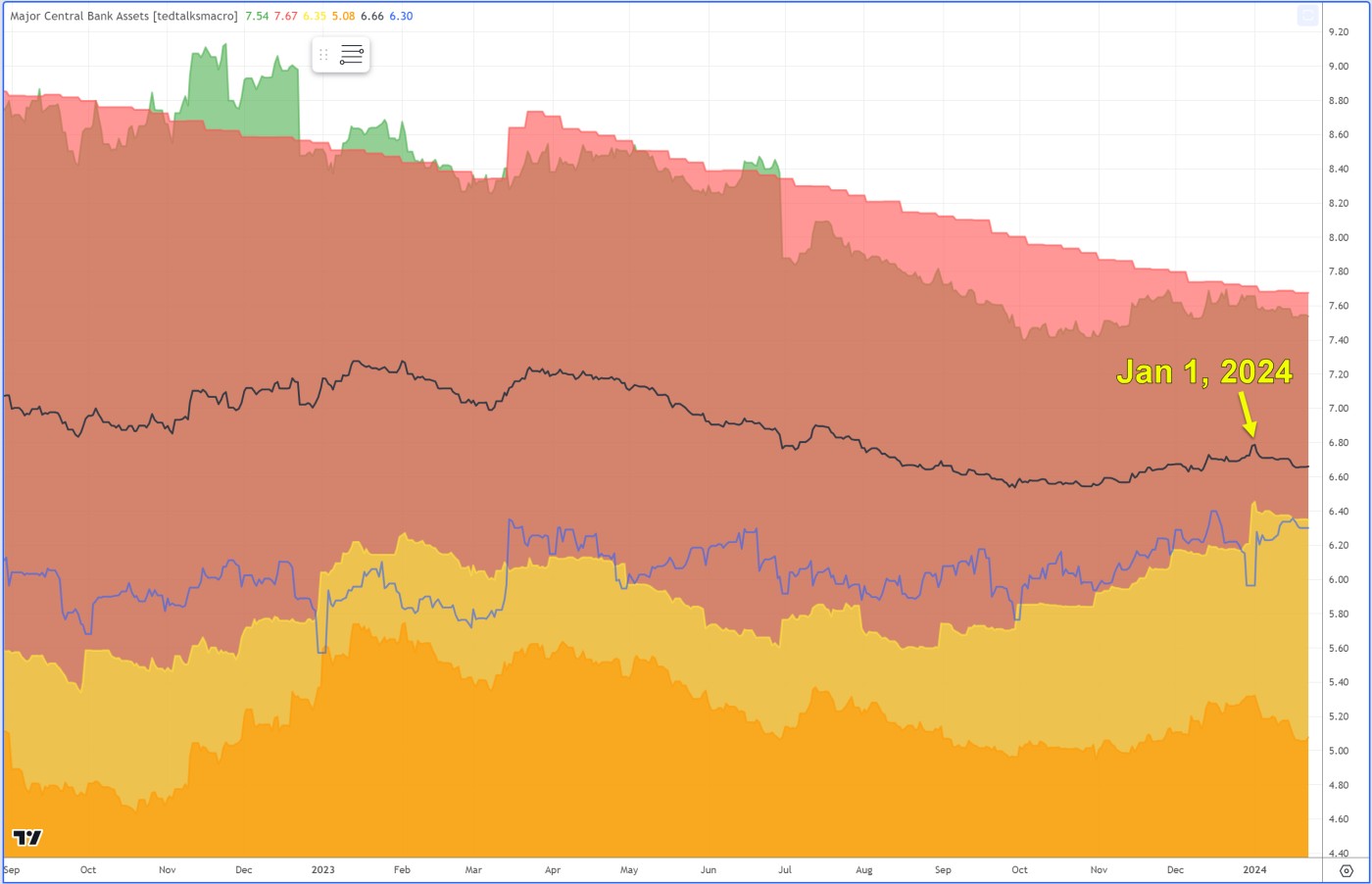

Adding to the overall selling pressure, central bank liquidity has been in a downtrend since the start of the year.

That said, this is likely to be a temporary downtrend as central banks must continue to create fiat to service the interest on record levels of debt that continues to grow. This is typically the beginning of the end for sovereign currencies as it plays out over the next decade based on Ray Dalio of Bridgewater's cogent analysis of market cycles going back several hundred years. But this time may be different as technologies growing at exponential rates such as AI and blockchain are creating massive utility and productivity never seen before given that over a billion people/companies and climbing are now utilizing such technologies since ChatGPT was launched just over a year ago.

Cryptocurrencies were also considerably overbought into the news of the spot ETF approval. Some of the strongest names went up by 3-10x in the Layer-1, gaming, and AI spaces, so some steep pullbacks can be expected here.

Bitcoin had a high volume reversal on its weekly chart after the spot ETF approval.

On a technical basis, BTC is likely to move sideways or lower from here for a short time before it can gather steam to heal and start to trend higher once again. A continued uptrend will be largely predicated on global central bank liquidity. We want to see that black line in the liquidity chart shown earlier start moving higher again. Further, recession as measured by the Fed heads will need to be postponed.

QE history

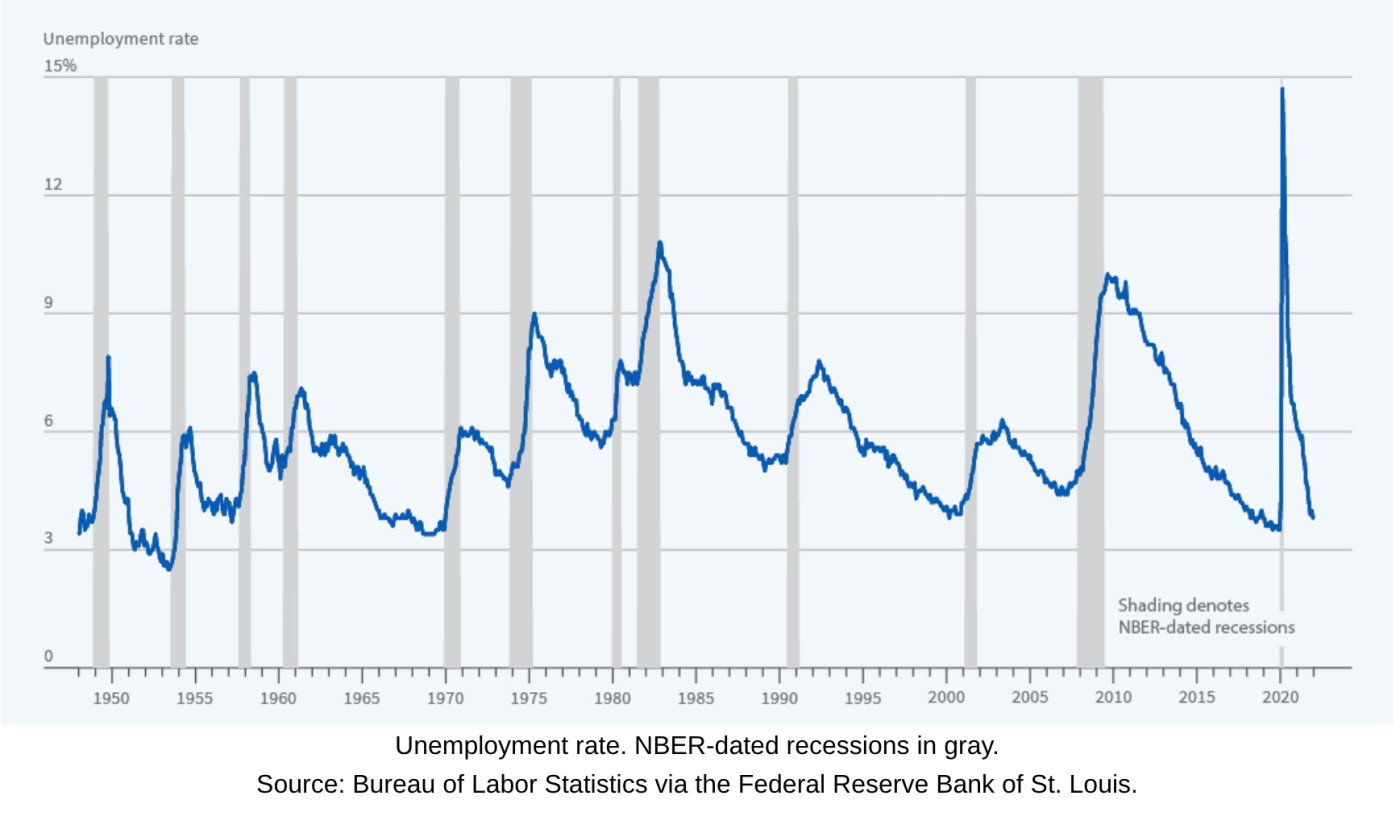

Given their liberal use of quantitative easing (QE) since 2008, they will likely use QE to postpone recession in this election year. This was never the case prior to 2008, the last major prolonged recession, as shown in the chart below. The gray areas denote recessionary periods.

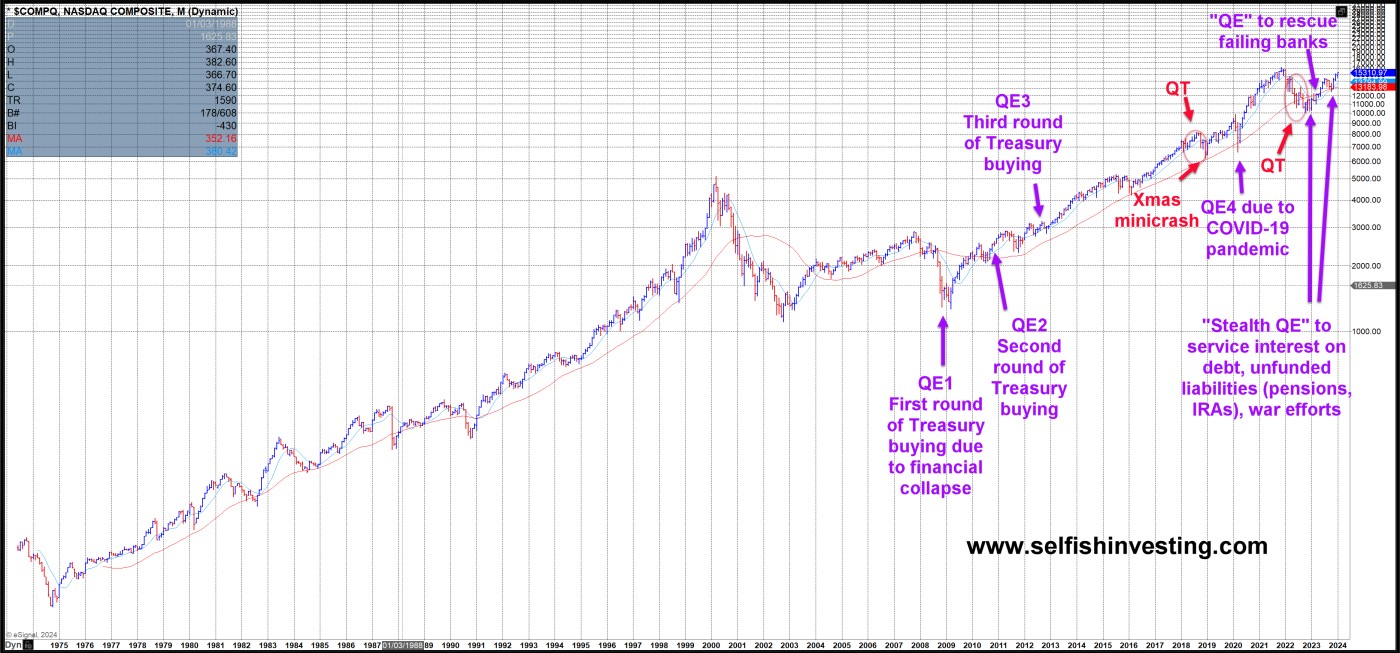

In 2008, the Fed embarked on a program which was new at the time called quantitative easing. This enabled them to print massive sums to rescue markets. 2009 therefore was a furiously bullish but choppy year. The last two series of QE in the chart below are in quotes because they were not called QE, but still had similar outcomes. The first QE in quotes, "QE", came in March 2023 when Silicon Valley Bank and other major banks collapsed. This was a temporary measure which spurred markets higher over the next few weeks. Additional QE came in the form of "Stealth QE" in late 2023 as central banks around the world continued to create fiat to help pay for their extensive debts. As we have said, governments are broke and hunting for money via taxes or by creating it via QE.

QE vs QT

QE is akin to a financial lifeline thrown by a central bank into the choppy seas of a struggling economy. Picture the central bank as a captain, ordering a hefty purchase of government bonds and other financial assets. This is not just a transaction—it's a bold move to breathe life into economic currents and get the wheels of commerce spinning again. This unconventional policy emerged from the shadows during the dark days following the 2007–2008 financial crisis, a time when traditional monetary strategies had lost their potency amidst the threat of deflation and stagnation.

On the flip side, there's quantitative tightening (QT). Imagine it as the central bank's careful reeling in of its expansive financial net, selling off portions of its asset catch. It's a deliberate stride to restore balance, a counterweight to the aggressive easing that came before. QT is the central bank's way of saying, "The economy can now breathe on its own; it's time to prepare for a future of stable growth."

The Fed underwent QT in 2018 which created the first stock market Christmas crash on record on Dec 24, 2018. The Fed quickly stepped in and declared it would give the markets what they want- no more tightening. The Fed also employed QT in 2022-2023 but by late 2023, they again declared they would unlikely tighten further. Markets rallied during both periods after the Fed waved their white flag.Why no QE during recessions prior to 2008?

Interest rates in this long term debt cycle as detailed by Ray Dalio are at historical lows for this cycle. When central banks hit the wall with interest rates near major lows, they turn to QE as their economic defibrillator. Low interest rates can trap an economy in a state of inertia, where cash becomes king and the allure of liquid assets eclipses the lackluster returns of bonds and stocks. In such a world, interest rates stubbornly resist the plunge below zero, leaving monetary authorities to inject life directly into the economy's veins through QE rather than futilely nudging interest rates below zero which can cripple the financial system.

QE isn't just a technical maneuver; it's a desperate charge to pull the economy back from the brink of recession and to keep the ghost of deflation at bay, ensuring inflation hovers around the central bank's target. Yet, this financial sorcery comes with its own set of ominous shadows. Critics warn of the potion being too potent, potentially stirring the cauldron of inflation to bubble over in the future. Or, in a twist of cruel irony, it could be an impotent spell if banks clench their vaults shut and borrowers shy away from loans. Banks got their comeuppance when the Fed hiked rates faster from near zero levels in record time in 2022 which resulted in huge losses on bank balance sheets due to their heavy exposure to bonds which normally are lower risk instruments. Furthermore, the rising tide of QE has been accused of lifting the boats of the wealthy alone, widening the chasm of inequality as financial asset prices soar. Indeed, populism is at levels not seen since the Great Depression of the 1930s. The decimation of the middle class does not create stable economies.

Where we go from here?We will continue to closely monitor technical price action in stocks, Bitcoin, and other leading names as well as global levels of liquidity and the reverse repo market which will likely hit zero in early March. The reverse repo program (RRP) enables stealth QE to continue because liquidity gets pumped into the financial markets via a decline in the RRP balance. RRP will likely hit zero by early March based on the rate of decline in 2023. The Fed will have to replenish RRP by some means to keep stealth QE alive or stock and crypto markets are likely to fall. Given their liberal use of QE since 2008, and also that this is an election year, it seems likely they will find a way to continue to employ stealth QE without creating a major dislocation in the general market uptrend. That said, nothing goes up in a straight line, so an upwardly sloping zig-zag pattern of intermediate uptrends and downtrends may be in the offing if they keep stealth QE to a minimum due to inflationary concerns. But liquidity from other major central banks such as China may offset any minimization from the US, thus it is important to closely monitor global levels of liquidity to gauge how trending or choppy markets become. Stay tuned for upcoming reports from www.selfishinvesting.com.