Market Lab Report / Dr. K's Crypto-Corner

by Dr. Chris Kacher

The (R)Evolution Will Not Be Centralized™

Buffett Dumps Banks

Warren Buffett has sold most all of his bank stocks. He has dumped Goldman Sachs, JP Morgan, Wells Fargo and other finance stocks completely. The banking system is in fairy tale land. The printing of money cant be forever. Either we all suffer a bit to reset the economy, or the U.S. dollar continues to lose its value. When people cant pay rent or find work or pay student loans, we will see a slew of severe bankruptcies. When mortgage and business defaults go up by 15-20%, it is a huge systemic risk. Thus Buffett has gone heavily into gold by buying Barrick Gold Corp. which mines gold.

Bitcoin vs. Gold

Bitcoin is better than gold but Buffett does not understand bitcoin and continues to think it is a scam backed by no value. Yet the value of gold hangs in the balance. The new frontier of gold mining will be mining on asteroids. Elon Musk's technologies may be the vanguard. It is clear an abundant amount of gold exists on other celestial bodies. The equivalent happened in the 1500s when we went from Europe to N. America which didn't exist in people's minds at the time. Once discovered, gold from the Americas flooded Europe. Human beings are inventive so their radius of influence continues to expand, not just globally, but galactically. A few years ago we couldn't go up and down with Elon's reusable rockets. Now we can. Mining gold on asteroids will likely be achieved within the next 10-15 years at the pace at which exponential growth technologies are evolving.

Bitcoin, meanwhile, cant be printed or mined more than what its mathematics dictate. So buying bitcoin today is a smarter move because markets are forward looking and based on future expectations. There are billions of dollars of gold in space. Humankind will find a way to get to it, just as they found a way to discover N. America that was not believed to exist back in the 1500s. Bitcoin is the only fixed asset in the galaxy. Elon's technologies may destroy the value of gold.

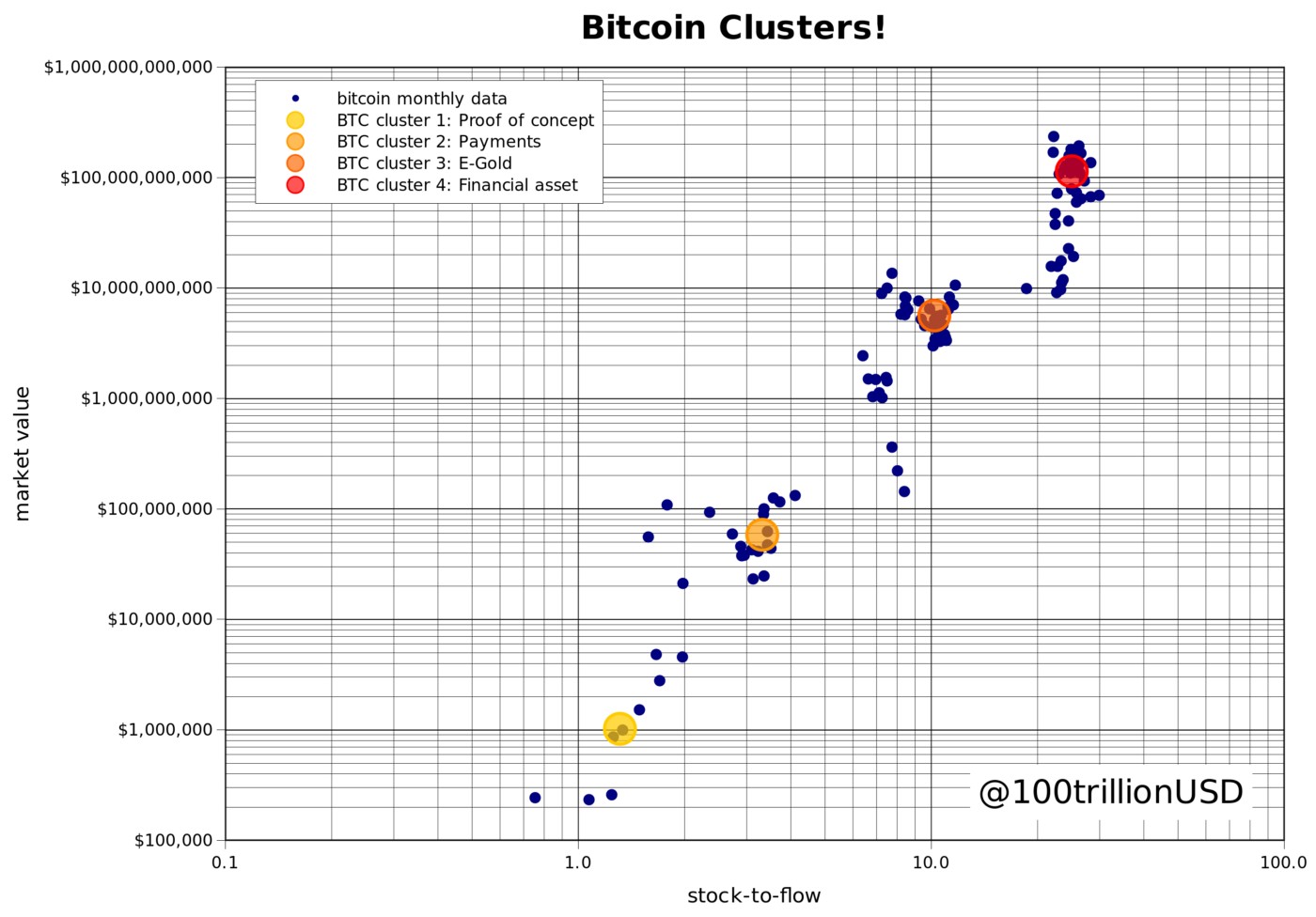

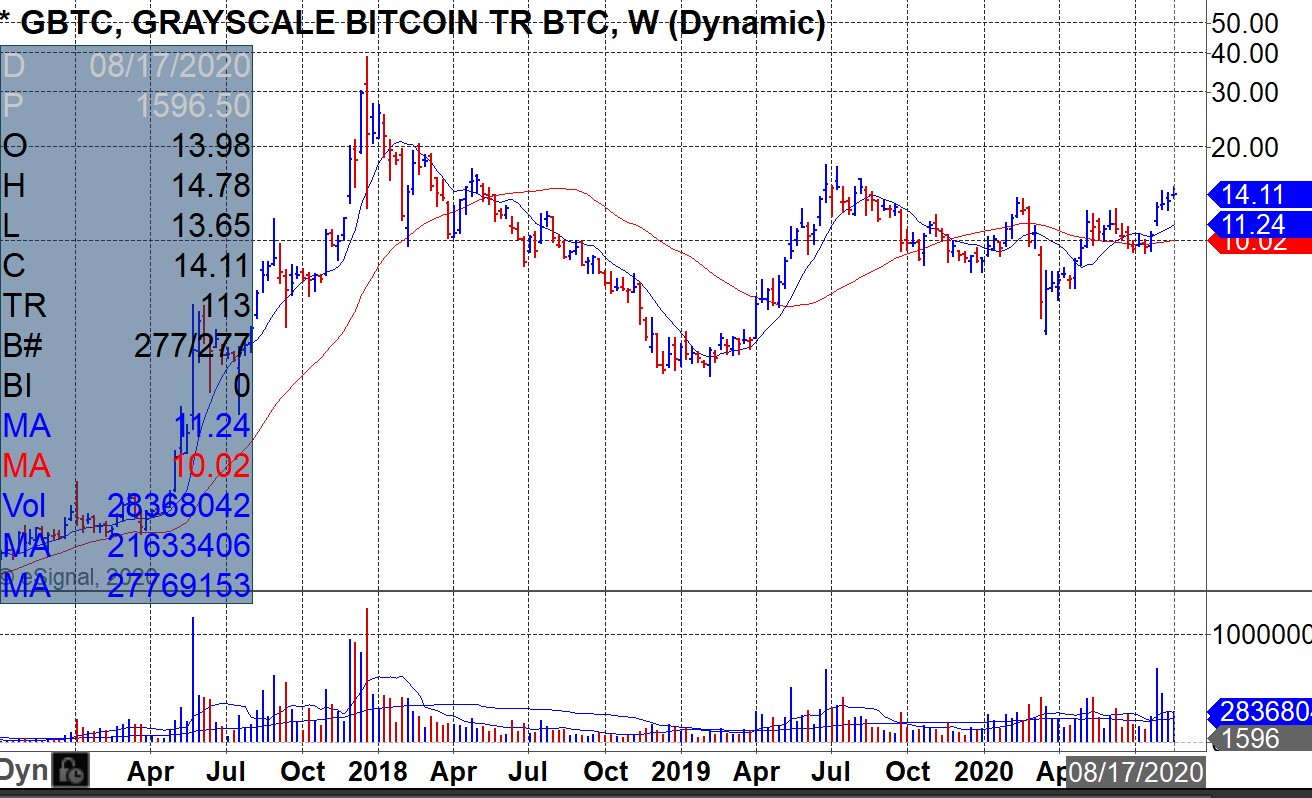

Just like water can go from various states from ice to water to steam to plasma state, the same for bitcoin. It goes from being proof of concept to payments to e-gold to a financial asset where Grayscale and other institutions are investing in bitcoin to challenge status quo fiat.

CME bitcoin futures are surging as institutional investors buy bitcoin as an inflationary hedge. Open interest in CME bitcoin futures recently hit $841 mil, a new high.

CME bitcoin futures are surging as institutional investors buy bitcoin as an inflationary hedge. Open interest in CME bitcoin futures recently hit $841 mil, a new high.The Digital Yuan

The Chinese are first to digitize their fiat currency into the digital yuan. China is sending this next stage of digital money across major cities in China. China issued an official statement on their digital yuan saying that the value of the digital yuan is stable. Stable? This is a potential lie as we have seen what can happen to fiat currencies. Is it decentralized? Of course not, so it will have no impact on bitcoin since no one can censor bitcoin while maintaining transactions outside of fiat whether or not the fiat is digital. Fiat is fiat.

By doing this, the Chinese government will be able to control transactions. They will be able to put a negative rate into your digital wallet. Taxation will be automatic. If you go to the wrong protest or support the wrong party, the government can shut you off from the financial ecosystem. Many stores in China no longer accept paper currency. Payment can only be made through digital payment structure via apps such as AliPay and WeChat. China remains anti-cryptocurrency.

Buffett Admits He's Wrong About Inflation

Trump has directed Mnuchin to push fiat into the hands of Americans by endless printing while suggesting a removal of the payroll tax. With the seemingly exponential rise of QE, Buffett admits he's been wrong about inflation. He always said we couldnt have the developments we have without inflation taking place, yet we haven't had serious inflation. While the CPI has been manipulated and the price of various common goods have no doubt risen well beyond the 2% annualized level, serious bouts of inflation have yet to occur.

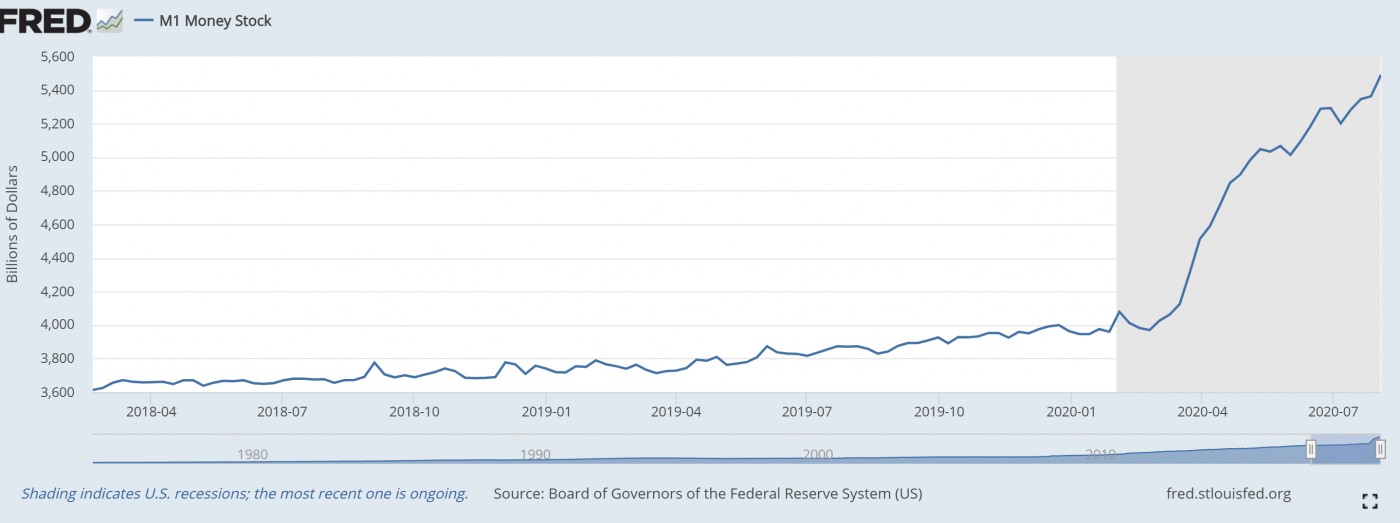

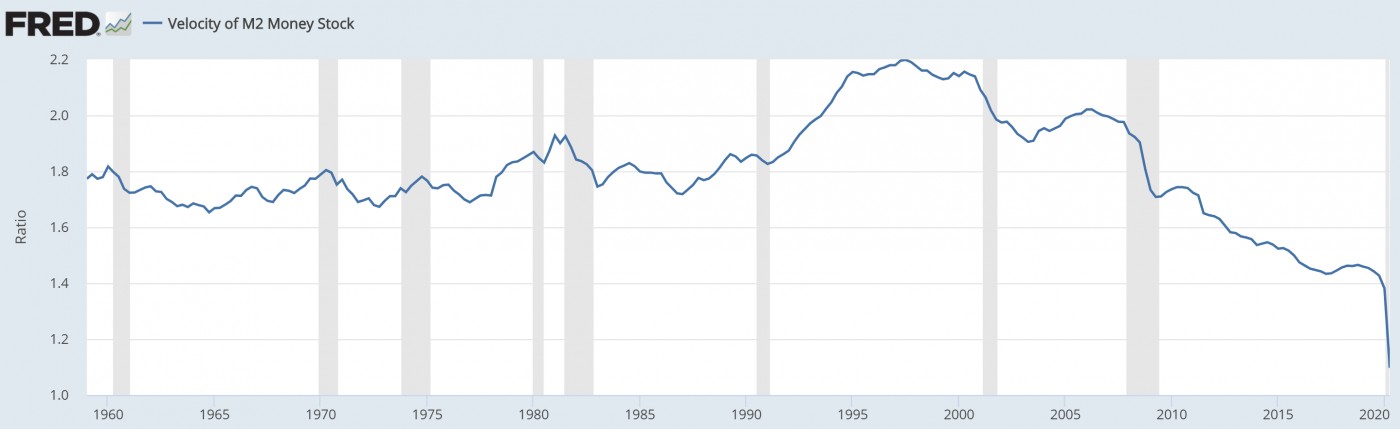

M1 Money & M2 Velocity

The point Buffett missed was two specific measures of money supply. M1 has shot straight up while the velocity of M2 has plummeted.

So even though interest rates are at historical lows and money continues to be printed, inflation has not yet happened. Buffett wonders how we can have all this money printing with rates as low as they are while inflation stays low? "I'll have to see it to believe it but I've been wrong so far." THE REASON: M1 is skyrocketing while inflation remains low because money velocity M2 isn't moving. Artificial stimulus checks sent out are not being spent because times are uncertain. People are scared. So the printed money is not entering the economy. It's being HODL'd in fear. But once people feel more relaxed and relieved, they will spend their cash. This will spike inflation. Meanwhile, according to Buffett, bitcoin is rat poison. Search YouTube for "Hidden secrets of money" episode 7 which shows how the money velocity gauge is key. When it picks up, central banks lose all control. In 1920s Germany, people forget that we actually saw a bit of deflation before hyperinflation took hold due to same psychology of people HODLing their cash from the crippled post World War I economy. But once Germans felt more confident, they started to spend. With all the Deutsche marks being printed, this created a massive wave of inflation leading to hyperinflation. In today's arena, the trillions of dollars that have been created will start being spent once people stop HODLing their cash. Central banks will not be able to do anything about it. so hyperinflation will occur if history repeats.

Big Names Buying Bitcoin

The renowned George Ball, ex-CEO of Prudential Financial $28 bil AUM, just bought into bitcoin. He says bitcoin cant be undermined by any government, and relative to today's yields, bitcoin is attractive long term. The traditional financial system is on a slow collapse so the big guns are now interested in bitcoin which defies gravity after its bubbles have blown apart.

As one of several examples of what is happening in the world, Turkish banks started to impose withdrawal fees to halt bank runs. While they pay a rate of 8.25%, people are losing -11.5% net on their lira. It is looking increasingly unlikely the Turkish lira will survive. As Jim Rogers always said, when a government says everything is fine regarding their currency, taking measures to either support their currency or prevent people from withdrawing savings, while saying the public should keep their money in banks, he goes short that currency.

So with hyperinflation a real possibility, hard assets are an even better safety net. Stocks, gold, and bitcoin of course should continue to thrive in such an environment. But as I've said many times, bitcoin has the greatest asymmetry of any instrument in the history of speculation. It comes at unique time in financial history when fiat of all stripes sits at a mega tipping point. Bitcoin's value is around $250 billion. It doesn't take much imagination to see this at $2.5 trillion sooner than later. While real estate, gold, and stocks should continue to do well, a 10-fold gain in any of these seems highly unlikely over the same time frame.

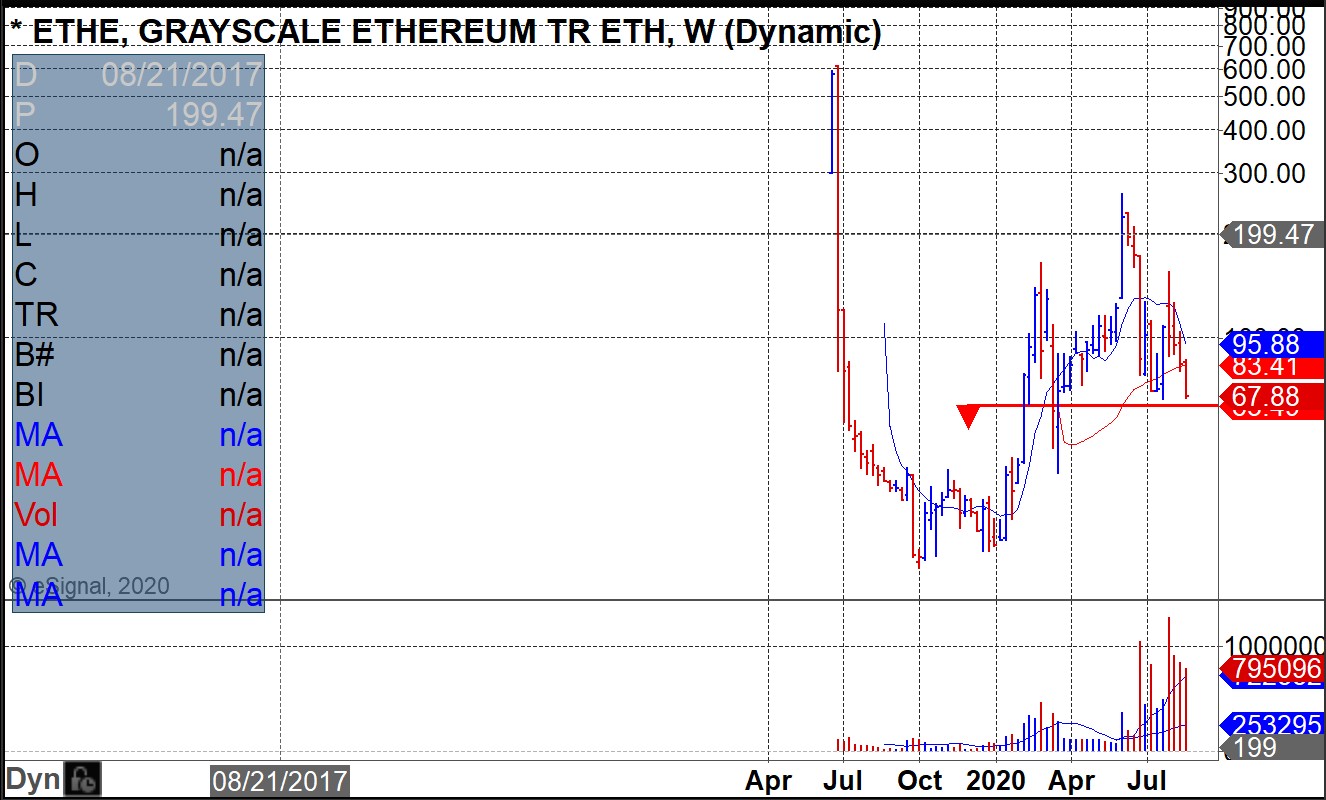

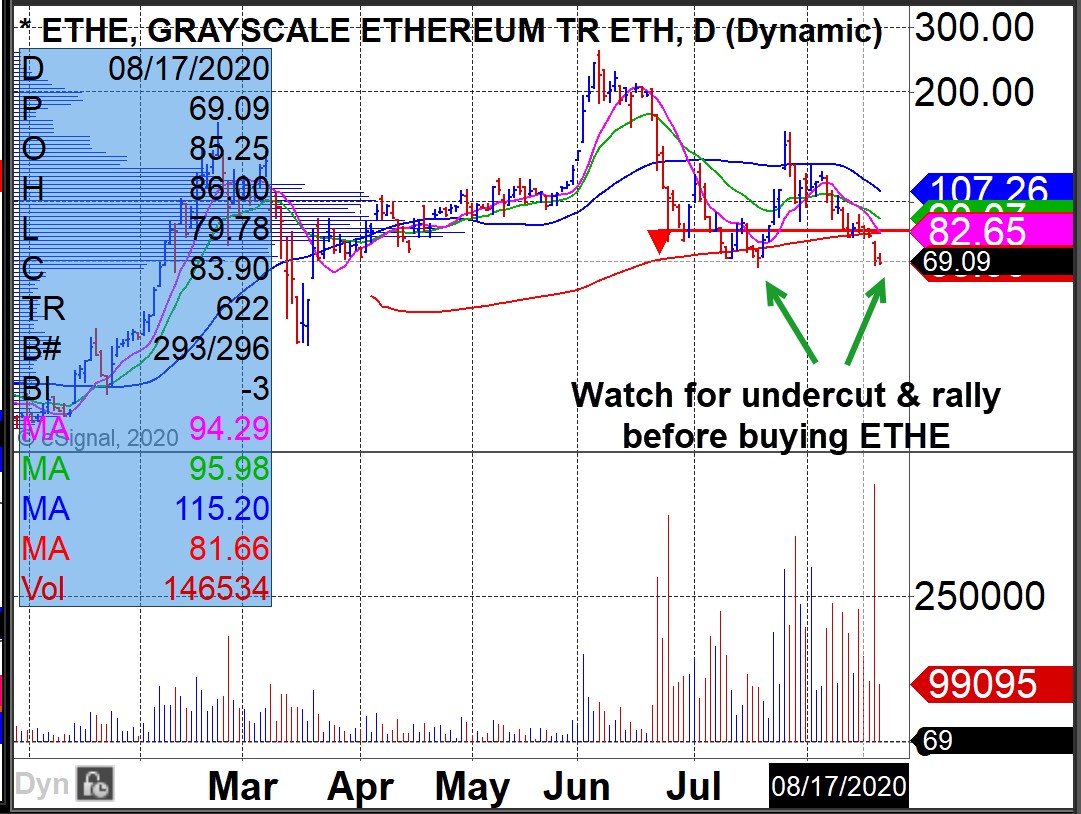

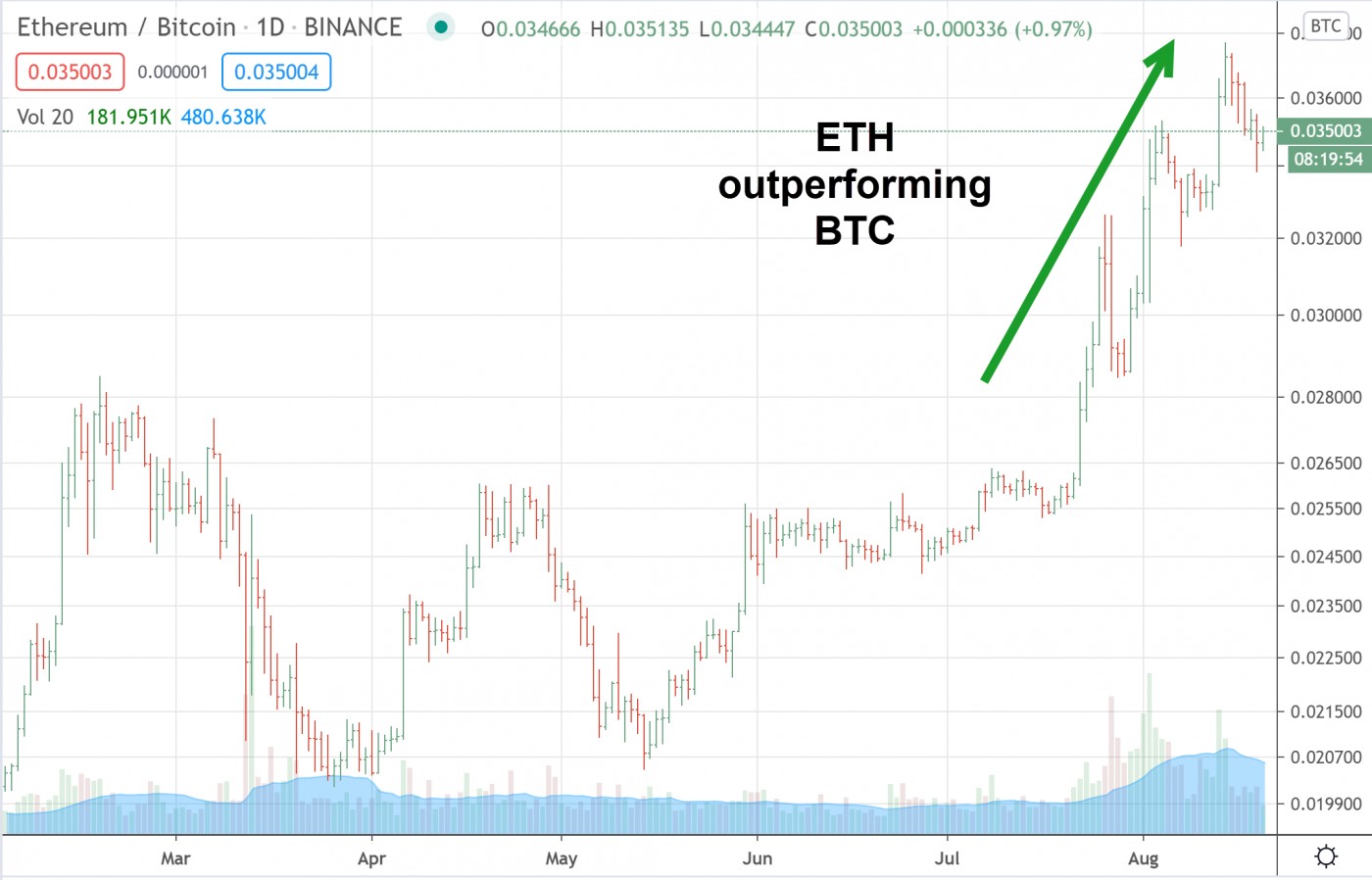

ETHE Ready?

One last thought: I like Grayscale's ETHE more and more as ETH is outpacing BTC and the premium on ETHE which can be seen on y-charts is historically at a level which is buyable. ETHE has always traded at a big premium to the actual price of ETH but current levels are buyable as ETH outperforms BTC. One way to handle ETHE is to wait for the undercut & rally before buying in case it drops further.

vs.