by Dr. Chris Kacher

PCE bullish?

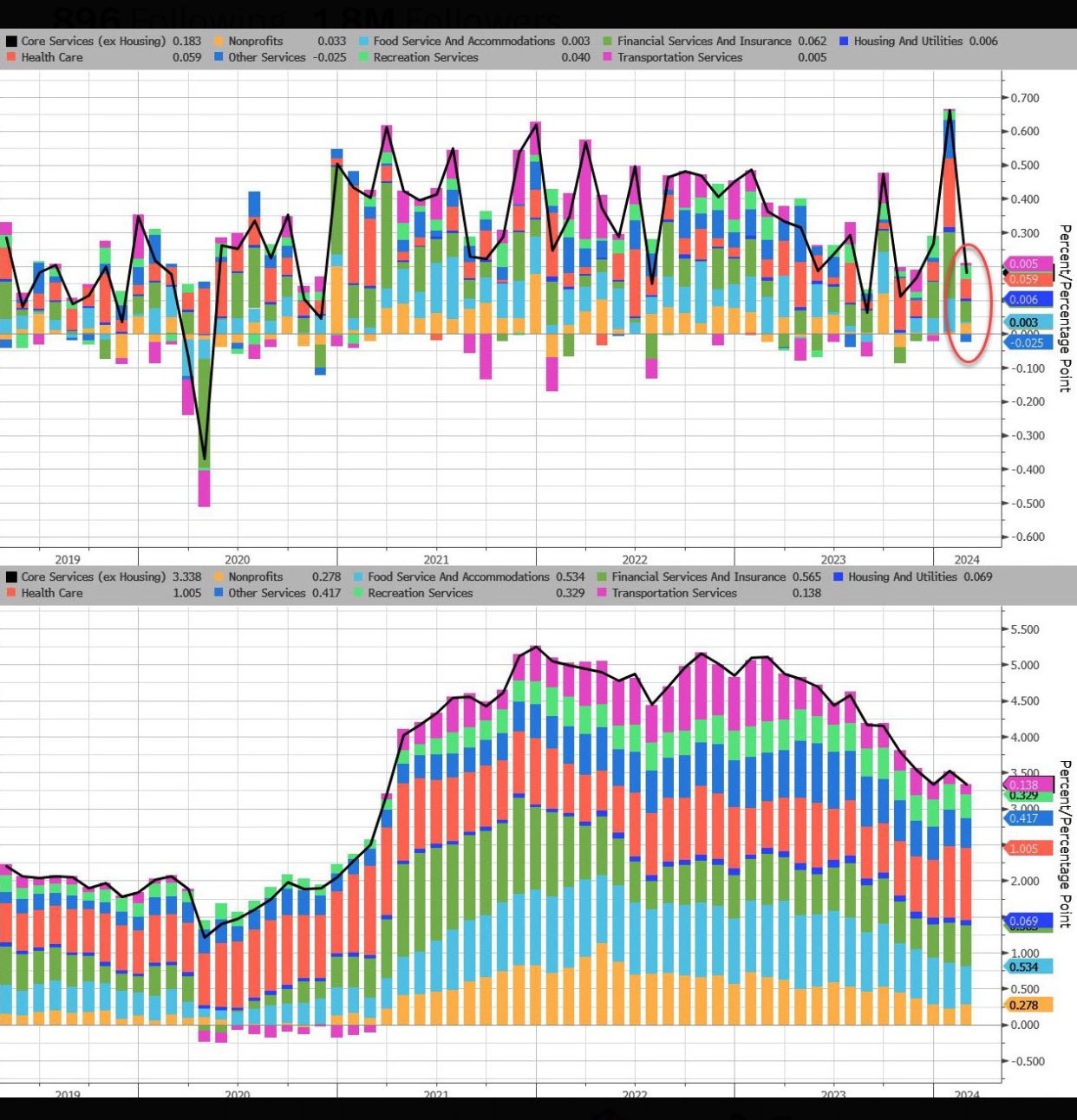

Just as with the CPI report, the sharp slowdown in Supercore PCE MoM will dominate commentary. With strong GDP and jobs data, investors hope the Goldilocks economy continues.

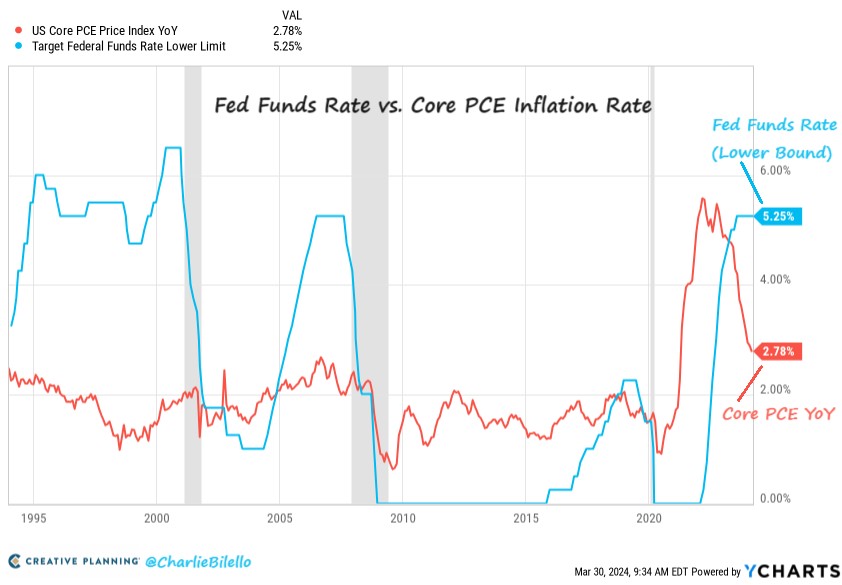

The Fed's preferred measure of inflation (Core PCE) moved down to 2.8% in February, the lowest since March 2021. The Fed Funds Rate is now 2.5% above Core PCE, the most restrictive monetary policy we've seen since September 2007. Due to stealth QE, the Fed prints $1 trillion about every 100 days so will be forced to keep rates higher for longer due to stubborn levels of inflation as long as the economy remains strong even if represented by measurements calculated by questionable, doctored means. Nevertheless, doctored data drives the markets but you cant create money without eventual consequences. There is no free lunch.

AI compute evolving at blinding speeds

Since generative compute AI was launched in late 2022, AI has been evolving at blinding speeds. Ray Kurzweil, who predicted with extraordinary accuracy way back in 1999, nearly 30 years ago, that AIs would achieve human-level intelligence before the end of this decade. Indeed, three weeks ago, Anthropic released Claude 3, its newest large language model (LLM), which was measured as having an above average IQ score of 101.

86% of Kurzweil's predictions have come true. Elon Musk recently noted, “I’ve never seen any technology advance faster than this, the AI compute coming online appears to be increasing by a factor of 10x every 6 months.” Then in early March 2024, in response to Ray Kurzweil, Elon tweeted: “AI will probably be smarter than any single human next year. By 2029, AI is probably smarter than all humans combined.”

By the end of this decade, AI may soon be one billion times more intelligent than humans. If a human is one billion times more intelligent than a mouse, what would an entity be like that is 1 billion times smarter than a human? And this entity can each subsequent bot generations so we could have an army of them.

That said, AI is well overvalued so any signs of material weakness in the economy that could spur a rate cut would likely induce sharp selloffs in leading tech stocks. At the same time, if the weakness is mild, markets could stand their ground on the basis that the economy remains not too hot and not too cold.Where we are in the Bitcoin bull cycle

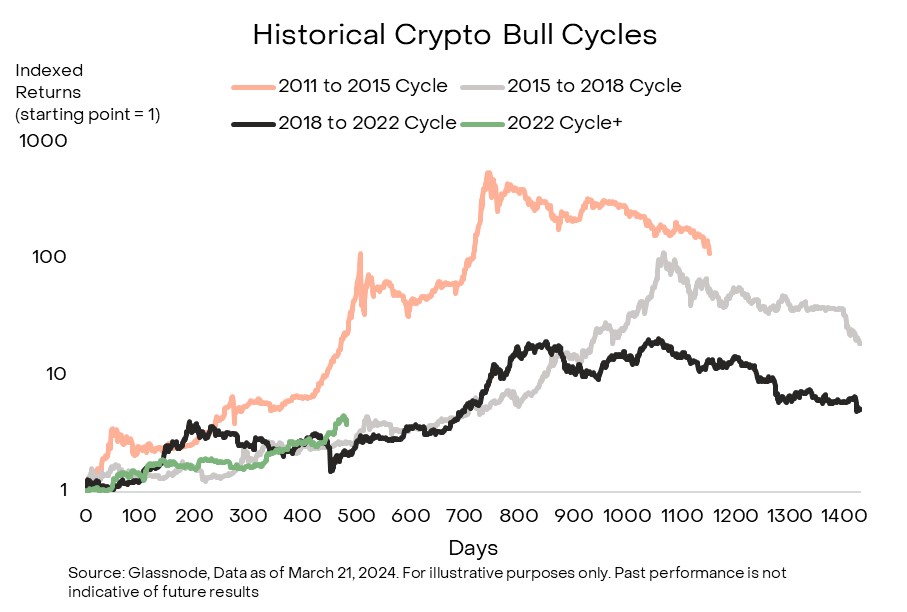

Historical crypto bull cycles show we are just getting started in the current cycle. But remember that Bitcoin is a volatile beast so expect some sharp shakeouts along the way. In past bull cycles, 15-30% corrections in Bitcoin thus 30-50% corrections in alt coins were the norm. This can be expected since in past bull cycles, Bitcoin has typically risen by at least 10-fold.

On interest rates and inflation

All G10 central banks except the Bank of Japan are expected to reduce policy rates over the coming year despite strong economic growth. For example, at the March 19-20 meeting, Fed officials said they still planned to cut rates three times this year, despite forecasting stronger GDP growth and higher inflation. Still, long bond yields, the dollar, and oil remain in rally mode suggesting less likelihood of three cuts by the end of the year. Similarly, at the Bank of England, no official supported raising rates for the first time since September 2021, then on March 21 the Swiss National Bank unexpectedly cut its policy rate. Only Japan hiked but by only 0.1%.

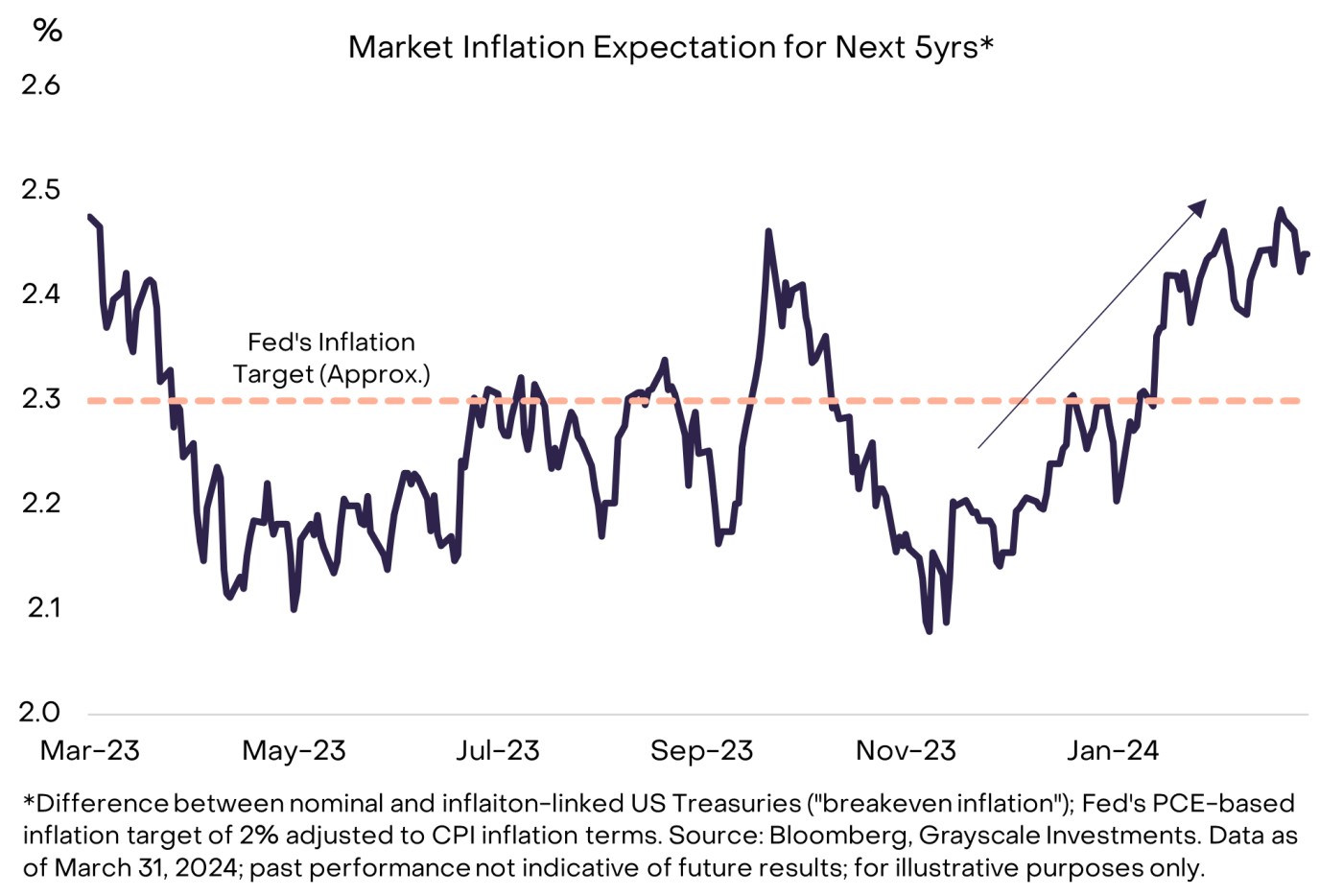

This attitude among central banks reflects the new norm as the 2% mandate for inflation by the Fed becomes less and less likely while a higher "norm" seems more likely. Market inflation expectations have therefore been boosted. The difference between nominal and inflation-linked US Treasury notes—so called “breakeven inflation”—has increased across maturities this year. The risk of higher inflation boosts demand for alternative stores of value, like physical gold and Bitcoin which explains the recent rise in precious metals.