Market Lab Report / Dr. K's Crypto-Corner

by Dr. Chris Kacher

The Metaversal Evolution Will Not Be Centralized™

End of the bear market?

The talk about new bull markets in stocks and crypto is premature. Traders cite the S&P 500, NASDAQ Composite, and Bitcoin breaking above their 200dmas because of tamer inflation and the coming Fed pivot. But a big reason for the rally was due to short coverings in stocks and liquidation in crypto which was the highest amount liquidated since the bull market began in 2020. Powell is also now using only the last year of CPI data so it can give him more reason to pivot as inflation data over the last year looks more favorable overall. Goldman Sachs felt Powell's statement was hawkish given that there may be more than just one more 25 bps hike and/or the terminal rate could stay elevated for some time in the face of record levels of debt, but Wednesday's rally was due in part to a dovish media who focused on Powell's disinflation language, "we can say the disinflation process has started".

In crypto, a number of Bitcoin metrics show Bitcoin is at major lows if one bases this on prior Bitcoin bear markets.

But once enough people are convinced, all it takes to pop this mini-dead bat bubble is a report from CPI, PPI, or PCE showing inflation is staying stubbornly high.

That said, even if inflation falls further, reports will eventually show that the economy is worse off than expected in the form of soaring unemployment, negative GDP, or other economic misses. Soft landing? We would be lucky to just get a hard landing.

Lower inflation or poor economic reports would prompt a Fed pivot to halting or lowering rates. Markets would celebrate, but history shows that reducing interest rates does not create a major low in stock markets. After a major bubble, it takes several rate reductions for markets to find major lows such as in 2000-2002 or 1930-1932.

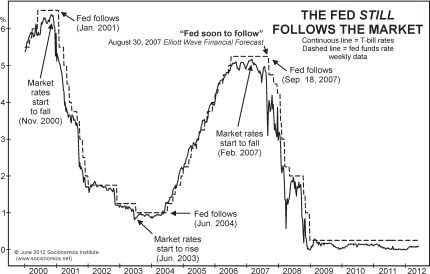

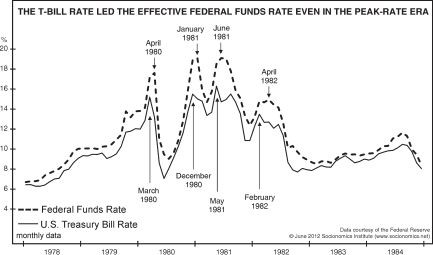

The Fed normally follows the stock market. From an earlier VSI report, history over the last century shows us that when the Fed pivots, it is too late. Unemployment soars, people spend less, earnings plummet, and the question is how deep and long does the recession last? Rate hikes break something material in the economy, but such hikes are inevitable especially when trying to unwind a massive bubble or tame inflation. Today, we have both.

I showed a chart in a prior report where the Fed Funds Rate typically follows stock market direction, and also equates well with the rough principle of "Three steps and a stumble" where the Fed hikes a few times in a bull market, which then ends the bull market, forcing the Fed to then lower rates. The US 3-month Treasury is also a solid predictor of the direction of interest rates. While the stock market leads the FFR, 3-mo Treasurys lead the FFR. For example, T-bill rates peaked four times in 1980-1982. Each of those peaks occurred a month or more before subsequent and reactive peaks in the federal funds rate. The Fed's rate also lags at bottoms, as depicted on the chart at the lows of 1980, 1981 and 1982-3.

Rate hikes in the face of falling markets

It is key to note that due to record debt, historically low interest rates, and soaring inflation, a perfect storm was created that forced the Fed to hike rates over the last 12 months despite the bear market. This is the first time the Fed hiked so aggressively in the face of a falling market, breaking from its tradition of following the market with rate hikes or rate cuts. But rates were already near zero at the stock market top, so they had no choice but to start cutting rates, bear markets be damned. This decoupling between rate hikes and stock market direction is historically unusual so expect materially serious consequences ahead, ie, the major bottom in stocks and crypto markets has yet to come. Indeed, the macro environment has never been worse in this long term debt cycle as detailed by Ray Dalio of Bridgewater.

Nevertheless, markets have been celebrating increased odds of such a pivot as well as reduced odds of continued 25 bps rate hikes beyond the next meeting in March. This partially accounts for the bounce that started at the start of this year in both stock and crypto markets.

We must not forget that M2 was expanded by record levels due mostly to COVID, political consequences, and supply chain issues. In consequence, much unwinding of the QE bubble still needs to be done. Exchanges such as FTX, Voyager, Genesis, and Celcius are looking to dump their crypto into this rally. Countries such as China who brought COVID restrictions to an end and Japan with its yield curve control are increasing their M2. This could put inflationary pressures on the rest of the world.

Capitulation

We never got proper capitulation based on technicals in stocks or metrics in crypto. We have yet to see the saying "Buy when there's blood in the streets" signal a major bottom. In the current bear, Bitcoin peak-to-trough has dropped only about -77%, or requiring about a 3x gain to reach new highs. Excluding the fast COVID crash of Mar-2020, in the last two crypto bear markets of 2014 and 2018 when macro and inflation were relatively tame, Bitcoin fell -84% and -87%, requiring about a 6x gain to reach new highs. In the last two stock bear markets of 2000-2002 and 2008, the NASDAQ-100 fell -78% and -55%. So far in this bear market, the NASDAQ-100 has fallen only -37%.

The incoming recession will make risk-on assets such as crypto and stocks highly vulnerable. Buyer beware. But when the recession is making things look at their worst and the mainstream press is headlining dire economic news, this is often when major markets find their bottoms.