by Dr. Chris Kacher

Yen carry moral hazard

Here's a lesson in moral hazard. The BOJ and the Fed won’t allow the $-yen interest rate differential to narrow otherwise markets will implode again. Knowing this, the market will continue to pile on leverage. Yen shorts have risen by about 40% in the past week, emboldened knowing the BOJ won't be raising rates.

More on the QE doom loop

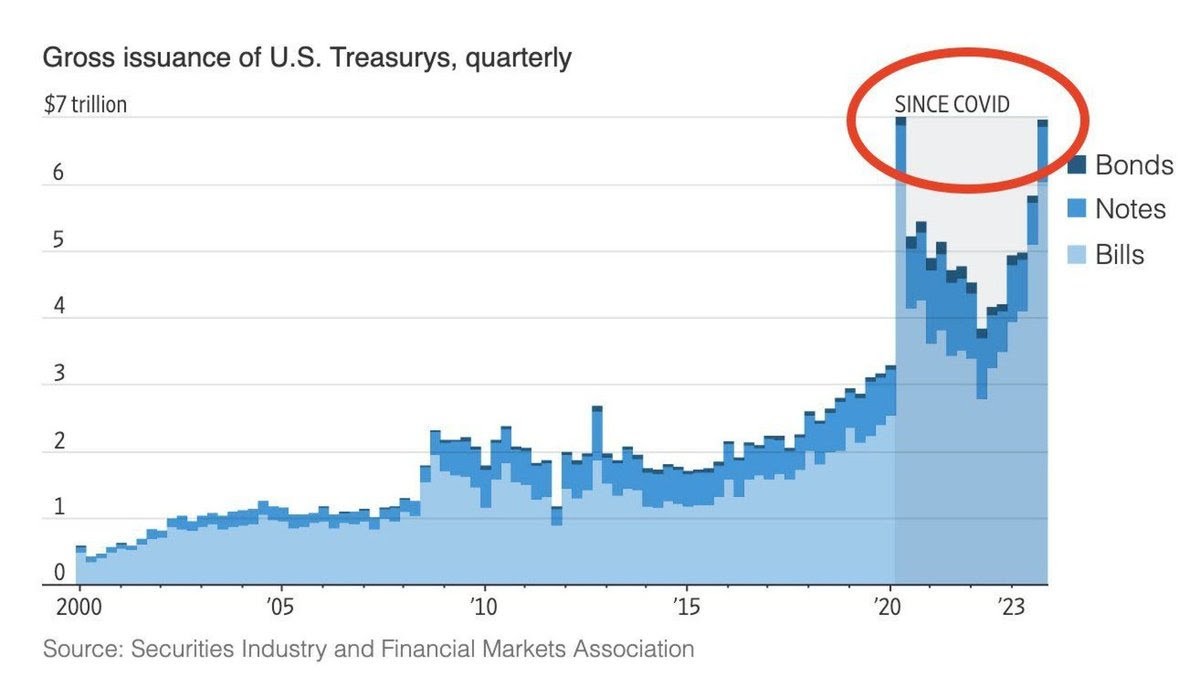

The financial system broke in 2008 so they launched QE which sank fiat, dooming the younger generations to economic enslavement while saving the boomer's pension and home price.

As one of many examples, the chart of the Caracas Stock Exchange in Venezuela goes vertical as it undergoes hyperinflation. Other country's charts look similar such as Zimbabwe, Yemen, and Argentina when they underwent hyperinflation.

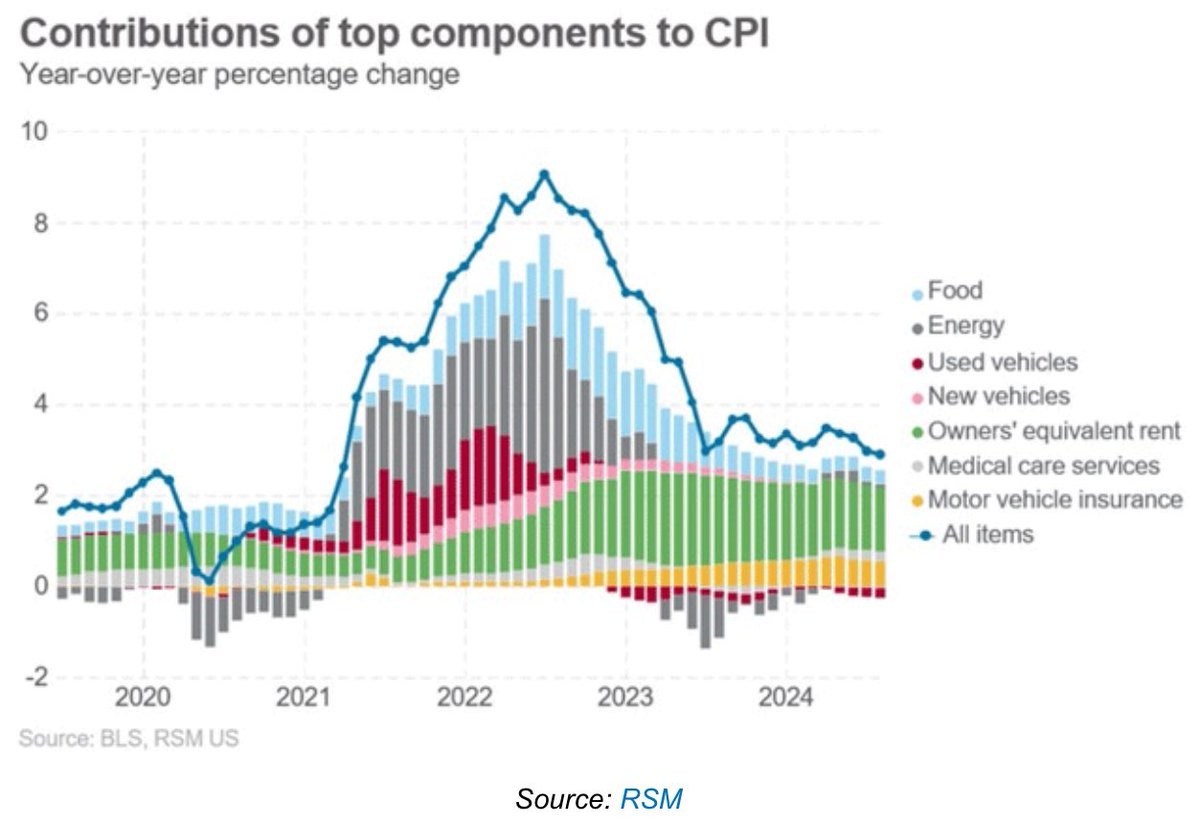

Inflation

We’ve seen some solid drops in inflation but the progress is flattening out. Rents, insurance, and food remain sticky around 3%.

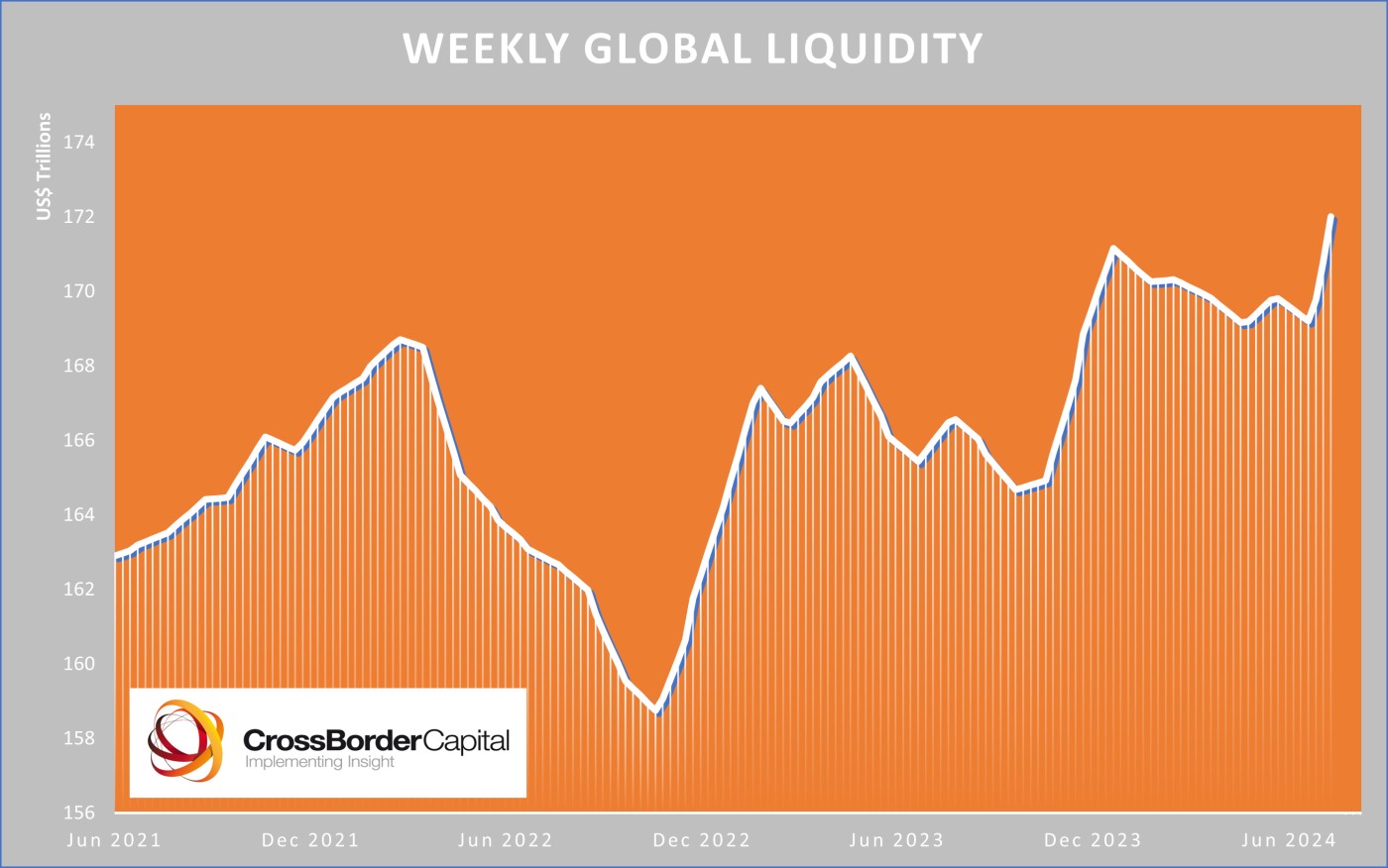

The Fed will therefore have to cautiously reduce rates. They can keep creating fiat via stealth QE as they have been doing since 2023 so don't have to rush rate reductions. As shown in a prior report, the U.S. government also borrowed more under the "Biden boom" since Jan-2023 than it did during COVID.

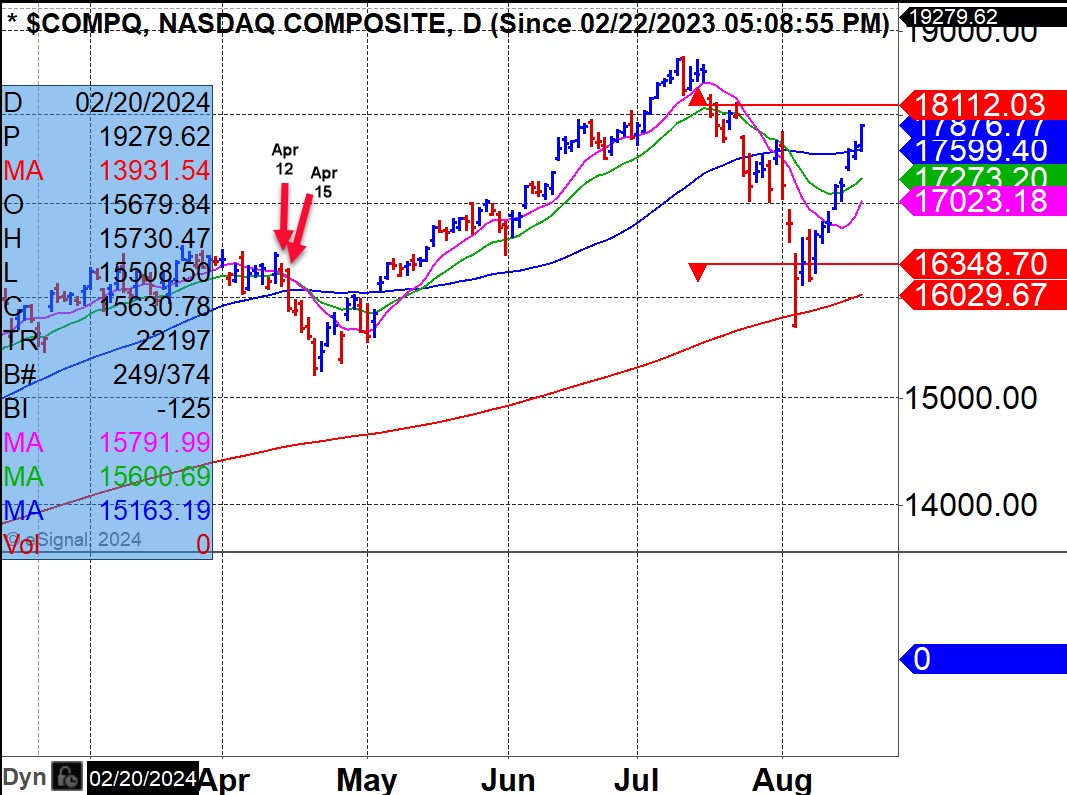

Iran-Israel conflict

War is inflationary but is also growth inducing through the creation of debt. The first attack by Iran on Israel was on April 13-14 which pushed markets down for a few days as markets worried the situation would escalate but then quickly rebounded.

The situation may be expanding months later as Iran becomes more of a threat to Israel. Iran recently announced that Israel could expect another attack from them in retaliation for the assassination of the Hamas political leader on July 31 in Tehran. The U.S. is preparing to counter it. On such an attack, should markets fall once again, this would likely be a buying opportunity though markets may react in a more muted fashion if the attack is a replay of what happened April 13-14. That said, if the situation looked to be worsening between the two countries or spreading to other countries, markets could fall for a time being.

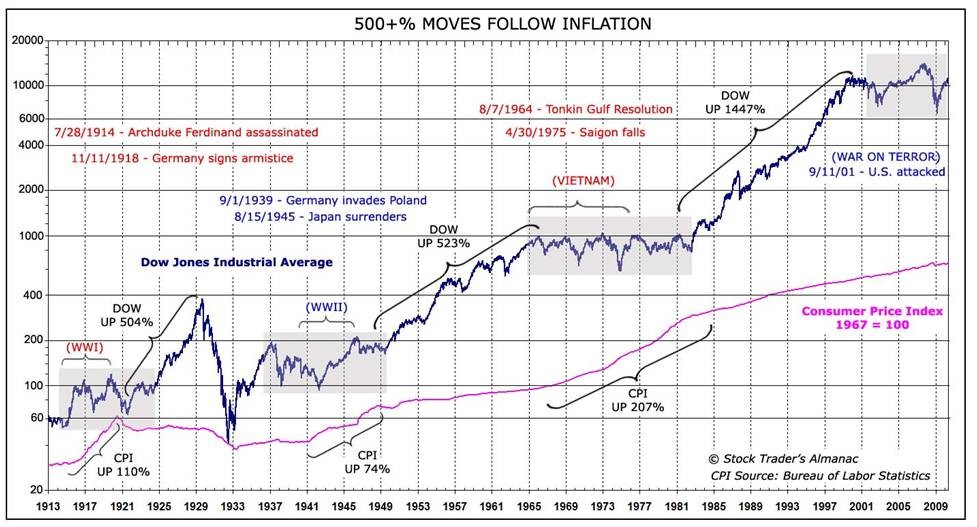

History of major wars. Are we on the brink?

As war spreads, more fiat would need to be created by the U.S. and other countries which contributes to the inflationary nature of war. This would ultimately have a bullish effect on markets but if uncertainty reigned supreme as war spread to other countries, markets could fall for a sustainable period as they did from 1937-38 and 1939-42. World War II ran from 1939-1945. Today's QE programs, stealth or otherwise, may prevent a repeat of 1937-38 which was triggered by an economic recession within the Great Depression and doubts about the effectiveness of Franklin D. Roosevelt's New Deal policy.

November 1938 to April 1939 (S&P -26.2%): Fears of recession loomed large as investors were still traumatized by the Great Depression.

October 1939 to June 1940 (S&P -31.9%): Hitler invaded Poland on September 1, 1939 then from October through June of the next year stocks fell almost 32% from recession fears due to the expanding war. The prospect of another world war weighed heavy on the psyche of investors.

November 1940 to April 1942 (S&P -34.5%): Again there was no recession to cause this downturn but there was the Pearl Harbor attack and the U.S. entering World War II. Following the Great Depression and its aftermath, most people had more or less given up on the stock market. Of course, this led to a great multiyear bull run until mid-1946.

It remains to be seen whether the current wars will spread. The U.S. paid for World War II by the creation of fiat. Global uncertainty and recessionary fears after the Great Depression created bear markets. The markets hit their lowest levels in April 1942, then turned as the Federal Reserve dropped interest rates to nearly zero, spurring the creation of fiat to fund the war. The Reserve Banks agreed to purchase T-bills at 0.375% per year, substantially below the typical peacetime rate of 2 to 4 percent. The interest-rate peg became effective in July 1942 which coincided with the start of a major bull market that lasted until the Fed started to tighten in 1946.

So once again, the creation of fiat by way of lower rates spurred the bull market back then. In today's markets, we are on the brink of major money printing via QE in all its forms.

Furthermore, with the dollar on the decline, gold is at new highs. The printing presses are rolling so even though the Fed is behind the curve, the only rate reductions we have had since 2008 started in 2019 which was a bull market for stocks. It did not lead to recession or a bear market.

All of this suggests higher bitcoin prices ahead but in the meantime, bitcoin first needs to get above its 50dma. The selling of bitcoin by miners looks to be nearing its end. Mt. Gox holders are also showing a higher likelihood of holding than selling their bitcoin.