by Dr. Chris Kacher

Markets are highly predictable

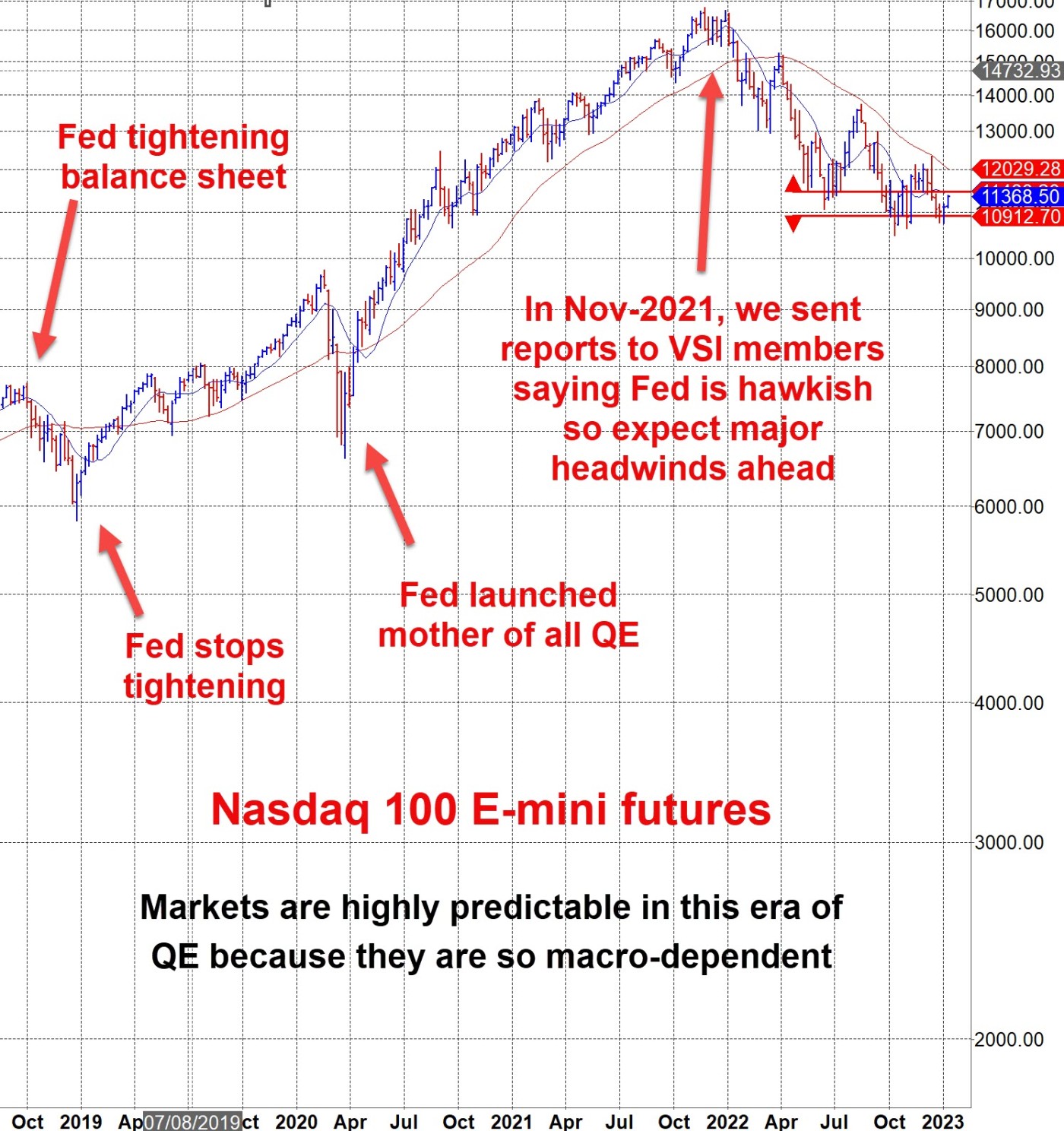

You can time to nearly the day when the Fed's actions influence the major averages into starting new uptrends or downtrends. There's late 2018 when the first Xmas crash on record caused the Fed chair to make an emergency announcement that he would no longer be tightening the balance sheet. This quickly led to more QE thus we were off to the races again in 2019. Then there was COVID which pushed the Fed into launching the mother of all QE programs. It was not until late 2021 that the Fed became hawkish. We notified members of this change of heart in Nov-2021 stating to expect headwinds. We then advised going to cash or shorting. Profits were taken in most crypto names on the Crypto Picks List in Jan-2022, then the remaining 4 names were removed in early Feb-2022. Interestingly one of the names was LUNA, the coin that bankrupted many but only later in 2022. At the time the name was removed from the list, profits were substantial.

Crypto has never been through a prolonged recession so expect valuations to drop even from current levels. As of this writing, the cryptospace is worth just over $1 trillion, down from $3 trillion, or about 2/3 off its peak. The macro picture is about as extreme as it gets since WW II based on the levels of debt, interest rates, and inflation so expect the recession to be deep and long. While we are witnessing a dead bat bounce because the market believes inflation is cooling, the Fed as well as majors such as Goldman Sachs and Blackrock believe inflation will remain stubbornly high so the terminal rate could be well above the 500-525 bps range estimated by the dot plot. Given record levels of debt due to COVID, something is liable to break even before the federal funds rate (FFR) gets to 500-525 bps. The odds of a black swan are substantial.

It is therefore not hard to believe that Bitcoin could drop by say -90% from its former peak of $69,000. This would be beyond what it dropped during its last two bear markets of -84% and -87%. Expect the cryptospace valuation to drop to $200-250 billion. This is -91% to -93% off its $3 trillion peak since Ethereum will probably drop -97%, beyond what it dropped in 2018 of -95%, thus smaller altcoins will probably drop -98% to -99.x%. This suggests a Bitcoin floor price of $6900 and an Ethereum price of $146, thus it's $10k and pray for Bitcoin.