Market Lab Report

by Dr. Chris Kacher

The Web3 Evolution Will Not Be Centralized™

Markets and central bank policy

The major stock market averages did an about-face on Thursday after NVDA reported blow out earnings. The NASDAQ Composite and S&P 500 first gapped higher into their 50-dmas, then finished at their lows. NVDA also reversed most of its gains the same day. This was a far cry from NVDA's prior earnings report when it gapped higher after the close, at first by about 7-8%, then opened the next day up around 30%. As the AI bubble is bursting, markets are far more suspicious. Further, real interest rates are sufficiently high to attract capital away from stocks. Should rates stay elevated while inflation cools, real interest rates will rise which will be bearish for stocks.

The Fed's Jackson Hole speech showed not much has changed. Powell is firmly sticking to the 2% inflation mandate and expects rates to remain at current elevated levels for a prolonged period. In consequence, CME FedWatch was expecting a rate hike to 550-575 bps on Nov 1, but since the Grayscale news that hit on Tuesday along with positive news in the AI space between NVDA and GOOGL, this is no longer the case. Instead, rates are expected to remain elevated at the current 525-550 bps then get reduced in May. Of course, this is subject to change with new data.

With the AI bubble seemingly on a break or more likely having popped, major market averages have little to stand on given current excessive valuations.

Further, the Grayscale win does not guarantee the SEC will approve their ETF. The SEC may find other reasons to deny them a spot Bitcoin ETF including appealing the decision or taking the case to the Supreme Court. In consequence, this legal battle could end up lasting even longer as this issue between Grayscale and the SEC started in June 2022. The SEC is currently appealing the Ripple Labs crypto decision, so the SEC is clearly not going to take the recent Grayscale decision lightly. Thus, it seems Tuesday's crypto bounce could be another good shorting opportunity. Indeed, XRP's price has retraced all its gains since its "win" in July.

Is it therefore reasonable to expect Bitcoin will also roll back over as it has done every time so far in 2023?

Crypto regulations

New cryptocurrency legislation in the United States is causing concern once again much as it did in 2022. Major players in crypto rose to the occasion just before crippling legislation could have been enacted back in 2022. This postponed any such legislation until now. At present, the lawmakers are aware of the damage their proposals would do to the cryptocurrency industry but are still pushing forward. In consequence, such proposals are less likely to be reversed or delayed and could have a significant impact on the crypto industry. The UK and EU seem to be in agreement with US policy. The three regions tend to correlate in terms of their attitudes towards crypto.

A developer suggests that crypto builders should consider not serving US customers for five to ten years to avoid regulatory hassles. This may eventually extend into the UK and EU.

The proposed US regulations would classify websites interacting with wallets as brokers, requiring them to issue tax statements. This would be onerous making compliance costly or even non-compliable. This would potentially affect all DeFi apps and services like etherscan.

The legislation is seen as a threat to individual self-custody and self-sovereignty over finances, and it reflects a broader trend of digital privacy erosion. The current administration's stance appears unfavorable to crypto and its development within the US. The upcoming presidential election is considered crucial for establishing common-sense crypto and privacy legislation, which is essential for the future of the industry and individual liberties.

This does not bode well for Bitcoin and alt coins which are in the midst of a prolonged bear market. Many crypto talking heads continue to draw upon the price and metrics history of Bitcoin to suggest a major bottom has been established. While such advice may have worked in past crypto bear markets such as around the start of 2015 when Bitcoin capitulated in Jan-2015, the macro environment was still bullish. In late 2018 when the macro environment was hawkish, a change of heart by the Federal Reserve created the major low for cryptocurrencies in Dec-2018. This broken record repeated numerous times throughout 2022 which was one of the worst years for crypto. Sadly, the broken record remains firmly in place. In consequence, losses continue to mount for those who try to jump back into crypto. The rhythm of 2023 has been a quick FOMO news led rally followed by an erosion of price. Unless we get another black swan of some magnitude, it is unlikely QE will rise.

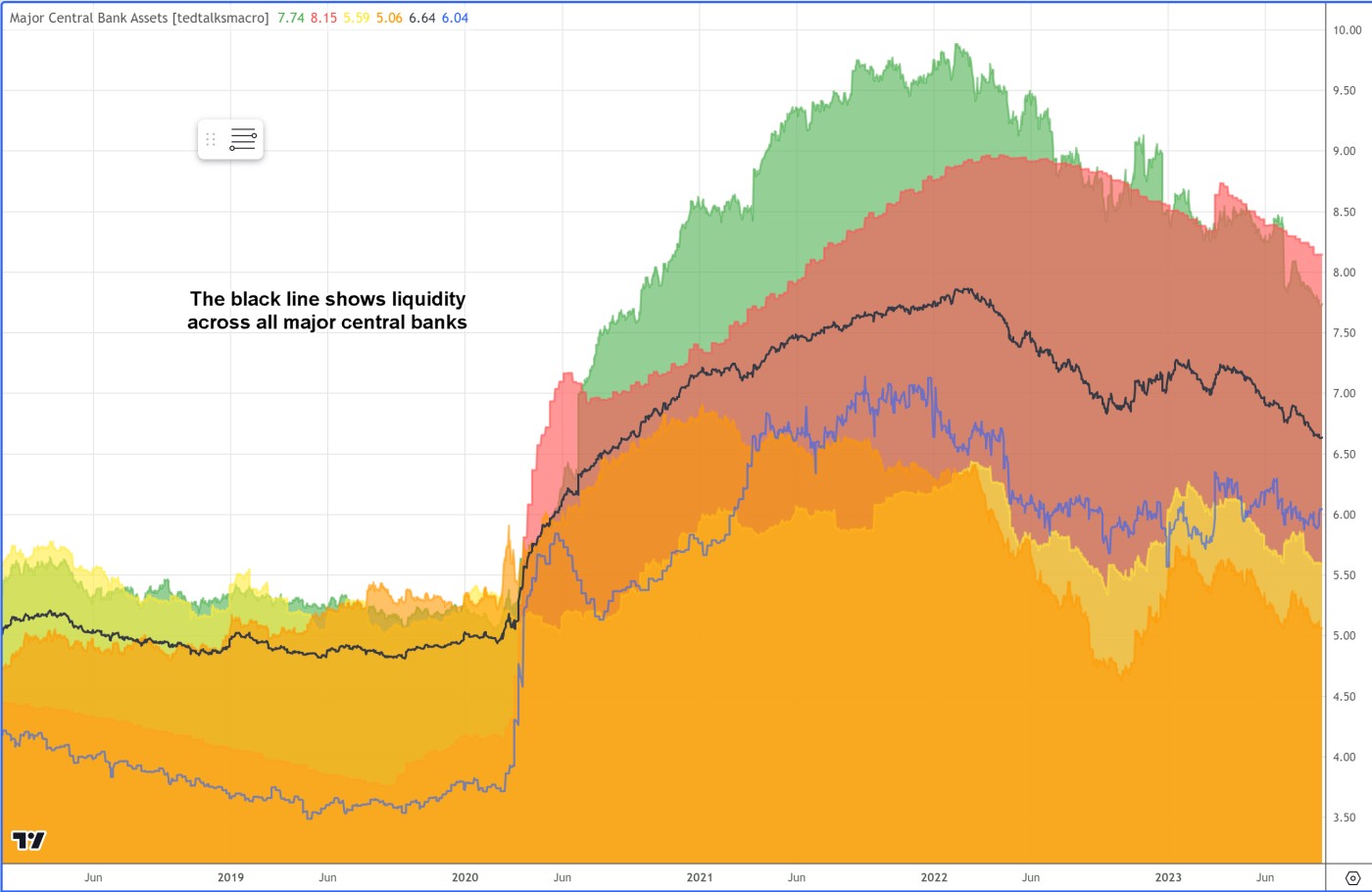

Indeed, global liquidity continues to fall.

Shorting cryptocurrencies has been and can continue to be profitable in such situations. That said, crypto is notorious for its vicious short squeezes so one must be even faster to take profits when they arise. Alternatively, one can add to their short position on such squeezes as they ride the overall trend lower keeping in mind 2023 has had 3 mini black swans, the first in January when China had been boosting liquidity via QE, the second in March when the Fed had to boost QE due to the failures of major banks, and the third in June when Blackrock filed for a spot Bitcoin ETF.

The most famous meme coin of 2023, PEPE, jumped in price along with most other alt coins when Blackrock filed for its spot Bitcoin ETF. The sudden optimism that the cryptospace would finally get its spot Bitcoin ETF was premature. While Blackrock may indeed get approval by the SEC, this is unlikely to come before Feb-2024, thus such news quickly became old news. A number of altcoins traded sideways for a bit then rolled back over.

Note that what makes shorting cryptocurrencies particularly challenging are its often extreme moves to the upside in a downtrend often due to short covering. AVAX had such an event in July, a few weeks after the Blackrock Bitcoin ETF news. Major moving averages can be used as a short selling guide. With AVAX, it rallied up into its 200-dma. It then broke back down through its 55-ema, 21-ema, and 9-ema. With cryptocurrencies, I have found these moving averages to work a little better than the traditional 50-dma, 20-ema, and 10-dma used with stocks.