Dr. K's Crypto-Corner

by Dr. Chris Kacher

Riding the Revolutionary Rocket with Cryptotechnologies... Entirely Evolutionary™

[Image courtesy of Username: cortezgold on Steemit]

Trading Sidebar: We have had a number of observations by members over a number of years on how the IBD breakout style has been fumbling. The risk/reward is unbalanced as one is often buying at new highs. Such a strategy worked well in the 1990s, but today's markets are vastly different. We continue to guide members into low risk trades especially in this algo-driven, QE manipulated market. Such trades tend to be undercut & rally types where shakeouts under a major moving average or significant area of support tends to work well. Gil sent a VooDoo report on this topic to members on Wednesday. Some members have also mentioned how ugly duckling patterns also can work well. Pocket pivots bought on constructive weakness after the pivot has occurred also keeps risk to a minimum.

Manufacturing Woes

The Federal Reserve lowered rates at their last meeting as expected but indicated there would probably be only one additional rate drop by the end of the year. Even though the CME Fed Futures had put odds of that being the most likely outcome, the market at first sold off, but then managed a strong rebound to close at the top of their intraday trading range. This was no surprise as markets know QEndless will continue to fuel the decade-old bull market.

Trump who is shamelessly optimistic says the U.S. economy is the strongest ever so has been urging the Fed to aggressively cut rates to make it even stronger, with little or no risk because inflation is so low. St. Louis Fed President Bullard supports this but holds an opposite view. He says the Fed should have cut deeper because the manufacturing sector “already appears to be in recession.”

As the trade war continues, a global slump in manufacturing is hurting growth in export powerhouses China and Germany. China just suffered the worst single-month reading for industrial output since 2002 and their producer prices fell at their fastest rate in three years in August, underscoring problems its manufacturing sector faces which is largely dependent on access to the U.S. market. Over in the eurozone, manufacturing sentiment fell in September to the worst level in nearly seven years, suggesting the economy nearly stalled at the end of the third quarter. German manufacturing PMI fell to 41.4 in September from 43.5, its worst reading since the Great Recession of 2009. Germany has normally been the most reliable source of growth in the region.

No surprise then that the International Monetary Fund reduced its global growth outlook to 3.2% this year, the weakest since 2009 that was due to the financial collapse of 2008. To add fuel to the fire, China is particularly vulnerable to rising oil prices as the world’s largest importer of oil, so expect the 5% estimated drop in oil production as a consequence of the Saudi attack to push oil prices higher.

FAQ on Timing the Next Recession

In light of the above, I've been asked about what happens to the prices of real estate when the next recession hits. The next recession will be a huge challenge for the planet as debt is at record levels and central banks have nearly no room to jump start the economy as interest rates are at historically low levels, and you can only go so negative. If the global economies continue to drag- a real possibility especially given the protracted trade war while Germany is teetering on recession- the US may go to 0% as soon as sometime in 2020. It's only 7 more rate reductions of 25 bps to 0%.

The next recession which could be substantially deeper than prior recessions or perhaps equivalent to the post-2008 recession will obviously have a hugely negative impact on the prices of stocks and real estate. QE only postpones recession but interest rates can only go so low, and the US, in time, is increasingly likely to have trouble meeting its healthcare and pension payments, thus an acceleration of QE and further reductions in interest rates are likely. When the dollar was pegged to gold prior to 1971, the U.S. was able to devalue the dollar overnight by 41% as gold was revalued overnight from $20.66 to $35. This time, QE is the main weapon in the arsenal of central banks.

What is the probable sequence of events? We know global central banks have no choice but to follow the Fed by lowering rates and restarting QE in the case of the ECB. It is likely central banks will continue to lower rates as much as they possibly can as this was the general direction interest rates took even before the trade war began. Now add in the pressure of the ongoing trade war and you have an even higher probability of lower rates ahead. Negative rates exist in a growing number of major countries such as Germany, Japan, and Switzerland. Making rates even more negative is a Hail Mary pass of sorts. I believe stocks, real estate, gold, and bitcoin all have room to move higher since there is probably at least a year or two left in the interest rate gas tank before things really tank by way of deeper fiat devaluations via greater reductions in interest rates and bigger boosts in QE.

Real estate and stock prices are likely to top after QE exhausts itself. This will happen when further boosts in QE and even lower rates do not help the global economy while digging an even deeper debt hole, after which, we get a recession. The seriousness, depth, and length of the recession will correlate with the level of debt generated via QE (how much needs to be unwound), exponential growth technologies which could help soften the situation, and Trump's pro-business policies which could enable the U.S. to grow out of its debt much as it did post-World War II.

Must Recession Occur?

The descent into recession will occur by seeing inflation in some countries spiral out of control, and/or by the Fed hiking rates at the wrong time, and/or by major countries such as Germany slipping into a full blown recession despite QE, and/or the boost provided by exponential growth technologies occurring later than sooner. Manufacturing is teetering and the Fed's Bullard thinks U.S. manufacturing is already in recession. So in the meantime, continue to ride the trend in real estate, stocks, gold, and bitcoin. Central banks will not stop printing unless we get sufficient help from exponential growth technologies that helps boost GDP thus gives the Fed room to hike rates. But this may not happen until after the recession. That said, the smarter of the “older guard” are well positioned in gold, real estate, and other assets that counter the devaluation of fiat. But rather than a day of reckoning, the next recession may be softened or even averted by technologies that are exponentially growing (ExpoTech). Exponential growth is always underestimated because it is... Exponential. GDP has been penalized by such technologies. As one of numerous examples, Skype is a technology that is free or at very low cost thus has brought much freedom of communication to the average person. Yet it has disrupted the telecommunications industry costing them a fortune thus has hurt GDP.

Nevertheless, the planet has not had a recession in a decade as QE has artificially kept the world afloat so one is perhaps due. Central banks may seem unstoppable as some once assumed the Titanic was unsinkable, but the larger the sovereign debt bubble becomes, the bigger the potential collapse when the dominoes tip. But don’t rule out the tempering effects of ExpoTech.

While QE remains alive and well and is responsible for the decade-old bull market in the U.S., know that nothing goes up in a straight line so risk management in moving to cash when warranted is prudent. While the bull market began in 2009, there have been corrections as steep as -20% in the major averages and far greater in individual stocks. Taking short positions in the right names has been lucrative during such corrections.

Bitcoin On Track

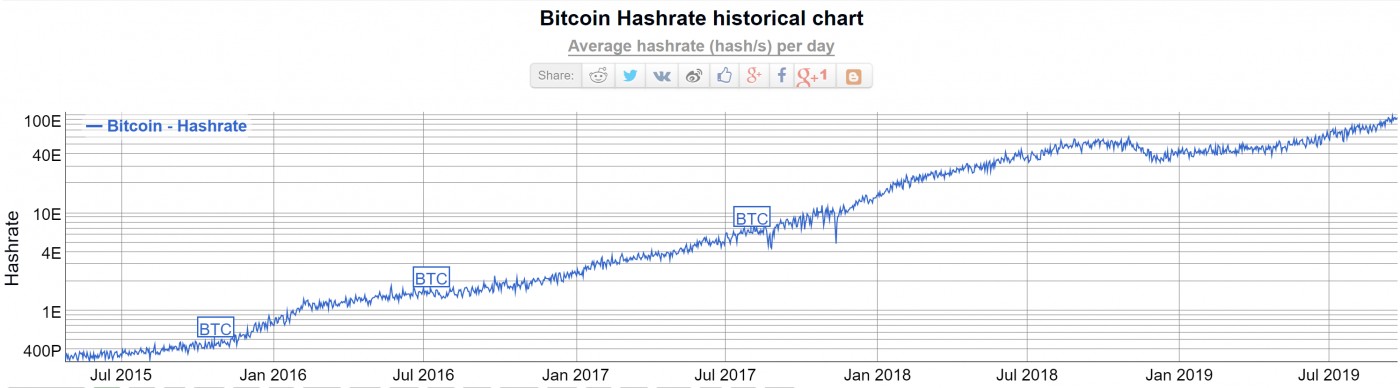

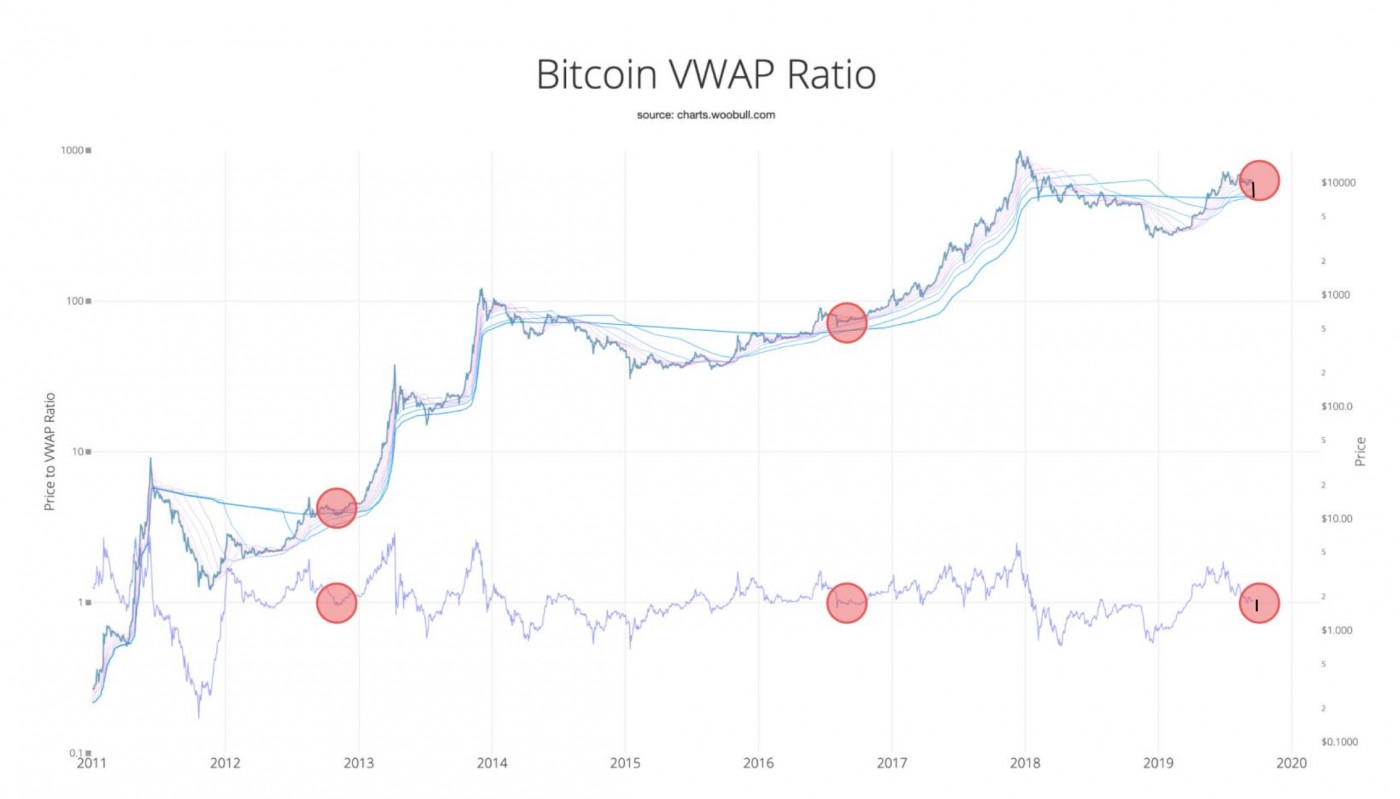

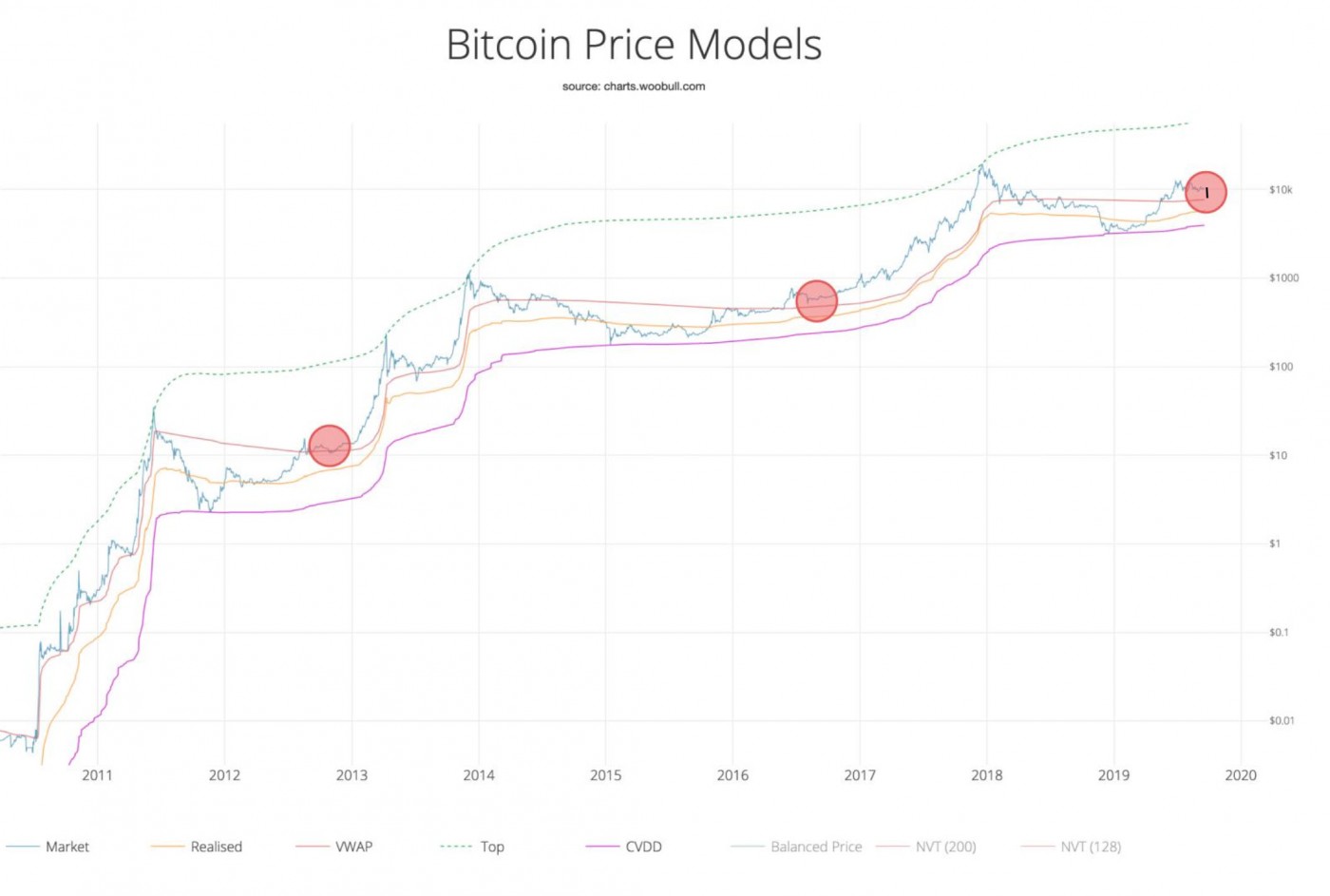

I have discussed at length why the price of one bitcoin should continue into the hundreds of thousands then millions of dollars in the coming years. Various metrics I use, some of which I have used in prior reports, together have called every major top and bottom in bitcoin since 2011, and show bitcoin's current correction is typical of bitcoin corrections during bull markets where it often corrects between -28% to -42% over a period of several weeks or less before resuming its longer term uptrend. The depth of the current correction stands at -44% from peak-to-trough. Expect the price of bitcoin to make a run at old highs sooner than later. While its hashrate fell sharply over the course of an hour which immediately pushed the price of bitcoin down below 8000, this was likely caused by two factors: 1) a group of miners going offline where China could have played a role since they have made mining illegal, and 2) on-chain volume showed that short-term holders via UTXO were disappointed with the low volume activity on the day of the launch of Bakkt. This setback is temporary as its hashrate has bounced back sharply. All tailwinds that I have discussed in prior reports remain in effect.

The above metrics show the current setback is still a small blip on the chart and likely at or near lows in this current bull which began last December. Further, shorter term metrics shown below also suggest bitcoin is at or near a low, keeping in mind the red and green lines on the MACD still need to cross, SQZMOM (squeeze momentum) could still go lower though it probably near its low, and Stoch RSI still needs to push into the purple zone:

The above metrics show the current setback is still a small blip on the chart and likely at or near lows in this current bull which began last December. Further, shorter term metrics shown below also suggest bitcoin is at or near a low, keeping in mind the red and green lines on the MACD still need to cross, SQZMOM (squeeze momentum) could still go lower though it probably near its low, and Stoch RSI still needs to push into the purple zone:

Price/volume also suggest a retest of lows where bitcoin could undercut prior lows. Bitcoin as we know is highly volatile so buying on strength after the dust clears is often a better, lower risk way instead of trying to catch the falling knife.

The Infinite Headed Hydras

Regulations are a double-edged sword as they are bullish for bitcoin since they enable major institutions to onboard bitcoin en masse, such as the last Monday's launch of Bakkt, but regulations can also be bearish for the cryptospace since if the SEC is too heavy-handed, the price of cryptocurrencies may temporarily stall or drop. Such a situation would ultimately push encumbered crypto platforms to other more accepting jurisdictions much as we have seen happen due to the onerous and costly BitLicense in the state of New York as well as what happened in Russia and in China. Cut off one head, and it grows back somewhere else.

Regulate Individuals

That said, some have judiciously pointed out that even though the SEC said bitcoin is decentralized thus cannot be regulated, we may soon have FinCEN running nodes on the bitcoin network and monitoring individuals for specious transactions that offend anti-money laundering laws. So while bitcoin itself cant be regulated, the individuals transacting bitcoin can. But I ask, so what? Isn't this ultimately for the greater good? Blockchain's transparency enables law enforcement to track illegal activities with record levels of precision. Meanwhile, legal activities can thrive as bitcoin is used as a tool to transact value in a borderless manner.

Witch Hunt Justice

Of course, one can rightly point out that 'justice' systems are often anything but just as deep corruption often exists within such systems. Times of crises are used as reasons to pass additional laws in the name of protecting the country against tyranny, but which is simply a guise to pass laws which give far more control to the deep state thus are often rights-crippling. Laws equivalent to the laws against witches centuries ago continue to this day. As has been said, humanity is still in kindergarten.

Numerous examples abound such as McCarthyism back in the post-World War II era, anti-marijuana in the 1960s and to this day in some countries such as China and Hong Kong, anti-terrorist post 9/11, anti-drug, and anti-sex. Thus some laws can be manipulated and interpreted in a variety of ways making what was legal some years ago, illegal today.

One's act of transacting bitcoin may be perfectly legal but the individual, via the Patriot Act laws, could be labeled a terrorist or a money launderer without the right to legal representation. The stated purpose of the Act is to "deter and punish terrorist acts in the United States and around the world, to enhance law enforcement investigatory tools, and for other purposes." One of the many criticisms of the Act is that "other purposes" often includes the detection and prosecution of non-terrorist alleged future crimes.

Banning Bitcoin

Now if a government, say the U.S., took a much heavier handed approach by at some point declaring bitcoin transactions illegal, this would be similar to their stance against illegal peer-to-peer file sharing. Massive sums of taxpayer dollars have been spent since the days of Napster in the mid-1990s to overthrow sites that facilitate illegal file exchange. But p2p file sharing is also a multi-headed hydra that grows more heads each time one head is decapitated. How many sites similar to 'Pirates Bay' exist today? Countless. And yes, while some ISPs can track illegal activity then throttle the offending user's bandwidth, millions use VPNs to counter this. As any old school hacker knows, any protection put in place can be overridden. Virtually no code is unbreakable, even at a quantum level. Quantum is just a higher order variation of protection. Even the professors at Cambridge University who run Cambridge Quantum Computing would agree.

The same will happen with bitcoin if such extreme measures were taken by the U.S. or any other government to illegalize its use. So while I am in full support of blockchain's transparency to combat the real criminals, I am firmly against any crony capitalism or deep state born corruption which will hopefully be distant memories as the rise of exponential growth technologies that eliminate the middle man trust model proliferate across the planet.

(͡:B ͜ʖ ͡:B)