Market Lab Report / Dr. K's Crypto-Corner

by Dr. Chris Kacher

TTPs

Modern society runs on databases that are run by TTPs (Trusted Third Parties). TTPs decide, in practice, your rights, from trivial to important. Egs: your hotel airline reservation is cancelled, you can only wire a limited amount to your crypto-exchange, you are not allowed to use AirBNB, you are not allowed to vote in the Presidential election. Centralized TTP consensus is everywhere: corporations, banks, hotels, airlines, restaurants, pension funds, the FBI/CIA/NSA/IRS. FAANG stocks have built a huge installed base of data and data infrastructure that is the main competitive barrier to entry in any modern business. Antitrust regulators know there is something problematic with FAANG, but can't find it. And these tech juggernauts who attract the majority of eyeballs have censored individuals that went against their narratives. #trump

TTPs cause micro problems in that they are anti-competitive and macro problems that present existential risks. The macro problem with TTPs and their increased centralization is they are creating growing numbers of chokeholds that can be used to hijack the parts and eventually the whole of society. Indeed, nation-states worry too much about day to day risks and not enough about existential risks. Day-to-day risks include crime such as money laundering, tax evasion, and terrorism (overplayed by mainstream media thus used as an excuse to pass more rights crippling laws) though many so-called crimes are of the witch hunt variety, ie, victimless. The existential risks, on the other hand, are dictatorships.

Crime and tax evasion in pre-Hitler Germany, pre-Stalin Russia, and pre-Mao China were standards. But such didn't lead to dictatorships which then often led to war and/or mass genocides.

The world is sleepwalking into increased levels of authoritarianism which are highly centralized systems. China is not the only country steeped in this ideology as the U.S., UK, and EU are all heading in the same direction: China is attempting global walled garden, U.S. political leadership is not thinking strategically seeing everything through an AML/KYC lens, and the EU is overregulating as always.

Blockchain and NFTs can counter this. BTC solved the Byzantine General's problem by allowing for decentralized consensus. This has led to permissionless wire transfers, digital gold, and uncensorable payments as a growing number of countries adopt BTC into their ecosystems. But this is just the ice cube on the iceberg.

While centralization in the current system is far more efficient and can scale more quickly than decentralized systems, tech takes time to mature. As decentralization becomes a larger part of the global system, efficiencies will be found, thus the cost savings and new efficiencies and added security born from decentralized platforms will win over centralized systems. Certainly decentralized entry points of P2P file sharing have proven to be as efficient as centralized systems such as iTunes and Spotify. Economics wins the day. People vote with their "pocketbooks".

Memes + NFTs

Memes are the shared myths of the metaverse. As Yuval Harari wrote in his brilliantly insightful book "Sapiens", myths are what enabled organizations to grow well beyond the 150 "member" maximum. This is how all societal myth-building institutions work and here are a few of the results:

The Republican Party

The Libertarian Party

The Catholic Church

BAYC, squiggles, cryptopunks, cool cats, et al, are all about identity and social organization, with zero membership criteria while being fully global. We have never had a social organizing tool this powerful. NFTs are the same class of solution as BTC, but looser, more abstract, more human. Humans* are non-fungible.™ *Holistically, ofc ;)

3 Phases of Blockchain

Blockchain has created three phases of product-market fit for crypto: ICOs, DeFi, and NFTs. The former two do not have first amendment protections. AML/KYC may apply. ICOs are often securities. DeFi is likely to morph into CeDeFi as it merges with the existing system.

By contrast, NFTs have full first amendment protection. They are creative expressions. They have converted our online communities for the very first time into an ownership society. We must seize the "memes of production".

The big advantage to NFTs is they are unique, non-fungible instruments compared to normal crypto. This means certain NFT families such as cryptopunks can choose not to sell to outsiders. While some argue this is creating a new elite, this is a decentralized form of grouping people together as opposed to the centralized form which is control-oriented.

This can result in certain groups born of decentralization having more influence over centralized forms. In consequence, NFTs can greatly diminish the power and influence centralized platforms have had over the last many milleniums. The intermediaries, fee takers, and traditional wealthy will not automatically be running the show. NFTs will spread wealth out far more broadly than ever before as decentralization takes hold.

NFTs Point the Way

Eventually, while NFTs flippen traditional art, NFTs will start eating brands, they will start eating culture, they will start creating decentralized alternatives to centralized organizations.

Axie infinity and Ronin are the scaling solutions for digital nations. NFTs are the fuel. The multiversal Metaverse is the beneficiary.

Fiat Flippening

NFTs have revolutionized private ownership. They have converted our online communities for the very first time into an ownership society. Your avatar, your digital art, your in-game items, are all NFTs and they are genuinely owned by you. You are not a 'user' as a mere guest on someone's centralized server with effectively no rights whatsoever, egs: not your keys not your coins, but a true sovereign owner of your digital objects. NFTs are BTC for everything digital.

But the scope of NFTs are not just avatars, art, or gaming. The best NFTs have huge utility including what DeFi already covers such as interest payments and lending. This is why BANANA, Cyberkongz, et al are all going ballistic. They’re sufficiently decentralized for DeFi. They are freedom of speech uncensored. They are the new uncensored social media. They can be used to build decentralized social organizations. They’re going to the moon. This is just the beginning. And they're all rooted from decentralized JPGs.

That said, they must be careful not to pass the Howey test or they will be designated as securities and thus subject to regulation. Ofc the elephant in the room is that even if certain NFTs are regulated in the U.S., they will seek other jurisdictions where they will remain free from regulation. While the U.S. can try to claim their regulations have global reach, they do not have the ability to enforce such laws across potentially millions of "lawbreakers". P2P file sharing is a classic example of over 100 million people using the technology illegally to file share copywritten music and films yet the U.S. could only make an example out of a tiny handful before they realized this is an unwinnable war. And sadly, this realization only came after they spent billions of taxpayer dollars to go after the biggest violators in protracted legal battles.

NFTs operate on various platforms. NFTs have been used initially as the transport layer for art and gaming but will turn to brands, culture, the metaverse, then finally off-chain assets and off-chain governance birthing a new decentralized system of governance. The transformation should take place over the next decade.

The Bitcoinization of Fiat

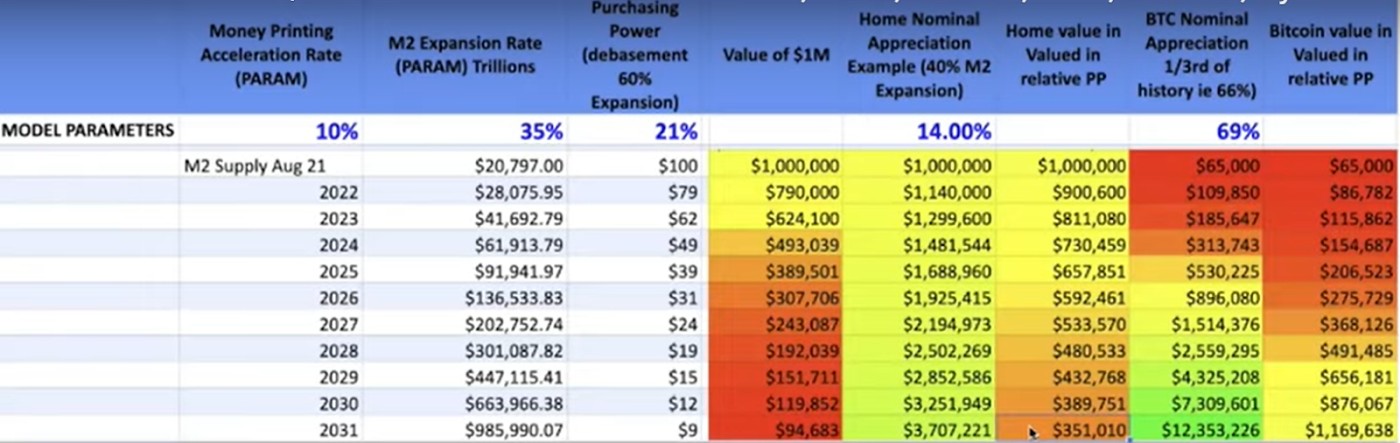

Meanwhile, since M2 does not contract once we are past the event horizon if history is any guide, M2 will continue to grow so weaker fiat will dollarize or bitcoinize. While hard assets will also exponentially rise in value, major ticket items such as real estate may not outpace inflation, so even though one may become a millionaire based on the value of their home, their buying power will have reduced by more than the increase of their net worth, thus once again, we see how inflation indirectly robs people of their net worth.

As the value of bitcoin rises into the millions while fiat continues to debase, bitcoin facilitates the separation of money and state, much as separation of church and state was key to certain personal freedoms centuries ago. Ultimately, this has vast implications for the way human beings are governed.

The table below is from InvestAnswers of YouTube. It makes logical assumptions over the next ten years. As you can see, the value of one’s home will increase but will not outpace inflation. Bitcoin, on the other hand, is the only vehicle that will beat inflation which will spur further migration into bitcoin and out of the dollar.

Some have argued the gateway will still remain fiat-to-crypto and crypto-to-fiat when one needs to buy something in meatspace such as real estate, a car, food, healthcare, education, etc but more majors are starting to accept bitcoin for such items. In consequence, I believe in the coming years one will be able to live on bitcoin/ethereum/alts without fiat once the tipping point of individuals and businesses accept crypto. Case in point: in 2014, various intrepid individuals proved they could travel the world with just bitcoin, finding places where they could buy goods and services for bitcoin. Today, far more goods and services are now available in bitcoin, and the situation is steeply accelerating. More and more businesses allow one to buy real estate or a high ticket item such as a Lamborghini for bitcoin, then resell it for fiat. This is a great gateway that enables one to move between fiat and crypto without regulatory issues.

That said, as mentioned above, regulations in parts of the world may see some NFTs as securities if they pass the Howey test in the U.S. Some countries may outright require onerous KYC requirements such as the EU is looking to do. We must seize the memes of production which are not securities thus cannot be regulated. Memes are the most important myths that rule the world. This is what we are fighting for. Culture is shaped from memes and everything is downstream from culture. As we start winning, the world will tilt toward greater levels of decentralization and lesser levels of authoritarianism which imply record levels of freedoms to the individual. Welcome to The Metaverse. #IRLflipper

Markets(͡:B ͜ʖ ͡:B)