by Dr. Chris Kacher

Overvalued markets?

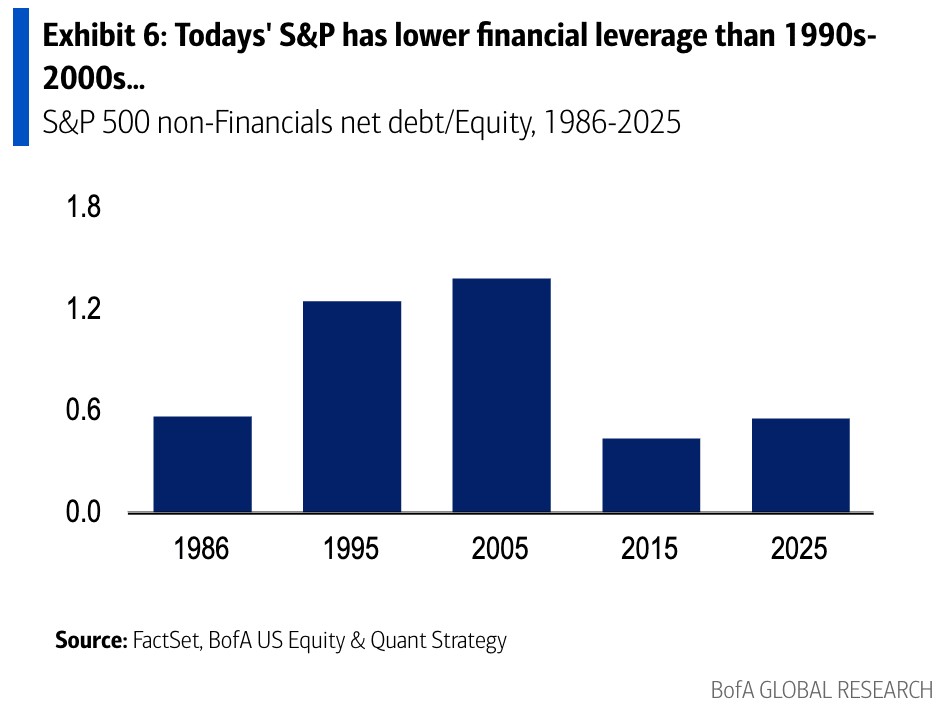

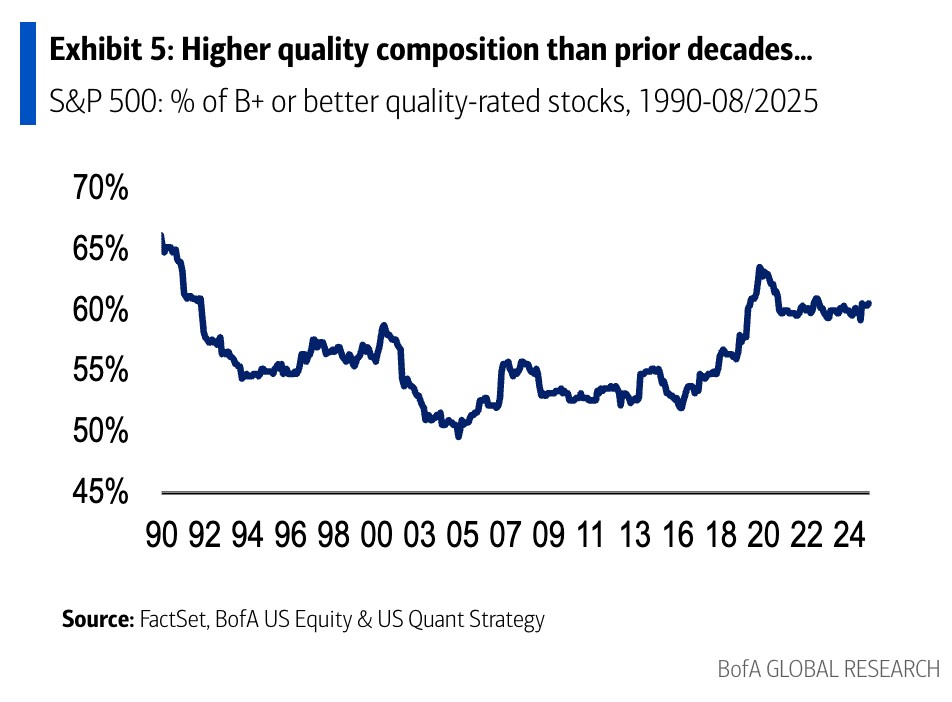

Today's market is not the dot-com market of the 90s, not just because companies hold a lot more actual value, but also because their balance sheets carry less leverage, most debt is long-term and fixed, and over 60% of the S&P 500 is rated “high quality” compared to less than 50% two decades ago.

While multiples are historically high, they’re attached to companies with more predictable earnings and lower risk profiles.

Today's multiples are the new normal. Further, dating back to 1928, the S&P 500 has notched a positive fourth quarter 74% of the time, averaging a 2.9% gain. The Nasdaq 100 performs even better, up more than 6% on average. We also have the tailwind of rate cuts.

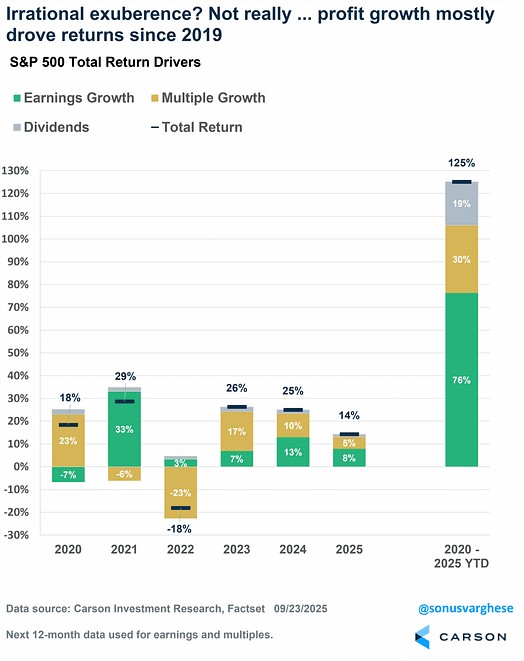

Today's multiples are the new normal. Further, dating back to 1928, the S&P 500 has notched a positive fourth quarter 74% of the time, averaging a 2.9% gain. The Nasdaq 100 performs even better, up more than 6% on average. We also have the tailwind of rate cuts.The Fed cutting against a backdrop of broadening and accelerating profits spurs EPS and GDP growth.

Companies are becoming more valuable, rather than stock appreciation due to some market mania that is unsustainable.

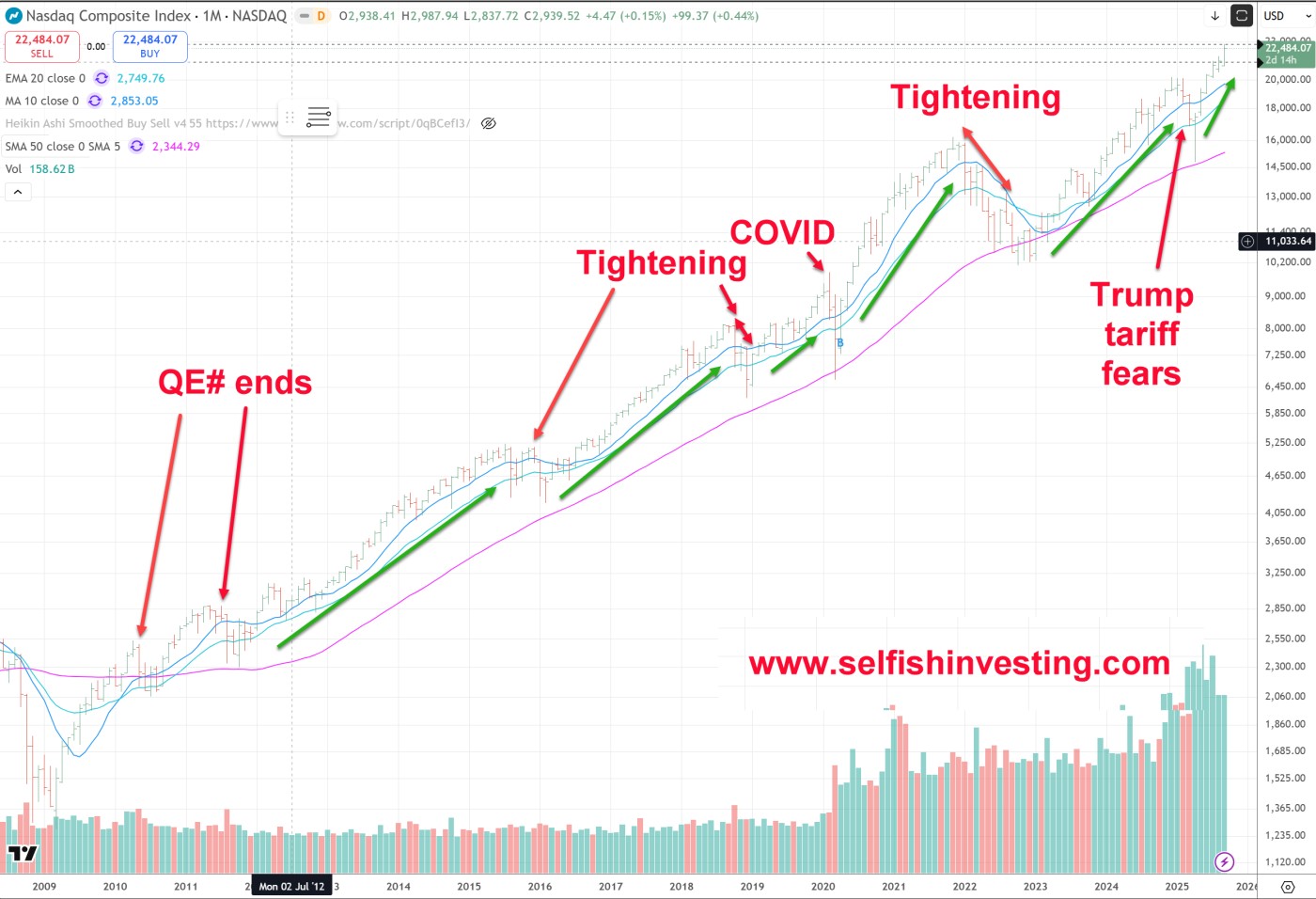

Neverending global liquidity: Monetary inflation well underway

Also favoring markets is QE in all its forms. We all know about QE programs launched starting in late 2008 then the various forms of indirect QE aka stealth QE. While the Fed’s dual mandate has traditionally been price stability and maximum employment, the notion of a third, long-overlooked aim—explicitly suppressing the long end of the yield curve—has resurfaced as a policy priority. Both Treasury Secretary Scott Bessent and Trump’s latest appointee to the Federal Reserve, Stephen Miran, both emphasise this ‘third mandate’.

Know that it takes massive levels of QE to suppress the long end of the yield curve especially when considering the black hole of growing debt which makes US Treasuries less attractive. Failing to do so could create a debt spiral or fiscal crisis as interest costs mount. This debt is amplified by demographic-led unfunded liabilities such as pensions and geopolitical pressures demanding ever greater defense spending. Rising debt/GDP ratios compound the problem.

As the US issues more long-duration Treasuries to fund deficits and refi old debt, upward pressure on yields intensifies—especially in the absence of strong foreign buying and amid demographic shifts that increase entitlements spending.

QE Limitations: Research shows that each new round of QE has diminishing returns—requiring ever-larger asset purchases just to keep long yields in check. Surging debt and risk aversion may eventually overwhelm even large-scale QE, leading to yield spikes if market confidence erodes.

Global Context: This mirrors the "whatever it takes" attitude famously invoked by European Central Bank policymakers during eurozone crises—using any means necessary to keep credit conditions loose and avoid systemic shocks.

If the Fed prioritizes capping long-term rates as a primary objective (rather than an aftereffect of low inflation), it could mean much more activist balance sheet policy or regulatory measures going forward.

Such policies, while possibly stabilizing debt costs in the near term, risk stoking future inflation, destabilizing policy expectations, and further politicizing monetary oversight.

The sheer scale of the challenge means the US could face a cyclical struggle to square fiscal needs, market credibility, and genuine economic stability—especially as debt loads, demographics, and geopolitics become steadily more difficult to manage.

Gold vs inflation

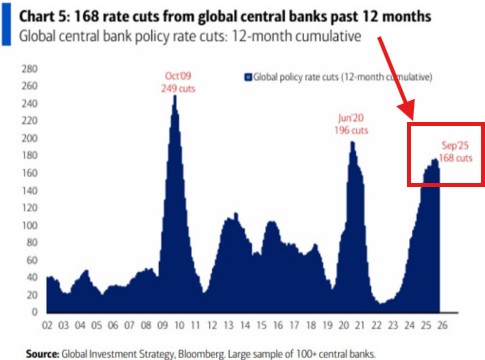

Meanwhile, US gold reserves just exceeded $1 TRILLION for the first time in history. World central banks have cut rates 168 times over the last 12 months, the 3rd highest reading this century but not because inflation is down as it was during the prior two highest readings which came in 2020 and in 2009.

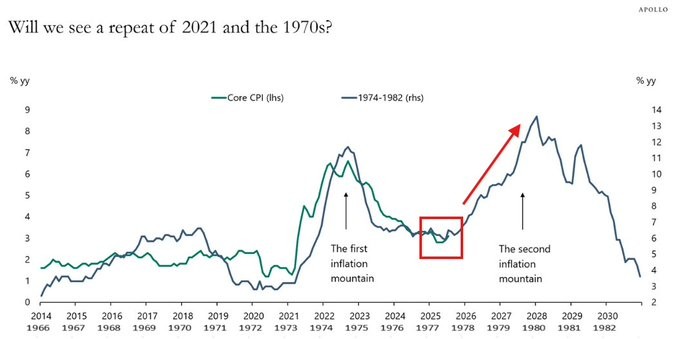

The Kobeissi newsletter asks if we will see a repeat of 2021 and the 1970s when CPI surged.

I would counter that month-to-month increases for both CPI and PCE are modest (about 0.3%), showing that inflationary pressures have eased from earlier highs but are not completely back to target levels. While 72% of the CPI components are above the Fed's 2% target, tariffs and AI are deflationary so instead of accelerating CPI, we may continue to see a moderating or even decelerating CPI.

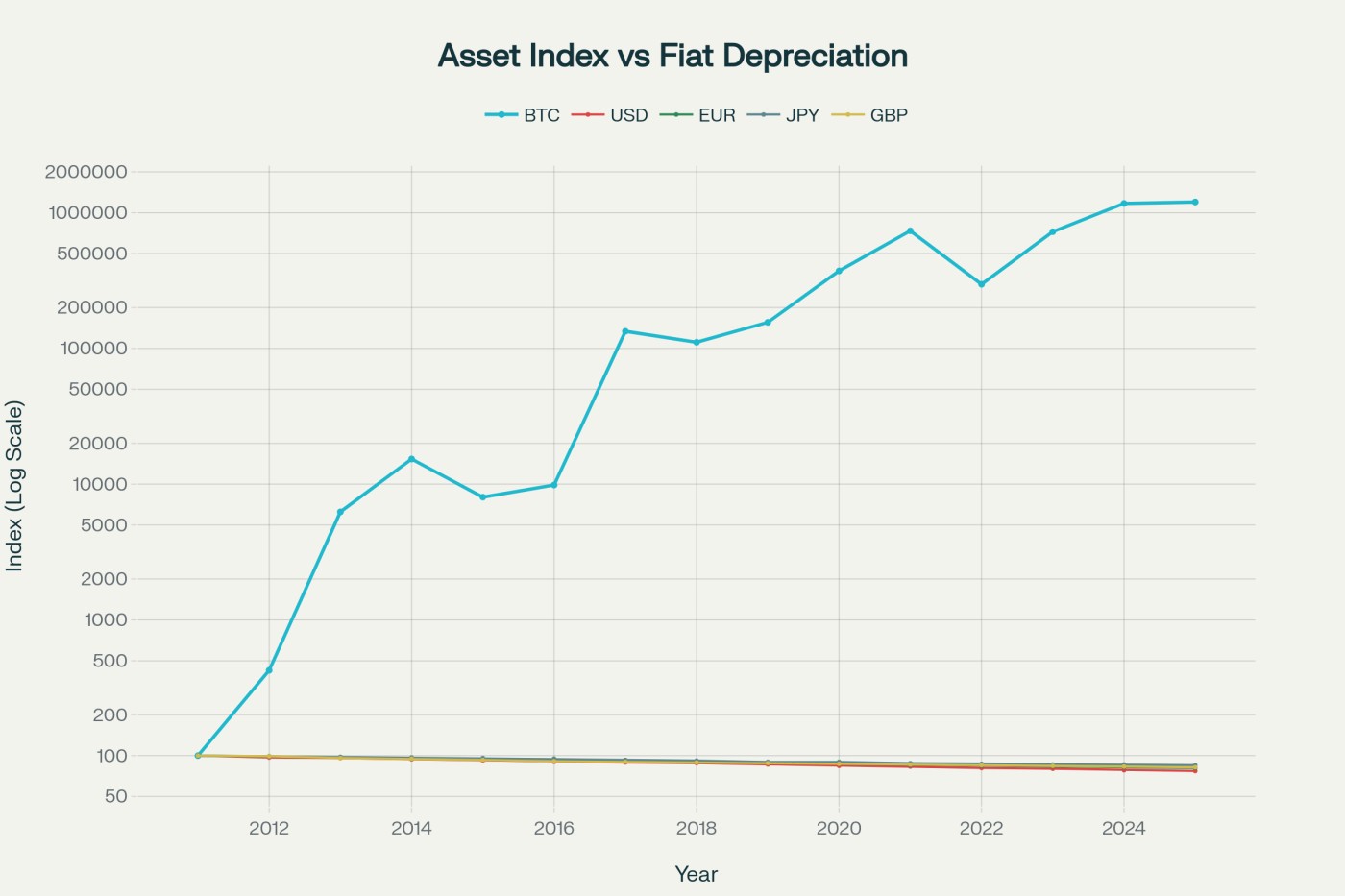

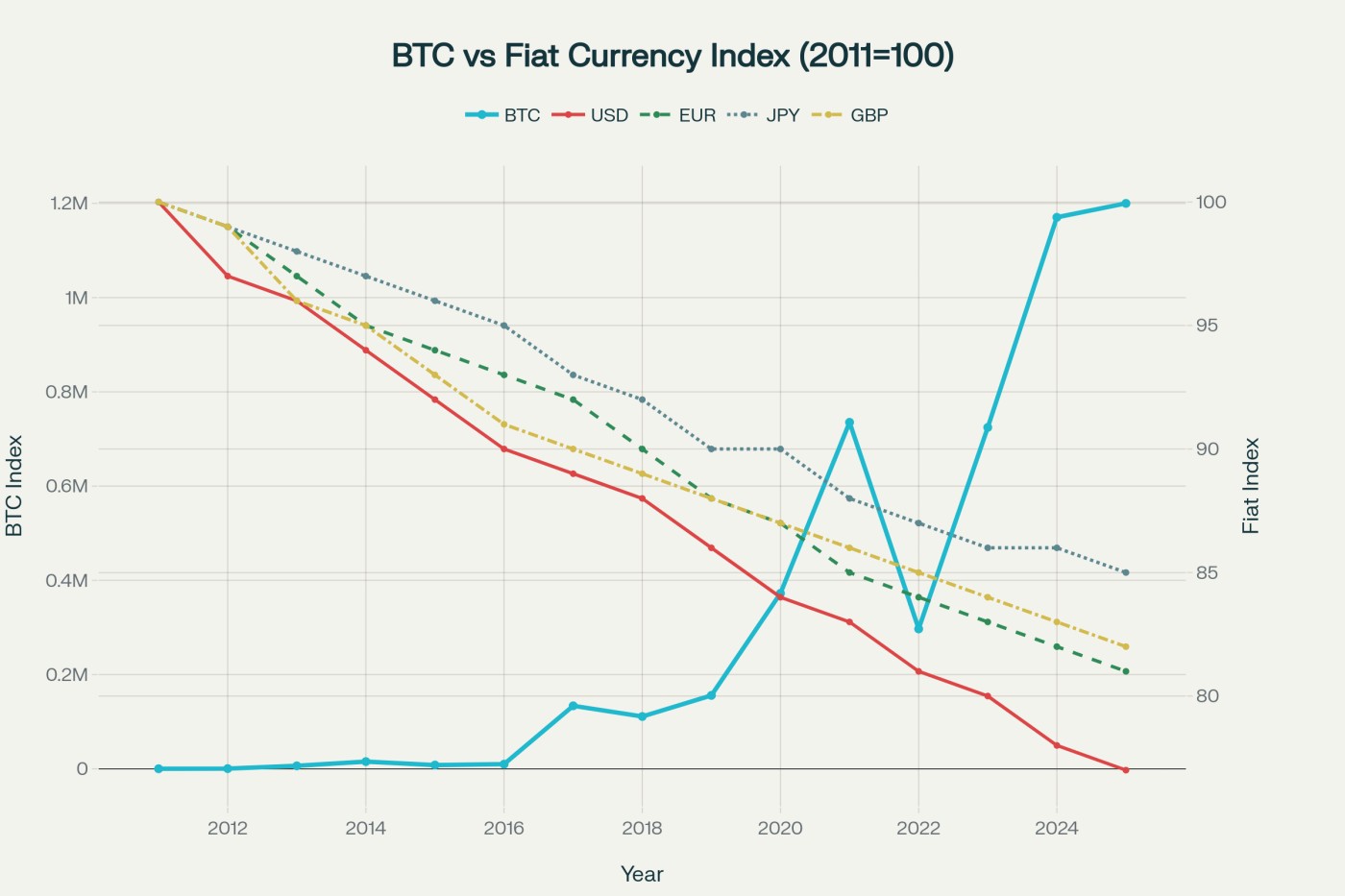

But even with higher inflation, the new norm has been yield curve control as mentioned earlier which suggests that global liquidity will continue to pace at a brisk rate which should keep both gold and Bitcoin trending higher overall.

Further, even if Dalio's suggestions are not implemented in full to which he spells doom for the US dollar, AI remains the powerful wildcard.

AI is accelerated, augmented, abundant intelligence

For now, AI is more real than 'hype'. AI should stand for accelerated intelligence.

Personal Use

Individuals use AI daily for time management, research, email organization, language translation, personal finance, and health tracking. AI assistants like ChatGPT, Google Gemini, and personal scheduling bots streamline tasks, save hours weekly, and improve decision quality.

Global upskilling programs and AI training platforms (Google Digital Garage, Coursera, AWS AI Ready) have already reskilled millions, broadening access to knowledge and high-quality jobs.

The number of people using platforms such as Manus, Cursor, Codex, Loveable, Copper, and various scrapers to build their AI stacks has accelerated because it optimizes personal workflow.

Corporate/Healthcare/Education

Companies cut costs by up to 80% and process times often 10-20x faster using AI for automation, customer support, document analysis, supply chain, predictive maintenance, and HR. Toyota reported material annual savings and 25% less machine downtime after AI-based predictive maintenance.

AI boosts sales, marketing, and product development: from automated outreach to real-time market analysis, corporations cite superior ROI and skill adaptation, a driving factor for innovation and competitive edge. AI-driven supply chains reduce downtime by 50% and error rates by up to 85% in manufacturing.

In retail, there is demand forecasting, recommendation engines, inventory automation, price optimization, and computer vision checkout.

In manufacturing, there is predictive maintenance, robotics, quality control, and supply chain risk management.

In logistics, there is route optimization, fleet tracking, delivery drones, and warehouse automation.

In healthcare, there is diagnostics (radiology, pathology), drug discovery, telemedicine, and care robots.

Public Sector/Government

Governments apply AI to public communication, service delivery, and policy analysis. For example, UK’s AI-powered “Assist” saves millions of man-hours across 120 public organizations by helping draft documents, analyze data, and develop strategy.

AI in public health detects outbreaks, speeds up crisis response, and improves citizen engagement. Canadian government AI systems reportedly deliver billion-dollar value in early-stage pandemic management.

In the energy sector, there is grid optimization, smart metering, predictive outage prevention, and efficiency analytics.

Supporting Data

The OECD, ECB, and G7 report robust evidence of AI’s productivity gains: automation, cost reductions, faster response times, better outcomes, and higher satisfaction scores.

Stanford’s 2025 AI Index confirms record adoption and business transformation across sectors.

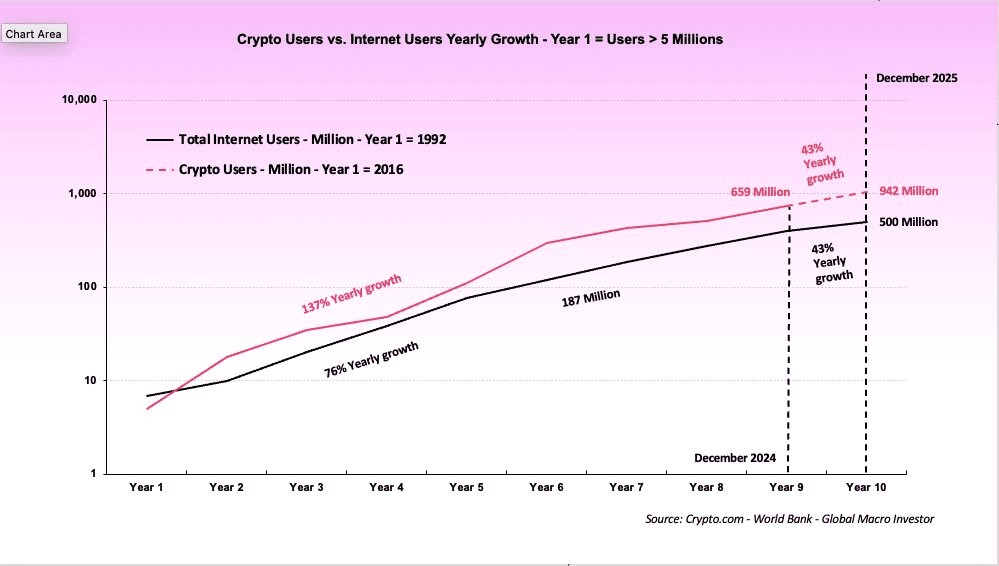

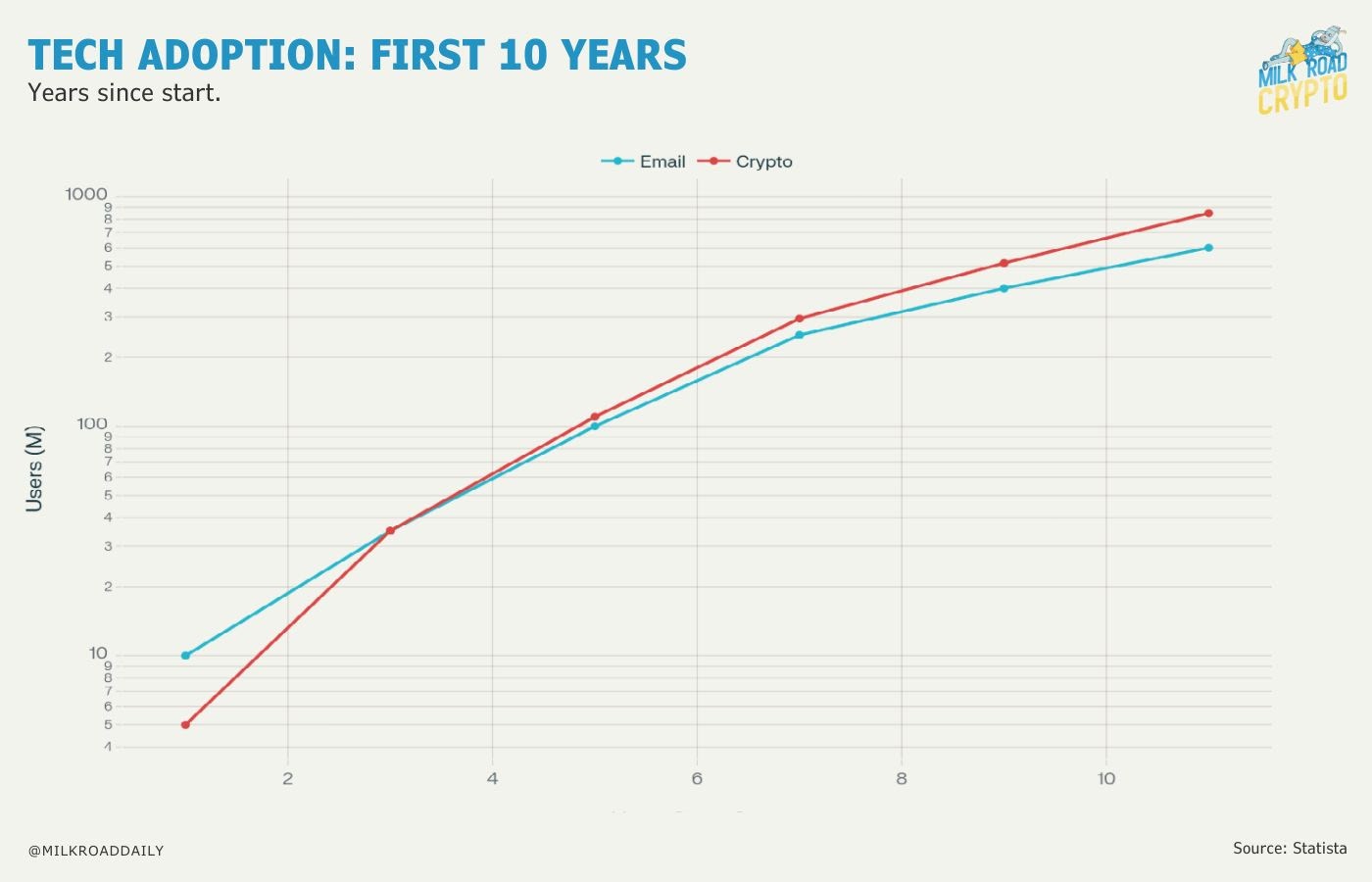

Crypto growth