Our Trading Volatility Report serves as the vehicle we use to suggest entry and exit points in UVXY and XIV to our members.

Further Evidence For A Spiking VIX

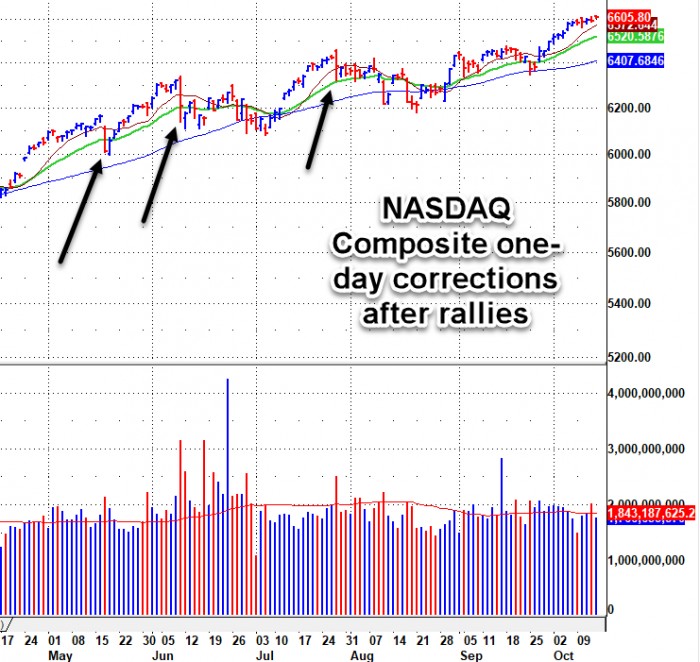

76.2% of S&P 500 stocks and 74.8% of NASDAQ Composite stocks are trading above their 50-day moving averages. The last time this happened was in late April 2016 and in July 2014. Both periods represented corrections in the markets, though relatively minor. But such minor corrections seen this year are accompanied by a spiking VIX and UVXY. Further, when you also factor in the NASDAQ 52-Week High/Low hitting extremes as well as the current ultra-low VIX levels, the odds of a spiking UVXY increase.

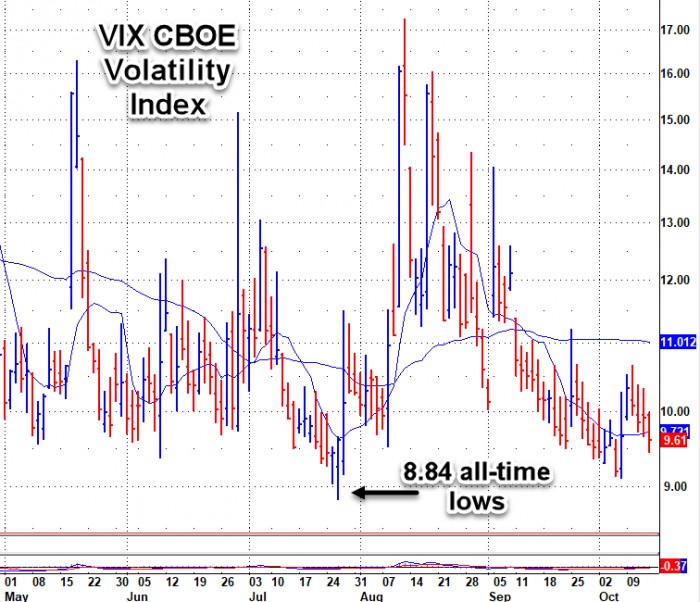

The chart below suggests we are due for another one-day (or deeper) correction after the current rally which has sent VIX back down toward all-time lows among other metrics that are overbought.

Market Complacency

The QE-induced rally remains alive and well, and the number of investors who started investing after the financial collapse in 2008 may have a "buy the dips" mentality as well as a "buy and hold" view as the idea of a major market correction seems increasingly less likely to them.

Even though 4 major banks (JPM, C, WFC, BAC) kicked off earnings season with three out of four of the banks gapping lower, this is similar to how the prior earnings season kicked off. So even though JPM and C have seen big drops in trading revenues with JPM now moving into financing home flippers in order to help drive new revenues, the market continues to grind its way higher. Indeed, this QE-bubble can continue for a lot longer than anyone expects.

Despite the many signs or reasons for a top in the markets, it always comes down to price/volume of your stocks. In the meantime, quick and sharp profits can be made by using the 620 MACD entry strategy with UVXY. The odds of a spiking UVXY stand at higher levels given the spiking percentage of stocks trading above their 50-day moving averages, the 52-Week High/Low index also spiking to extremes, and where the VIX is currently trading.