The situation remains dicey, however, and investors should have raised cash levels several days ago as Focus List names began to break near-term support levels. Some have now broken longer-term support levels as many have violated their 50-dmas this week. In many cases, this could force investors concentrated in these names to now be mostly, if not fully, in cash at this time.

Futures are down this morning as the market shows some follow-through to yesterday's weak close, and caution remains the order of the day.

Focus List Notes:

Caterpillar (CAT) pulled into its 10-dma and the top of its prior base breakout point, which technically puts it in a lower-risk long entry position using the 20-dema as a maximum selling guide. However, if the general market begins to falter, keep your stops tight and clearly in mind in the event CAT breaks support.

With one name, CAT, left on the Focus List, we are still monitoring the action in names that were removed yesterday. In most cases, bounces off of logical support stalled badly. Here are three different permutations of how this occurred yesterday. Some of these may have topped and have further downside, while some may end up building new bases and setting up again. History tells us that this normally takes some time, but in a QE market we are not necessarily ready to rely on what history tells us, since the "Ugly Duckling" gives this environment of unique flavor all its own.

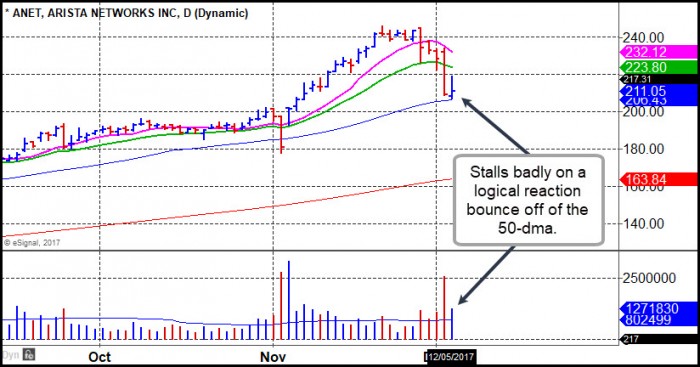

Arista Networks (ANET) bounced off its 50-dma after a brutal downside break on Monday, but the bounce was extremely feeble as the stock stalled and closed near its intraday lows and the 50-dma on heavy volume. Not very impressive action, so we might look for the stock to drop below the 50-dma where it might find support along the top of the prior base structure that extends from late September to late October.

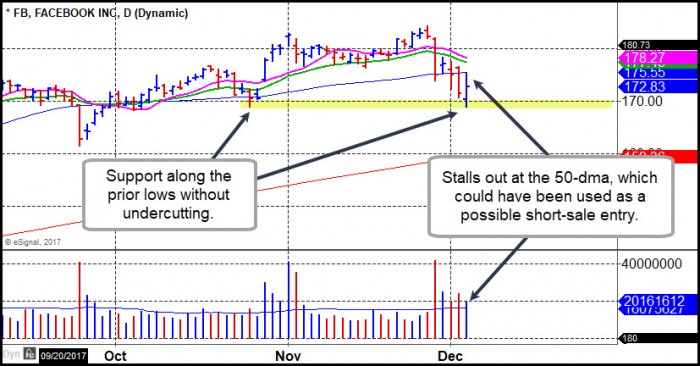

Facebook (FB) found support along its prior October lows and rallied up as far as its 50-dma, where it ran into resistance. The rally into the 50-dma could have been used as a short-sale entry point, using the 50-dma as a tight upside stop.

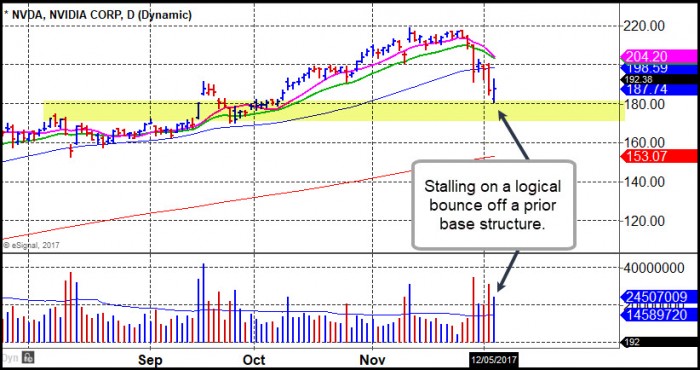

Nvidia (NVDA) busted its 50-dma on Monday, and yesterday found support near the tops of prior base structures. It stalled, however, to close about mid-range on heavy volume. A weak rally into the 50-dma could present a possible short-sale entry if the general market continues to weaken. Note that on Monday NVDA opened up just above the $200 Century Mark and the 50-dma, but failed quickly, triggering a possible short-sale entry for members who are experienced and knowledge of our short-selling members. This is a tricky environment, so we tend to think that short-selling carries higher risk than might be the case in a "normal," non-QE-infused environment. Thus short-sellers must be nimble since short-sale trades may only turn out to be quick, swing-trading affairs.