by Dr. Chris Kacher

The recent selloff in bitcoin on Tuesday after markets closed were due too what's called a long squeeze. Too many longs were crowding the plate so the market picked them off. Cathie Wood's Ark fund also saw its largest amount of bitcoin being sold. This offers a lower risk entry point for short term traders.

If we take the longer view, markets move in cycles. Bull and bear, greed and fear, like low and high tide. This is human nature on parade so will never change. Right now we are in between greed and fear, but we just had fear/bear, so greed/bull is likely next.

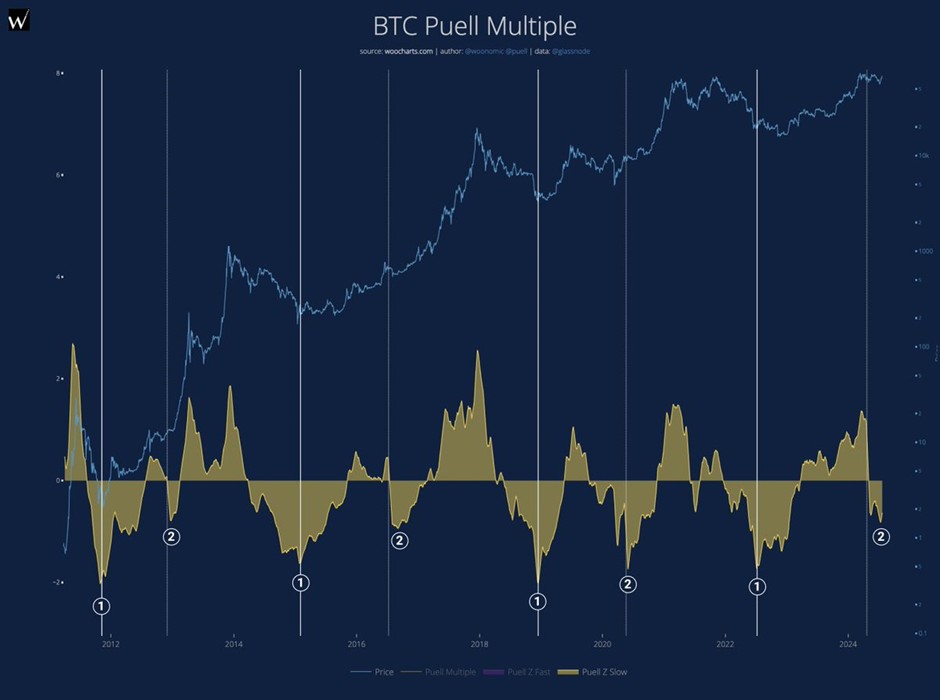

Fresh liquidity bodes well for Bitcoin which has been in a basing pattern for the last 5 months. The Puell Multiple measures miners relative profit to past revenues. It's a 1-2 punch macro signal.

The circled 1) show macro bottoms happen when profitability is at a minimum as shown by the white vertical line.

The circled 2) is a signal bottom which happens when BTC halving cuts miner earnings by 50%, leading to the proper bull run. The faint blue vertical lines are the halvings.

We are at (2). Bitcoin looks ready to start into a strong uptrend later this year if history is any guide. Plus we have increasing global liquidity on the way.

NVDA earnings

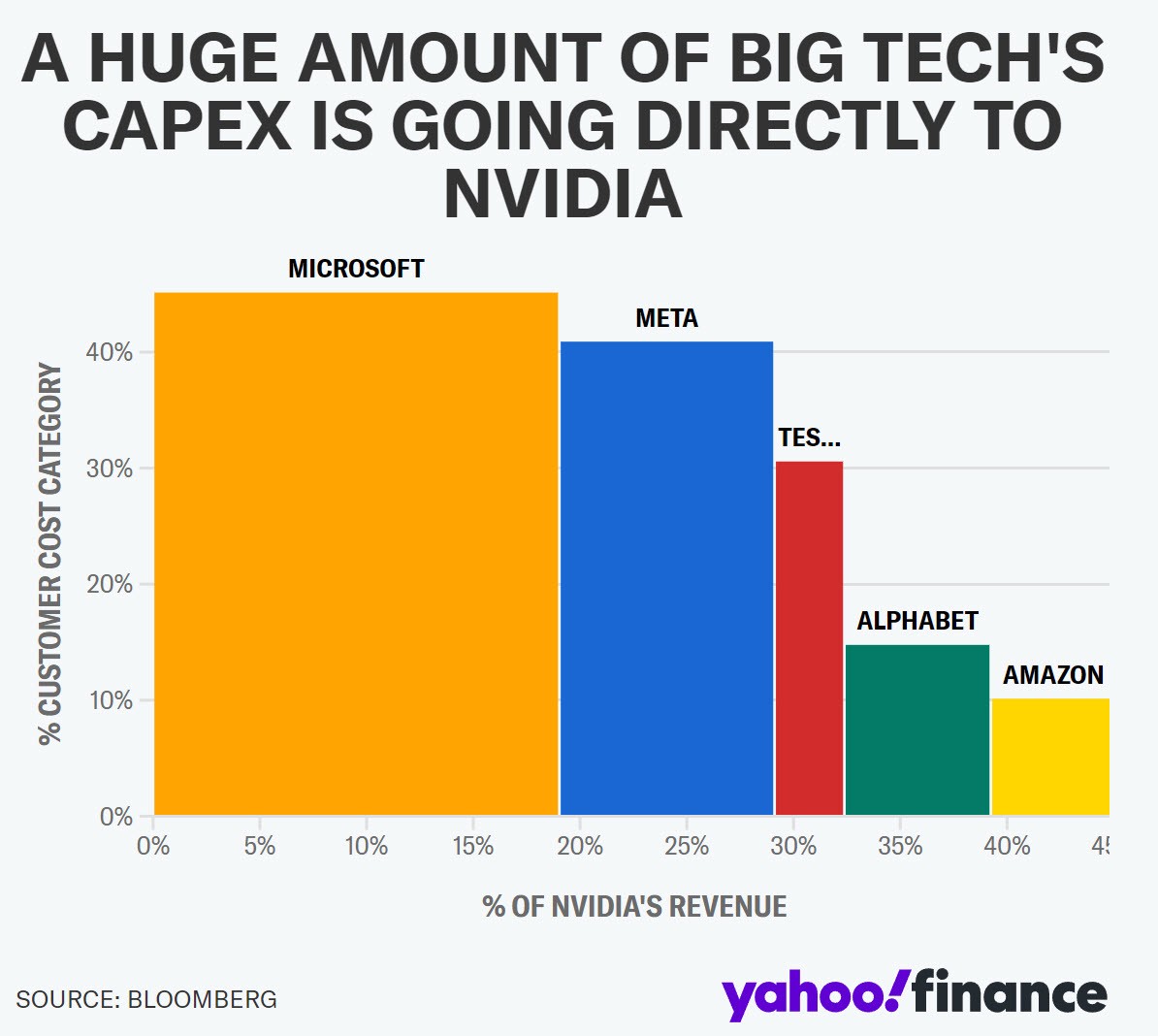

NVDA beat revenue estimates, earnings-per-share, and third-quarter guidance but it was the smallest earnings beats leading to concerns about the law of large numbers. Nevertheless, CEO Jensen Huang remains optimistic about the revenue prospects for its forthcoming Blackwell chip despite a snag in the product's rollout. Nvidia has an endless stream of demand for its chips and products as it remains the “picks-and-shovels” producer in the AI gold rush will be hard to dismantle. Nvidia is the world leader in AI chip design and software, controlling between 80% and 95% of the market.

In consequence, all the major tech companies such as Amazon, Meta, and Google look poised to deploy billions upon billions of capital into Nvidia in a spending war over AI-related resources. Elon Musk has said that his startup xAI will need hundreds of thousands of chips from Nvidia in the coming months.

One of the caveats is that potential production delays for Nvidia's next-generation Blackwell AI chips could be on the horizon. CEO Jensen Huang initially announced that the chips would ship in the second quarter, but analysts have identified design challenges that could push back the release. Despite this, some analysts believe Nvidia can mitigate the impact by substituting Blackwell orders with its previous generation Hopper chips. While the Hopper processors aren't as powerful or profitable as Blackwell, they are still capable of handling most AI-related applications effectively.

Despite the less-than-brilliant earnings report, keep in mind that generative AI such as ChatGPT are just milestones on the AI journey, not the final destination. Large Language Models (LLMs) are merely the beginning, and what's coming next will dwarf them in significance. Companies heavily invested in LLMs may not survive. This situation reflects a bubble, driven by inflated expectations surrounding LLMs, which are ultimately just sophisticated tools. But the next phase in the AI evolution is at hand. At the core of the AI megatrend is NVDA, whose GPUs, now rebranded as AI processors or more accurately, compute accelerators, position the company to maintain its pole position in the industry.

Furthermore, money printing in all its forms, stealth and otherwise, will likely keep markets humming ahead with its share of 'V' bottoms like the one we just saw as long as the trend favors easy money. Indeed such has been the case since QE was launched in late 2008, and central banks have been on an easing trend in part due to it being an election year but more so because they have to address debt interest and other major expenses. Tech juggernauts have been leading the way. Their strong price momentum provoke fund managers to own them or they may quickly underperform. You don't get fired for investing in AAPL and META.

QE due to Japan

As for the yen carry trade issue, it has been a concern that with rates heading lower, the yen will get stronger since the Bank of Japan has no intention to lower rates. The BOJ has said they will closely monitor market action so any additional rate hikes would be contained. But markets know this is an impossibility so the yen carry trade is being populated by traders once again on the notion that interest rates in Japan will stay at current levels.

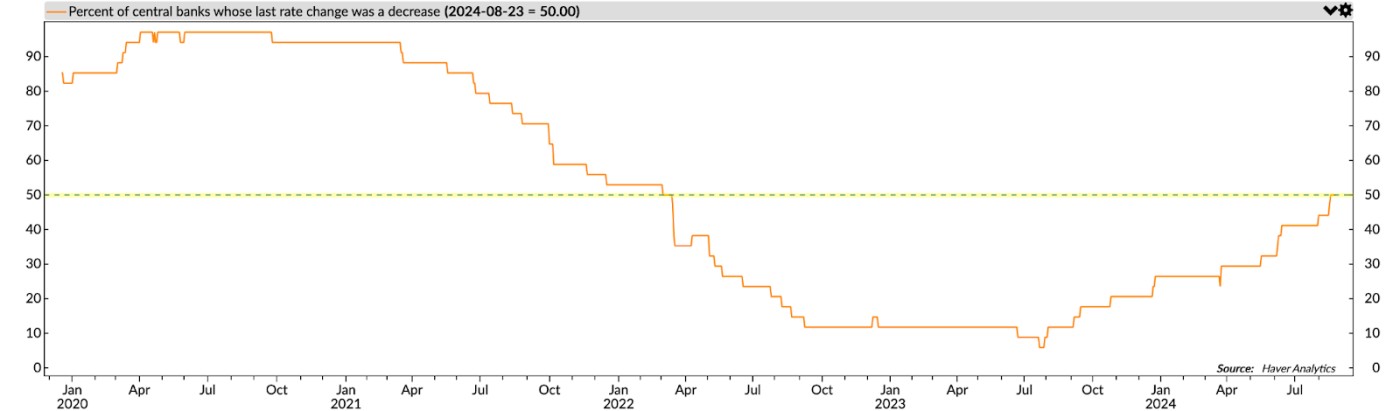

About half of global central banks have started lowering interest rates. The Fed is next. This will weaken the US dollar vs. the yen which can again create selloffs. But the Fed is committed to never letting financial markets stop their upward ascent. The US is a hyper-financialized economy that requires up-only fiat asset prices which drive capital gains tax receipts. In short, a falling market is bad for the financial health of the US.

In consequence, Powell and Yellen will provide some form of Fed balance sheet expansion very shortly to counter the effects of a strengthening yen, otherwise the temporary boost from the Fed's rate cut would be short-lived if traders began to unwind dollar-yen carry trade positions.

If the yen's appreciation accelerates, the Fed's initial response would not be to resume overt QE. Instead, the Fed would likely reinvest proceeds from maturing bonds in its portfolio back into US Treasuries and mortgage-backed securities. This move would effectively end the Fed's quantitative tightening (QT) program.

Should market pressures persist, the Fed may then resort to central bank liquidity swaps or a resumption of overt QE. Concurrently, Secretary Yellen may inject dollar liquidity by selling additional T-bills and drawing down the Treasury General Account. However, neither the Fed nor the Treasury are likely to explicitly attribute these actions to the yen carry trade unwind's destabilizing effects.

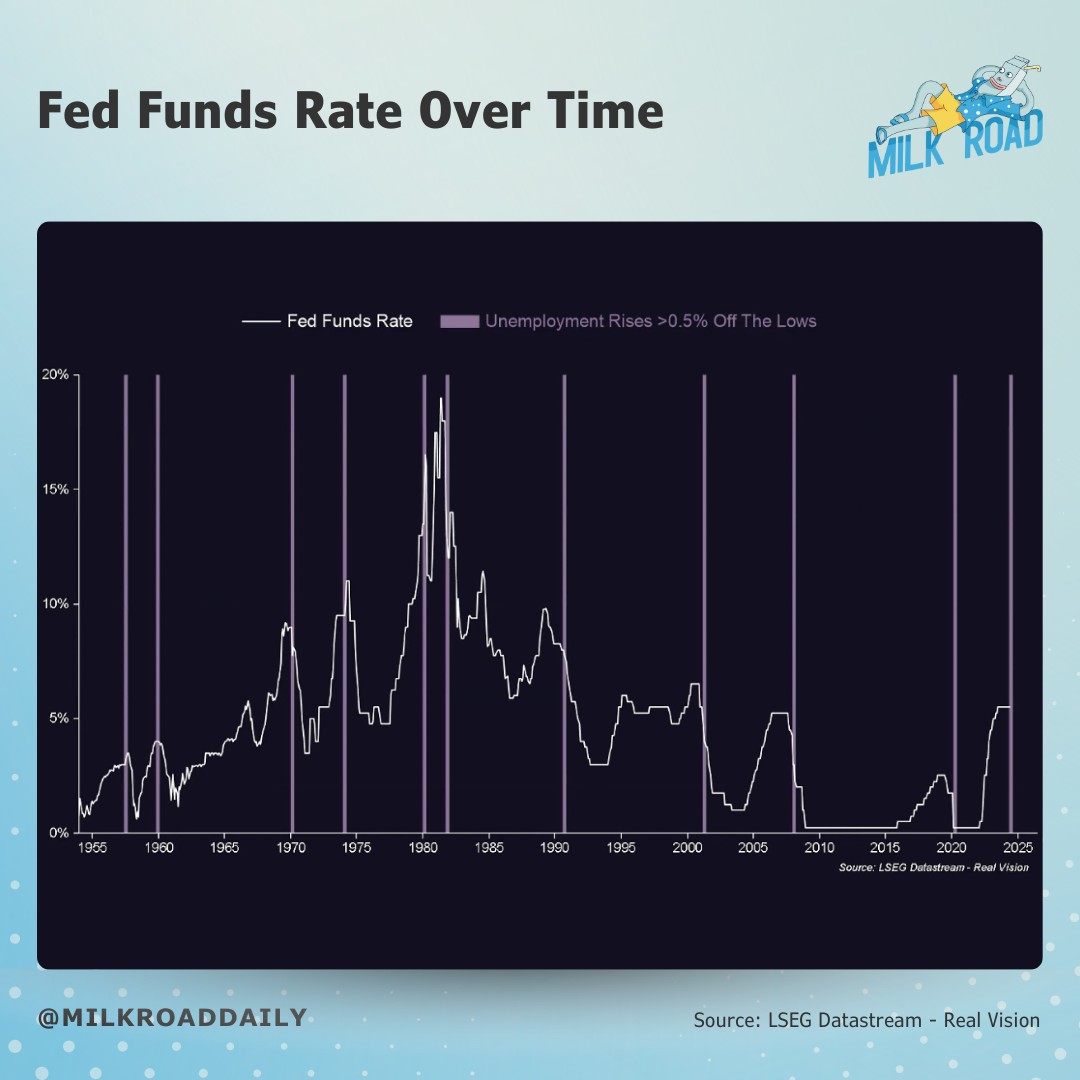

First rate cut

The first rate cut is believed to signal a potential recession. But since 2008 when QE began, rates were only cut starting in 2018 and did not create a recession. Currently, the Fed is cutting rates when inflation is above target and growth is still sufficient, so the net effect will be another wave of rising liquidity that can fuel markets higher. Imagine what they will do if there actually is a classic US recession as defined by the Fed which markets tend to follow. That said, technically speaking, the US has been in recession for a number of quarters if we were to use the actual, unadulterated CPI and GDP numbers.

Given the deep distortions in GDP and CPI, it is likely the US has been deep in recession territory over the last few quarters. Further, the signs are clearly evident that people are struggling. This is not the economy the Fed tries to paint, much as they tried to paint a false picture that inflation was transitory prior to launching the fastest rate hikes in history in 2022.

Inevitably, the way things stand, the Fed will ramp up the money printer and dramatically increase the money supply. Still, an economy that slows too quickly would cause market selloffs which would enable additional shorting opportunities besides the ones we have seen this week. Never wed yourself to the bull or the bear side of markets. Always remain nimble.