by Dr. Chris Kacher

Recession incoming?

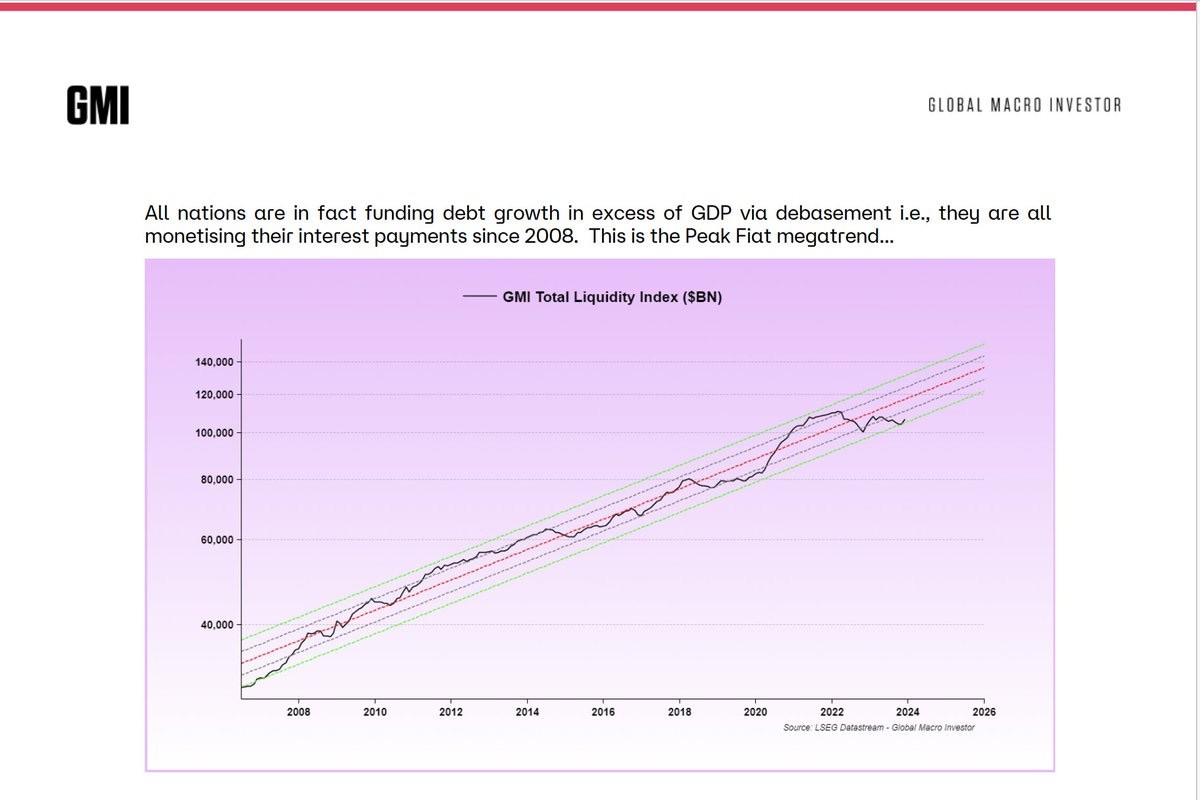

With the Bitcoin spot ETFs and its upcoming halving, Bitcoin may hit new all-time highs this year, but it may do so in a choppy manner. New highs in Bitcoin depend on a short or postponed recession. With some economic data still coming in strong, it will be a tug-o-war between a soft and hard landing. To spur a softer landing, the Fed needs reasons to create more money, ie, monetize their debt through QE. Funding global geopolitical conflicts, paying the interest on record levels of debt, and honoring unfunded liabilities are three strong reasons to engage QE. That said, their hands will be tied should inflation bounce due to some of its stickier components. Further, war is inflationary.

After the higher than expected CPI, lower than expected PPI, strong retail sales, and the hawkish testimony given by the Fed's Waller, CME FedFutures show the first rate cut in March dropped to 55% (as of this writing), with a terminal rate of 375-400 for a total of 6 cuts this year. Past cycles illustrate that when the Fed began a series of rate cuts, a bear market began. The Fed is nearly always behind the curve because of the way the system is structured. They would rather mute inflation which puts them behind the curve due to the lagging effects of their actions than not hike rates enough such that inflation gets out of hand.

Given the reasons central banks must continue to monetize their debt, the global liquidity cycle appears to be headed back into an upwards cycle that will bring trillions of dollars back into the global economy.

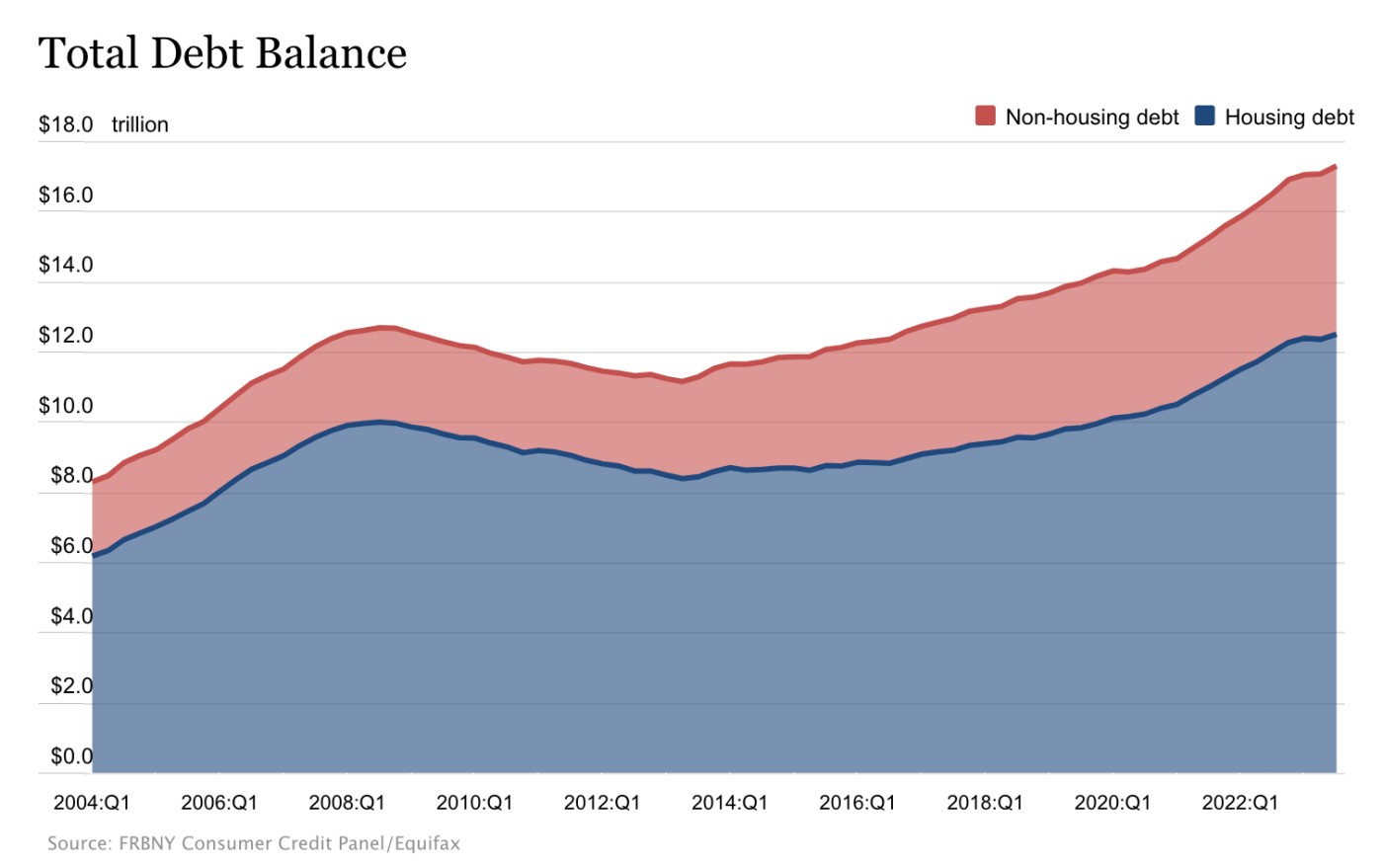

Household debt in the US continues to hit new highs at a record $17.2 trillion in Q3 2023.

Non-housing debt stands at $2.38 trillion. This comes from credit card balances at $1.08 trillion, auto loan balances at $1.6 trillion, and student loans at $1.6 trillion.

So the Fed may opt to quantitatively ease its way out of any recession, shortening or postponing it, as it is an election year. In such years, major stock market indices end higher 85% of the time most likely because those who have influence create more easy money policies to help buoy stock markets which in turn stave off recession. But we do have some Fed members such as Waller who is taking a cautious approach as he advocates keeping rates higher for longer and no reason to cut rates as quickly as in the past until it is clear the fight against inflation has been won. While future robust economic numbers would help postpone rate cuts, we cant ignore debt monetization due to reasons cited earlier which would spur rate cuts, thus the tug-o-war. We also have cracks showing such as the New York Empire State Manufacturing number which missed estimates by miles.Why Bitcoin?

So with Bitcoin spot ETFs having launched, it begs the question "Why Bitcoin?" The Fed printed $10 trillion, gave you a $1400 stimulus check, and left you with inflation, higher costs of living, and an 8% mortgage rate. Bitcoin fixes this.

Under a central bank digital currency (CBDC), rights become privileges based on your compliance with a government mandate. Freedom of speech becomes irrelevant if a government can starve you to death. Bitcoin fixes this.

What is Bitcoin? It's the first network of its kind for the public to make transactions digitally on the blockchain.

What's its purpose? It enables you to send and receive money anywhere in the world, as long as you have a computer and internet.

Why is it a game changer? It's the first ever digital means for public payment, and it doesn't require a middleman like traditional methods.

Before Bitcoin, our only public payment method was cash. But cash only works if you're actually there in person.

To send money across the globe, you couldn't safely use public services. You had to go through private banks or companies. These institutions charge high fees just for keeping records straight.

The issue is that there are fewer, but bigger and more influential companies in charge of these private payment services.

This leads to riskier systems that can fail in one go. When they do, the fallout is huge.

The remedy: Bitcoin - the first public money system available to everyone around the world.

It doesn't care about your race, nationality, religion, or gender. Bitcoin is available for everyone to send money globally.

Is it flawless? No. But then again, the internet wasn't perfect when it first came out either.

Just like the internet changed public access to information (meaning anyone can Google anything), Bitcoin will do the same for money. It is the magna carta of code. Bitcoin underscores the freedom to transact without which there are no constitutional rights. The transaction of information, money, services, and goods is fundamental to growth.

Bitcoin stands apart from traditional currencies due to its decentralized nature; no single government can assert control over it. This separation between money and state mirrors the principle of the separation of church and state. It's a borderless currency, offering a lifeline to millions who are unloading their devalued local money for Bitcoin and then converting it to more stable currencies like dollars. This is particularly valuable in countries plagued by corruption and hyperinflation, a situation unfortunately on the rise in the developing world.

While traditional "fiat" currencies rely on the trust and credit of the governments that issue them—backed by the taxes paid by citizens—Bitcoin's value springs from different sources. Its worth is rooted in its limited supply (only 21 million bitcoins can ever exist), its usefulness in transactions, and the ever-growing community that uses it. Imagine a single telephone: useless on its own but invaluable as more people join the network. Similarly, a social media platform like Facebook isn't merely software; its value lies in the billions of users it connects. Bitcoin operates on the same principle: the more people use and trust it, the more valuable it becomes. Despite the ups and downs in the market, Bitcoin's computing power and user base have reached record highs, signaling a robust and growing network.

Bitcoin's immunity to inflation is another key advantage. It can't be devalued by printing more, as there is no central authority to do so. Its design ensures security, utility, and the seamless transfer of value across borders. That's why, even after market crashes, Bitcoin's price against major fiat currencies has consistently rebounded to new heights.

Some argue that governments could wipe out Bitcoin with advanced technologies like quantum computing or by attacking it when it becomes a threat to fiat currencies. However, the Bitcoin community is proactive, developing solutions to counter such hypothetical threats. Moreover, history shows that decentralized technologies can be incredibly resilient. The battle against peer-to-peer file sharing, which began with Napster in the 1990s and saw countless taxpayer dollars spent in attempts to shut it down, is a case in point. Despite these efforts, file sharing didn't just survive; it thrived, adapting and multiplying in response to each challenge.

The cryptocurrency market, much like the dot-com industry, has weathered severe downturns. Bitcoin and other leading cryptocurrencies have emerged from the recent bear market—just as the strongest internet companies weathered the dot-com crash. This resilience suggests that, while not invulnerable, the foundational technologies and the communities that support them can survive and even prosper after periods of adversity.

Anti-1933The Bitcoin spot ETF could be said to be the opposite of FDR's landmark decision in 1933 when he made it illegal to hold gold so he could impose a stealth tax on Americans of 41% when the price of gold was hiked from $20.67 to $35. The Federal Reserve Act (1913) required 40% gold backing of Federal Reserve Notes that were issued. By the late 1920s, the Federal Reserve had almost reached the limit of allowable credit. This price revision allowed the debt ceiling to jump by 41%, effectively diminishing the value of the dollar by this amount since the gold content of the dollar from $20.67 to $35 per ounce devalued US federal reserve notes by 41% which were backed by gold.

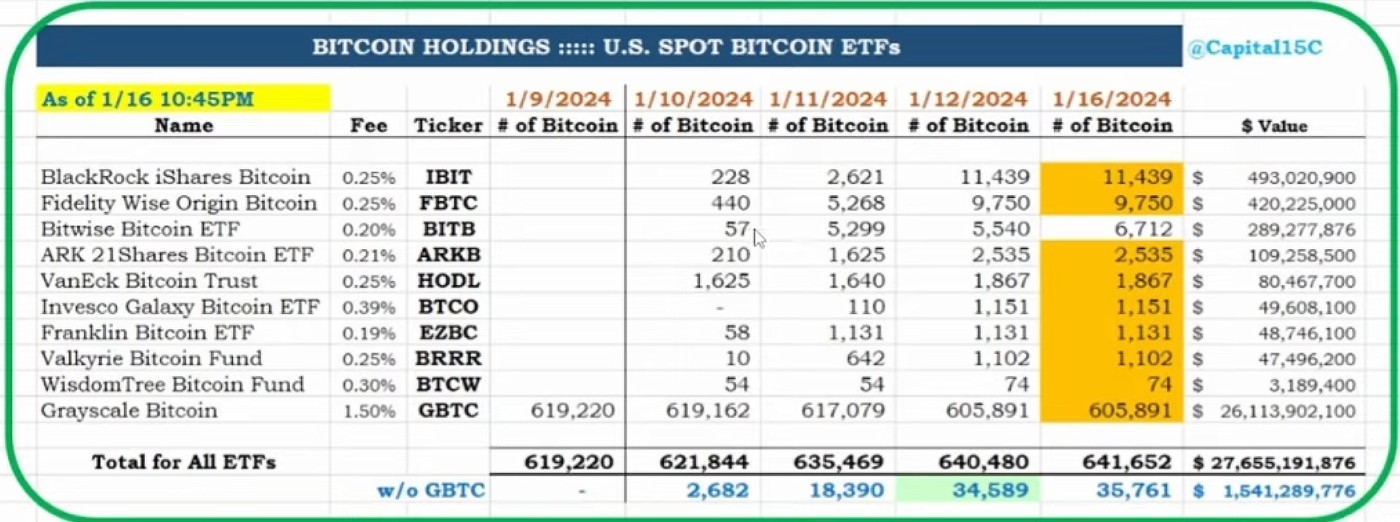

With the launch of spot Bitcoin ETFs, investors that were locked into Grayscale's GBTC ETN can finally sell their GBTC shares. GBTC held $25bn+ worth of Bitcoin that had been locked up for years. This partially accounts for the recent selloff in Bitcoin. We also have a drop in global liquidity since the start of the year. This is likely to resume its upward trajectory as central banks have no choice but to keep creating fiat to service the interest on record levels of debt as well as honor unfunded liabilities such as pensions. So while the Bitcoin spot ETF is bullish over the long run, GBTC selling will counter the buying of the new ETFs even if the amount is one-fifth of the $25bn+ GBTC that can be sold.