Trading Journal notes from Gil and Dr. K regarding this week's pocket pivot and buyable gap-up reports.

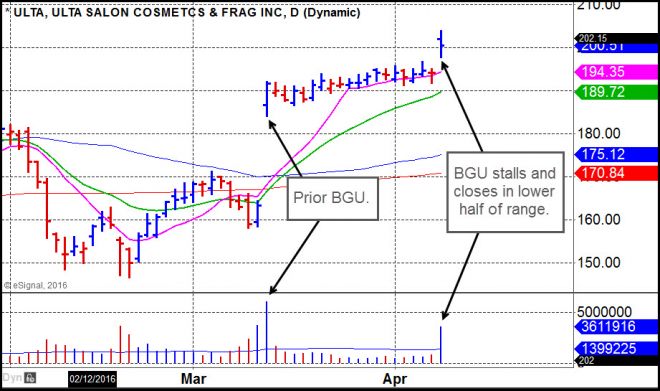

Ulta Salon Cosmetics & Fragrances (ULTA)

GM - This buyable gap-up is occurring after a prior buyable gap-up that ULTA had in March, so it may be getting long in the tooth. However, if one likes the stock then this is actionable from a objective standpoint, using the intraday low of Friday at 197.81 as a selling guide. Had one seen the initial buyable gap-up in March, one could have handled that in the same way, and in this manner would be ahead of the game by the time this second buyable gap-up occurred.

Dr. K - ULTA tends to track sideways after gapping higher. Still, its strong fundamentals and two prior gaps higher on strong earnings may help jump start this stock into an uptrend. If one sells on any undercut of the low of its gap higher, risk here is 1.3%. Of course, one may decide to give the stock a little wiggle room in context with the general markets to allow for a 1% undercut of its gap up day low.

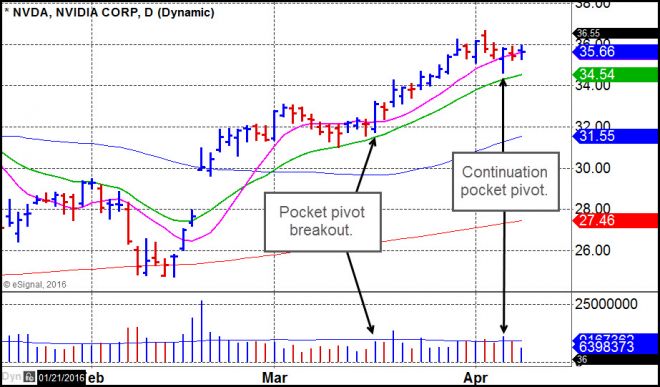

Nvidia (NVDA)

GM - this probably would have been better if we had issued a report on the initial pocket pivot that occurred on a cup-with-handle breakout back in March. The stock is now about another 10% higher from there but issued a continuation pocket pivot at the 10-day line on Wednesday. With the stock hanging along the 10-day line, the continuation pocket pivot is buyable with the idea of using the 10-day line as a selling guide. Notice that NVDA is a big stock, and as a big stock acts more like another big-stock, AVGO: steady to the upside. Meanwhile, these dinky semiconductors like MTSI and MXL go nowhere, and illustrate why I prefer big stocks in this market. SIMO, which we issued a pocket pivot report on back in early March, is perhaps an exception as a small semiconductor, but notice that owning this stock requires that one sit through some extreme volatility, or at least be willing to take 10-15% profits or better when one has them, with the idea of buying back on a pullback into a logical area of support. Study SIMO's chart to get a sense of how this works.

Dr. K - Semiconductors tend to trade with greater volatility as was also true even in the 1990s, thus those who like smaller cap names should know they are taking on additional risk since this environment has shown that larger caps tend to be more reliable often with less noise in their chart patterns. That said, knowing that semiconductors trade in this manner means one must be extra nimble in taking profits when you have them, sometimes within a day or two of buying your position, should the semiconductor stock have a good short-term move.

Weibo (WB)

GM - Admittedly, putting out a report on a stock that is already up 10% on the day from its 10-day moving average strikes me as somewhat late. At that point the only way to buy it is on a pullback into the 10-day line at 18.87, and that remains the case as the stock gets more extended. In my view, this is more an example of how one should look for tight action within bases and look to get in before the stock shows strength. So far, however, one could have gotten away with buying it extended on Wednesday.

Dr. K - WB tends to pull back to its 20-day moving average so may give an opportunity in the coming days keeping in mind that, so far, WB's price pattern has traded fairly erratically so buying on weakness, not strength, is essential.

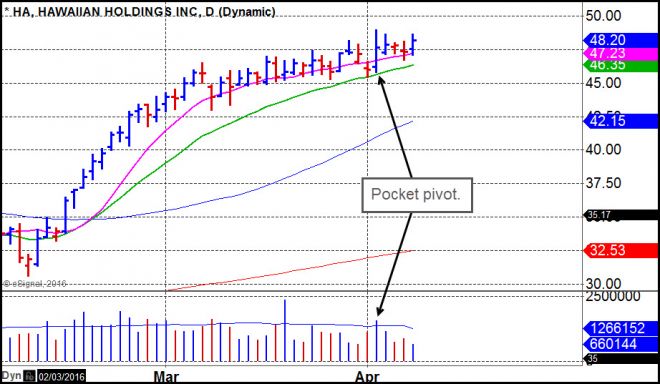

Hawaiian Holdings (HA)

GM - this is a typical continuation pocket pivot along the 10-day line following HA's base breakout through the 40 price level back in late February. So far the pocket pivot hasn't gone anywhere but the stock is holding tight along the 10-day line where it remains in an objectively buyable position using the 20-day line at 46.35 as a selling guide.

Dr. K - HA is showing the greatest price strength and cleanest patterns in the airline group. Should this continue, HA should outperform the general market.