Market Lab Report / Dr. K's Crypto-Corner

by Dr. Chris Kacher

The Metaversal Evolution Will Not Be Centralized™

Sticky PCE vs. CPI

The bounce that began at the start of this year has been mostly due to retail investors. This is never a good sign as such speaks to further evidence of a relief rally. As stock and crypto markets roll back over, the recent inflation data shows it is stickier than expected. Fed members, CME Fed Fund Futures, the dollar, and the bond markets have underscored the issue that the terminal rate will be at least 525-550 bps, or three more rate hikes of 25 bps. The yield on the 2-year bond recently closed at new highs.

We have spoken of these issues in past reports where supply chain issues, fertilizer and wheat shortages, uneconomic ESG (Environmental, Social, and Governance) initiatives, and war between Russia and Ukraine all push prices higher. The Fed has even spoken of a 50 bps rate hike should data warrant. But even when the Fed pivots sometime later this year, while this may spark another relief rally, it historically is a bad omen for what is to come. Stock markets lead interest rate direction so as recession kicks off, markets will head lower forcing the Fed to lower rates. This cat-and-mouse chase between interest rates and stocks could be prolonged though as discussed in prior reports, a major low could be found due to any of: 1) exponential growth technologies creating massive utility so avert a crash landing but just a hard landing, 2) a black swan which forces the Fed to print trillions once again which ushers in a new bull market, and/or 3) global QE from countries such as China, Russia, and Japan which has recently more than offset the record speed of tightening by the Federal Reserve in the US; such could also avert a crash landing.

Talk about the Fed changing their 2% inflation target could, according to Fed governor Philip Jefferson, call "into question their commitment to stabilizing inflation at any level. It might lead people to suspect that the target could be changed opportunistically in the future." Nevertheless, Ray Dalio suggested the Fed may have no choice but to revise their target should inflation remain elevated. Indeed, the Fed revised the way other variables are calculated such as now using only the last year of CPI data so it can give him more reason to pivot as inflation data over the last year looks more favorable overall. In consequence, it's not a stretch to see the Fed revising their inflation target upwards.

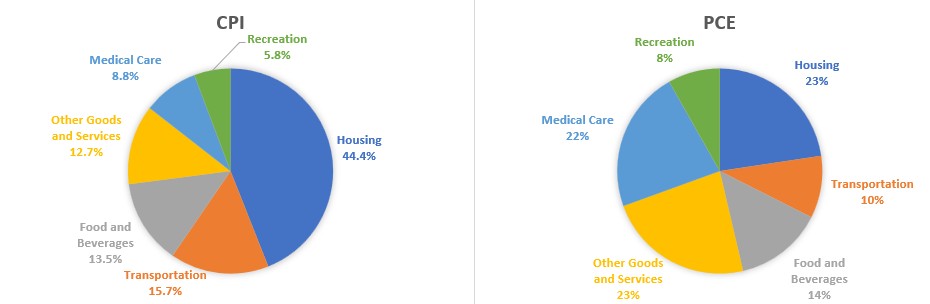

PCE is the Fed's preferred measure of inflation but markets react to both PCE and CPI data. The largest weighting differences are in housing and medical care. PCE carries less weight in housing which is strongly coming off peak while giving more weight to medical care costs which remain sticky. This, together with the new way CPI is calculated is likely to keep PCE elevated, while bringing CPI and PCE closer together.