August 27, 2023

Important Notice to Members: As the end of August approaches, I again remind remaining Gilmo Report members that the final Gilmo Report will be posted on August 30, 2023. The site will then be shut down on September 2, 2023 at which point the lights, so to speak, will go out. All remaining memberships will have expired at that time, and members who wish to follow me on the internet can consider subscribing to VirtueofSelfishInvesting.com or TheOWLTrader.com. Now back to your regularly scheduled report.

The market was primed for a big bull party on Thursday after Nvidia (NVDA) handily beat earnings estimates when it reported Wednesday after the close and gapped up through the $500 level. But as I noted in Wednesday’s report, “Frankly, I cannot recall if I have ever seen so much certainty of a bullish outcome from the crowd when it comes to an earnings report.”Things were perhaps just a bit too obvious as big sellers pulled the rug out on the dumb money that came piling into AI meme stocks of every stripe Thursday morning. As the morning progressed, however, NVDA reversed back below the $500 Century Mark to trigger a short entry per Jesse Livermore’s Century Mark Rule for the short side and headed back towards the UNCH line.

It was followed by other AI meme stocks as the group reversed en masse with many AI meme stocks posting high-volume outside reversals to the downside. To get a sense of how badly AI meme names reversed on Thursday, look at the group of four AI meme semiconductors I have discussed in recent reports. All four stocks, Advanced Micro Devices (AMD), Broadcom (AVGO), Marvell Technology (MRVL), and the marquee name Nvidia (NVDA) all reversed hard, triggering short-sale entries along the way.

AVGO and NVDA played out as Century Mark short-sale entries at the $900 and $500 price levels, respectively, while AMD triggered a short entry as it reversed along the 20-dema and near the 50-dma. MRVL flipped out at the 50-dma and broke even lower after-hours following its earnings report last night, closing down nearly 6% again on Friday on a gap-down break.

On Friday AMD remained near Thursday’s lows while AVGO rallied back up into shortable resistance at its 50-dma and backed down to close in the red. After triggering both a Century Mark and DTSS entry on Thursday, NVDA rallied back up to 480.88 price resistance and reversed, offering a second DTSS entry.

At this stage these names are somewhat oversold in the near-term so we can now watch to see how these develop along moving average support and resistance from here. Rallies into moving average resistance would bring them back into optimal short-sale range, while fresh breaches of moving average support would trigger new short-sale entries lower in the patterns.

Needless to say, the outside reversals seen in a broad number of individual stocks on Thursday showed up in the aggregate on the daily charts of the major market indexes, all of which posted similarly bearish outside reversals on higher volume. On Friday, the market started to the upside ahead of Head Fedhead Jerome Powell’s speech at the Fed’s Jackson Hole, Wyoming Economic Policy Symposium that came 35 minutes after the opening bell.

After reversing into the red as the other indexes flattened out, the NASDAQ found its feet and turned in a reaction rally that carried it back up towards 20-dema resistance. The more cynical-minded might ascribe the rally to the fact that it would have been very poor optics for the market to sell off hard on the first two days of the Fed’s Economic Policy Symposium boondoggle and so they dusted off and unleashed the fabled Plunge Protection Team.

Whatever it was, late shorts getting squeezed, oversold rallies among individual stocks, etc., the rally was nothing spectacular as all of the major indexes move up less than 1% on lighter volume. The NASDAQ in fact led on Friday with a 0.94% gain. For now, the downtrend remains in force as the index tests the lows of two Fridays ago.

Clearly, the crowd was set up in a big way on Thursday as the AI meme hype streaming across the airwaves and elsewhere reached an ebullient crescendo. But as the group initially gapped higher in sympathy to NVDA’s earnings, it eventually flipped to the downside as we see in the charts of AI meme stocks discussed in recent reports. That basically set up a situation for opportunistic short-sellers that rivaled the proverbial shooting of fish in a barrel.

Adobe Systems (ADBE) reversed back below its 10-dma and 20-dema after gapping up towards the $540 level Thursday morning. On Friday the stock regained the 10-dma and 20-dema where it held support by the close. Any break below the moving averages would trigger short-sale entries from here so can be watched for.

Arista Networks (ANET) triggered a clean double-top short-sale entry at the 190.64 left-side peak of August 1st, which in my Wednesday report I noted as something to watch for. On Friday, ANET closed just below 10-dma resistance and above 20-dema support. For now, it is extended on the downside from the DTSS entry at 190.64 but any break below the 20-day line would trigger a fresh short-sale entry so can be watched for.

CrowdStrike (CRWD) reversed along price resistance established earlier in the week and broke back below its 10-dma, 20-dema and 50-dma on Thursday to trigger short-sale entries. On Friday, CRWD rallied back into the three moving averages to bring it back into short-sale range using the same moving averages as covering guides. CRWD is expected to report earnings next Tuesday, August 29th.

Cloudflare (NET) rallied right back up into its 50-dma on Thursday morning where it offered a reasonable short-sale entry using the 50-day as a covering guide. It then reversed back below the 20-dema to trigger another short-sale entry. On Friday, it rallied back into the 20-dema to bring it into short-sale range again using the 20-day as a covering guide.

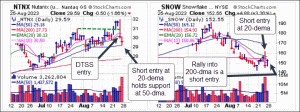

Nutanix (NTNX) finally cut loose and broke below the 30.96 left-side peak in its recent base to trigger a double-top short-sale (DTSS) entry using the 30.96 level as a covering guide. On Friday, it presented a convenient short-sale entry along the underside of the 20-dema and then broke lower before bouncing off 50-dma support. Rallies back into the 20-dema would bring the stock back into short-sale range so can be watched for. NTNX is expected to report earnings next Wednesday, August 30th.

Snowflake (SNOW) rallied Thursday morning not only in sympathy to NVDA earnings but also to its own earnings report the night before. But, like all the other AI meme stocks, that move reversed sharply along the 20-dema as SNOW triggered short-sale entries at the 20-dema and then the 200-dma before finally closing below the 10-day line, the lowest moving average on its chart. On Friday it rallied back up into the 200-dma where it is a short entry again using the 200-day as a covering guide.

C3.Ai (AI) rallied back up to its 20-dema on Thursday in sympathy to NVDA earnings where it was eminently shortable using the 20-dema as a covering guide. It then reversed hard to post lower lows. On Friday the stock held right along Thursday’s lows but any rallies back up into the 20-dema would bring the stock into better short-sale range from here so can be watched for.

IonQ (IONQ) reversed at Wednesday’s closing highs to close back below its 10-dma and 20-dema. It did, however, hold support at the 50-dma. On Friday it continued to hold 50-dma support as it stalled along the 10-dma and 20-dema. Watch for any break below the 50-day line as a short-sale entry trigger if it occurs.

Big-stock NASDAQ reversed as well, but in some cases, there was little in the way of sympathy moves in response to NVDA earnings. For example, Apple (AAPL) simply opened Thursday where it ended the day on Wednesday just below its 20-dema and back in optimal short-sale range as I noted in my report that day.

AAPL then broke lower as it reversed with everything else and closed below its 10-dma. On Friday, AAPL regained the 10-dma, so watch for any rallies closer to the 20-dema as they would bring the stock back into short-sale range at the line.

Microsoft (MSFT) exhibited a little more sympathy for NVDA earnings, rallying up to is 50-day moving average on Thursday where it was back in optimal short-sale range. It then reversed hard to close back below the 10-dma and 20-dema. On Friday MSFT rallied up to the 20-dema where it stalled, thus presented a short-sale entry at the 20-day line which then becomes a tight covering guide.

Amazon.com (AMZN) rallied past its 10-dma on Thursday, not that much in terms of a sympathy move to NVDA earnings. It then reversed sharply to trigger short-sale entries at the 10-dma and then the 20-dema before holding support right at the 50-day moving average. It shook out along the 50-dma which could theoretically be treated as an MAU&R at the line which then becomes a tight selling guide.

If AMZN then rallies back up into the 20-dema then it would come back into short-sale range. Otherwise, any decisive break below the 50-dma would trigger a fresh short-sale entry so can be watched for.

Alphabet (GOOGL) made things relatively easy for shorts as it rallied past the left-side peak in its current base at 133.74 on Thursday morning. I had noted in my Wednesday report that, “It is possible that double-top resistance could come into play tomorrow so can be watched for.”

That turned out to be precisely the case as GOOGL rallied as high as 134.25 on Thursday morning before reversing and triggering a DTSS entry at the 133.74 left-side peak which is then used as a covering guide.

Meta Platforms (META) responded to NVDA earnings with a gap-up move just past the 20-dema and 50-dma before it reversed at both moving averages to trigger short-sale entries at that point. It remains extended but can be watched for rallies into the 10-dma, 20-dema, or as high as the 50-dma which would bring META back into short-sale range.

Netflix (NFLX) rallied up through its 20-day exponential moving average on Thursday where it promptly reversed and triggered a short-sale entry at the line. It had already triggered a short entry at the 50-dma on Wednesday when it reversed at the line, and by Friday was a tad oversold as it rallied back up into the 20-dema. This bring sit into short-sale range using the 20-dema as a covering guide.

Tesla (TSLA) was in a parabolic downtrend last week, but this past week continued to rally back up into its 20-dema all week long. I view these rallies into the 20-dema as potential short-sale entries as close to the line as possible.

The situation was no different with the semiconductor equipment makers I have discussed in recent reports, Applied Materials (AMAT), KLA Corp. (KLAC) and Lam Research (LRCX). All four stocks tarted the day to the upside on Thursday morning in sympathy to NVDA earnings before reversing sharply in massive outside reversals.

All three stocks triggered short-sale entries as they flipped to the downside and came crashing through their 20-day exponential moving averages on Thursday. On Friday, all three shook out along their 50-day moving averages and closed above 50-dma support. These theoretically triggered MAU&R long entries at the 50-day line which is then used as a selling guide.

At the same time, all three rallied up into 20-dema resistance where they also come back into short-sale range. My guess is that if the market breaks to lower lows these will all resolve by decisively busting their 50-dmas and triggering fresh short-sale entries. This can therefore be watched for in the coming week.

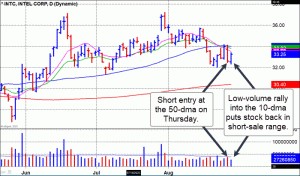

As I noted on Wednesday, Intel (INTC) actually started trading down in response to NVDA earnings that afternoon, and so this set it up as an easy short at the 50-dma on Thursday morning. The 50-day line then became a tight covering guide, and INTC streaked lower from there.

On Friday, INTC rallied back up into its 10-dma which is now well below the 50-day line. Volume was light, so this may present a potential short-sale entry, this time, at 10-dma resistance which is then used as a tight covering guide.

The 10-Year Treasury Yield ($TNX) ended the week at 4.239%, not too far off its March 2023 peak at 4.333% but still 23.5 basis points below Wednesday’s intraday high at 4.474%. Still the U.S. dollar made another higher high as we see on the daily chart of the Wisdomtree US Dollar Bullish (USDU) ETF shows below.

Despite the rallying dollar, precious metals held their ground on Thursday. The SPDR Gold Trust (GLD) ended the week at 177.62, still above the June 29th low at 175.79 where it posted a U&R earlier in the week. That U&R remains in force using the 175.79 prior low as a tight selling guide.

The iShares Silver Trust (SLV) trade big volume on Friday as it found support off the intraday lows and also held above the 22.03 intraday low of Wednesday’s bottom-fishing buyable gap-up (BGU) move. That was an impressive display of support and SLV remains a BFBGU in force using the 22.03 low as a selling guide.

Gold miners Agnico-Eagle Mines (AEM), Alamos Gold (AGI), AngloGold-Ashanti (AU), Equinox Gold (EQX), Barrick Gold (GOLD) and Kinross Gold (KGC) are a decidedly mixed bag here as they flop around. AEM held potentially buyable support along its 10-dma on Friday while AGI and EQX, two of my favorite junior gold miners, held potentially buyable support at their 50-day moving averages. In each case the moving average in question becomes your selling guide.

AU posted a bottom-fishing buyable gap-up on Wednesday as I noted in my report of that day with a 16.71 intraday low. So far, the stock has held above that low, keeping the BFBGU in play for now using the 16.77 level as a selling guide. GOLD remains above its U&R low of 16.77 after shaking out on Friday so remains a U&R in force using the 16.77 level as a selling guide.

KGC is the surprising laggard here as it broke below its 200-day moving average on heavy selling volume. While that can technically be treated as a short-sale entry using the 200-day as a covering guide, watch for any move back above the line over the next 2-3 days as a possible MAU&R.

First Majestic Silver (AG), half silver miner and half gold miner, held above the 5.77 prior low in the pattern to keep its U&R along that low in force for now. The stock is buyable as close to the 5.77 low as possible at which point the low is used as a selling guide.

The five banks that were downgraded one notch by Standard & Poor’s earlier in the week, Associated Banc-Corp. (ASB), Comerica (CMA), Keycorp (KEY), UMB Financial (UMBF), and Valley National Bancorp (VLY) remain in various states of disrepair. On Friday, CMA, UMBF, and VLY were all short entries at their 50-dmas before peeling off to the downside.

Downgraded Banks Daily

The SPDR Regional Bank (KRE) ETF reflects the general pressure that the regional banks are feeling currently as it flashed a short-sale entry at the 50-day moving average on Friday. The 50-day line is then used as a tight covering guide.

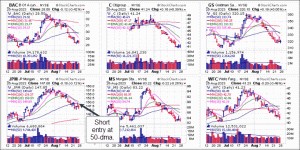

Big-stock financials Bank of America (BAC), Citigroup (C), Goldman Sachs (GS), J.P. Morgan (JPM), Morgan Stanley (MS), and Wells Fargo (WFC) did not have much to say about NVDA earnings on Thursday as they all remain within well-defined downtrends. On Thursday JPM even flashed a short-sale entry at its 50-day moving average, while on Friday GS and WFC were potential shorts on little rallies into 10-dma resistance before they turned back into negative territory.

The action in financials, from big-stock money-center banks to regionals to mid-tier institutions like Bank of New York Mellon (BK), Charles Schwab (SCHW), and U.S. Bank (USB) is weak across the board. Note that BK was a short entry near the 50-dma on Thursday and then again at the 20-dema on Friday.

SCHW has been sliding precipitously as of late, and last triggered a short-sale entry along the underside of its 50-dma this past Tuesday. Meanwhile, USB was a clean short-sale entry at the 50-dma on Friday.

On its face, the broadly deteriorating action in the financial sector seems to be hinting that something is wrong somewhere in the system. Lately, even as interest rates and the dollar rise, the positive action in precious metals also hints at the possibility of a potential crisis that could affect confidence in the financial system.

And if that happens then the space could benefit from Lifeboat Trade if and as more cockroaches in the regional bank sector or anywhere else in the broader financial sector start to emerge from the walls. It is why I think we need to keep precious metals and related stocks on our radar as they attempt Ugly Duckling style moves off the bottoms in recent days.

Thursday’s reversal in the major market index that was led by a massive reversal and breakdown in the AI meme stock sector was a classic illustration of how what the crowd “knows for certain” is often something to fade. After NVDA reported earnings, the group appeared unstoppable, but then everyone knew it, and everyone was in up to their eyeballs. At that point, there was only one way for the money to flow, and that was out of AI meme stocks.

How this plays out from here will likely figure heavily into where the general market heads in the coming weeks as we make the turn into Fall, a time of the year that has historically been less kind to stocks. Certainly, the dominoes are set up to fall, now it is just a matter of seeing how the set-ups line up in the coming days following the perfect short-sale entries we saw on Thursday. Stay tuned.

Gil Morales