Market Lab Report

by Dr. Chris Kacher

The Web3 Evolution Will Not Be Centralized™

The global economic doom loop

The planet sits with a massive economic problem. The monetization of debt has resulted in the QE inflation megatrend which is why 'V' bottoms are formed when QE is being employed. This is true for every drop in the major averages since QE was launched in late 2008. The only real bear markets we have had since then occurred when QE was being restrained.

Why will we see an acceleration in inflation going forward? Think of it this way. Population growth drives GDP. But population growth has been decelerating around the world. In consequence, the average age has increased. As people age, they get less productive. So the economic driver of population growth has slowed which, in turn, has slowed productivity growth which slows GDP growth.

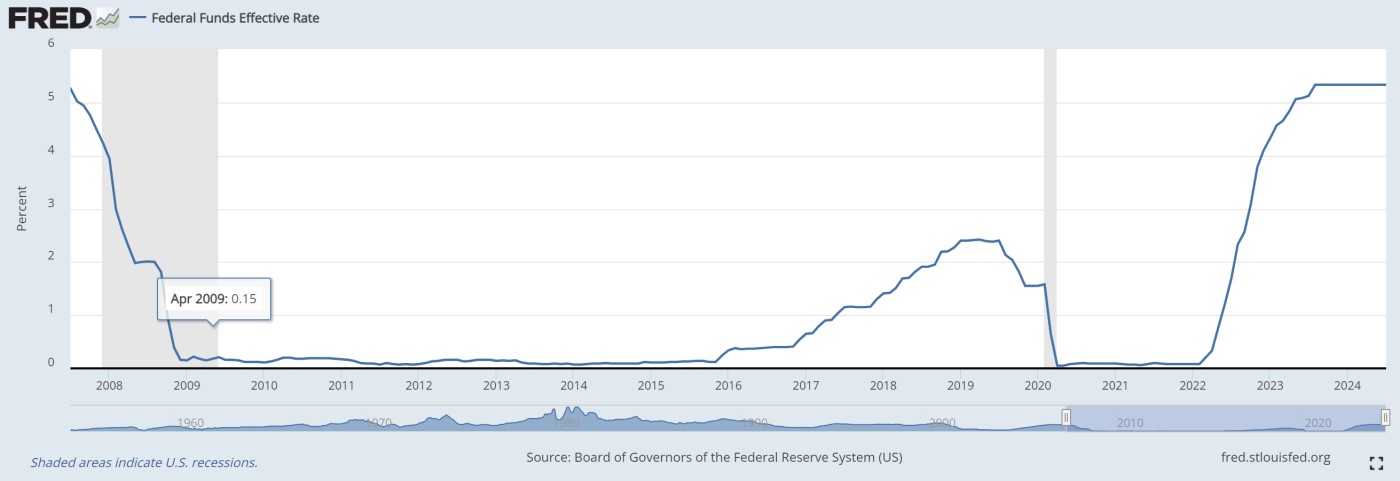

We also have debt that fuels growth but this ended in 2008. Debt growth prior to 2008 helped boost real GDP, but since 2008 when QE was launched, it now services existing and growing debts, so its former contribution to economic growth has disappeared.

So GDP continues to weaken which implies more global debt. Central banks must therefore create fiat to stimulate their economies. But this drives up inflation which weakens fiat further so even more fiat must be created.

This doom loop keeps repeating ad infinitum where we have to keep debasing fiat to offset the rising debt payments because GDP growth is insufficient. GDP used to be the economic cash flow that paid for the debts. Since GDP is low, interest rates need to stay low to prevent GDP from falling further. But since GDP is low, debt growth keeps growing because there's not enough GDP growth to grow the economy out of debt.

COVID accelerated the above issue. But in the last couple of years, total stealth QE has been greater than QE during COVID.

All of the above contributes greatly to the sometimes bizarre behavior we have observed in the markets over the past few years. But one thing seems certain. As long as QE in all its forms continues, we will see higher prices across the board in the form of accelerating inflation, and higher stock, bitcoin, and real estate prices and more 'V' bottoms which are typically the result of transitioning from restrained QE as we saw in the latter parts of 2010 and 2011, early 2016, the latter part of 2018, and 2022 to a re-acceleration of QE.

That said, exponential growth technologies such as AI, blockchain, and robots can break the cycle by contributing to actual productivity which bolsters GDP. Robots are replacing humans in the work force because they are more efficient, cheaper, they dont have unions, and they dont complain. Robotics companies are emerging with Tesla leading the way. Multi-tasking robots are coming. A broad spectrum of jobs such as retail workers, surgeons, accountants, and lawyers will get replaced by AI in the coming years. The abilities of robots are growing exponentially.

Is the Fed behind the curve?

Is the Fed behind the curve? Yes, but QE may save the day once again especially since this is an election year globally so central banks are printing away. The only rate reductions we have had since 2008 started in 2019 which was a bull market for stocks. It did not lead to recession or a bear market.

Depending on how fast the economy slows, the Fed may manufacture a reason why QE is necessary. But they have a number of stealth QE tools at their disposal such as reverse repos and their making Japanese banks whole due to the recent yen carry trade debacle which would classify as a black swan, so they may not need to relaunch some traditional QE program such as the ones we saw in the 2010s or during COVID.

The macro future

The recent ISM (Institute of Supply Management) report reflected a sharp rebound in the services side of the US economy. The bounce was led by its employment data which came in strong at 51.1 vs its prior 46.1. This underscores how the weak jobs report was largely due to Hurricane Beryl which pushed unemployment up 0.2% to 4.3% and was a large contributing factor to the low payroll number. The number of people out of work due to bad weather reached 461,000, the highest for July on record. The BLS downplayed this, but the New York Times noted that nearly half a million people reported being employed but not working due to bad weather, the highest since January.

Nevertheless, the economy is slowing on many levels at home and abroad. But due to the incoming lower rate cycle spurring a reacceleration of QE in all its forms, Raoul Pal who attributes much of his success to correlating macro with markets, writes:

IF we were at the point where the ISM was turning down after a cycle peak, then this could usher in something more protracted. But we are at the bottom of the business cycle with a massive easing of financial conditions in place, accelerated by the dollar decline that is just starting and by the rate decline. Forward looking indicators are showing signs of a good recovery ahead. Thus the probabilistic outcome is that this was just a nasty flush out. Therefore using my framework which is all about the cycle and not about the wiggles, I'd be strongly biased towards using this reset as a very good opportunity to add to trades ahead of the liquidity spigots opening (whenever that is...but likely within 4 weeks). That is the macro set up I am personally focussed on. I don't trade the wiggles anymore but instead the secular cycle and the longer business cycle. The issue here is figuring out if this is a nearly-done event, or we have a short bounce and then a final leg lower, or re-test of those lows. The situation in the Middle East might well dictate that. It is too early to know but I for one am looking to add to my tech stocks over the next week or so. Not looking to get the exact bottom...but just to get great prices for the Macro Summer/Fall period that we have started but got sideswiped by the yen carry trade in Japan. I personally think of this as a violent shakeout and a reset of risk-taking leverage and that strong upside will be the feature of this year into 2025. <<end of report>>

You can see that in each of the boxes since 2008 when QE was first utilized, four out of four times, QE quickly pushed the ISM into an uptrend which correlated with the start of a new uptrend in the NASDAQ Composite. We are now resting at the fifth time where the ISM came in above expectations at 51.4 which is above the last box shown on the chart, and QE once again is being launched across many central banks as rates come down. As of now, just over half of central banks have started to low rates, up from 25% just a few weeks ago.