Leading tech names are likely far from over. Strong rotation that propelled major indices such as the broad-based NYSE Composite to new highs are not signalling a bear market. Global liquidity which strongly correlates with major averages remains robust. This suggests taking advantage of recent dips, some of which were mentioned in our recent reports to members, could be worthwhile. Of course, always keep your stops tight in case recent lows are broken.

That said, the last time humanity experienced a true step-function increase in global GDP growth was during the Industrial Revolution. Railroads shrank distances and unlocked continental-scale commerce. Electricity turned night into productive time and powered factories that never slept. The internal combustion engine liberated mobility and birthed entire industries around oil, automobiles, and aviation. Together, these breakthroughs lifted average annual global economic growth from roughly 0.6% to around 3%, a 5x increase that permanently reset the trajectory of human prosperity.We are now living through something potentially larger, and it is happening in plain sight.Five exponential technology platforms are converging simultaneously:

- Robotics — machines that see, reason, and act in unstructured environments

- Energy storage — cheap, dense, scalable batteries that make renewable energy dispatchable

- Artificial intelligence — systems that learn, plan, and create at superhuman speed

- Blockchain — programmable, censorship-resistant money and property rights

- Multiomics — the convergence of genomics, proteomics, metabolomics, and systems biology that unlocks programmable biology

Each platform is advancing on its own exponential curve. More importantly, they are beginning to reinforce one another in powerful feedback loops.

AI designs better robots and optimizes energy storage chemistry. Robotics manufactures batteries and solar panels at scale and dramatically lowers the cost of biological research equipment. Energy abundance powers the massive compute clusters that train ever-larger AI models. Blockchain provides the trust and ownership layer for decentralized AI training markets, tokenized energy assets, and secure biological data marketplaces. Multiomics, accelerated by AI and robotics, produces the biological breakthroughs—personalized medicine, synthetic biology, longevity—that create demand for even more energy, compute, and secure value transfer.

The result is not five separate exponential curves. It is a single, compound-exponential wave.

The Recency Bias Trap

Most investors remain anchored to roughly 125 years of ~3% real annual GDP growth and assume the future will look like a gentle continuation of the recent past. That mental model made sense when the dominant growth driver was incremental improvements within an already-industrial economy. It is dangerously outdated now.

Policymakers continue to measure economic health with metrics designed for a world of analog factories and predictable supply chains—metrics that systematically undercount the value created by software, data, compute, and biological reprogramming.

Productivity statistics, inflation measures, and GDP methodologies all lag reality by years, sometimes decades.

Analysts, meanwhile, remain siloed in legacy sector buckets. Technology is treated as a vertical rather than the horizontal layer that is dissolving the boundaries between industries. Healthcare, energy, manufacturing, finance, agriculture, logistics, defense, entertainment—every sector is being rewritten by the same converging platforms. Yet most research desks still analyze them as though they operate in separate universes.

The Likely Outcome

When five exponential technologies converge and reinforce each other, the historical precedent is not modest productivity gains. It is structural, economy-wide transformation.

The Industrial Revolution did not merely make existing goods cheaper; it created entirely new categories of wealth and entirely new ways of organizing society. The current convergence is doing the same thing—only faster, because the building blocks (compute, data, biology, energy, trust infrastructure) are themselves digital or rapidly digitizing.

Bitcoin/blockchain

Bitcoin and blockchain sit at the center of this transformation. They provide the native monetary and property layer for a world in which intelligent machines, abundant energy, and programmable biology interact at planetary scale. A fixed-supply, decentralized, censorship-resistant asset becomes exponentially more valuable as the rest of the system accelerates. With intergenerational wealth transfers accelerating, the younger generation will diversify into digital gold rather than physical bars.

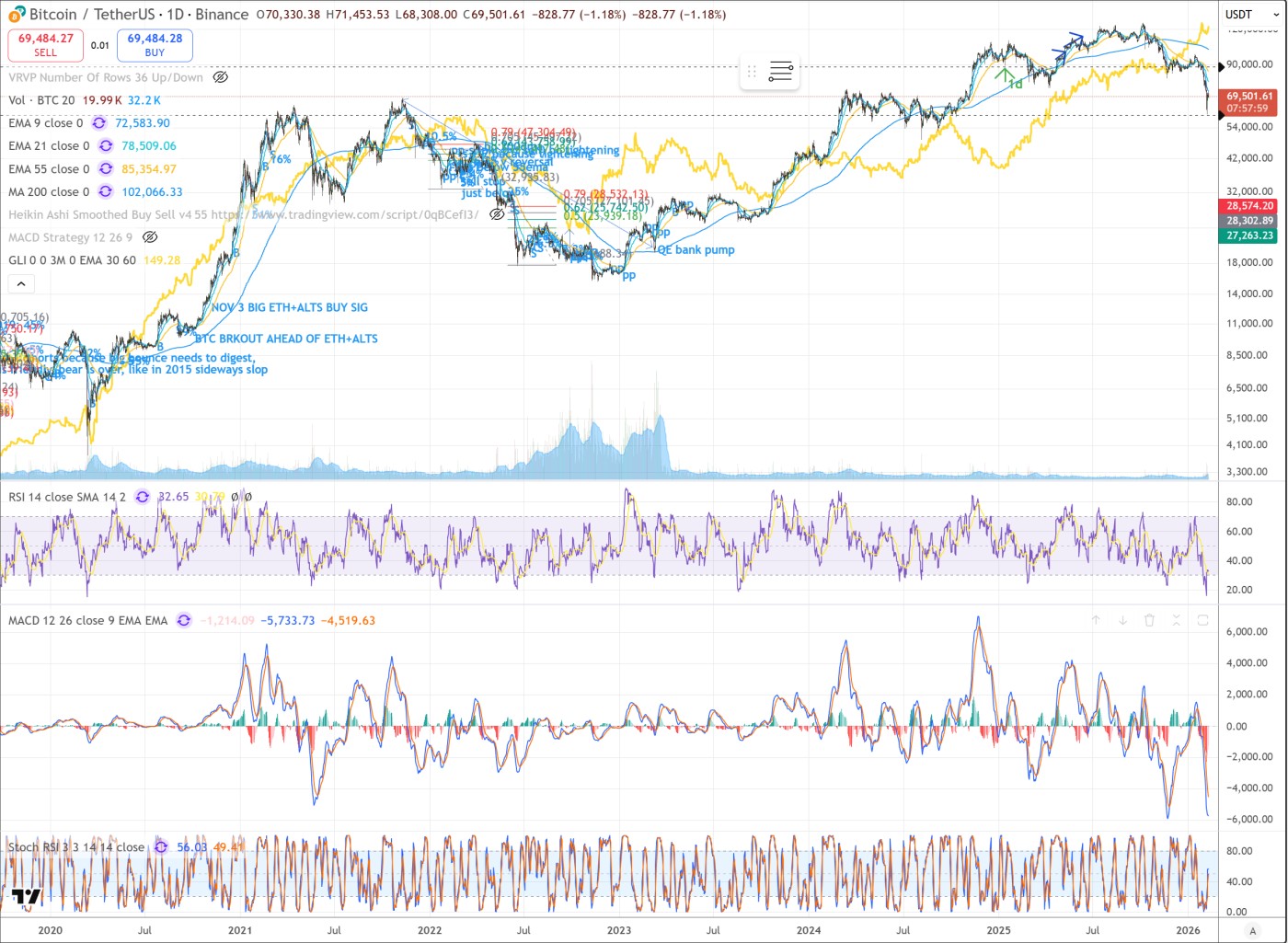

The October 10th flash crash—caused by a Binance software glitch—wiped out $28 billion in leveraged positions. That deleveraging has largely cleared. Nevertheless, the crash damaged investor psychology. In the interim, gold has captured the “crisis hedge + central-bank bid + macro uncertainty” flows. Still, bitcoin RSI hit a critically low level which has suggested we are close to a major low if history in any guide. Bitcoin may retest lows but, so far, has never dropped appreciably from such levels. The two exceptions are 2018 and 2022 when the pace of global liquidity slowed, always a precursor to major crypto bear markets.

Looking Through the Noise

The path will be volatile. Recency bias is powerful. Legacy metrics are comforting. Siloed analysis feels safe. But the underlying forces—exponential platforms converging and reinforcing—are already in motion.The question is not whether this step-function change will occur. It is already occurring. The only question is how quickly people, institutions, and capital will recognize it—and how much of the upside they will capture before the pattern becomes obvious to everyone.

History suggests the answer is: not quickly enough.

The Industrial Revolution rewarded those who saw the railroad, the dynamo, and the automobile for what they were: civilization-scale platforms. The current convergence will do the same.

The only difference is the speed. And the scale. And the fact that this time, the platforms are digital—and therefore global from day one.