Market Lab Report / Dr. K's Crypto-Corner

by Dr. Chris Kacher

The Metaversal Evolution Will Not Be Centralized™

Scenarios: Dead bat bounce OR sloppy sideways markets

It is therefore highly unlikely that this current bounce is anything more than one of the dead bat variety unless QE-lite becomes an enduring factor which could result in extended sloppy sideways market action. The level of debt remains massive as the QE bubble slowly unwinds, so as interest rates rise, the amount of capital needed to service the debt has been and will continue to be "printed" in the form of QE-lite. This is also being practiced by other central banks such as the Bank of England.

Scenario: New bull market

Alternatively, if the Fed starts to print large sums once again due to another black swan event such as we saw as a result of the post-2008 financial meltdown and the COVID pandemic, we will likely see a new bull begin. Such could be spurred in part by the lack of Treasury liquidity which has deteriorated significantly. Despite the massive Treasury market, these days, buying even $100 million in bonds can be difficult because major countries such as Japan and China are stepping back while the Fed continues to tighten the money supply.

Debt delinquency continues to spike higher as well which would be another factor that forces the Fed's hand to start printing again.

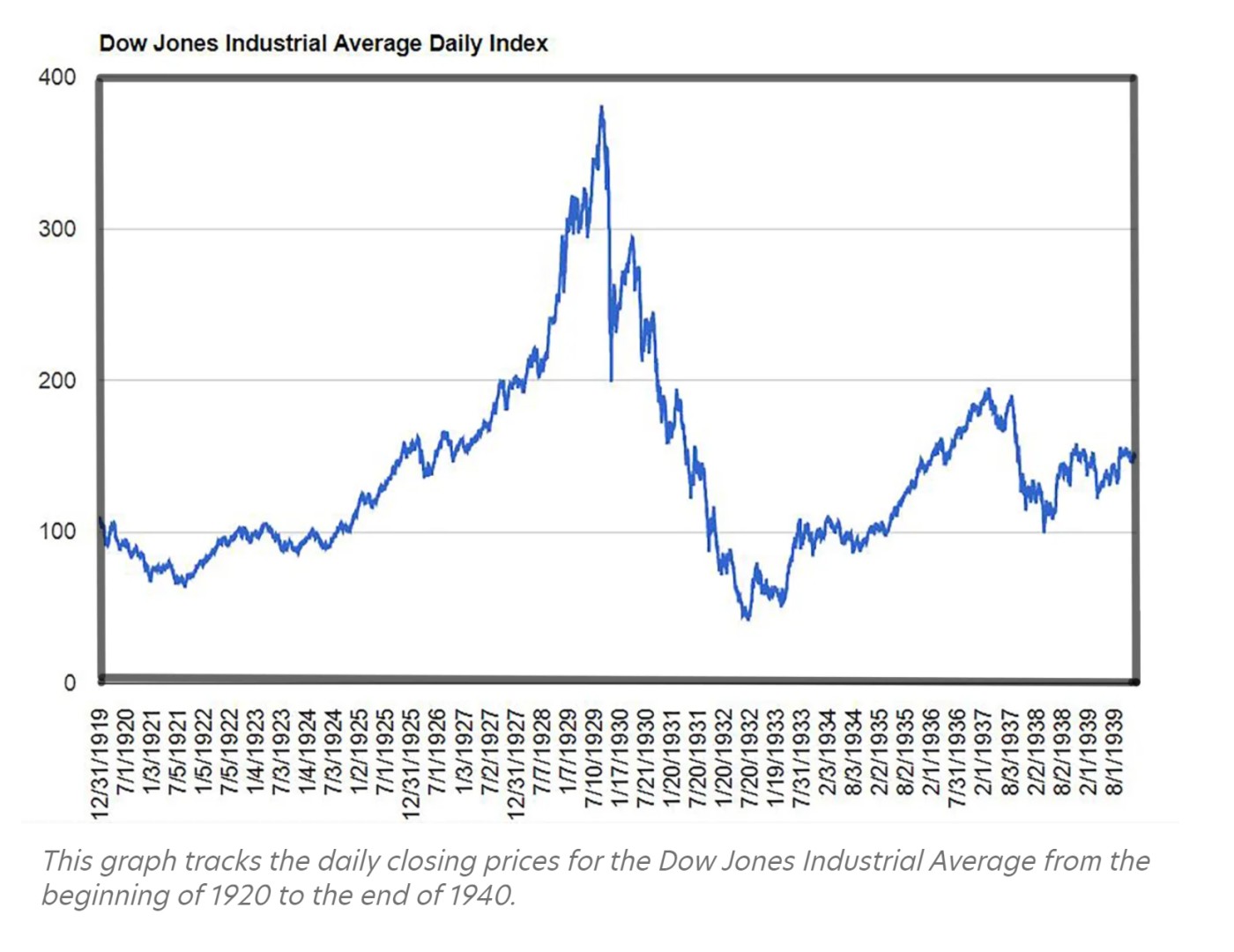

Even if we dont get such a flood of money printing, we have seen in prior bear markets such as in 2000-2002 or 1930-1932 how bounces can run for many weeks before the downtrend continues.

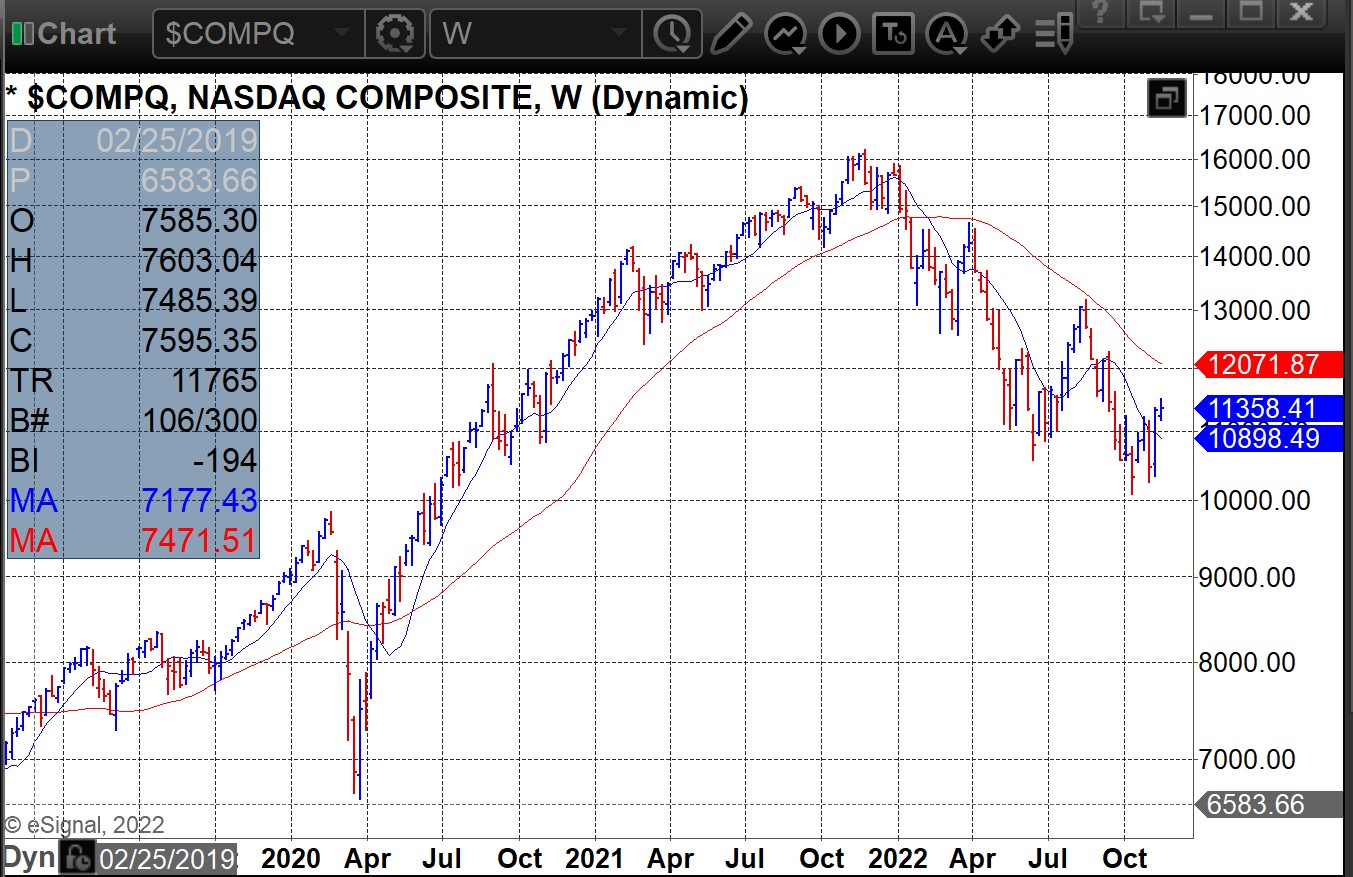

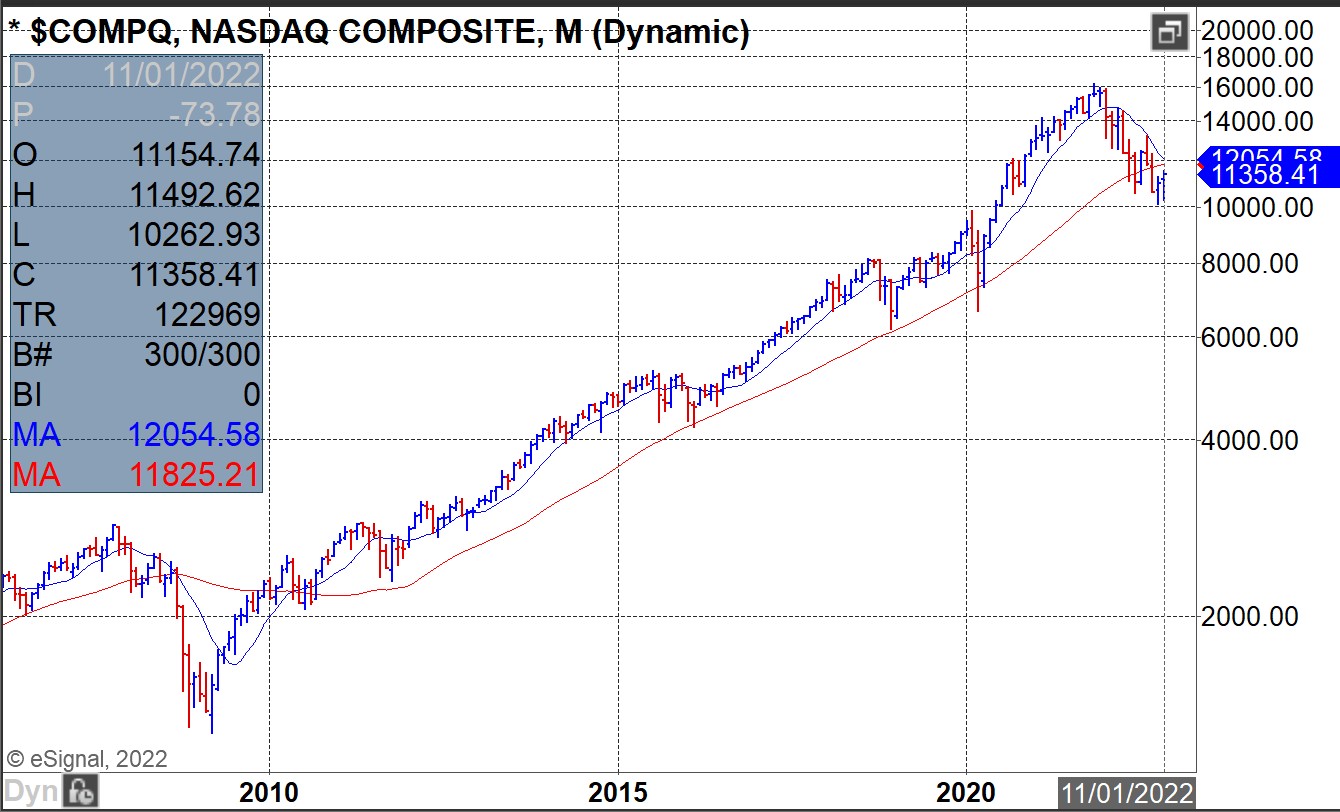

When you look at the monthly chart going back to 2008 when QE began and more or less ran through late 2021 with only minor interruptions, we are still a long way from those levels.

Contrast this with the 2000-2002 bear when the NASDAQ Composite lost -78% retracing 5 years worth of gains which represented much of the dot-com boom which was launched in 1996 when Netscape had its IPO. In the present bear market, we have only retraced about 1 1/2 years worth of gains from the decade plus QE bubble, so it seems we have more selling ahead with a continuation of the downtrend, notwithstanding some sharp bounces or a black swan induced money printing party.

For historical reference, the 1930-32 bear retraced all of the gains made in during the roaring 20s bull as the bubble was unwound.

As for crypto, all metrics point to this being the bottom IF we were in a macro bull environment. In actuality, we are in the worst macro environment seen in this long term debt cycle which typically spans 75-100 years. In consequence, all the metrics and stats one wants to conjure up from prior bottoms carry far less weight than what the Fed will do next. The saying "Dont fight the Fed" has never been more true than this year.

As for crypto, all metrics point to this being the bottom IF we were in a macro bull environment. In actuality, we are in the worst macro environment seen in this long term debt cycle which typically spans 75-100 years. In consequence, all the metrics and stats one wants to conjure up from prior bottoms carry far less weight than what the Fed will do next. The saying "Dont fight the Fed" has never been more true than this year.