by Dr. Chris Kacher

Jobs shocker?

Earlier this year, there was a dramatic downward revision when the BLS revealed that job growth had been overestimated by 818,000 for the prior 12 months. Markets took it in stride. But what stands out about the latest July 2025 jobs report is that the scale of the downward revision for May and June, a reduction of more than a quarter million jobs, hasn’t been seen since the peak pandemic months of early 2020. According to Goldman Sachs, this marked the largest two-month revision since 1968 during non-recession periods. Economists note that negative revisions have occurred every single month in 2025, underscoring a persistent deterioration in labor market conditions. Furthermore, the quits rate sits at its lowest level in the last decade, and more than 1.8 million people report being unemployed for at least 27 weeks — the most since 2017 outside COVID. That makes the current episode historically significant for how rapidly job-market sentiment changed in only a couple months.

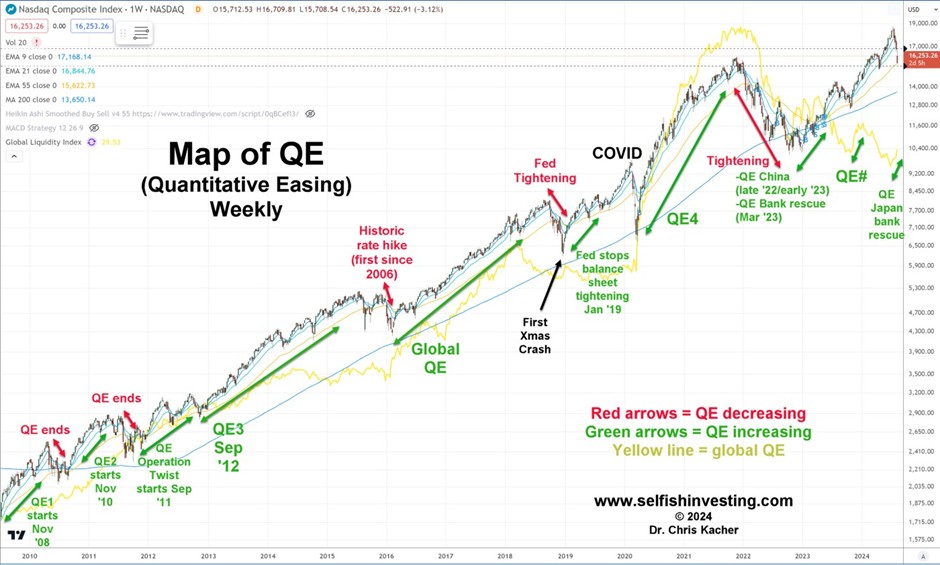

The two Fed governors and Trump who dissented against Powell at the July meeting look prescient. All three have pointed to labor market fragility in recent months to argue for lower interest rates. Economist David Rosenberg wrote, “Had the Fed been aware of these massive downward revisions, the consensus among FOMC voting members would have converged on Waller and Bowman this past Wednesday."That said, global liquidity continues to push higher so even with the delay in lower rates, the digital printing presses roll on which should help cushion market weakness.

Nevertheless, the news spurred Trump to fire the Commissioner of Labor Statistics saying the jobs numbers are "being produced by a Biden Appointee" who "faked jobs numbers." We know the data on various key metrics has been manipulated over the years. Trump's claim adds another potential layer of manipulation for political purposes if true. That said, Trump can bloviate so it can be challenging to know where the truth lies.

Still, Ray Dalio wrote, "I probably would have fired the head of the Bureau of Labor Statistics too. That's because its process for making estimates is obviously obsolete and error-prone, and there is no good plan in the works for fixing it. The huge revisions in Friday’s employment numbers are symptomatic of this, especially because the revisions brought the numbers toward private estimates that were in fact much better. I assure you that this is something that I know a lot about because of how I use data to follow the economy and bet on where it's going."

Jobs silver lining

Bank of America wrote, “Labor supply has cratered due to immigration restrictions. So while demand has also weakened, labor slack hasn’t increased." They point to stable unemployment and steady wage growth as evidence that the slowdown stems more from constrained supply than collapsing demand. More than half of the revisions were due to seasonal factors and public payrolls.

Goldman Sachs reiterated its view Monday that the US economy is near “stall speed” so the Fed will deliver three rate cuts in a row starting next month.

At the same time, Powell says the issue is the low unemployment rate so some think he may not cut rates until next year. This is in sharp contrast to CME FedWatch futures which show an 92% chance of a cut in September when they next meet.

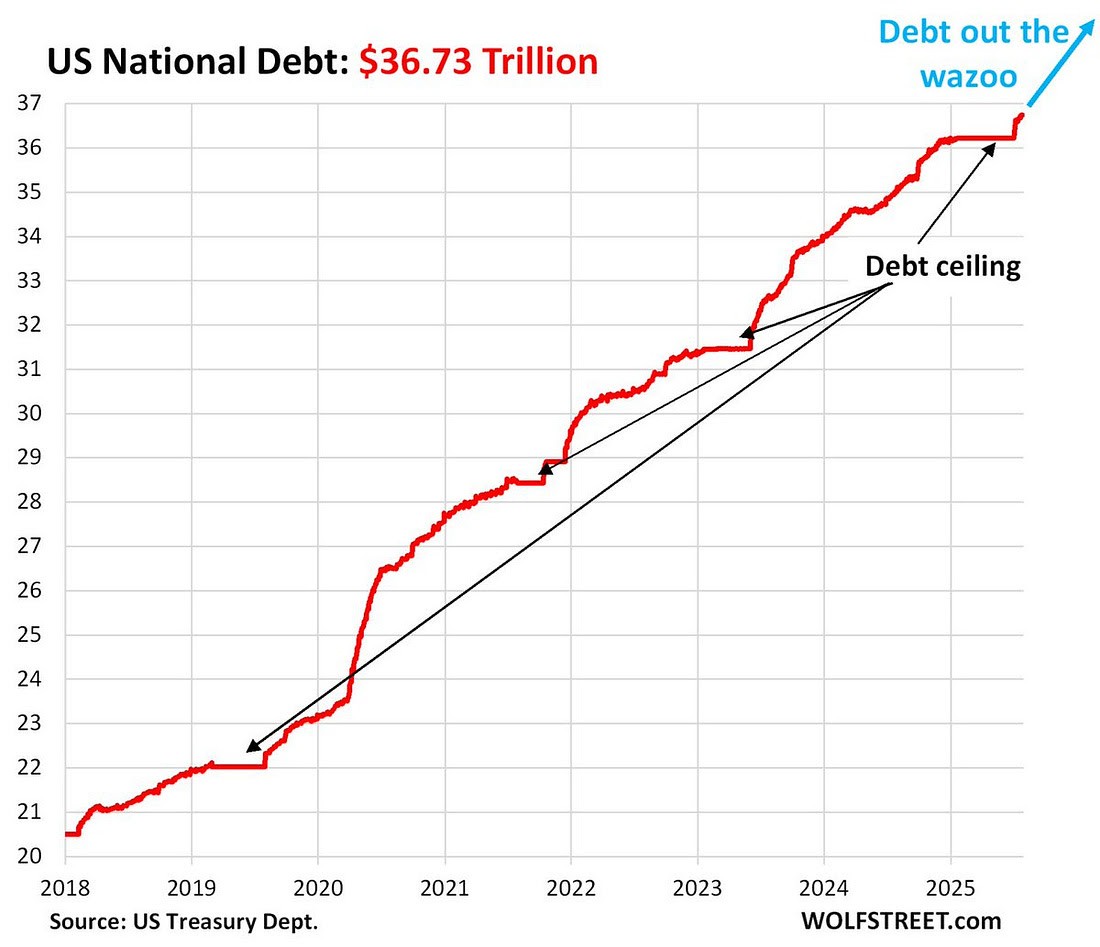

Debt ceilings

When it comes to debt ceilings, the sky is just the beginning. Whenever the debt ceiling is reached, it is soon raised to much higher levels so that the Fed can continue to create money to pay the broad spectrum of debts. US interest on debt now exceeds $1 trillion a year.

But other countries such as China have many of its provinces paying 100% of its profits to service debt.

Top 10 companies

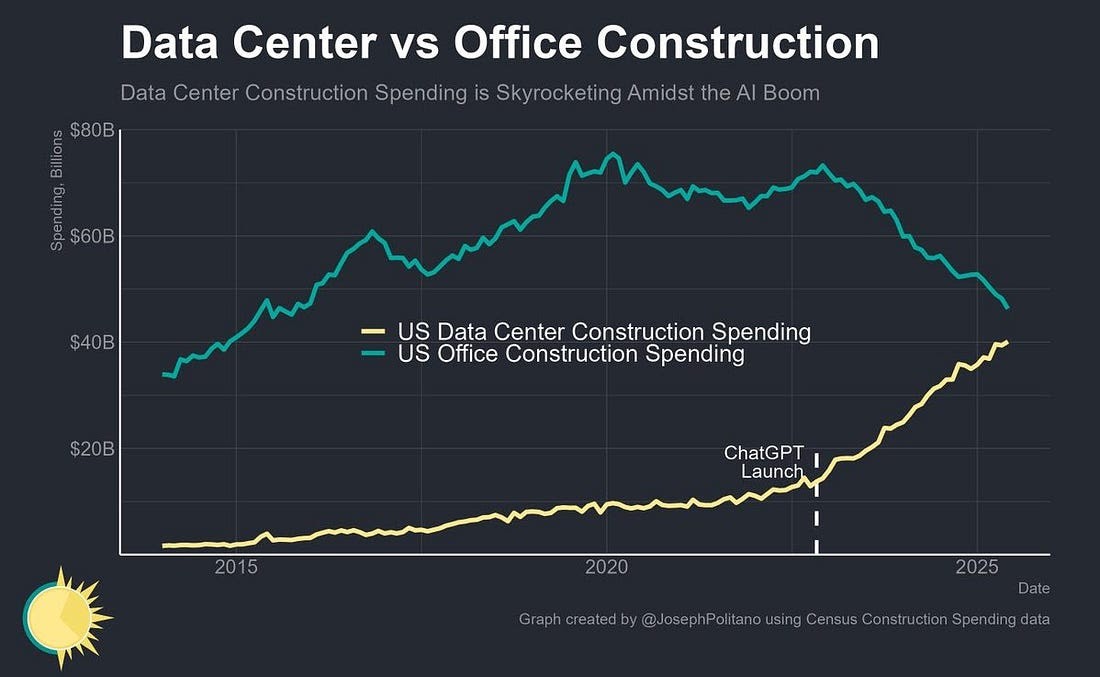

The top 10 companies are pouring R&D into anything related to AI. Data center construction spending will eclipse office construction spending in the coming months. This has been especially true since the launch of ChatGPT on November 30, 2022.

In consequence, the top 10 companies in the S&P 500 have been well outperforming the other 490 companies since early 2023 which means they have been top performers for nearly 2 1/2 years since ChatGPT revolutionized AI usage.

With the river of digital money printing continuing to flow, these top 10 companies well entrenched in AI should continue to outperform which also suggests the 3x ETFs concentrated in technology stocks such as TQQQ and TECL as well as leading crypto-related instruments such as GBTC, MSTR, and ETHE should also continue their sharp uptrends.

All these instruments had sharp corrections whenever printing slowed or stalled. Fortunately, the Fed has always signaled such slowdowns such as Powell did in November 2021, in 2018, or in the first half of the 2010s whenever a quantitative easing program came to an end.

[The chart above shows the weekly NASDAQ Composite Index.]