Trading journal notes from Gil and Dr. K regarding this past week's Pocket Pivot and Buyable Gap-Up reports:

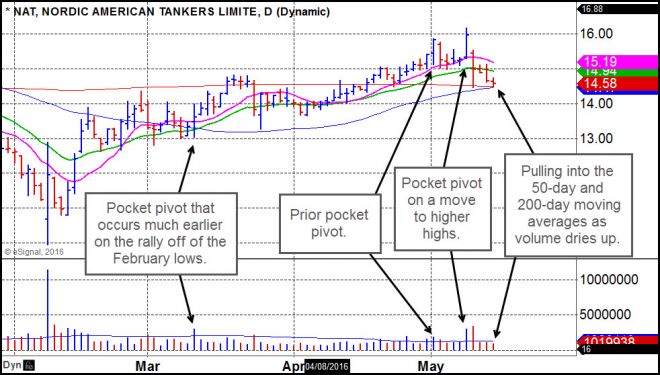

Nordic American Tankers Ltd. (NAT)

GM - NAT's pocket pivot on Monday occurred the day before the company announced earnings. This led to a gap-down break that more or less killed the pocket pivot. I would not have considered this actionable just ahead of the earnings report since I never play "earnings roulette" by holding a stock through earnings unless I have a reasonable profit cushion. The post-earnings pullback is bringing the stock right back into the confluence of its 50-day and 20-day moving averages as volume dries up. Objectively, this would be considered a lower-risk entry point since one could use the two moving averages as a very tight selling guide. Notice that NAT has had prior pocket pivots within the pattern, and the first one did lead to a decent price move from there.

Dr. K - In prior times, stocks could sometimes leave a clue the day before earnings as to whether the report would be good or bad. We can continue to suggest such stocks, but know that those times seem a distant memory. Case in point: NAT had a strong day the day before earnings, yet gapped lower when their earnings report was released. Had one bought it on the pocket pivot day, one should immediately sell as the stock gapped lower at the open.

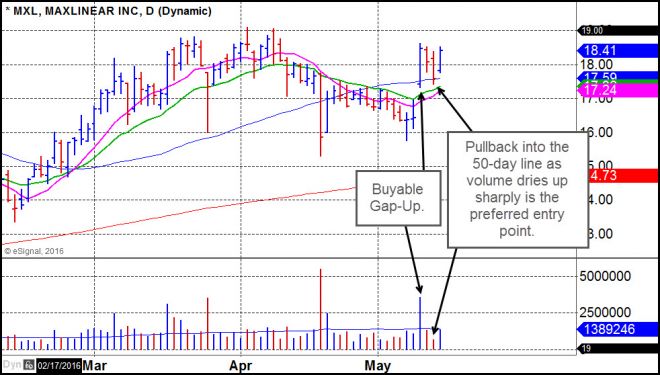

Maxlinear (MXL)

GM - This buyable gap-up got extended rather quickly on Tuesday, but on Wednesday we put out a follow-up report alerting members to the fact that the stock was pulling into its 50-day moving average where it would present a lower-risk entry point. On Thursday the stock came right into the line as volume dried up, and this led to a move back to the Tuesday intraday highs. The pullback into the 50-day line was obviously your chance to buy shares, and the stock is now back up to the highs of the three-day price range.

Dr. K - Technically speaking, MXL gave a perfect low-risk entry point on Thursday. Fundamentally, MXL is strategically positioning itself on the broadband wifi build-out via satellite, high-speed home networking, and 5G.

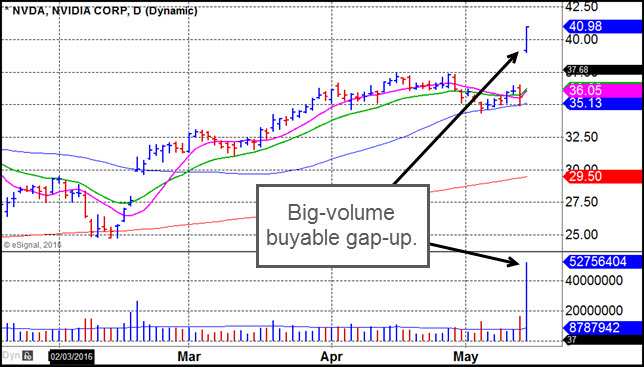

Nvidia (NVDA)

GM - a standard BGU using the intraday low at 39 as your selling guide. The only caveat would be that the BGU may have limited "shelf life" if the general market gets into more trouble. But in any case risk can be controlled simply by adhering to the use of the 39 BGU intraday low as your selling guide.

Dr. K - NVDA could be more vulnerable at these levels though it managed to close at its intraday highs, bucking any market weakness during the trading day. Nevertheless, given the tone of the general market, risks in any new buys are elevated. Buying closer to the lows of the gap up day naturally reduces risk. We have always suggested placing stops no more than 1-2% under the low of the gap up day.