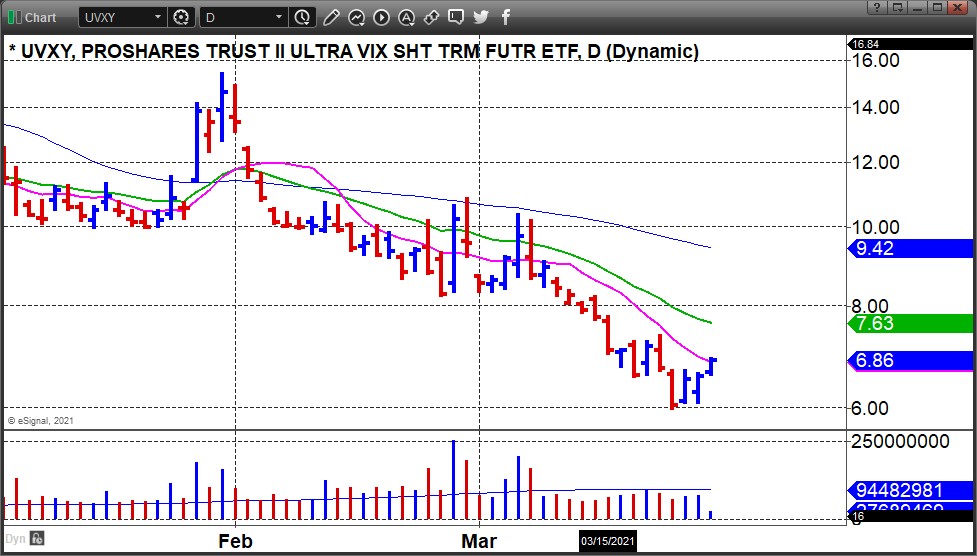

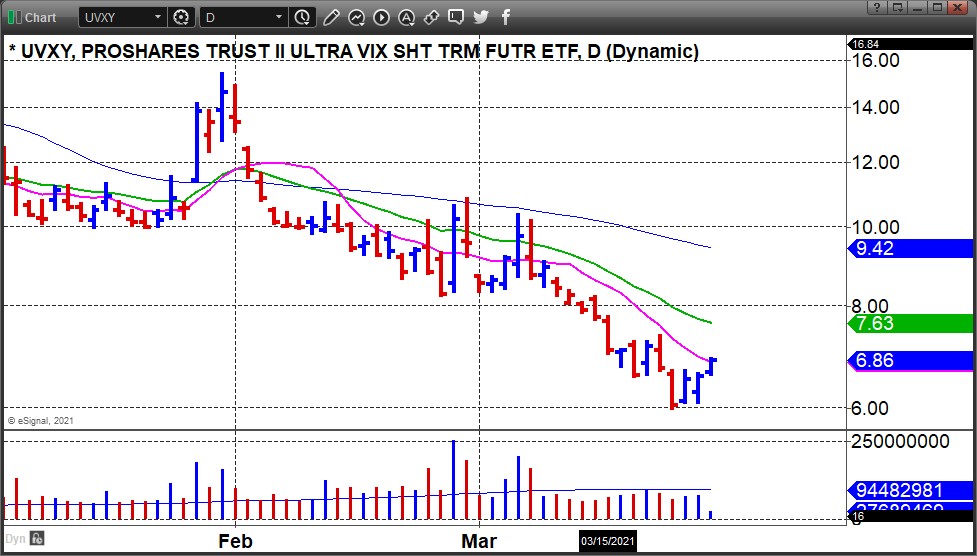

As reported in real-time yesterday, our entry on the

ProShares Trust Ultra VIX ETF (UVXY) was in the 6.23 to 6.30 area. It has moved higher since so any entries in that price zone were almost immediately profitable. It's now pushing above 6.80 as I write, and there is working well. The question now is whether this fulfills the original objectives of the trade. I trade the VIX using the UVXY when I think we may be at an important downside inflection point in the general market. I don't have or need a "model" to handle this - I simply use my trading acumen (such as it is) in combination with a variety of contextual factors. The trigger point occurs primarily based on the action of leading stocks and the general market. The objective is to catch an inflection point that yields a gain of 20-30% or more very rapidly, with the understanding that the trade does not have to work. That's what your stop is for.

For this reason, I generally take a heavy, very full (maybe even stuffed!) position at the initial entry, and will peel off tiny amounts as it begins to move higher, generally 10% or more. The VIX tends to be volatile itself, hence the UVXY will be as well. If you choose to jump on this ride, fasten your seatbelts. For now, my trailing stop is my original entry at 6.23. As noted in yesterday's report, I would probably only allow for a maximum stop at 6.00, but once you are up and away with the position you can manage it a bit more deftly in terms of selling into bursts and buying back on reaction pullbacks.

This information is provided by MoKa Investors, LLC DBA Virtue of Selfish Investing (VoSI) is issued solely for informational purposes and does not constitute an offer to sell or a solicitation of an offer to buy securities. Information contained herein is based on sources which we believe to be reliable but is not guaranteed by us as being accurate and does not purport to be a complete statement or summary of available data. VoSI reports are intended to alert VoSI members to technical developments in certain securities that may or may not be actionable, only, and are not intended as recommendations. Past performance is not a guarantee, nor is it necessarily indicative, of future results. Opinions expressed herein are statements of our judgment as of the publication date and are subject to change without notice. Entities including but not limited to VoSI, its members, officers, directors, employees, customers, agents, and affiliates may have a position, long or short, in the securities referred to herein, and/or other related securities, and may increase or decrease such position or take a contra position. Additional information is available upon written request. This publication is for clients of Virtue of Selfish Investing. Reproduction without written permission is strictly prohibited and will be prosecuted to the full extent of the law. ©2026 MoKa Investors, LLC DBA Virtue of Selfish Investing. All rights reserved.