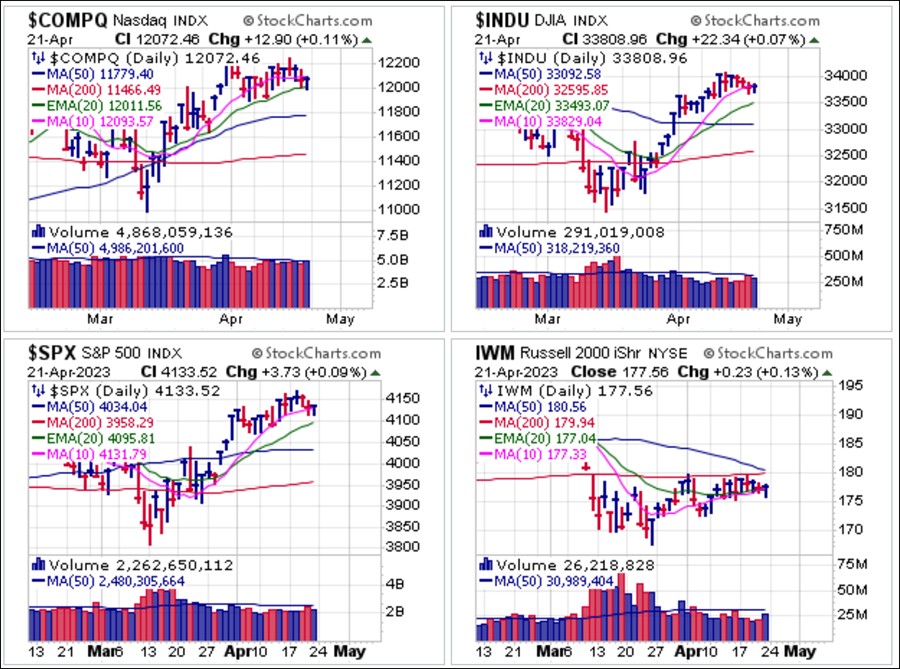

The market has spent the past three weeks moving sideways with little to catalyze significant movement in either direction. However, with allegedly favorable inflation data and sharply weakening economic data, one might expect trading algorithms to invoke a buy signal and commence gobbling up stocks on the long side, leading to a sharp short-covering rally by CTAs who have allegedly been heavy short this market. So far, that has not happened despite having happened the last 5 times according to Goldman Sachs. As we move into the heart of earnings season this week with several big-stock index names like Amazon.com (AMZN), Alphabet (GOOG), Intel (INTC) and Microsoft (MSFT) expected to report, we could see potential catalysts that could push the market out of its current slumber one way or the other.

Gold has dropped back below $2,000 an ounce, a key psychological level. This could send hot money which, came in late once the crowd's ebullience peaked two weeks ago, scampering out of precious metals. We note last weekend that the VanEck Merk Gold Trust (OUNZ) had posted an evening star candlestick topping formation two Thursdays ago and it has continued lower from there. On Friday OUNZ closed just below the 20-day exponential moving average which technically triggers a short-sale entry using the 20-dema as a covering guide.

Gold has dropped back below $2,000 an ounce, a key psychological level. This could send hot money which, came in late once the crowd's ebullience peaked two weeks ago, scampering out of precious metals. We note last weekend that the VanEck Merk Gold Trust (OUNZ) had posted an evening star candlestick topping formation two Thursdays ago and it has continued lower from there. On Friday OUNZ closed just below the 20-day exponential moving average which technically triggers a short-sale entry using the 20-dema as a covering guide. Silver has also come in, but only slightly so. The Aberdeen Physical Silver Trust (SIVR) continues to hold above its 20-day exponential moving average and the prior breakout point at 23.08. However, Friday's close below the 10-day line on heavy selling volume seems to forbode an impending test of the 20-dema so can be watched for.

Silver has also come in, but only slightly so. The Aberdeen Physical Silver Trust (SIVR) continues to hold above its 20-day exponential moving average and the prior breakout point at 23.08. However, Friday's close below the 10-day line on heavy selling volume seems to forbode an impending test of the 20-dema so can be watched for. As gold has dropped below $2,000, Bitcoin ($BTCUSD) has dropped below the $30,000 level. This shows up as a break below the 20-day exponential moving average in the Grayscale Bitcoin Trust (GBTC) as its recent breakout from a short three-week flag now fails. This also triggers a short-sale entry at the 20-dema which is then used as a covering guide. One can reference the chart of GBTC to initiate a Bitcoin short using the ProShares Short Bitcoin Strategy ETF (BITI). BITI is then purchased when GBTC is as close to the underside of the 20-dema as possible. If GBTC moves back above the 20-dema than a position in BITI is stopped out.

As gold has dropped below $2,000, Bitcoin ($BTCUSD) has dropped below the $30,000 level. This shows up as a break below the 20-day exponential moving average in the Grayscale Bitcoin Trust (GBTC) as its recent breakout from a short three-week flag now fails. This also triggers a short-sale entry at the 20-dema which is then used as a covering guide. One can reference the chart of GBTC to initiate a Bitcoin short using the ProShares Short Bitcoin Strategy ETF (BITI). BITI is then purchased when GBTC is as close to the underside of the 20-dema as possible. If GBTC moves back above the 20-dema than a position in BITI is stopped out.

While the indexes move sideways, the situation underneath the surface of the market as represented by the indexes continues to show deterioration. We see breakdowns in economically sensitive names, semiconductors as a whole, industrial metals, lithium names, etc. as indicative of a market that is slowly coming unraveled stock-by-stock, group-by-group. Perhaps earnings season will serve as a clarifying catalyst for a potential resolution to the currently benign index action or perhaps it will take another Black Swan to emerge from the fertile ground of unexpected second- and third-order effects resulting from Fed monetary policy, the latest of which has been the demise of SVB Financial Group (SIVB) and Signature Bank (SBNY) with First Republic Bank of San Francisco (FRC) dangling on the ropes. As we survey the charts of other regional banks, including Columbia Bank (COLB), Keycorp (KEY), Old National Bank (ONB), Regions Financial (RF), Trust Financial Corp. (TFC), and Zions Bancorp (ZION), below the picture is not a pretty one as these all appear ready to break out from bear flags to lower lows and may be indicative of more Black Swans to come.

Indeed, the banking sector is struggling as the bounce is anemic at best so another domino could tip in banking or in other vehicles such as pensions, IRAs, and commercial real estate that have high bond exposure.

The big QE pump to backstop depositors due to the banking crisis in March is likely short lived as liquidity starts to dry up again. In the current environment, the direction of liquidity typically affects market direction within 2 weeks or less.

The Market Direction Model (MDM) remains on a CASH signal.