Current Focus List

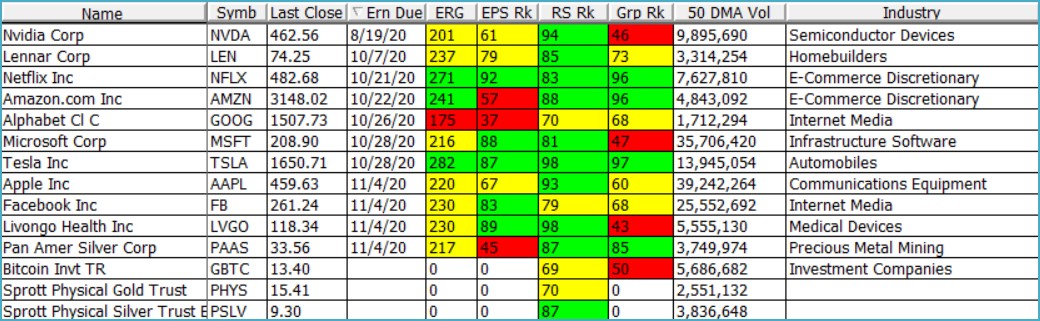

The VoSI Focus List is a compilation and reference list of stocks for which Pocket Pivot or Buyable Gap-Up Reports have been issued and which have been deemed suitable for inclusion on the Focus List. Not all stocks for which a Pocket Pivot or Buyable Gap-Up report has been issued will necessarily be added to the list. It is not intended as a "buy list" or a list of immediately actionable recommendations. Stocks on the list may or may not be in proper buy positions, and investors should exercise discretion and proper judgement in determining when and where stocks on the Focus List can be purchased. The following notes are intended to assist in this process. Please note that members can enlarge the Focus List image by clicking on the body of the email and then holding the Control Key while pressing the "+" key until it is large enough to read.

General Observations:

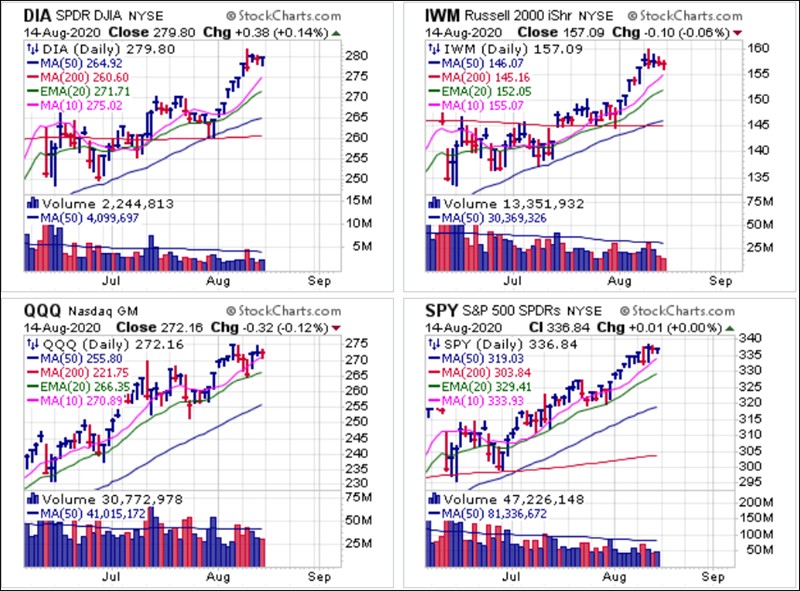

Major market indexes continue to hold near their highs in what looks like a quiet week on the charts. Underneath the surface some changes have occurred as cloud leaders have corrected and industrials/cyclicals have rallied. Whether this indicates an overall rotation into under-performing areas of the market remains to be seen. The bottom line is that QE-Infinity remains firmly in place, and this has been the primary driver for the market, fundamentals be damned. For now, the market index trend remains up until further notice, while investors should pay closer attention to the specific action of individuals stocks and their own positions.

The Market Direction Model (MDM) remains on a BUY signal.

Removed from the List this Week: Cisco Systems (CSCO), Everquote (EVER), Oracle (ORCL), and SSR Mining (SSRM).

Focus List Stocks Expected to Report Earnings this Week: Nvidia (NVDA) on Wednesday after the close.

Notable Action:

Amazon.com (AMZN) has pulled into its 20-dema as volume dried up to -43.3% below average on Friday. The stock is in a buyable positon here using the 20-dema as a selling guide.

Facebook (FB) has pulled into its 10-dma as volume dried up to -42.1% below average on Friday. This puts the stock in a lower-risk entry position using the 10-dma as a tight selling guide.

The Sprott Physical Gold Trust (PHYS) broke below its 20-dema on Tuesday and has since rallied back up to the 20-dema on declining volume, a wedging rally. We would watch for an undercut of Tuesday's 15.16 low as the metal attempts to consolidate its prior move.

The Sprott Physical Silver Trust (PSLV) broke down hard on Tuesday as well, but held support at its 20-dema. It has since bounced up into its 10-dma on wedging volume. We would watch for a retest of the 20-dema or an undercut of the 8.80 low of this past Tuesday. For now, the white metal is consolidating the prior sharp upside move and will likely need more time to do so before it can set up again.

Bitcoin also sold off on Tuesday with precious metals. The Grayscale Bitcoin Trust (GBTC) found support at its prior breakout point, however, and has since bounced. We would watch for pullbacks to the prior breakout point and the 20-dema as potentially lower-risk entry opportunities from here.