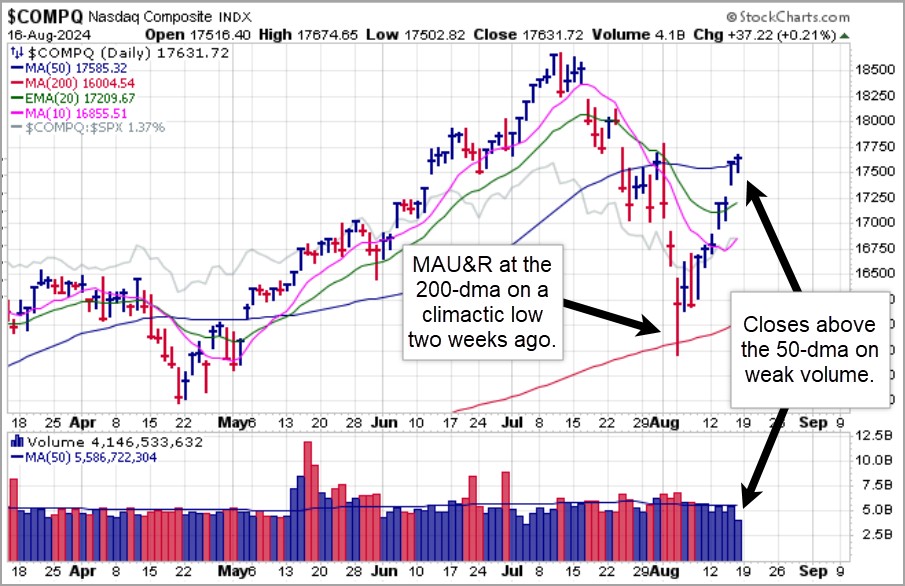

Last weekend we pointed out the bottoming signals evident in both the NASDAQ Composite and S&P 500 Indexes. The NASDAQ Composite issued a moving average undercut & rally (MAU&R) bottoming signal two Mondays ago on a climactic panic low on overnight news of a carry trade crisis in Japan. That led to an exhaustion low.

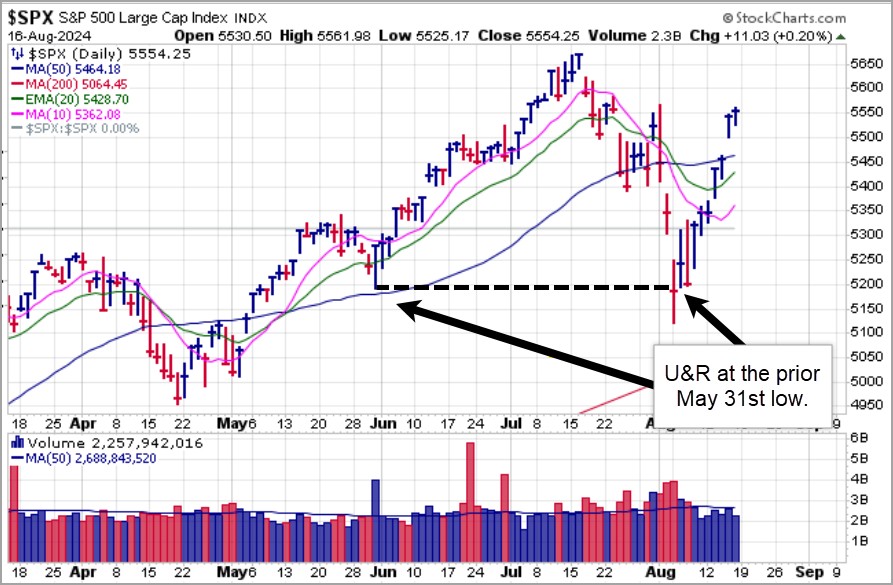

The next day, two Tuesdays ago, the S&P 500 posted a price undercut & rally (U&R) at its May 31st. low. Since then, both indexes have continue to melt higher after the panic low two Mondays ago apparently and thoroughly wrung the last remaining sellers out of the market following a three-week plus decline off the early July peaks in the major market indexes.

Gold posted a new all-time high on Friday, with the nearest futures contract printing $2,546.20 an ounce on Friday. Spot gold prices also hit an all-time high on Friday at $2,512.40. Technically the breakout remains within buying range as of Friday's close per the daily chart of the SPDR Gold Trust (GLD) below.

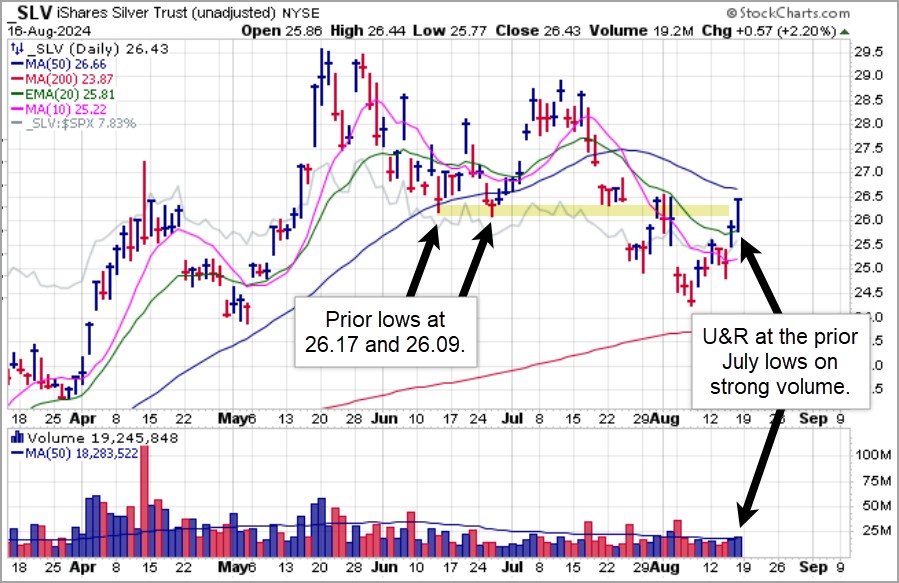

Gold posted a new all-time high on Friday, with the nearest futures contract printing $2,546.20 an ounce on Friday. Spot gold prices also hit an all-time high on Friday at $2,512.40. Technically the breakout remains within buying range as of Friday's close per the daily chart of the SPDR Gold Trust (GLD) below. Silver is turning back to the upside after testing 40-week moving average support last week, and successfully so. On Friday the iShares Silver Trust (SLV) posted a price U&R along its July lows of 26.17 and 26.09. That triggers an actionable entry using the two lows as selling guides.

Silver is turning back to the upside after testing 40-week moving average support last week, and successfully so. On Friday the iShares Silver Trust (SLV) posted a price U&R along its July lows of 26.17 and 26.09. That triggers an actionable entry using the two lows as selling guides.

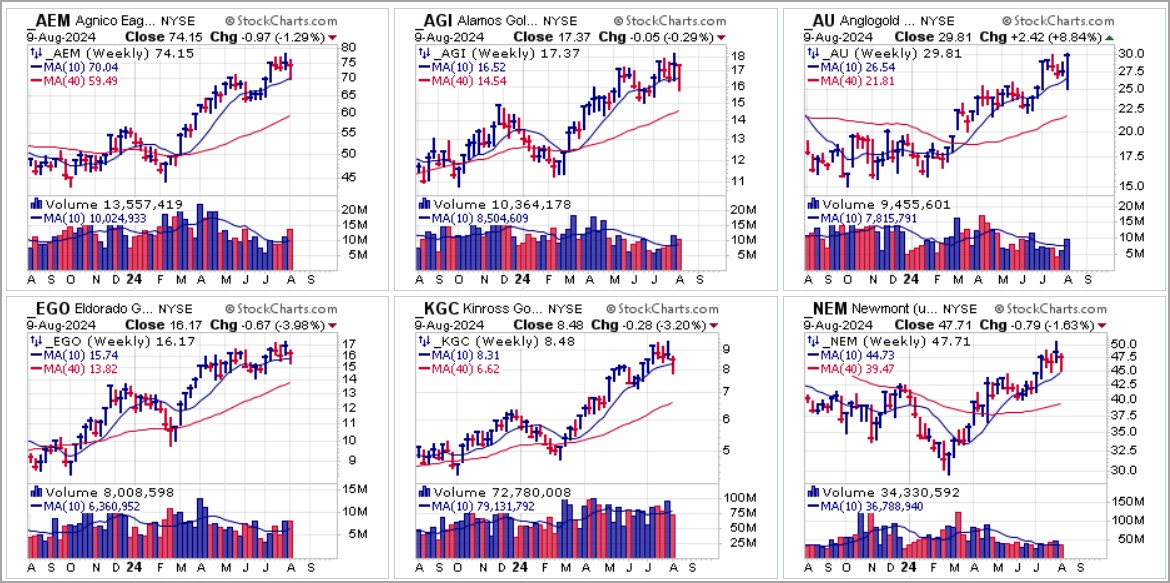

We noted last weekend that gold miners were looking constructive on their weekly charts as they based. As we wrote in our last Focus List Review report, "Interestingly, some of the best-looking charts in the current market environment can be found among the precious metals miners. A few examples are shown below on the weekly charts and include leaders in the group such as Agnico-Eagle Mines (AEM), AngloGold- Ashanti (AU), Alamos Gold (AGI), Eldorado Gold (EGO), Kinross Gold (KGC), Iamgold (IAG), and Newmont Corp. (NEM)." This is the weekly group chart of gold miners that we showed in last weekend's FLR report:

This week these stocks were all busy breaking out by Friday as they followed gold to new highs. The daily charts of six gold mining leaders below express some decent volume breakouts. Interestingly, these come three days after a typical O'Neil-style follow-through day and represent some of the only areas of the market posting clean base breakouts as tech still have significant price ground to make up before reaching new highs themselves. Each of these names remains within buying range of recent breakouts.

This week these stocks were all busy breaking out by Friday as they followed gold to new highs. The daily charts of six gold mining leaders below express some decent volume breakouts. Interestingly, these come three days after a typical O'Neil-style follow-through day and represent some of the only areas of the market posting clean base breakouts as tech still have significant price ground to make up before reaching new highs themselves. Each of these names remains within buying range of recent breakouts. Meanwhile, Bitcoin ($BTCUSD) continues to flounder below 50-dma and 200-dma resistance. So far over the past two weeks it has acted as a short at 50-dma and 200-dma resistance. That remains the case for now until and unless $BTCUSD can eventually regain both moving averages, but for now it acts more like a risk asset than an alternative currency.

Meanwhile, Bitcoin ($BTCUSD) continues to flounder below 50-dma and 200-dma resistance. So far over the past two weeks it has acted as a short at 50-dma and 200-dma resistance. That remains the case for now until and unless $BTCUSD can eventually regain both moving averages, but for now it acts more like a risk asset than an alternative currency.

While the market rallied on Thursday quite sharply on the rise of a new, and perhaps too hopeful, Goldilocks narrative of Fed rate cuts without an economic crash, we remain cautious. For example the 1.0% rise in retail sales was mostly due to a bump in auto sales, contributing 0.6% worth of the 1.0% surprise. Also, the market took heart in Walmart’s (WMT) positive earnings report Thursday morning, which the pundits hailed as a sign that the consumer is still alive and kicking. We might argue that the consumers are seeking to retain their status as still alive and kicking by avoiding starvation, and so their shopping patterns have migrated from Whole Foods to Walmart as a source of cheaper groceries. That may be what WMT's strong earnings report was all about.

For now, the index rally that began with classic OWL signals such as the MAU&R in the NASDAQ Composite two Mondays ago and the price U&R in the S&P 500 two Tuesdays ago, remains in force, and has been playable using index ETFs. For that reason, the Market Direction Model (MDM) remains on a BUY signal.