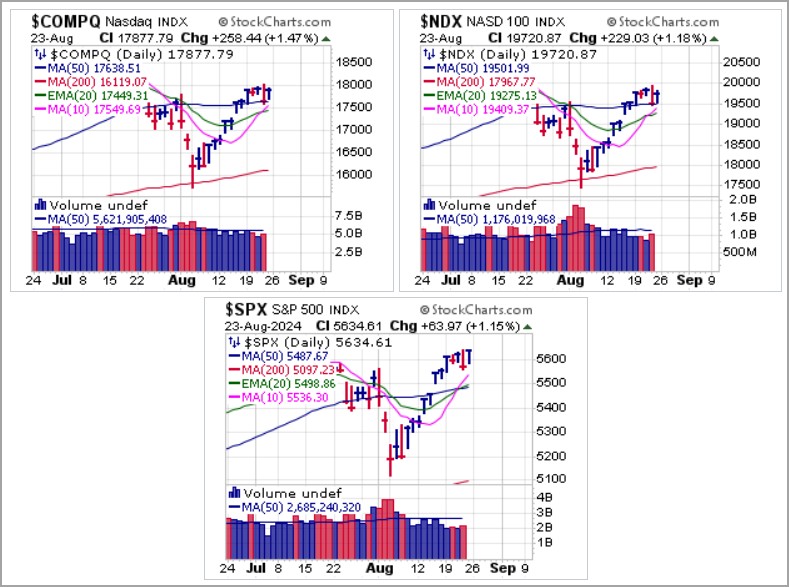

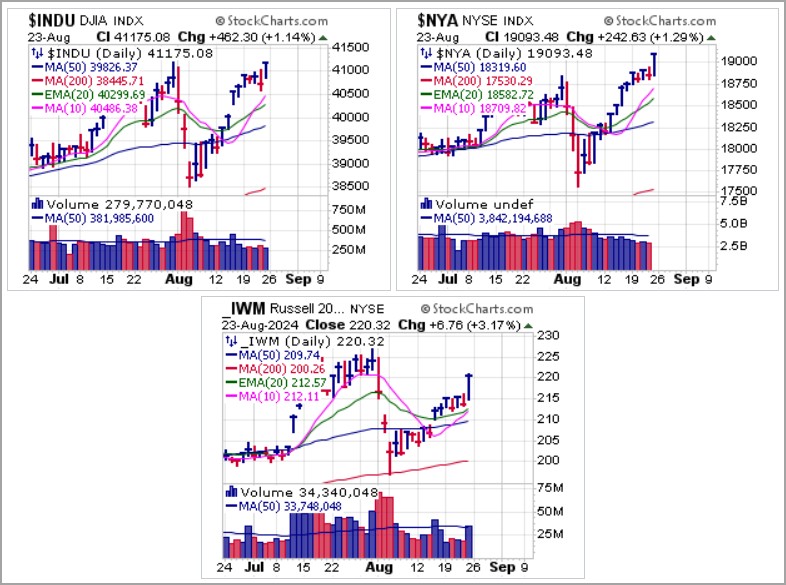

Tech-centric market indexes, the NASDAQ Composite, the NASDAQ 100, and the S&P 500 spent the week chopping around while making slight upside progress by the end of the week. The S&P 500 in fact posted a new all-time closing high.

Meanwhile, less tech-centric indexes like the Dow, NYSE Composite, and small-cap Russell 2000 flexed their muscles on Friday as they all pressed to higher highs.

Fed Chairman Jerome Powell spoke at the Fed's annual symposium in Jackson Hole, Wyoming on Friday, and while he did not say anything new, he confirmed what the market already knew, which is that the Fed is likely to lower rates when it meets again in September. Powell was not specific on whether such a rate cut would be 25 basis points or 50 as the Fed remains data dependent and this coming week's Bureau of Labor Statistics jobs report might figure into this. Either way, the market started lowering rates back in April, so Powell's speech had nothing new to offer beyond what the market already seems to know.

However, this past week the total number of new nonfarm payrolls reported by the Bureau of Labor Statistics in 2023 was revised downward by a whopping 818,000 jobs, the highest downside revision since the 2008 Financial Crisis. When the Fed is allegedly data dependent, one must wonder about the soundness of decisions made with data that is later revised drastically lower, as most government economic data is over time. The Fed knew about the state of the labor market long ago. Monthly payrolls are nothing but political theater and meant to trigger momentum ignition algos that trigger stops.

Big-stock techs spent the week chopping around after initial rallies off the panic lows of three Mondays ago. So far, other than the oversold capitulation low of three weeks ago, catalysts for further and substantial upside have not shown up yet. That could change this week when big-stock AI-Meme semiconductor name Nvidia (NVDA) reports earnings on Wednesday after the close.

Since bottoming with the market three weeks ago, NVDA has continued to rally on very light volume, reflecting the washout nature of the panic low three Mondays ago. It is now approaching prior all-time highs ahead of earnings, and for now it is likely best to sit back and wait for the report, after which we may see a proper long or short set-up materialize once earnings are out. In addition, this will likely catalyze the semiconductors and the broader tech space in either direction, depending on how NVDA earnings are received investors. Stay tuned.

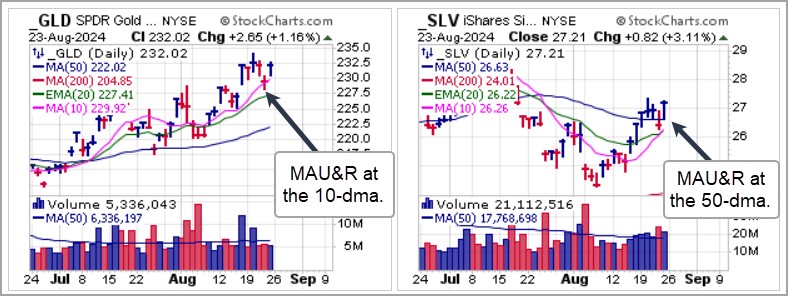

Precious metals started the week off on a tear, following through on the rallies they began when the panic low of three weeks ago occurred. Gold and silver both rallied higher earlier in the week with December gold futures clearing to all-time highs at $2,570.40 an ounce on Tuesday. Silver cleared the $30.00 level on Tuesday but both gold and silver retreated from those highs.

The pullbacks have offered opportunistic long entries however, as the SPDR Gold Trust (GLD) posted a moving average undercut & rally (MAU&R) at its 10-dma on Thursday and then the iShares Silver Trust (SLV) posted an MAU&R at its 50-dma on Friday. Both moves were actionable on the long side using the respective moving averages as selling guides.

Bitcoin ($BTCUSD) posted a pocket pivot at its 10-dma on Wednesday and but failed to clear 50-dma resistance. After a small pullback on Friday, it was able to decisively clear its 50-dma and close above the 200-dma on a strong volume signature. While this was actionable earlier in the week on the basis of Wednesday's pocket pivot, we would now watch for the 200-dma to serve as potentially buyable moving average support.

The Market Direction Model (MDM) remains on a BUY signal.