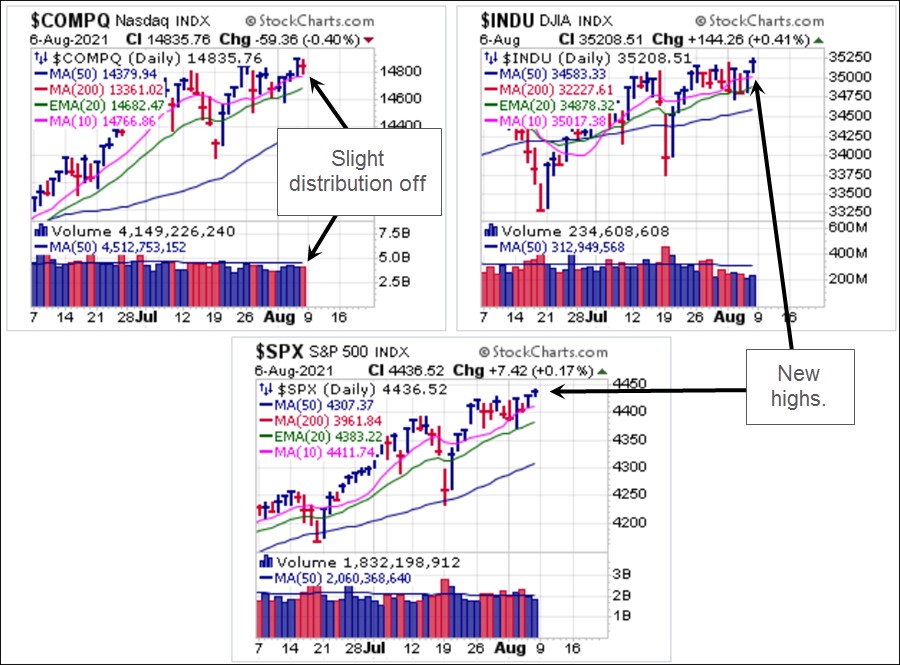

On Thursday the NASDAQ Composite, led by the NASDAQ 100 Index, posted new highs before pulling back on Friday, but we continue to see weak breadth as measured by the NASDAQ Advance-Decline line, below. This market has been plagued by divergences and bifurcations that, while resulting in a lot of rotational action both up and down, have mostly led to a market where big-stock ideas with at least intermediate-term trend potential are far from plentiful despite the new highs in the major market indexes.

The Market Direction Model (MDM) remains on a BUY signal.

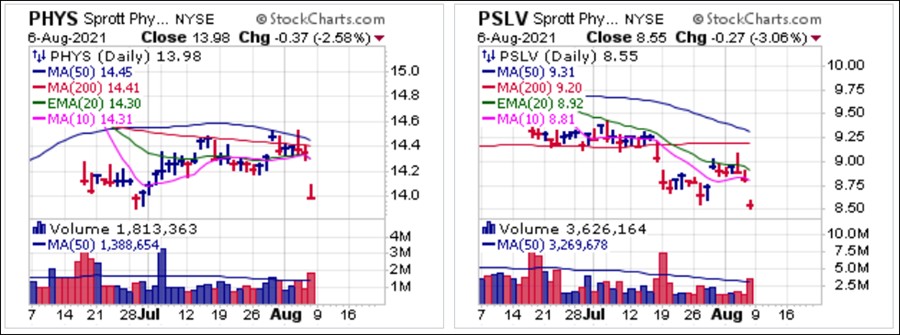

The strong jobs number sent interest rates higher, with the 10-Year Treasury Yield closing Friday at 1.XXXX%. As a result, precious metals did not take kindly to the idea of higher rates and headed back to their recent lows, negating their recent long entry signals.

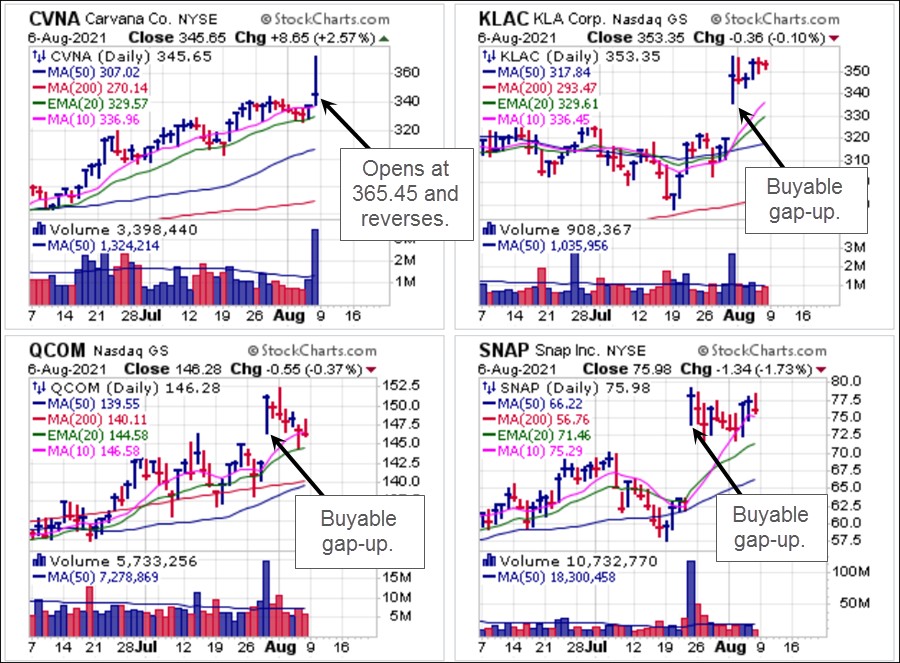

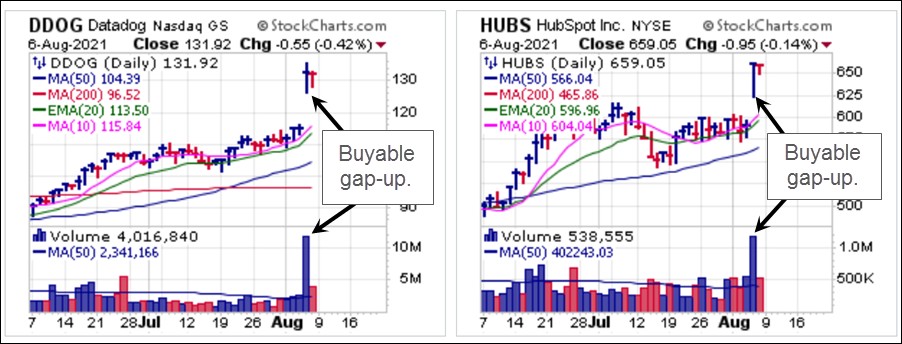

Earnings season has produced the usual number of strong price reactions in leading and not-so-leading stocks. The success rate of long set-ups like Buyable Gap-Ups has been meager, with most showing little further upside progress or just failing altogether. This is one reason we have not been in a big rush to send out reports on buyable gap-ups in this environment. The typical upside thrust and price continuation has not been of the quality that we look for in BGUs in most cases.

This past week we saw Buyable Gap-Ups in cloud names DataDog (DDOG) and HubSpot (HUBS) which have so far held up well and above their respective BGU intraday lows at 126.33 and 622.05, respectively. The primary issue with high-PE techs is that they could be subject to PE-compression if we see interest rates begin to trend back to the upside again. Certainly, one can test any BGU move once a firm intraday low is set, which then becomes your selling guide, but the main issue is whether these will lead to significant, intermediate-term uptrends.

For the time being, we continue to find nothing that we feel is worthy of inclusion on the Focus List, so it will remain the null set until we see something that fits the criteria necessary for inclusion on the list. To some extent it is indicative of the rotational, bifurcated environment we find ourselves in currently, which in turn is more suitable for swing-traders and even day-traders rather than intermediate- to longer-term trend-following investors.

For the time being, we continue to find nothing that we feel is worthy of inclusion on the Focus List, so it will remain the null set until we see something that fits the criteria necessary for inclusion on the list. To some extent it is indicative of the rotational, bifurcated environment we find ourselves in currently, which in turn is more suitable for swing-traders and even day-traders rather than intermediate- to longer-term trend-following investors.