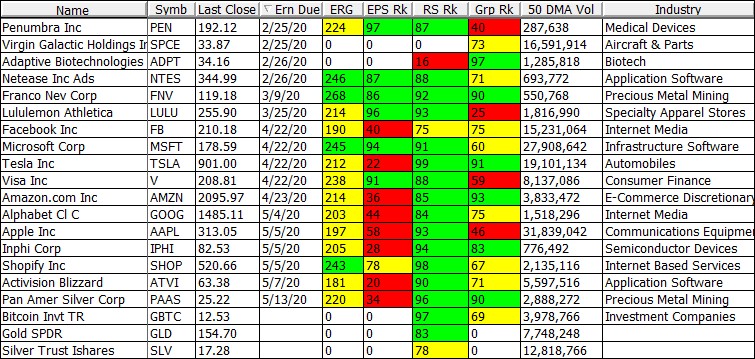

Current Focus List

The VoSI Focus List is a compilation and reference list of stocks for which Pocket Pivot or Buyable Gap-Up Reports have been issued and which have been deemed suitable for inclusion on the Focus List. Not all stocks for which a Pocket Pivot or Buyable Gap-Up report has been issued will necessarily be added to the list. It is not intended as a "buy list" or a list of immediately actionable recommendations. Stocks on the list may or may not be in proper buy positions, and investors should exercise discretion and proper judgement in determining when and where stocks on the Focus List can be purchased. The following notes are intended to assist in this process. Please note that members can enlarge the Focus List image by clicking on the body of the email and then holding the Control Key while pressing the "+" key until it is large enough to read.

General Observations:

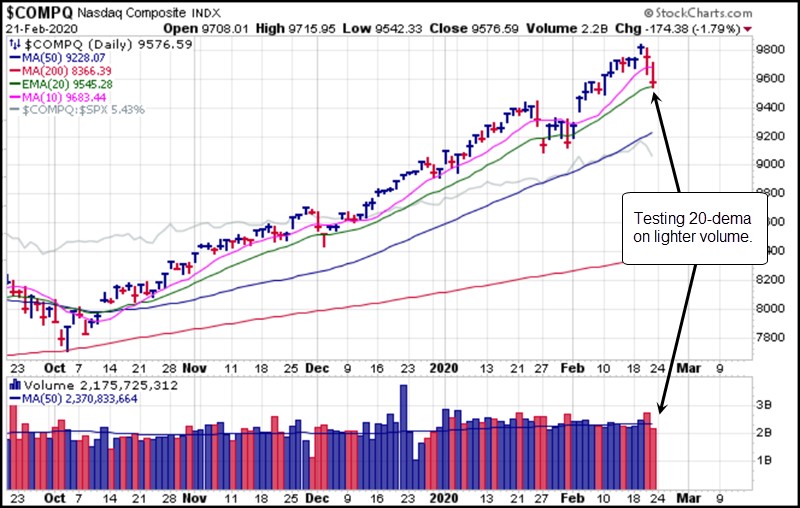

The general market came under selling pressure into the end of the week, sending the NASDAQ Composite Index down to its 20-dema. Volume was slightly lighter. If the 20-dema does not hold up as near-term support, then we could see a test of the 50-dma, but the situation remains fluid for now. Investors simply need to review their trailing and absolute stops and obey them if and when they are hit in any continuing market correction.

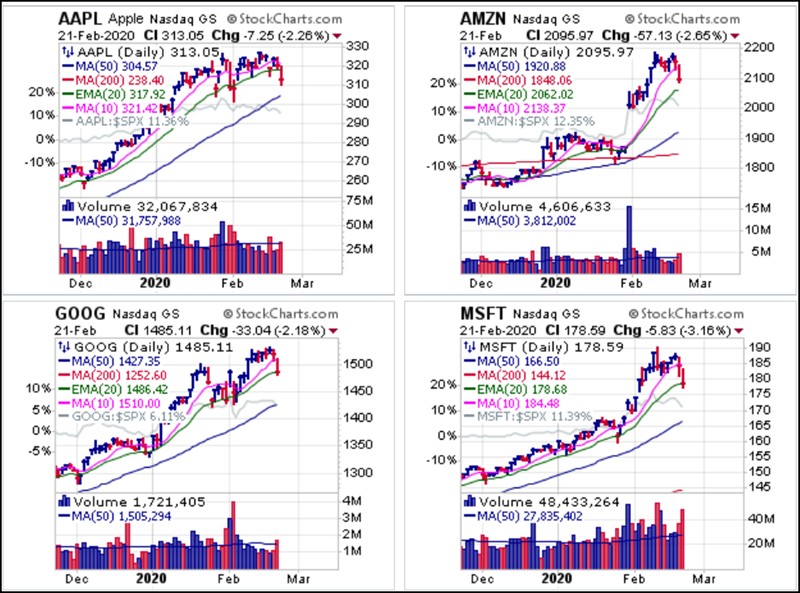

Big-Stock NASDAQ names on our Focus List broke down and closed below their 20-demas on Friday. Apple (AAPL), Amazon (AMZN), Alphabet (GOOG), and Microsoft (MSFT) all rolled over on Friday, with AAPL, GOOG, and MSFT closing below their 20-demas. Often this is the first sign of late-stage failure, but these stocks have shown a tendency to find support on pullbacks, and the 50-dma would serve as potential support for all three, while AMZN has yet to test the 20-dema..

The Market Direction Model (MDM) remains on a BUY signal.

Removed from the List this Week: Ultraclean Holdings (UCTT).

Focus List Stocks Expected to Report Earnings this Week: Adaptive Biotechnologies (ADPT), Penumbra (PEN), Netease (NTES), and Virgin Galactic (SPCE) - see the "ERN Due" column in the list above, which is also sorted by earliest expected earnings date first.

Notable Action:

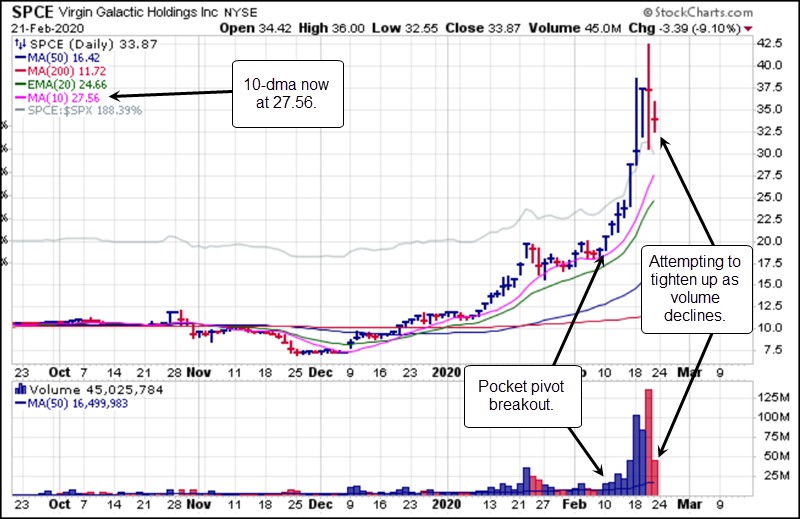

Virgin Galactic (SPCE) remained the story stock of the week. More press over the long President's day weekend prompted retail investors to pile into the stock, sending it above the $40 price level on Thursday. That would have made for a roughly 100% move since we first report on the stock two Mondays ago. The stock is trying to hold in relatively tight but has been volatile over the past four days. The 10-dma, now at 27.56, would be the only available reference point for buyable support on any pullback from current levels.

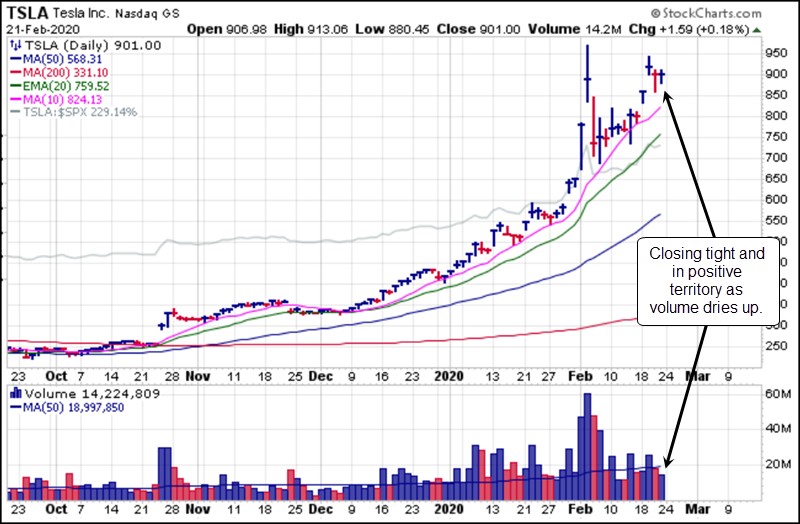

Tesla (TSLA) has shown an unwillingness to give up its recent gains. Even amid a sharp general market sell-off on Friday the stock held firm, closing in positive territory as volume dried up. We would only view this as potentially buyable on pullbacks to the rising 10-dma, now at 834.13, as it is extended currently.

Facebook (FB) broke below its 10-dma, 20-dema, and 50-dma on Friday as selling volume increased. The stock had been rallying following the big-volume gap-down break through the 50-dma after earnings in late January. Technically, the stock became shortable once it breached the 20-dema, but could also be viewed as a short-sale target right here using the 50-dma as a tight covering guide.

Gold and silver have continued to move higher, with the SPDR Gold Shares (GLD) posting a nearly seven-year high this past week. Buying interest was big on Friday, but the GLD is now in an extended position. It was last buyable along the 20-dema per our prior weekend reports.

The iShares Silver Trust (SLV) is also extended. For both the GLD and the SLV, it will take some time for the 10-dma to catch up, at which point it could provide a reference for buyable pullbacks from current extended levels. Overall, we tend to think that there is a reasonable probability that the precious metals are starting another up leg in their patterns.

The Grayscale Bitcoin Trust (GBTC) has continued higher through 2020 after we first identified an undercut & rally (U&R) long entry down around 8.50. It closed Friday at 12.53 and is quite extended on the upside. Bitcoin, which underlies the GBTC, tends to be very volatile, so we would look to buy the GBTC on weakness down to the 20-dema.