Current Focus List

The VoSI Focus List is a compilation and reference list of stocks for which Pocket Pivot or Buyable Gap-Up Reports have been issued and which have been deemed suitable for inclusion on the Focus List. Not all stocks for which a Pocket Pivot or Buyable Gap-Up report has been issued will necessarily be added to the list. It is not intended as a "buy list" or a list of immediately actionable recommendations. Stocks on the list may or may not be in proper buy positions, and investors should exercise discretion and proper judgement in determining when and where stocks on the Focus List can be purchased. The following notes are intended to assist in this process. Please note that members can enlarge the Focus List image by clicking on the body of the email and then holding the Control Key while pressing the "+" key until it is large enough to read.

General Observations:

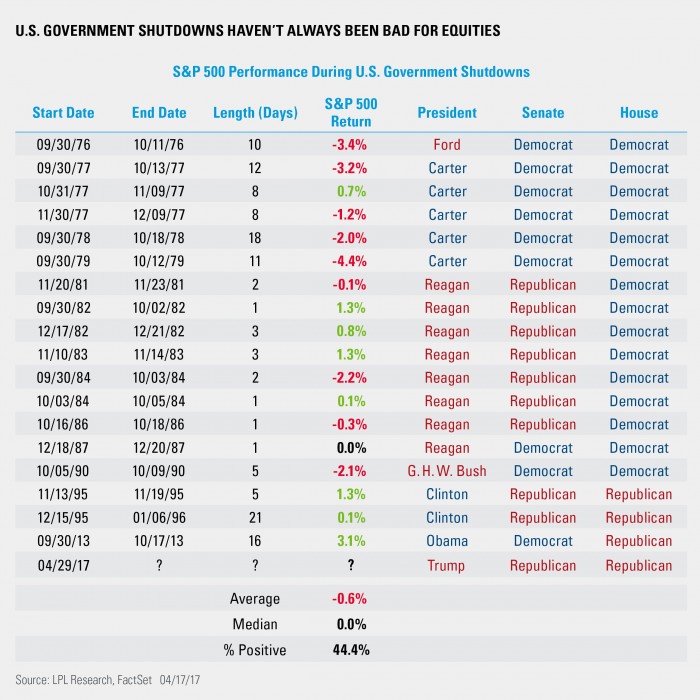

Both the NASDAQ Composite and S&P 500 Indexes closed at all-time highs on Friday. The market has remained in a steep uptrend since the start of the New Year, with no let-up in sight. Saturday morning, at midnight, the U.S. Government shut down for the first time since 2013 after lawmakers were unable to reach an agreement on funding, choosing to use the shut down as leverage for their agendas on immigration policy. While the markets mostly shrugged off the drama surrounding a potential government shutdown, we will now have the opportunity to see how it reacts after the fact. In prior shutdowns, markets tend to initially react negatively but then roughly have the time, retrace loses to close higher than the start of the shutdown.

Meanwhile, leading stocks continue to act well, and we have seen most names on the Focus List continue higher over the past several days. Note that the Focus List above is sorted by upcoming earnings report dates for quick-reference. as we move into the thick of earnings season.

The primary driver for stocks would appear to be money rotating out of bonds and into equities as market interest rates continue to rise. The iShares 20+ Year Treasury Bond ETF (TLT) is now testing its prior lows of 2017.

The Market Direction Model (MDM) remains on a buy signal.

Removed from the List this Week: None.

Focus List Stocks Expected to Report Earnings this Week: Netflix (NFLX) Monday, after the close; Caterpillar (CAT) on Thursday, before the open.

Notable Action:

Square (SQ) gapped up on Friday on an upgrade from Nomura Securities, putting a rather lofty $64 price target on the stock. The move started out the day looking like a possible buyable gap-up but by the close volume was only 11% above-average. This would not even be enough for a standard breakout, but it was enough for a single five-day pocket pivot off the 10-dma. Remember that we like to see clusters of five-day pocket pivots in lieu of a single ten-day pocket pivot. The move took SQ right back up to its highs of the prior week

Take-Two Interactive (TTWO) has closed tightly over the past two weeks on the weekly chart as it consistently finds support at the 10-week moving average. Those pullbacks to the 10-week moving average on the weekly chart, below, have coincided with pullbacks to the 20-dema on the daily chart, as we've discussed in recent Focus List Notes. The stock looks ready to break out from what is so far an eight-week base.