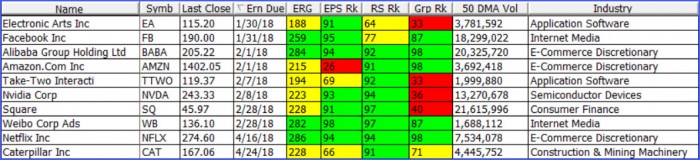

Current Focus List

The VoSI Focus List is a compilation and reference list of stocks for which Pocket Pivot or Buyable Gap-Up Reports have been issued and which have been deemed suitable for inclusion on the Focus List. Not all stocks for which a Pocket Pivot or Buyable Gap-Up report has been issued will necessarily be added to the list. It is not intended as a "buy list" or a list of immediately actionable recommendations. Stocks on the list may or may not be in proper buy positions, and investors should exercise discretion and proper judgement in determining when and where stocks on the Focus List can be purchased. The following notes are intended to assist in this process. Please note that members can enlarge the Focus List image by clicking on the body of the email and then holding the Control Key while pressing the "+" key until it is large enough to read.

General Observations:

The Dow is now within 1.5% of the 27,000 level after blasting through the 25,000 price level in early January. The trend since the breakout in early September has been quite steady, with the trend becoming more consistently pronounced throughout January. While the market rally looks "parabolic," one cannot discount the possibility that it could become more parabolic. This week will see a number of big-tech names report earnings, including four names on the Focus List, as we move into the "meatiest" part of earnings season.

Meanwhile, the NASDAQ Composite Index cleared the 7,500 level for the first time ever on Friday, while the S&P 500 Index is 4% away from the 3,000 level. The indexes have been smashing through milestones one after the other, and this has led to steady performance for the Market Direction Model (MDM) which is up 25.8% so far in 2018 using the 3x leveraged Direxion Daily Technology Bull 3X Shares (TECL) and 8.7% using the non-leveraged NASDAQ Composite as the benchmark. It remains on a buy signal.

Removed from the List this Week: Coherent (COHR).

Focus List Stocks Expected to Report Earnings this Week: Electronic Arts (EA) Tuesday, after the close; Facebook (FB) Wednesday, after the close; Alibaba (BABA) Thursday, before the open; Amazon.com (AMZN) Thursday, after the close.

Notable Action:

Most Focus List names remain extended. Note that the Focus List at the top of this report is sorted by nearest earnings date as a convenient reference.

Caterpillar (CAT) reported earnings on Thursday and took shareholders on a wild ride. It initially gapped up at the open but then reversed hard as it dropped just below its 20-dema. However, by the close, it was up on the day and well above the 20-dema on very heavy volume. This would qualify as supporting action at the 20-dema. On Friday, CAT retested the 20-dema and held as volume declined. The 20-dema would continue to serve as a selling guide, as the stock has had a long run and could correct more severely.

Take-Two Interactive (TTWO) posted a new all-time closing high, but remains within its base. It has been buyable on pullbacks to its 20-dema as it has gone about the business of building what looks like a very constructive base. Watch for some sort of actionable move after EA reports earnings Tuesday after the close.