Major market indexes ran into some selling pressure later in the week after Taiwan Semiconductor (TSM) reported earnings and threw water on the AI meme "frenzy" as the Chairman of TSM put it, on Thursday. As well, the company is seeing continued deterioration in the semiconductor business. This set off a bomb in the tech sector as techs across the board were hit with selling, sending the NASDAQ Composite and NASDAQ 100 Indexes down to test their 10-day moving averages. On Friday, both indexes started to the upside but reversed to close negative and below the 10-day moving averages. Volume was relatively muted considering Friday was the largest July OpEx in history based on the $2.7 trillion in notional options exposure that was expiring that day.

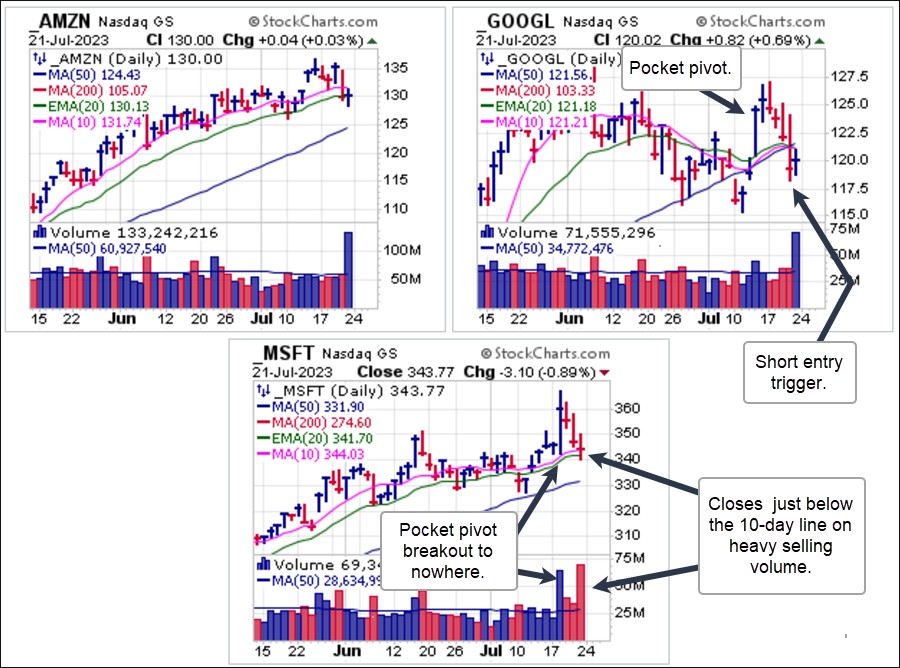

AI meme stocks also took some heat, with Amazon.com (AMZN) and Alphabet (GOOGL) reversing back below moving average support following strong upside moves the prior week. AMZN broke below its 10-dma on Thursday while GOOGL slashed through its 10-dma, 20-dema, and 50-dma on Thursday where it may be a short entry using the moving averages as covering guides. Microsoft (MSFT) broke out to new highs on Tuesday on news of AI product offerings on its Office 365 service, but despite the heavy volume the stock slumped back into its prior base. In reality, the proper long entry point occurred on the pair of undercut & rally (U&R) long entry triggers along the prior base lows two weeks ago.

AI meme stocks also took some heat, with Amazon.com (AMZN) and Alphabet (GOOGL) reversing back below moving average support following strong upside moves the prior week. AMZN broke below its 10-dma on Thursday while GOOGL slashed through its 10-dma, 20-dema, and 50-dma on Thursday where it may be a short entry using the moving averages as covering guides. Microsoft (MSFT) broke out to new highs on Tuesday on news of AI product offerings on its Office 365 service, but despite the heavy volume the stock slumped back into its prior base. In reality, the proper long entry point occurred on the pair of undercut & rally (U&R) long entry triggers along the prior base lows two weeks ago. Leading big-stock AI meme semiconductor Nvidia (NVDA) posted a five-day pocket pivot along the 10-dma two Wednesday's ago and has since moved to higher highs. We typically prefer to see a cluster of five-day pocket pivots in lieu of a single ten-day pocket pivot, but this one worked. On Friday the move following the pocket pivot reversed almost completely as the stock dropped below the 10-day moving average on heavy selling volume. This brings the 20-dema into play as potential moving average support. NVDA has obeyed the 20-dema on the way up over the past several months and a violation of the line would trigger a sell per the Seven-Week Rule.

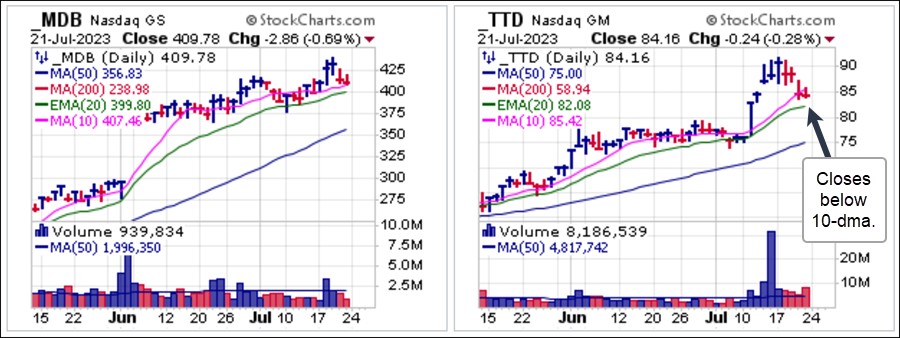

Leading big-stock AI meme semiconductor Nvidia (NVDA) posted a five-day pocket pivot along the 10-dma two Wednesday's ago and has since moved to higher highs. We typically prefer to see a cluster of five-day pocket pivots in lieu of a single ten-day pocket pivot, but this one worked. On Friday the move following the pocket pivot reversed almost completely as the stock dropped below the 10-day moving average on heavy selling volume. This brings the 20-dema into play as potential moving average support. NVDA has obeyed the 20-dema on the way up over the past several months and a violation of the line would trigger a sell per the Seven-Week Rule. Other AI meme names we have reported on include MongoDB (MDB) which is currently struggling to hold a recent breakout but on Friday held buyable support along the 10-dma. The 10-dma or 20-dema would suffice as selling guides depending on risk-tolerance. The Trade Desk (TTD) blasted out of a short base two weeks ago and is now coming in to test 10-dma and 20-dema support. It closed Friday just below the 10-dma which would bring the 20-dema into play as the next logical level of buyable moving average support in the pattern so can be watched for.

Other AI meme names we have reported on include MongoDB (MDB) which is currently struggling to hold a recent breakout but on Friday held buyable support along the 10-dma. The 10-dma or 20-dema would suffice as selling guides depending on risk-tolerance. The Trade Desk (TTD) blasted out of a short base two weeks ago and is now coming in to test 10-dma and 20-dema support. It closed Friday just below the 10-dma which would bring the 20-dema into play as the next logical level of buyable moving average support in the pattern so can be watched for. Members may recall that three weeks ago we pointed out macro-U&R set-ups in the weekly charts of Endeavour Silver (EXK), Fortuna Silver Mines (FSM), and Pan-American Silver (PAAS). Since then, all three stocks have shot higher, in large part thanks to the light CPI and PPI numbers two weeks ago. Near-term we see potential lower-risk entries for EXK or FSM at the 200-day line initially, with 10-dma support coming into play as the rapidly rising 10-day lines in each stock catch up to price.

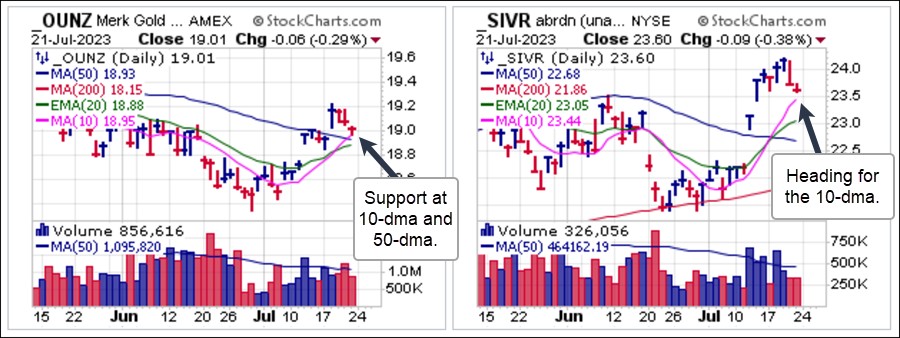

Members may recall that three weeks ago we pointed out macro-U&R set-ups in the weekly charts of Endeavour Silver (EXK), Fortuna Silver Mines (FSM), and Pan-American Silver (PAAS). Since then, all three stocks have shot higher, in large part thanks to the light CPI and PPI numbers two weeks ago. Near-term we see potential lower-risk entries for EXK or FSM at the 200-day line initially, with 10-dma support coming into play as the rapidly rising 10-day lines in each stock catch up to price. As these silver miners come in this week so do precious metals gold and silver. Silver has outperformed gold by a wide margin and both are now pulling back to test near-term support. Both metals, like the miners, gained momentum following the light inflation data two weeks ago. The VanEck Merk Gold Trust (OUNZ) held support on Friday at its 10-dma and 50-dma which can be treated as a lower-risk long entry point using the 50-dma as a tight selling guide. The Aberdeen Physical Silver Trust (SIVR) meanwhile remains well above its 10-dma in constructive fashion. We would watch for pullbacks to the 10-dma or, even better, the 20-dema, in SIVR as potentially opportunistic entries from current levels.

As these silver miners come in this week so do precious metals gold and silver. Silver has outperformed gold by a wide margin and both are now pulling back to test near-term support. Both metals, like the miners, gained momentum following the light inflation data two weeks ago. The VanEck Merk Gold Trust (OUNZ) held support on Friday at its 10-dma and 50-dma which can be treated as a lower-risk long entry point using the 50-dma as a tight selling guide. The Aberdeen Physical Silver Trust (SIVR) meanwhile remains well above its 10-dma in constructive fashion. We would watch for pullbacks to the 10-dma or, even better, the 20-dema, in SIVR as potentially opportunistic entries from current levels.

Bitcoin ($BTCUSD) has spent the past several days building a small bear flag primarily underneath the 20-dema but we also note a reversal at the 10-dma three days ago on the chart below. This comes after a failed breakout attempt two weeks ago as $BTCUSD eyes a potential test of the 50-day moving average below $29,000.

The Market Direction Model (MDM) remains on a BUY signal.