Current Focus List

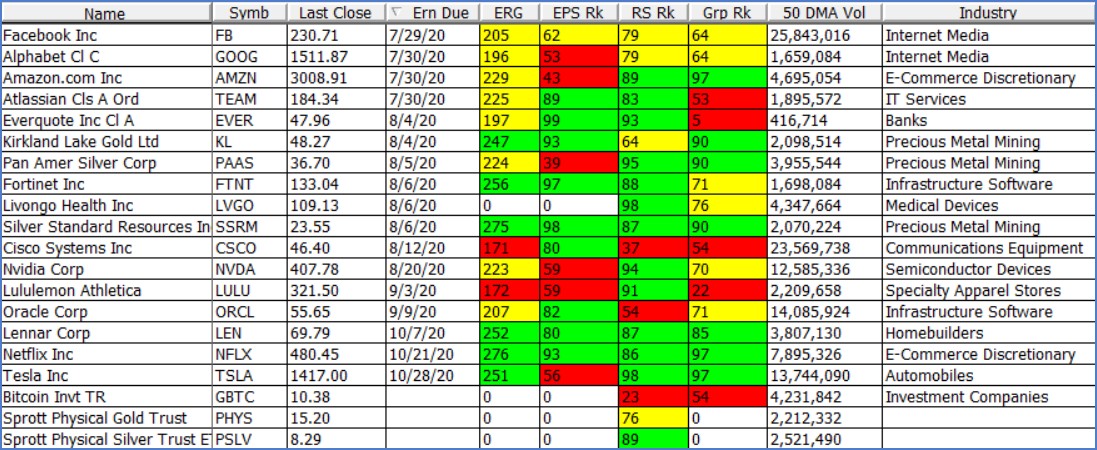

he VoSI Focus List is a compilation and reference list of stocks for which Pocket Pivot or Buyable Gap-Up Reports have been issued and which have been deemed suitable for inclusion on the Focus List. Not all stocks for which a Pocket Pivot or Buyable Gap-Up report has been issued will necessarily be added to the list. It is not intended as a "buy list" or a list of immediately actionable recommendations. Stocks on the list may or may not be in proper buy positions, and investors should exercise discretion and proper judgement in determining when and where stocks on the Focus List can be purchased. The following notes are intended to assist in this process. Please note that members can enlarge the Focus List image by clicking on the body of the email and then holding the Control Key while pressing the "+" key until it is large enough to read.

General Observations:

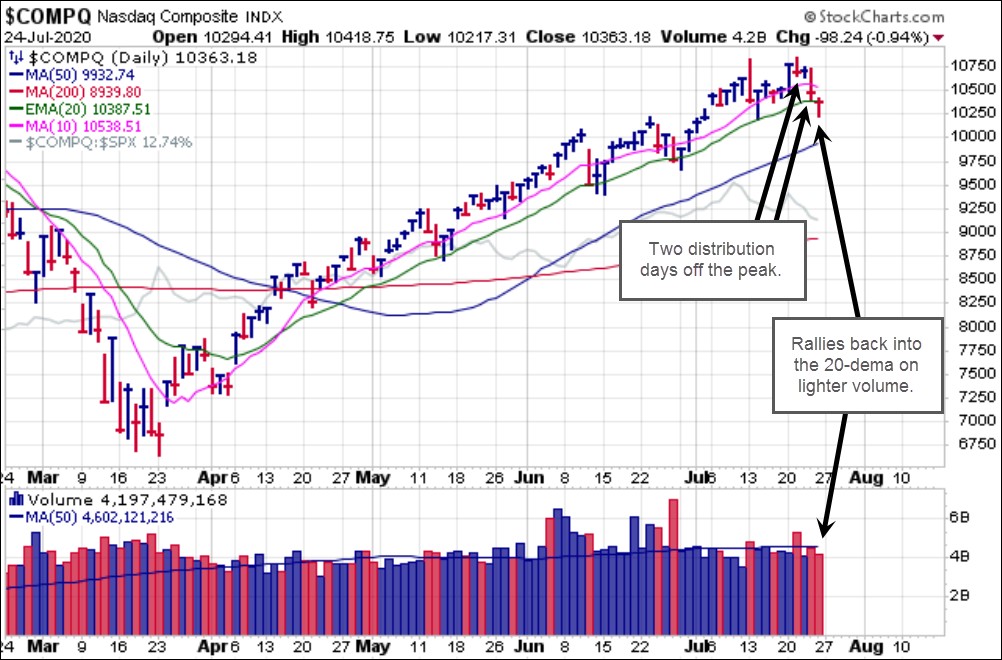

The NASDAQ Composite Index posted two distribution days off the peak this past week, one on Tuesday and the second on Thursday. It then attempted to recover from an early sell-off on Friday and closed just below the 20-dema. This may be another short sell-off before the market turns higher or potentially something more severe. Currently there is no conclusive evidence for a change of trend, but with several big-stock names reporting earnings this week, including Apple (AAPL), Amazon.com (AMZN), Facebook (FB) and Alphabet (GOOG), the action could shift in either direction depending on the quality of these big-stock earnings reports and the market's reaction. Investors should remain fluid and alert as we progress through earnings season.

The Market Direction Model (MDM) remains on a BUY signal.

Removed from the List this Week:

Focus List Stocks Expected to Report Earnings this Week: Facebook (FB) on Wednesday post-close; Alphabet (GOOG), Amazon.com (AMZN), Apple (AAPL), and Atlassian (TEAM) on Thursday post-close. Please note that the list of stocks above is sorted by earliest earnings report date at the top for easy reference. The third column from the left labeled "Ern Due" shows the expected earnings date for each stock. We recommend double-checking and confirming these dates using other sources such as Briefing.com or the company's own websites as appropriate.

Notable Action:

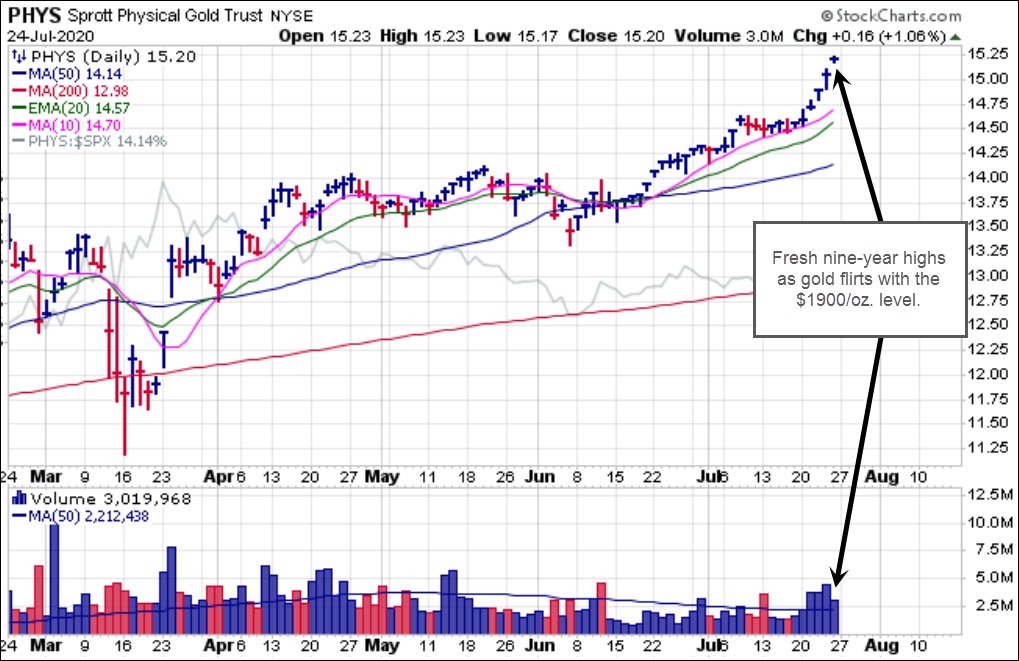

Gold is flirting with the $1900/oz. level and closed Friday at $1900.30. This has sent gold ETFs shooting higher, including the Sprott Physical Gold Trust (PHYS) as gold posted a fresh nine-year high this week.

Silver posted a four-year high as futures cleared the $23 price level this week. The Sprott Physical Silver Trust (PSLV) posted a fresh four-year closing high on Friday. While the metals are extended and could pull back at any time in a natural reaction, we believe that longer-term they will move higher. In the meantime, the 10-dma and 20-dema for both PHYS and PSLV were be your first references for potentially buyable pullbacks from here.

In last weekend's Focus List Review we pointed out the U&R long entry signal in the Grayscale Bitcoin Trust (GBTC) as it undercut and rallied through the prior 9.18 low of late June. It has since moved higher, clearing the 200-dma, 20-dema and 10-dma in that order over the past week. The 50-dma presented resistance on Thursday and Friday, but note that the GBTC found support at the 20-dema. We would view pullbacks to the 20-dema as potentially lower-risk entries for the purpose of adding to any position taken on the U&R earlier in the week.

Netflix (NFLX) broke below the $500 Century Mark earlier in the week which could have been used as a tactical short-sale entry using Jesse Livermore's Century Mark Rule in Reverse for the short side. It then breached the 20-dema on Thursday and on Friday rallied back up into the line. This puts the stock in a two-side, or 360-degree position where persistent resistance at the 20-dema or the $500 level makes it a short-sale entry while a move that regains the 20-dema and the $500 level could trigger a moving average undercut & rally type of move. Currently, the 20-dema is only 2% below the $500 Century Mark so one must approach this fluidly based on the real-time evidence going forward.

Tesla (TSLA) topped out on Thursday after gapping higher in the morning following its Wednesday earnings report. This is a similar scenario to what we saw in late February when the stock posted a climax top and then retested the highs to form a small double-top before plummeting some 65% to the downside. That action coincided with the general market top at that time. Now, in July, TSLA has again posted a climax top and tested the prior highs in a litle double-top type of move and has since broken to the downside. It is currently attempting to hold support at the 20-dema. Note that TSLA has held along the 20-dema since early April, so it would serve as a selling guide based on the Seven-Week Rule. That said, those who follow Gil on Twitter know that he pointed out a potential intraday reversal on Thursday above the $1600 level in real-time which could have been sold into. At this point, however, the 20-dema now serves as ultimate support for the stock, and if it cannot hold the line then it could trigger a short-sale entry at that point.

Fortinet (FTNT) illustrates the problem of using moving average violations as sell signals in this market. In this case, note that FTNT violated its 50-dma the prior week, triggering a sell signal based on the Seven-Week Rule. This serves to make the point that no selling guide is perfect. But one has to have a selling guide somewhere if one is going to properly respond to sell-offs in one's positions and thereby employ sound risk-management. It is therefore not a matter of changing the "rules" for the Seven-Week Rule method (which, by the way, is one of several ways to handle risk-management in existing positions as we discuss in our webinars) in order to "adapt." We adapt by employing identifiable long entry set-ups that enable us to get long again if we've been shaken out on a moving average violation without having to wait for a new breakout, which is an entirely outmoded way of buying stocks, frankly.

This is why the U&R long set-up is so useful in a volatile market that loves to shake investors out. After breaking to lower lows last week, FTNT turned back to the upside and triggered a U&R long entry signal through the prior lows of the base. It ran into resistance at the 50-dma mid-week and successfully tested the U&R lows on Friday. If FTNT can hold above those prior lows it may remain viable on the long side if it can also regain the 50-dma in short order.

Lululemon Athletica (LULU), Nvidia (NVDA) and Oracle (ORCL) all found support along their 20-demas on Friday. This puts them in potentially lower-risk entry zones using the 20-dema as a selling guide. If the 20-dema is breached in any of them, however, this could portend further downside particularly within the context of any continuing market pullback or correction.