We have noted many times over the past year that this market operates with a unique and utterly bizarre set of underlying conditions. The effects of 14 years of unlimited money printing and off-the-charts fiscal deficits and national debt have created underlying conditions for which there is zero historical precedent. Thus, this market faces a variety of unknown unknowns that in turn can spawn Black Swans as second- and third-order effects begin to surface, often where nobody expects them.

Such was the case on Thursday when SVB Financial Group (SIVB), parent company of Silicon Valley Bank, and ground zero for the venture capital industry, announced that they were forced to sell low-yielding Treasuries amid a liquidity crunch, taking a nearly $2 billion loss on the position. That sent the stock, which had closed Wednesday at 267.83 down to $106.04 by Thursday's close, and on Friday morning trading was halted at the open after the stock traded down to as low as 33.40 in the pre-open session.

When SVB was acquiring treasuries (mid-2021) at ultra low interest rates, 72% of the Fed presidents said rates would be under 1% in 2023, and 100% said under 1.75%. We are one quarter into 2023 at fed funds rate of 4.75%. With soaring rates, bond values plummet. This is a perfect example of a completely inept and unaccountable institution which has been given a monopoly on money printing in America.

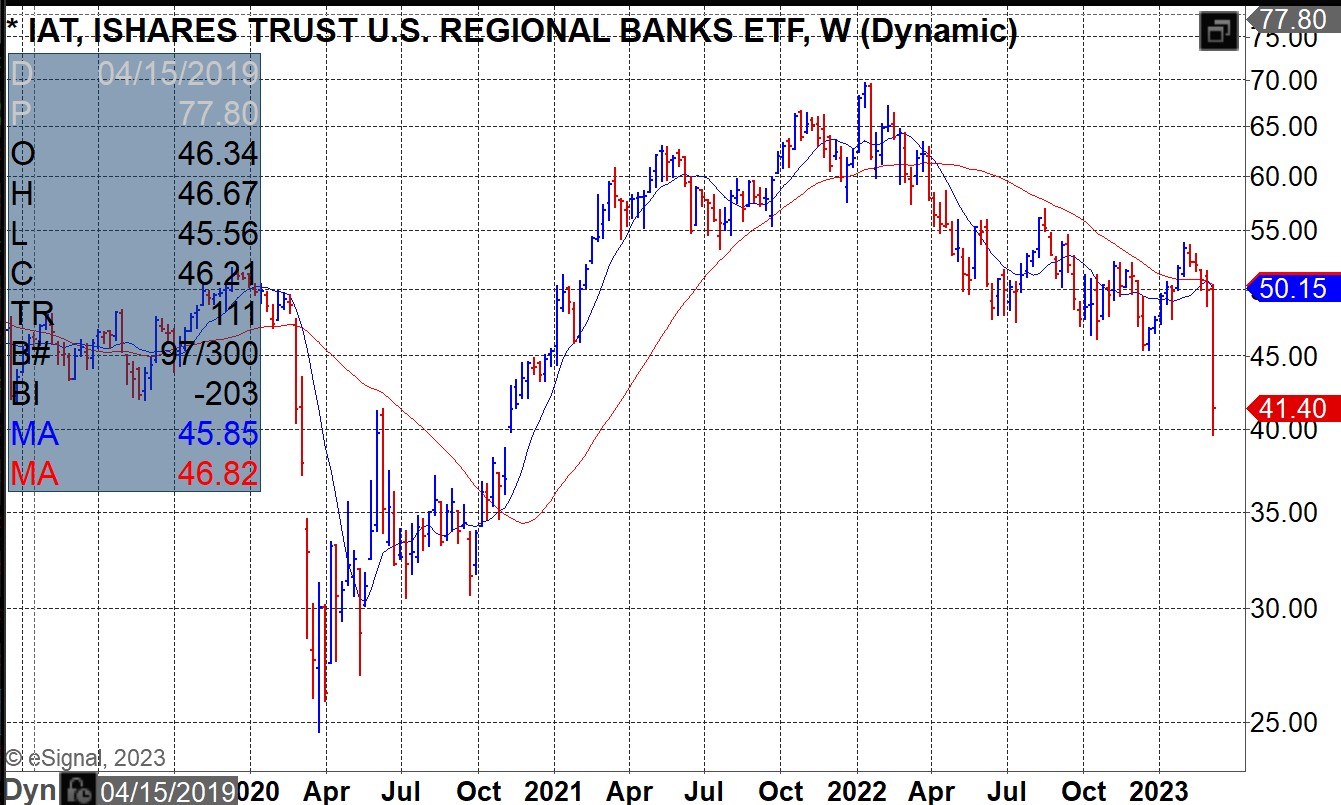

When SVB was acquiring treasuries (mid-2021) at ultra low interest rates, 72% of the Fed presidents said rates would be under 1% in 2023, and 100% said under 1.75%. We are one quarter into 2023 at fed funds rate of 4.75%. With soaring rates, bond values plummet. This is a perfect example of a completely inept and unaccountable institution which has been given a monopoly on money printing in America. Banks are at risk:

Especially the smaller regional banks:

The follow-on effect to SVB are the payment processors who were exposed. They will fail to provide to their thousands of tech companies who won't be able to make payroll to their employees.

Balaji Srinivasan nicely summarizes why SVB happened: 1) First, the state set up fake accounting rules. Those rules allowed banks to tell customers they had money when they did not have money. 2) Next, the Fed suddenly sent interest rates to the sky after years of keeping them near zero, denying inflation was a problem, and/or telling the world inflation was transitory. 3) Finally, banks that bought bonds under the Fed's misleading guidance got rug-pulled. Skyrocketing interest rates meant the government bonds they bought just a few months ago were suddenly far less valuable. So that's why people don't have the money in their SVB accounts. All their capital was used to buy bonds from the government, and the government allows banks to legally lie about this in their accounting. Uncle Sam is the new Sam Bankman-Fried. We cant trust the banks. That's why we need Bitcoin.

In consequence, the Fed just announced they will do SVB bailouts. This will hopefully prevent systemic risk. Depending on the severity of the domino effect that may topple more banks, the Fed may have to launch QE once again much as they did after the 2008 financial collapse or after COVID hit. Both times were the start of major multi-year bull markets. Higher inflation would become the standard as the Fed would be forced to accept a higher inflation target well above 2% which Ray Dalio had predicted in one of his published pieces.

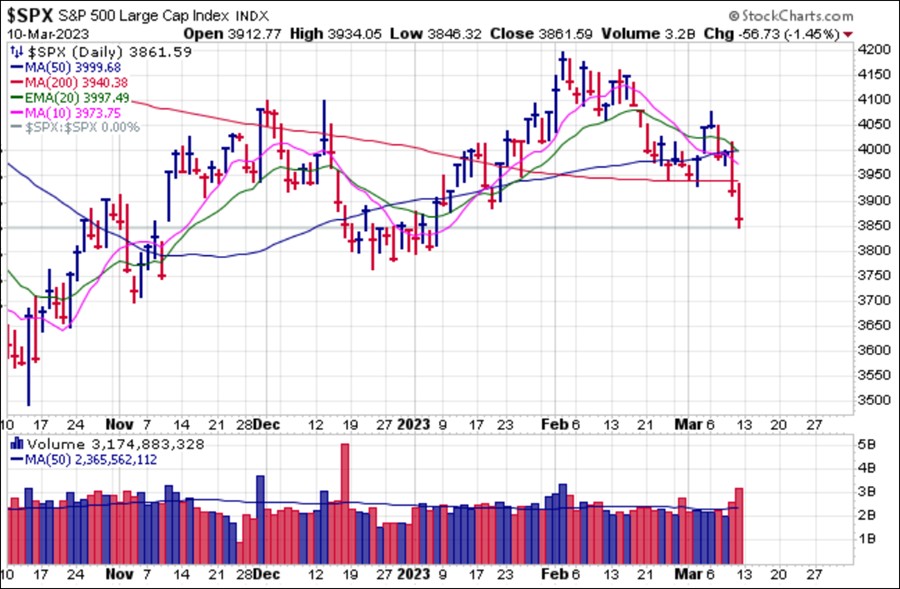

The SIVB news overshadowed the "all-important" Friday jobs number, which suddenly did not seem so important. The number came in at 311,000 vs. expectations of 205,000, but the market focused mainly on the implications of the SIVB debacle. The NASDAQ Composite broke lower to breach its 200-day moving average on Thursday and then its 50-day moving average on Friday.

The S&P 500 busted its 200-dma on Thursday and continued lower on Friday.

Interest rates and the U.S. Dollar as gold and silver rallied on the fear bid. Gold outperformed significantly as the VanEck Merk Gold Trust (OUNZ) posted a massive-volume buyable gap-up and pocket pivot at the 50-dma on Friday.

On Monday we reported on Ford (F) as a short-sale set-up at its 200-day moving average resistance. The stock gave short-sellers two chances to enter a short position, first on Monday and then again on Thursday when the market opened briefly to the upside before breaking sharply lower. F is now extended on the downside, but rallies back up into the 50-dma from here would bring it back into short-sale range so can be watched for.

On Monday we reported on Ford (F) as a short-sale set-up at its 200-day moving average resistance. The stock gave short-sellers two chances to enter a short position, first on Monday and then again on Thursday when the market opened briefly to the upside before breaking sharply lower. F is now extended on the downside, but rallies back up into the 50-dma from here would bring it back into short-sale range so can be watched for.

We continue to maintain what we believe to be the obvious fact that this is NOT a "new bull market" as some would have you believe. The events of this past week illustrate the potential for Black Swans to unexpectedly materialize out of nowhere as second- or third-order effects of off-the-charts monetary and fiscal policy. That is what the most absurd and bizarre set of underlying conditions ever seen in market history will do for you. Take heed.

The Market Direction Model (MDM) remains on a SELL signal.