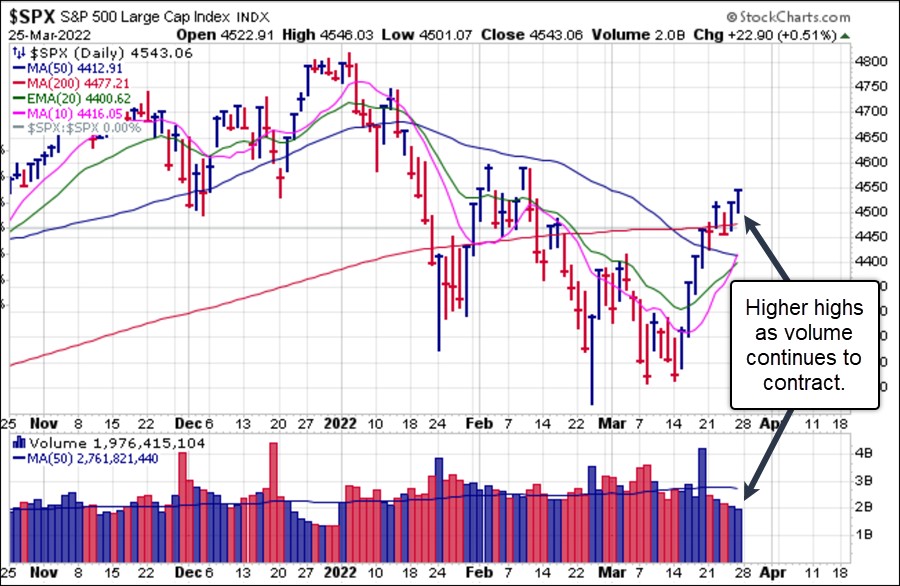

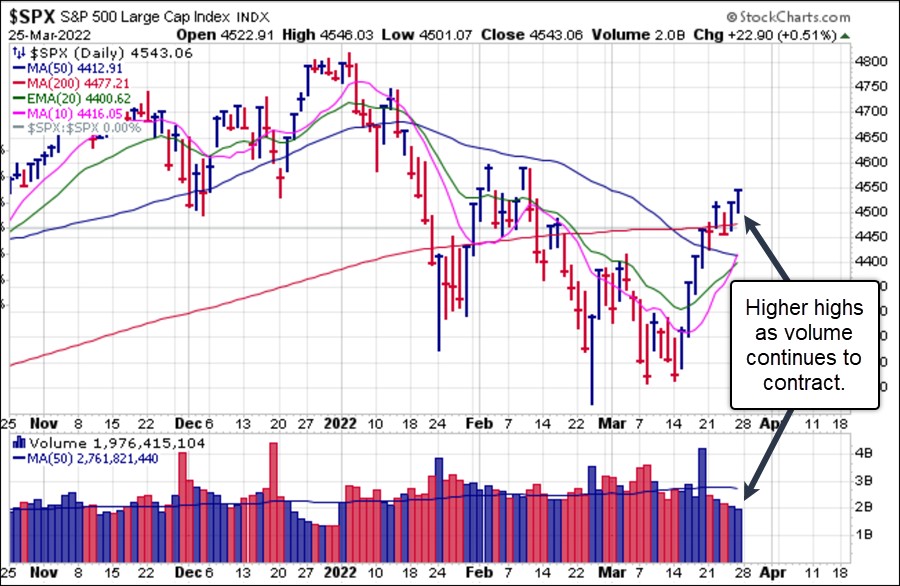

The market rally off the lows of March 15th has taken both the

S&P 500 and

NASDAQ Composite Indexes above their respective 50-day moving averages. The

S&P 500 has also regained its higher 200-day moving average. The rally shows no signs of abating, although higher highs were posted on Friday as volume continues to contract. The S&P 500 is now pushing past its 50-day and 200-day moving averages as it appears to be headed for a test of its early February highs.

The paradox in the market currently is that market-determined interest rates such as the

10-Year Treasury Yield ($TNX) continue to streak higher. The

$TNX reached its highest levels since May of 2019 on Friday, closing the week at 2.492%. So far, this has not weighed on stocks but investors should be alert to this as it may eventually become a factor. One possibility is that as the 10-Year Treasury Yield rises it will attract money out of stocks and back into Treasuries, although that has not been the case so far as Treasury yields streak higher.

We reported earlier in the week on

Advanced Micro Devices (AMD) which posted a pocket pivot at its 50-day moving average on Thursday and then successfully tested the line as volume declined. This remains in a buyable position using the 50-day line as a selling guide.

While we are open to long entry set-ups as they occur in real-time, we remain cautious. The market is fraught with absurdities, and liquidity remains rampant amid an oversold rally in the market and beaten-down former leaders. At the same time, a stealth bull market has existed for several weeks in commodity-related stocks among industrial metals, precious metals, agriculturals, and energy, adding to the bizarre nature of the current market environment. In our view, this is not conducive to trend-following investors, as we tend to favor market environments where one can build positions within a coherent intermediate-term market trend. The current market environment is far too fragmented to be considered optimal for trend-following investors.

The

Market Direction Model (MDM) remains on a

SELL signal.

This information is provided by MoKa Investors, LLC DBA Virtue of Selfish Investing (VoSI) is issued solely for informational purposes and does not constitute an offer to sell or a solicitation of an offer to buy securities. Information contained herein is based on sources which we believe to be reliable but is not guaranteed by us as being accurate and does not purport to be a complete statement or summary of available data. VoSI reports are intended to alert VoSI members to technical developments in certain securities that may or may not be actionable, only, and are not intended as recommendations. Past performance is not a guarantee, nor is it necessarily indicative, of future results. Opinions expressed herein are statements of our judgment as of the publication date and are subject to change without notice. Entities including but not limited to VoSI, its members, officers, directors, employees, customers, agents, and affiliates may have a position, long or short, in the securities referred to herein, and/or other related securities, and may increase or decrease such position or take a contra position. Additional information is available upon written request. This publication is for clients of Virtue of Selfish Investing. Reproduction without written permission is strictly prohibited and will be prosecuted to the full extent of the law. ©2026 MoKa Investors, LLC DBA Virtue of Selfish Investing. All rights reserved.

The paradox in the market currently is that market-determined interest rates such as the 10-Year Treasury Yield ($TNX) continue to streak higher. The $TNX reached its highest levels since May of 2019 on Friday, closing the week at 2.492%. So far, this has not weighed on stocks but investors should be alert to this as it may eventually become a factor. One possibility is that as the 10-Year Treasury Yield rises it will attract money out of stocks and back into Treasuries, although that has not been the case so far as Treasury yields streak higher.

The paradox in the market currently is that market-determined interest rates such as the 10-Year Treasury Yield ($TNX) continue to streak higher. The $TNX reached its highest levels since May of 2019 on Friday, closing the week at 2.492%. So far, this has not weighed on stocks but investors should be alert to this as it may eventually become a factor. One possibility is that as the 10-Year Treasury Yield rises it will attract money out of stocks and back into Treasuries, although that has not been the case so far as Treasury yields streak higher. We reported earlier in the week on Advanced Micro Devices (AMD) which posted a pocket pivot at its 50-day moving average on Thursday and then successfully tested the line as volume declined. This remains in a buyable position using the 50-day line as a selling guide.

We reported earlier in the week on Advanced Micro Devices (AMD) which posted a pocket pivot at its 50-day moving average on Thursday and then successfully tested the line as volume declined. This remains in a buyable position using the 50-day line as a selling guide. While we are open to long entry set-ups as they occur in real-time, we remain cautious. The market is fraught with absurdities, and liquidity remains rampant amid an oversold rally in the market and beaten-down former leaders. At the same time, a stealth bull market has existed for several weeks in commodity-related stocks among industrial metals, precious metals, agriculturals, and energy, adding to the bizarre nature of the current market environment. In our view, this is not conducive to trend-following investors, as we tend to favor market environments where one can build positions within a coherent intermediate-term market trend. The current market environment is far too fragmented to be considered optimal for trend-following investors.

While we are open to long entry set-ups as they occur in real-time, we remain cautious. The market is fraught with absurdities, and liquidity remains rampant amid an oversold rally in the market and beaten-down former leaders. At the same time, a stealth bull market has existed for several weeks in commodity-related stocks among industrial metals, precious metals, agriculturals, and energy, adding to the bizarre nature of the current market environment. In our view, this is not conducive to trend-following investors, as we tend to favor market environments where one can build positions within a coherent intermediate-term market trend. The current market environment is far too fragmented to be considered optimal for trend-following investors.