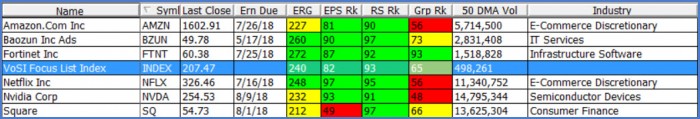

Current Focus List

The VoSI Focus List is a compilation and reference list of stocks for which Pocket Pivot or Buyable Gap-Up Reports have been issued and which have been deemed suitable for inclusion on the Focus List. Not all stocks for which a Pocket Pivot or Buyable Gap-Up report has been issued will necessarily be added to the list. It is not intended as a "buy list" or a list of immediately actionable recommendations. Stocks on the list may or may not be in proper buy positions, and investors should exercise discretion and proper judgement in determining when and where stocks on the Focus List can be purchased. The following notes are intended to assist in this process. Please note that members can enlarge the Focus List image by clicking on the body of the email and then holding the Control Key while pressing the "+" key until it is large enough to read.

General Observations:

The S&P 500 and Dow Jones Industrials have now joined the NASDAQ Composite and Russell 2000 Indexes above their respective 50-dmas. The S&P 500 cleared its April peak on Thursday, but volume was light on the move. The index has successfully tested its 200-dma three times since the sharp "insta-correction" in late January and early February. Overall, the index remains in a broad, choppy range that lends itself to more of a swing-trading rather than a trend-following approach.

Meanwhile, the small-cap Russell 200 Index leads the market as it has now posted a new all-time closing high, but for the most part is simply back at the highs of its own broad, choppy price range extending back to the late January/early February breakdown.

The Market Direction Model (MDM) remains on a cash signal.

Removed from the List this Week: None

Focus List Stocks Expected to Report Earnings this Week: Baozun (BZUN) on Thursday before the open.

Notable Action:

Amazon.com (AMZN) and Netflix (NFLX) are holding in tight ranges near their prior highs. Both stocks pulled slightly lower down towards their 10-dmas pm Friday and should be watched for possible entries at the 10-dma.

Baozun (BZUN) is expected to report earnings on Thursday before the open, and should be watched for any actionable developments following the report.

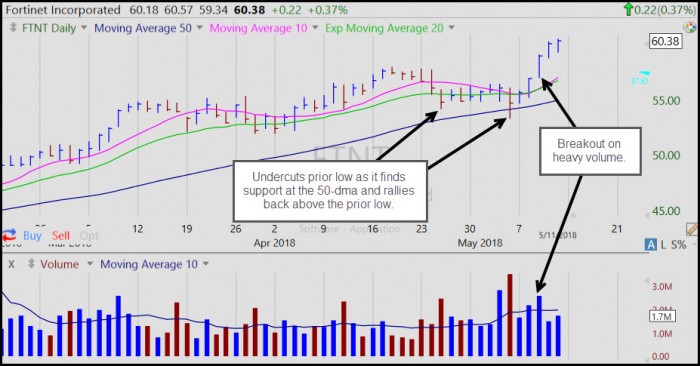

Fortinet (FTNT) rallied sharpl this week to new highs. It is currently one of the primary leaders in the cyber-security space. We discussed this as being buyable last weekend when it had posted an undercut & rally move on the downside break that held support at the 50-dma last Thursday.

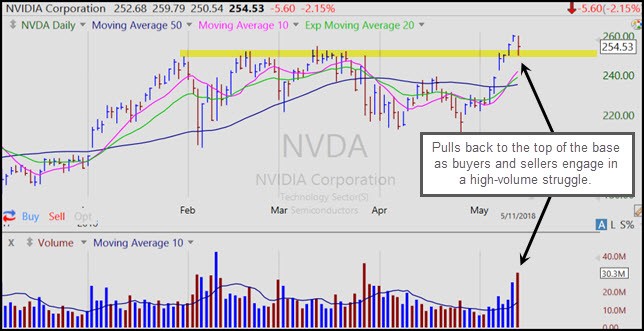

Nvidia (NVDA) reported earnings on Thursday after the close and gapped down, but remains roughly at its prior breakout point. Volume was heavy as buyers and sellers butted heads. This brings the stock into buyable range of the prior base breakout, but given the sharp move up from the lows of the pattern a pullback to the 10-dma is also possible, and should be watched for as the most opportunistic entry point. Otherwise, one could look to buy the stock here and use the 10-dma as a selling guide.

Square (SQ) is back up near its prior highs and is well extended from its 50-dma and the prior pocket pivot we reported on that occurred below the 50-dma on May 3rd. We use pullbacks to the 10-dma as opportunistic entries, otherwise we would look for the 10-dma to eventually catch up to the stock price if SQ continues to hold tight sideways up here.