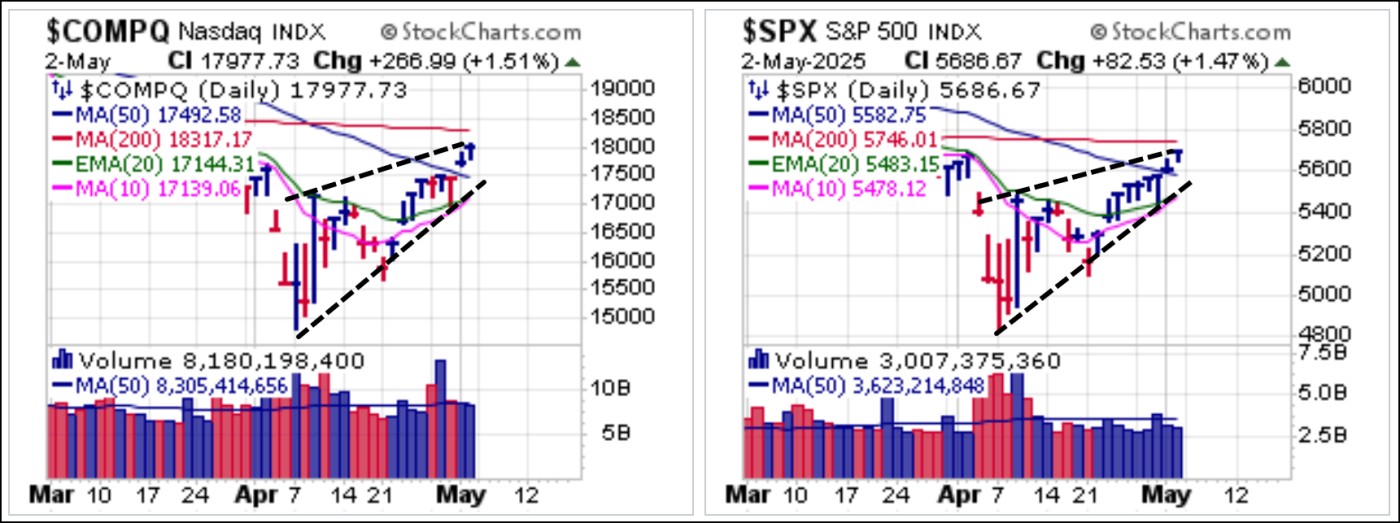

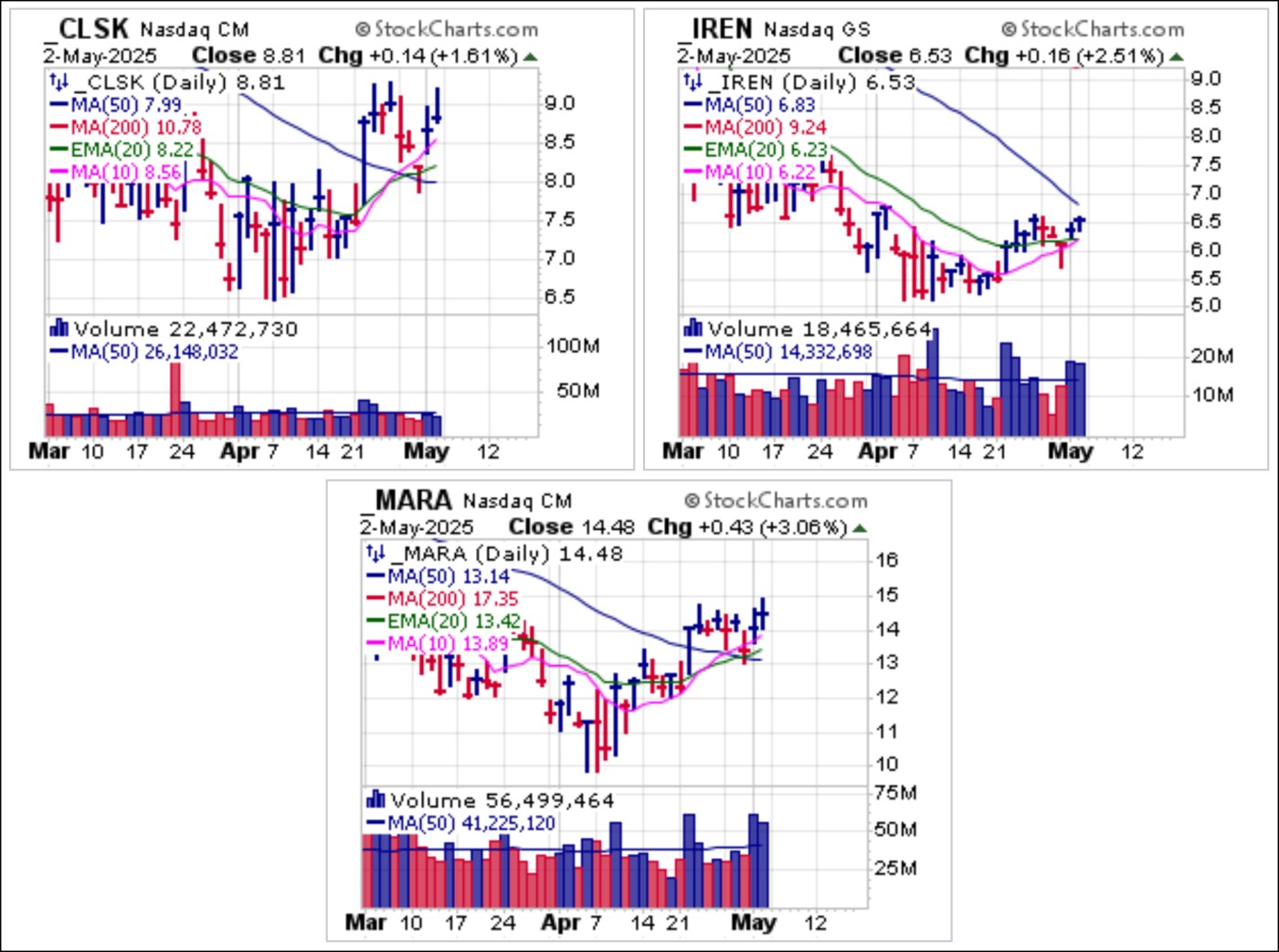

Market indexes continued to rally on hopes of a pivot in the U.S.-China Trade War narrative, pushing the major market indexes through 50-dma resistance and onward, towards 200-dma resistance. In the process the NASDAQ Composite has rallied over 20% above the April 7th intraday low.

Earnings season remains in full bloom, as the last of the big-stock NASDAQ names, Alphabet (GOOGL), Amazon.com (AMZN), Meta Platforms (META), and Apple (AAPL) reporting over the past week with mixed results. AAPL gapped down after earnings and closed below the 20-dema where it may be a potential shortable gap-down (SGU) set-up using the 20-dema as a tight covering guide. AMZN stalled at 50-dma resistance after earnings where it is a potential short-sale entry near the 50-dma which is then used as a selling guide. META and MSFT both played out as big, stalling, tail-up sorts of bottom-fishing buyable gap-up (BFBGU) set-ups using Thursday's intraday low for each as a selling guide. On Thursday, META also looked like a short entry as it reversed at 200-dma resistance, but was able to find its feet and clear the line on Friday.

On Wednesday we reported on a VDU pullback to 10-dma support in quantum computing name IonQ (IONQ). The stock rallied from there and then posted a pocket pivot at the 10-day line on Friday. It is now extended ahead of earnings which are expected this coming Wednesday, May 7th.

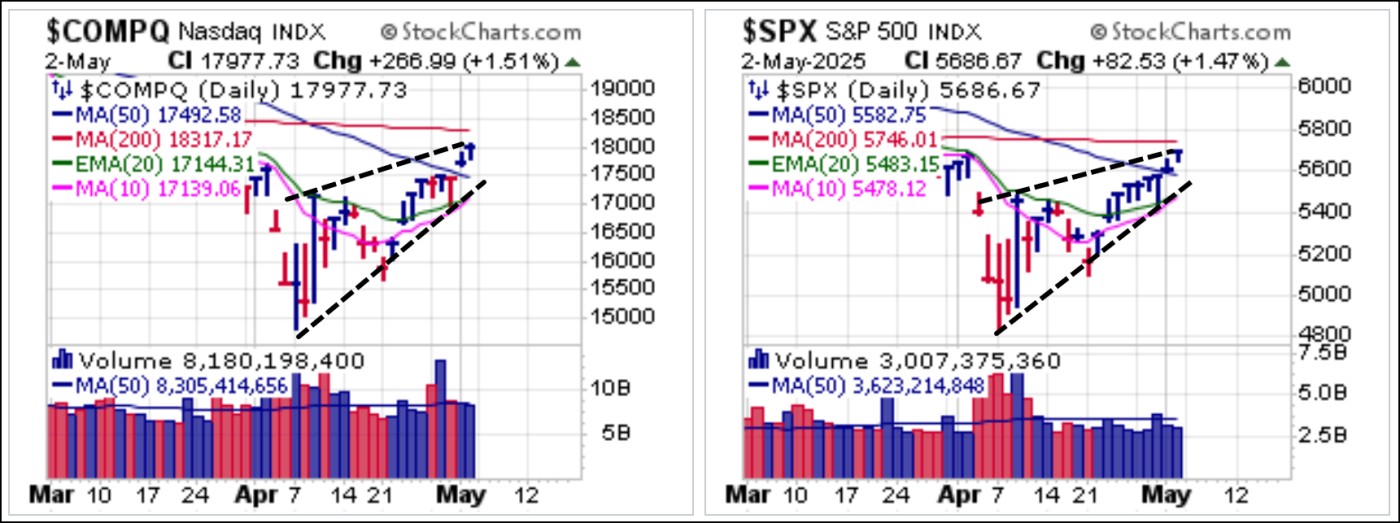

Big-stock names that we will be watching closely this week when they report earnings include Palantir (PLTR) on Monday after the close, Advanced Micro Devices (AMD) and Arista Networks (ANET) on Tuesday after the close, and Arm Holdings (ARM) on Wednesday after the close.

Bitcoin ($BTCUSD) has continued to edge higher with stocks. As we noted last week, it tends to act more like stocks than an alternative currency these days, but that can always change under the right set of underlying conditions. For now, it tends to act like a risk-on asset, but that is good enough for us if it wants to keep rallying as it has posted U&Rs and pocket pivots on the way up as we reported.

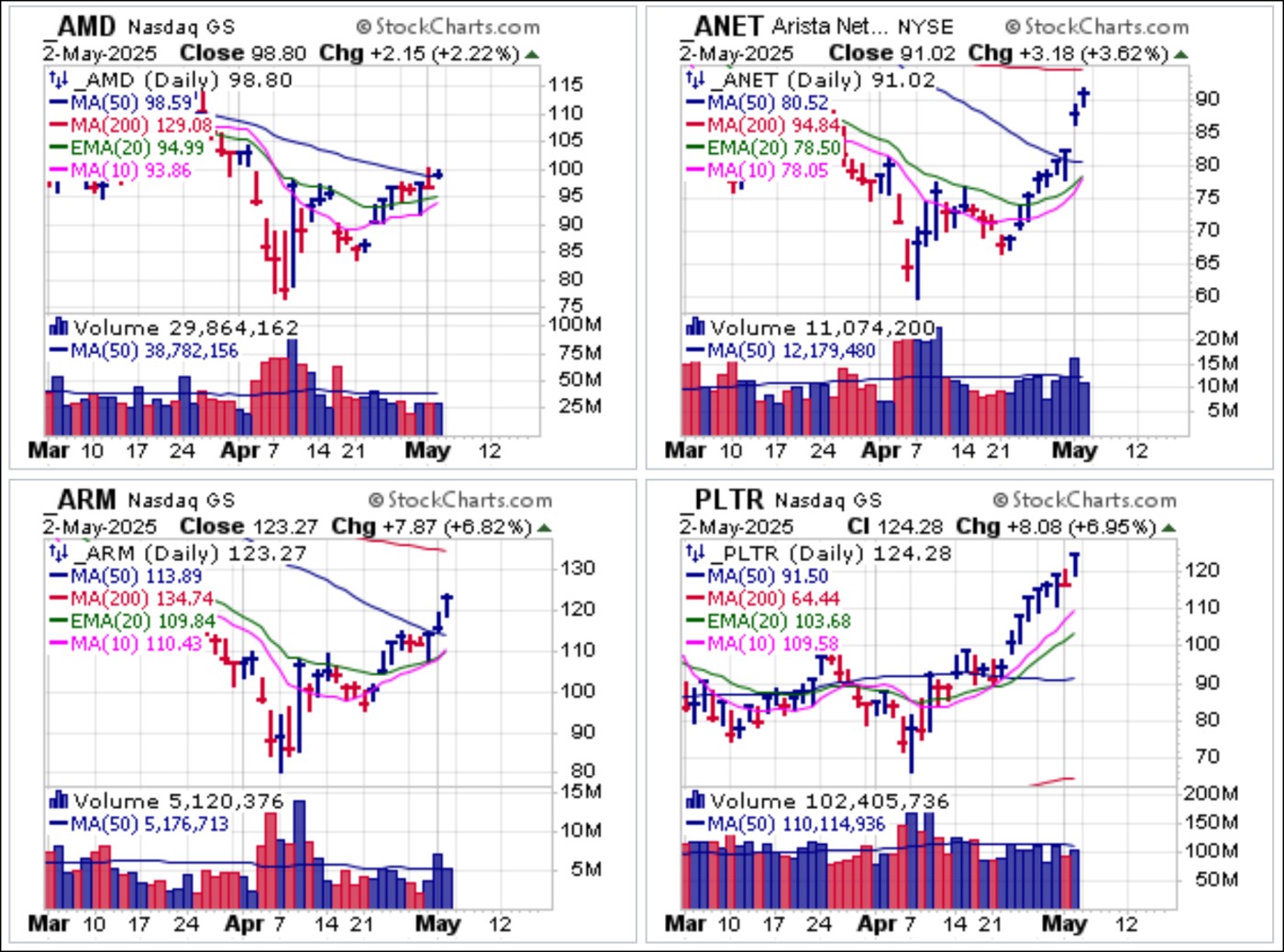

On Thursday we reported on potential pocket pivots in crypto miners CleanSpark (CLSK), IREN Ltd. (IREN), and Marathon Digital Holdings (MARA), all at the 10-dma. Volume levels for CLSK fell short of that required for a pocket pivot on Thursday, but both IREN and MARA posted valid pocket pivots at the 10-dma which is used as a selling guide. Note that CLSK and IREN are expected to report earnings on Wednesday of this week while MARA is expected to report on Thursday.

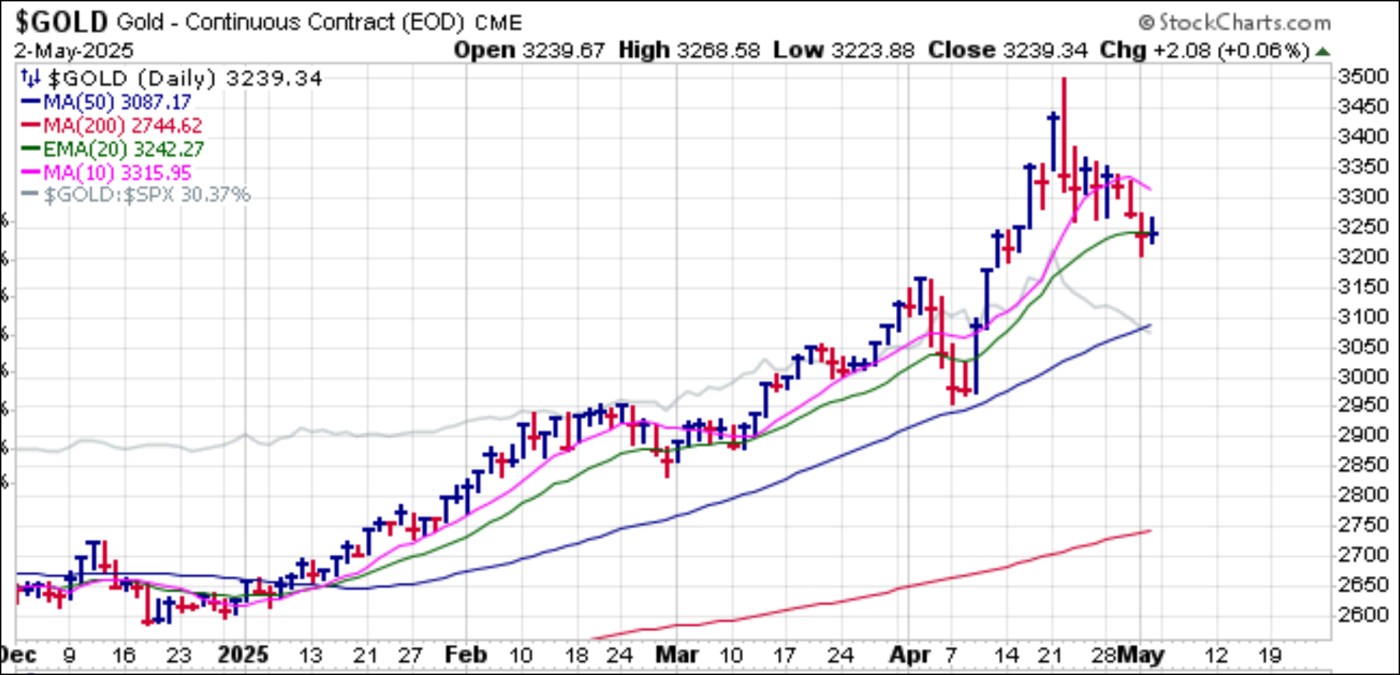

Following a parabolic run past $3500 an ounce, gold is now correcting as would be expected. The yellow metal went on a torrid run in the early part of April, even as stocks bottomed, briefly correlating to stocks until two weeks ago when it cleared $3500, a level that even the most bullish analysts did not expect. Such is the way of analyst calls. Gold has now corrected 7% as it hangs along 20-dema support but could potentially test the 50-day line as it did in early April in an ongoing and perhaps well-deserved consolidation.

Aside from a heavy docket of earnings reports this week, we will also see the latest Fed policy announcement on Wednesday. The Fed is expected to keep rates unchanged, but their comments in the policy statements and during Fed Chair Jerome Powell's ensuing press conference could move the markets.

The Market Direction Model (MDM) switched to a BUY signal on Thursday, May 1, 2025.