Current Focus List

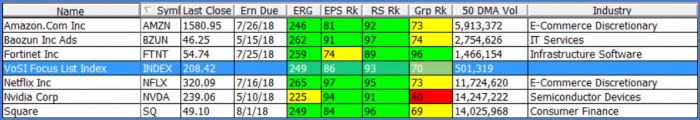

The VoSI Focus List is a compilation and reference list of stocks for which Pocket Pivot or Buyable Gap-Up Reports have been issued and which have been deemed suitable for inclusion on the Focus List. Not all stocks for which a Pocket Pivot or Buyable Gap-Up report has been issued will necessarily be added to the list. It is not intended as a "buy list" or a list of immediately actionable recommendations. Stocks on the list may or may not be in proper buy positions, and investors should exercise discretion and proper judgement in determining when and where stocks on the Focus List can be purchased. The following notes are intended to assist in this process. Please note that members can enlarge the Focus List image by clicking on the body of the email and then holding the Control Key while pressing the "+" key until it is large enough to read.

General Observations:

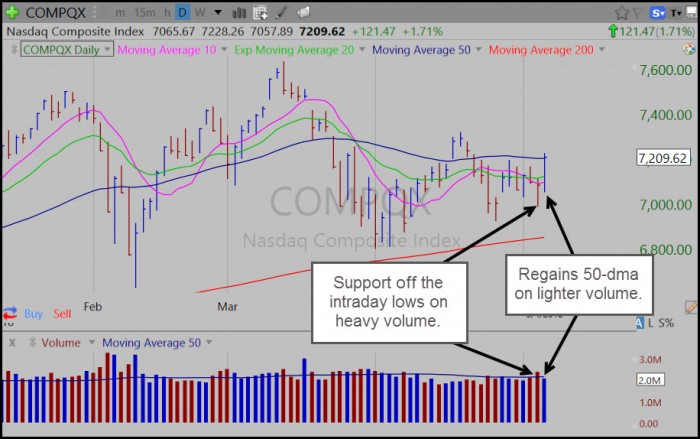

The NASDAQ Composite Index regained its 50-dma on Friday after a sharp shakeout and reversal on Thursday. The indexes have been showing signs of tightening up as the volatility has declined somewhat over the past month. This may set up a more pronounced resolution sooner rather than later. We think it is mostly a matter of keying on individual stocks, many of which appear to be setting up.

The Market Direction Model (MDM) is currently on a sell signal.

Removed from the List this Week: None.

Focus List Stocks Expected to Report Earnings this Week: Nvidia (NVDA), Thursday after the close.

Notable Action:

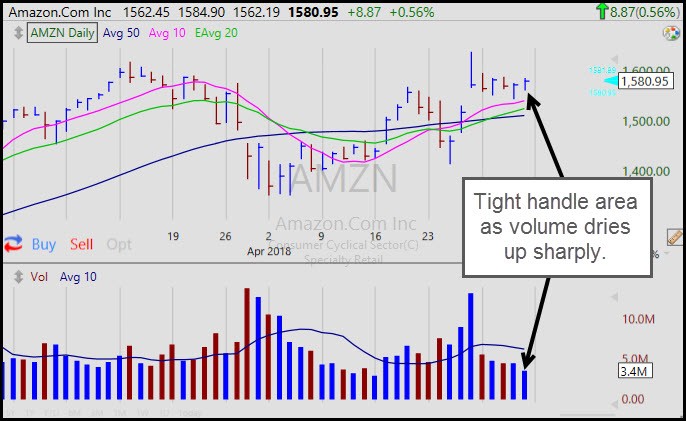

Out of all the stocks that make up the big-cap NASDAQ 100 Index, the three names with the highest RS Rank are: AMZN, NFLX, and NVDA. This is largely why we've kept these names on our Focus List throughout the recent choppy, trendless action. While NVDA awaits earnings this Thursday, both AMZN and NFLX, which have already reported earnings, appear to be setting up for a run at their recent highs.

Amazon.com (AMZN) looks to be holding up in a cup-with-handle formation as it forms a tight handle over the past several days since failing to hold an intraday breakout after earnings. The action here looks constructive, and puts the stock in a buyable position with the idea that it should hold the 10-dma.

Netflix (NFLX) is holding tight in a short eight-week cup-with-handle formation on the weekly chart with supporting action at the 10-week moving average last week. The stock failed on a recent breakout attempt on the daily chart, but notice that on the weekly chart there was no true breakout. The announcement of a $1.5 billion bond offering sent the stock back down below its 10-week line, but it recovered to end the prior week just above the line.

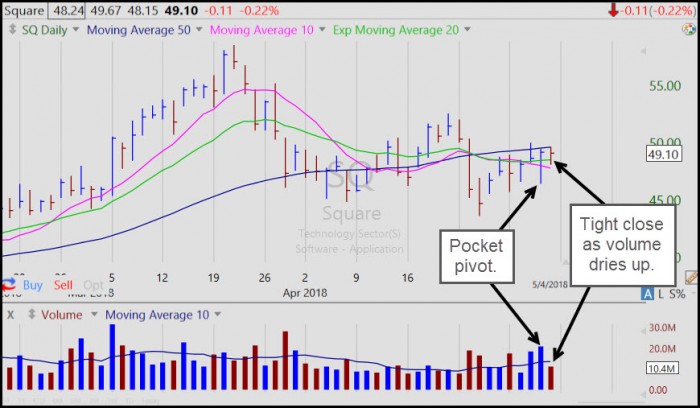

Square (SQ) closed tight on Friday after posting a surprising pocket pivot recovery at the 10-dma on Thursday despite gapping down hard at the open after reporting earnings Wednesday after the close. Note that the stock "violated" its 50-dma two weeks ago, but in this market a 50-dma violation is often a sign of a bottom. As an example, we would note that AMZN violated its 50-dma on April 2nd, SQ appears buyable along the 10-dma and 20-dema with the idea of using these moving averages as selling guides. We would like to see a strong move back up through the 50-dma as confirmation and follow-through to Thursday's pocket pivot.

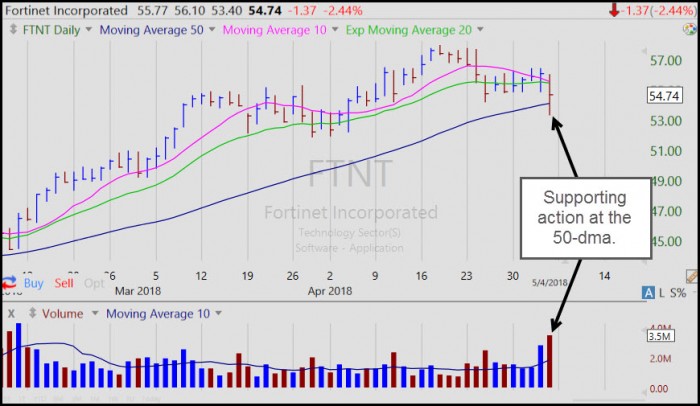

Fortinet (FTNT) sold off after reporting favorable earnings on Thursday after the close. Note the supporting action at the 50-dma on Friday as the stock closed mid-range on very heavy volume. So far, the stock is holding this key level of support, and we would look for some stabilization to occur here if the stock is to recover from Friday's sell-off.