Friday's Bureau of Labor Statistics monthly jobs report disappointed investors fixated on the fantasy that the Fed will soon be pivoting towards an easing stance, despite the parade of Fed Heads out on the speaking circuit over the past week or more insisting that the Fed will continue tor raise rates and then keep them in place in order to quell rampant inflation. Two initial bear legs in the 2022 Bear Market led to a classic bear market rally into the 200-day/40-week moving average by the S&P 500. The index is now on the verge of breaking to lower lows, setting into motion the possibility of a steeper and deeper new bear market leg in a logically broadening chart formation.

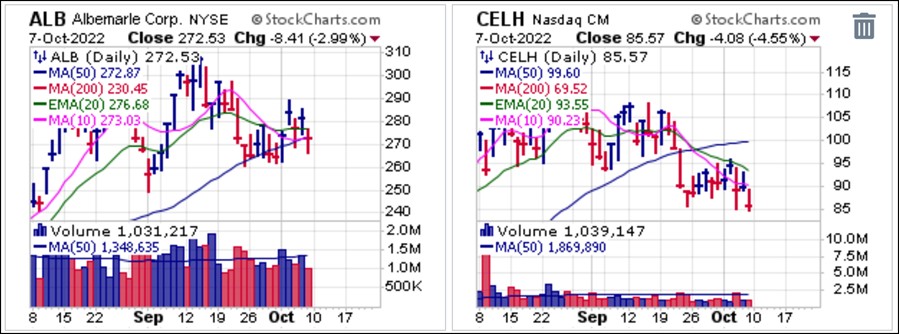

Short-sale targets Albemarle (ALB), a lithium producer, and Celsius Holdings (CELH), a maker of poor-tasting "energy" drinks, remain in play. ALB closed Friday just below its 50-day moving average which puts it in a short-sale entry position using the 50-dma as a covering guide. CELH is a Punchbowl of Death short-sale formation in progress with various short-sale entry triggers along the way. On Friday it posted a lower closing lower after offering short-sellers clean entries along the descending 20-day exponential moving average. It is currently extended on the downside although rallies back up into the 10-dma or 20-dema could bring it back into short-sale range again and can be watched for.

Short-sale targets Albemarle (ALB), a lithium producer, and Celsius Holdings (CELH), a maker of poor-tasting "energy" drinks, remain in play. ALB closed Friday just below its 50-day moving average which puts it in a short-sale entry position using the 50-dma as a covering guide. CELH is a Punchbowl of Death short-sale formation in progress with various short-sale entry triggers along the way. On Friday it posted a lower closing lower after offering short-sellers clean entries along the descending 20-day exponential moving average. It is currently extended on the downside although rallies back up into the 10-dma or 20-dema could bring it back into short-sale range again and can be watched for.

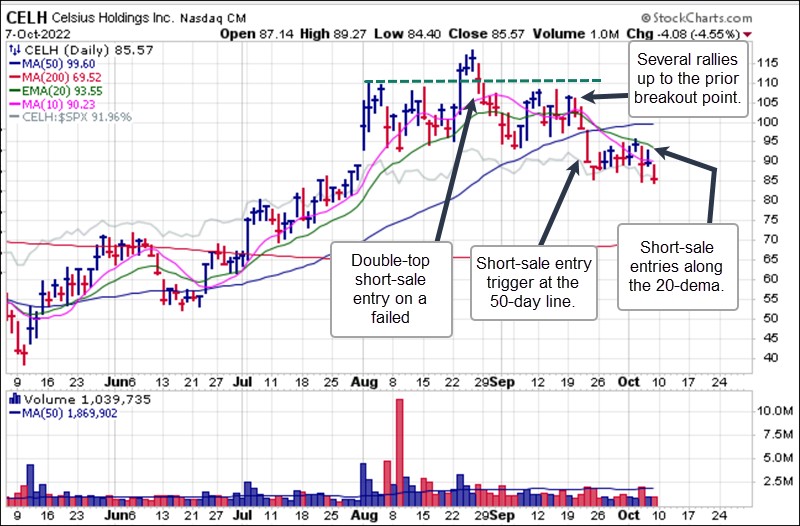

A detailed analysis of CELH shows the various short-sale entry points on the chart as it has evolved into a full-blown POD short-sale set-up. The initial double-top short entry at the highs of the late-stage base in late August was followed by an initial confirmation of a base-failure one the stock busted the 20-dema. That was followed by several rallies just past the 10-dma and 20-dema and up towards the prior breakout point which eventually failed and triggered a short-sale entry as the stock breached the 50-dma two weeks ago. More recently, feeble rallies back up into the 20-dema have presented short-sellers with additional short-sale entries and CELH has now posted its lowest closing low since failing on the August breakout attempt.

First Solar (FSLR) is an unusual punchbowl breakout that never confirmed as a POD short-sale set-up since the stock never violated the 20-dema on the way up. On Tuesday of this past week FSLR attempted a breakout from the mythical, magical "high, tight flag" pattern and failed immediately, triggering a double-top short-sale entry once it broke below the 140.64 mid-point high in the base. That was followed by a breach of the 20-dema on Friday to trigger another short-sale entry. Now, FSLR can be watched for any small rallies back up into the 10-dma/20-dema confluence as potential short-sale entries from here.

First Solar (FSLR) is an unusual punchbowl breakout that never confirmed as a POD short-sale set-up since the stock never violated the 20-dema on the way up. On Tuesday of this past week FSLR attempted a breakout from the mythical, magical "high, tight flag" pattern and failed immediately, triggering a double-top short-sale entry once it broke below the 140.64 mid-point high in the base. That was followed by a breach of the 20-dema on Friday to trigger another short-sale entry. Now, FSLR can be watched for any small rallies back up into the 10-dma/20-dema confluence as potential short-sale entries from here. The coming week will feature the Producer Price and Consumer Price Index reports out on Wednesday and Thursday, respectively. As with Friday's jobs number, these will add fuel to or simply douse the fire of investors' fantasies that the Fed is on the verge of an imminent pivot toward an easing stance once again.

The coming week will feature the Producer Price and Consumer Price Index reports out on Wednesday and Thursday, respectively. As with Friday's jobs number, these will add fuel to or simply douse the fire of investors' fantasies that the Fed is on the verge of an imminent pivot toward an easing stance once again.The Market Direction Model (MDM) remains on a SELL signal.