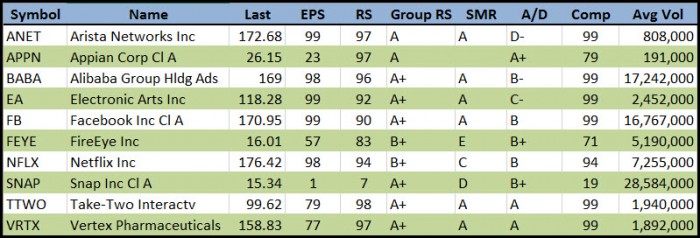

Current Focus List

The VoSI Focus List is a compilation and reference list of stocks for which Pocket Pivot or Buyable Gap-Up Reports have been issued. It is not intended as a "buy list" or a list of immediately actionable recommendations. Stocks on the list may or may not be in proper buy positions, and investors should exercise discretion and proper judgement in determining when and where stocks on the Focus List can be purchased. The following notes are intended to assist in this process. Please note that members can enlarge the Focus List image by clicking on the body of the email and then holding the Control Key while pressing the "+" key until it is large enough to read.

General Observations:

NASDAQ 100 Index names took some heat on Friday as they diverged from the rest of the market and sent the NASDAQ 100 down -0.85% on the day. This contributed to a -0.59% decline in the NASDAQ Composite as it diverged from the Dow Jones Industrials Index, which was up 0.06% and the S&P 500 Index, which was down -0.15% on Friday. Both the broader NYSE Composite Index and the small-cap Russell 2000 Index closed up on Friday in a what was a curious overall divergence.

We believe investors should play their hand close to the vest, seeking to buy stocks ONLY when they pull into areas of logical support while using those same levels of support as tight selling guides. This helps keep risk to a minimum in what is still a choppy, uncertain, and highly news-oriented environment. Chasing strength is not advised.

The Market Direction Model (MDM) moved to a buy signal on Friday, while the VIX Volatility Model (VVM) moved to a provisional sell signal.

Removed from the List this Week: None

Focus List Stocks Expected to Report Earnings this Week: None.

Notable Action:

Arista Networks pulled into its 10-dma on Friday as volume contracted to -61% below average on the day. This would put it in a lower-risk entry position using the 10-dma as a tight selling guide.

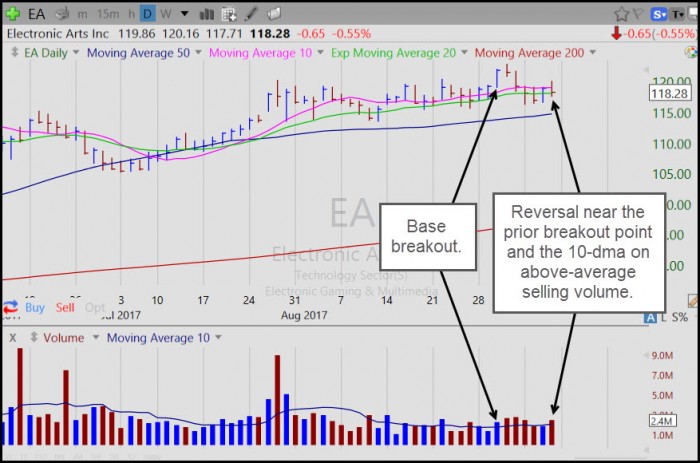

Electronic Arts (EA) is starting to look a bit failure-prone as it fails to hold its prior pocket pivot breakout of seven trading days ago on the chart below.

Facebook (FB) was added to the Focus List on Thursday by virtue of its pocket pivot on that day. On Friday the stock pulled into its 10-dma as volume declined to -35% below average, just enough to qualify as a "voodoo" pullback. This puts the stock in a lower-risk entry position using the 10-dma as a tight selling guide or the 20-dema.

Fireeye (FEYE) was added to the Focus List on Thursday after posting a buyable gap-up move using the 15.45 intraday low as a selling guide. The stock is slightly extended from that price level, so pullbacks closer to the 15.45 price level would offer lower-risk entries from here, in our view.

Netflix (NFLX) pulled back on Friday but remains slightly above its 10-dma as volume declined to -37% below average. We would prefer to look for a further pullback into the 10-dma as your best, lower-risk entry opportunity, while using the 10-dma as a selling guide.

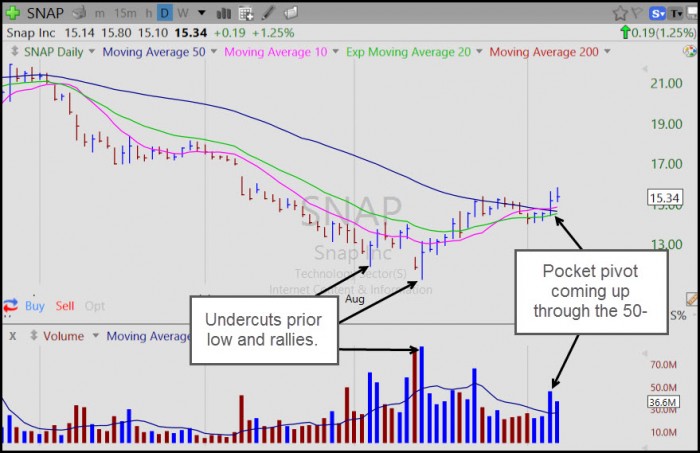

Snap (SNAP) is an Ugly Duckling situation that was added to the Focus List on Thursday after it posted a roundabout type of pocket pivot coming back up through its 50-dma. Pullbacks closer to the 50-dma would offer lower-risk entry opportunities, with the idea of using the line as a tight selling guide.

Vertex Pharmaceuticals (VRTX) has pulled back into its 10-dma as volume declined to -45% below-average on Friday. This puts the stock in a lower-risk entry position using the 10-dma or the 20-dema as reasonably tight selling guides.