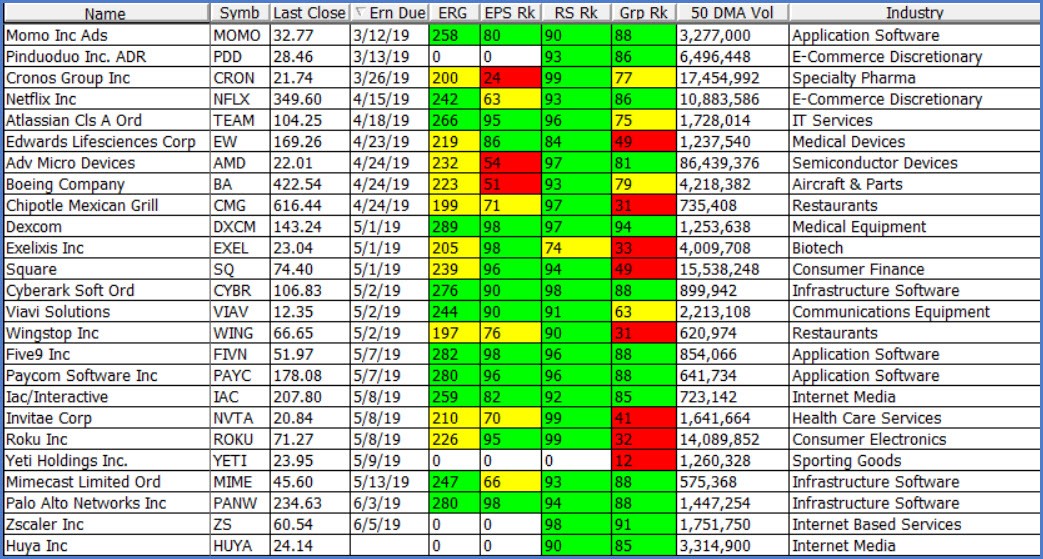

Current Report Watch List

The list above is a compilation and reference list of stocks for which Pocket Pivot or Buyable Gap-Up Reports have been issued since last December and which are still considered active. It is not intended as a "buy list" or a list of immediately actionable recommendations. Stocks on the list may or may not be in proper buy positions, and investors should exercise discretion and proper judgement in determining when and where stocks on the list can be purchased as well as appropriate stop/loss and trailing stop/loss points on the charts. The following notes are intended to assist in this process. Please note that members can enlarge the list image by clicking on the body of the email and then holding the Control Key while pressing the "+" key until it is large enough to read.

General Observations:

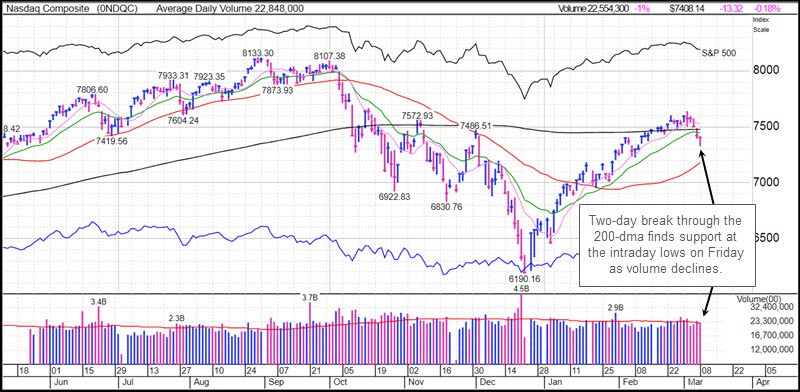

All the major market indexes except the Dow Jones Industrials are now trading below their 200-day moving averages. The NASDAQ Composite and the S&P 500 Indexes broke below their 200-day moving averages on Thursday, while the small-cap Russell 2000 Index broke below its 200-day line on Monday. It had already been having trouble holding above the line the previous week.

The market weakness throughout the week was capped off by a very weak Bureau of Labor Statistics new jobs number of 20,000, as well as weak economic data coming out of China overnight on Thursday. Fuel was added to the fire by news that the U.S.-China trade talks are still far from producing a viable agreement. However, after gapping down sharply at the open on Friday, the indexes quickly found their feet and slowly levitated from there, retracing most of their early losses. The NASDAQ Composite, which was down over -1% at the lows of the day ended the day down -0.18%. The action had the feel of a low-volume shakeout, but the S&P and NASDAQ will have to eventually regain their 200-day moving averages if the rally is to resume.

The Market Direction Model (MDM) remains on a buy signal.

Stocks Expected to Report Earnings this Week: Momo (MOMO) on Tuesday before the open and Pinduoduo (PDD) on Wednesday before the open.

Notable Action:

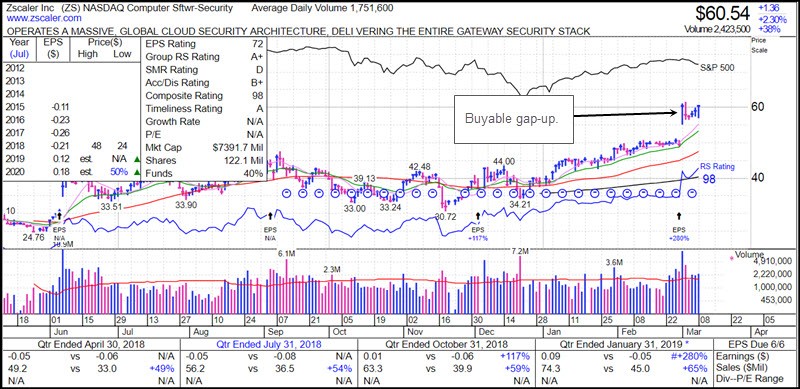

ZScaler (ZS) was reported on this past Monday as an actionable buyable gap-up (BGU) as it pulled in close to the low of last Friday's gap-up move following earnings. The intraday low of the BGU price range is 55.30, and the stock was within 3% of that on Monday. It has since moved back up to the BGU highs and is extended. It has held up well over the past week as the market has declined.

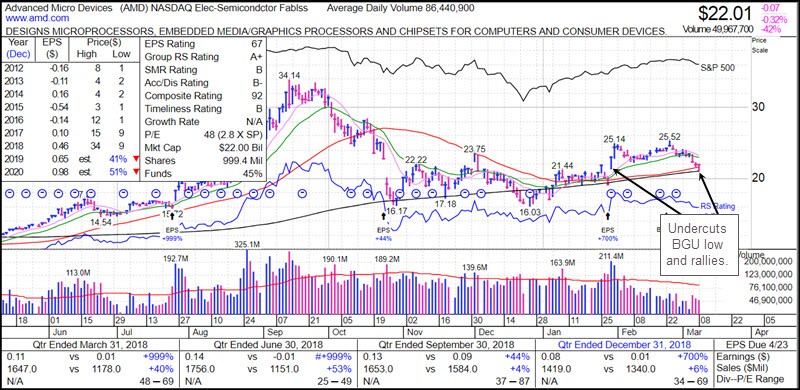

Advanced Micro Devices dropped below the 21.37 of its late January BGU after earnings and closed above the line. This trigger an undercut & rally buy point on Friday using the 21.37 low or the 200-dma as a selling guide.

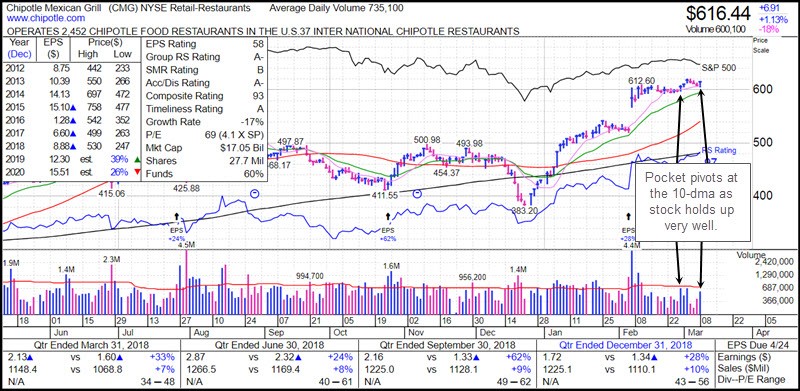

Chipotle Mexican Grill (CMG) has continued to act well and is tracking tight sideways along its 10-dma. The stock posted a pocket pivot at its 10-dma two Thursdays ago and another one on Friday. Overall CMG has held tight although it has not made much upside progress since its buyable gap-up after earnings four weeks ago, but held tight over this past week as the general market pulled back. This constructive, tight action may indicate it is ready to spring higher if the market recovers.

Stocks on the list pulling into or holding along their 20-demas: Boeing (BA), Cronos Group (CRON), Exelixis (EXEL), Huya (HUYA),

Stocks on the list pulling into support or holding at their 50-dmas: Advanced Micro Devices (AMD) and Dexcom (DXCM).