Oracle (ORCL) failed to hold its BGU low at 312.09, failing the next day after posting a BGU following earnings on Tuesday afternoon. The BGU failed the very next day, on Thursday, as the stock broke below the 312.09 intraday low of Wednesday's BGU price range. ORCL then went on to trigger a Jesse Livermore Century Mark Short-Sale entry as it reversed back below the $300 price level. ORCL underscores the difficulty in finding fresh set-ups that work in this market. As we noted last week, often it can seem as if identifying actionable set-ups that work has become very much like throwing mud at the wall and hoping something sticks.

Oracle (ORCL) failed to hold its BGU low at 312.09, failing the next day after posting a BGU following earnings on Tuesday afternoon. The BGU failed the very next day, on Thursday, as the stock broke below the 312.09 intraday low of Wednesday's BGU price range. ORCL then went on to trigger a Jesse Livermore Century Mark Short-Sale entry as it reversed back below the $300 price level. ORCL underscores the difficulty in finding fresh set-ups that work in this market. As we noted last week, often it can seem as if identifying actionable set-ups that work has become very much like throwing mud at the wall and hoping something sticks. Many AI-related tech names also rallied on the ORCL earnings news, with some starting to falter on Friday, such as Arista Networks (ANET) and F5 Networks (FFIV), both of which triggered double-top short-sale (DTSS) entries as they failed on recent breakouts and dropped below the left-side peaks of cup formations. Cisco Systems (CSCO) had triggered a short-sale entry at the 50-dma on Thursday as it reversed at the line and then traded lower again on Friday.

Many AI-related tech names also rallied on the ORCL earnings news, with some starting to falter on Friday, such as Arista Networks (ANET) and F5 Networks (FFIV), both of which triggered double-top short-sale (DTSS) entries as they failed on recent breakouts and dropped below the left-side peaks of cup formations. Cisco Systems (CSCO) had triggered a short-sale entry at the 50-dma on Thursday as it reversed at the line and then traded lower again on Friday. That said, there are still several AI-related names holding up, at least for now. From a VoSI perspective, one only needed to be long IREN Ltd. (IREN), a crypto miner that is pivoting its business towards low-cost Data Center infrastructure solutions. We originally reported on IREN as a pocket pivot along the $10 level back in early June and the stock has move than tripled since then. More recently, as the stock was hanging around in the $20 price area, we note that the 18-times forward PE made IREN less vulnerable to correction as a result of an extreme PE-expansion, and so far that has held true.

That said, there are still several AI-related names holding up, at least for now. From a VoSI perspective, one only needed to be long IREN Ltd. (IREN), a crypto miner that is pivoting its business towards low-cost Data Center infrastructure solutions. We originally reported on IREN as a pocket pivot along the $10 level back in early June and the stock has move than tripled since then. More recently, as the stock was hanging around in the $20 price area, we note that the 18-times forward PE made IREN less vulnerable to correction as a result of an extreme PE-expansion, and so far that has held true. Gold continues to post all-time highs with Spot Gold ending the week at $3,642.37 an ounce. COMEX Futures SPDR Gold Trust (GLD) ended the week at $3,680.70 an ounce after reaching an all-time intraday high of $3,715.20 an ounce, clearing the $3,700 level for the first time in history. We discussed the tight action in gold back in mid-September in this report, noting that it appeared to be coiling for a breakout, and it has not disappointed as it continue to post new highs.

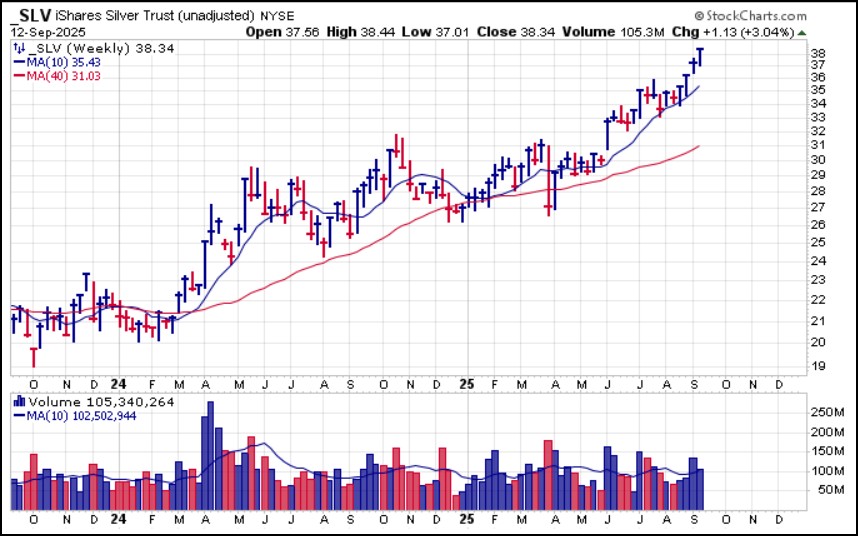

Gold continues to post all-time highs with Spot Gold ending the week at $3,642.37 an ounce. COMEX Futures SPDR Gold Trust (GLD) ended the week at $3,680.70 an ounce after reaching an all-time intraday high of $3,715.20 an ounce, clearing the $3,700 level for the first time in history. We discussed the tight action in gold back in mid-September in this report, noting that it appeared to be coiling for a breakout, and it has not disappointed as it continue to post new highs. Spot silver ended the week at 14-year highs, closing Friday at $42.16 an ounce. COMEX Silver Futures ended the week at $42.16 an ounce after peaking at $43.04 an ounce and clearing the $43.00 an ounce level for the first time since September 5, 2011. We remember that time well since we played the long side of silver as it streaked up towards the $50.00 level in early 2011, enabling our hedge fund at the time to post triple-digit returns for the year. The iShares Silver Trust (SLV) closed a dime below Friday's intraday high as it posted its second week of upside after breaking out from a short five-week flag formation in late August.

Spot silver ended the week at 14-year highs, closing Friday at $42.16 an ounce. COMEX Silver Futures ended the week at $42.16 an ounce after peaking at $43.04 an ounce and clearing the $43.00 an ounce level for the first time since September 5, 2011. We remember that time well since we played the long side of silver as it streaked up towards the $50.00 level in early 2011, enabling our hedge fund at the time to post triple-digit returns for the year. The iShares Silver Trust (SLV) closed a dime below Friday's intraday high as it posted its second week of upside after breaking out from a short five-week flag formation in late August. The optimal long entry in silver was discussed in this report when it was previously named the Focus List Report when silver posted an actionable MAU&R on August 15th. At that time silver Spot Silver was trading at $38.00 an ounce.

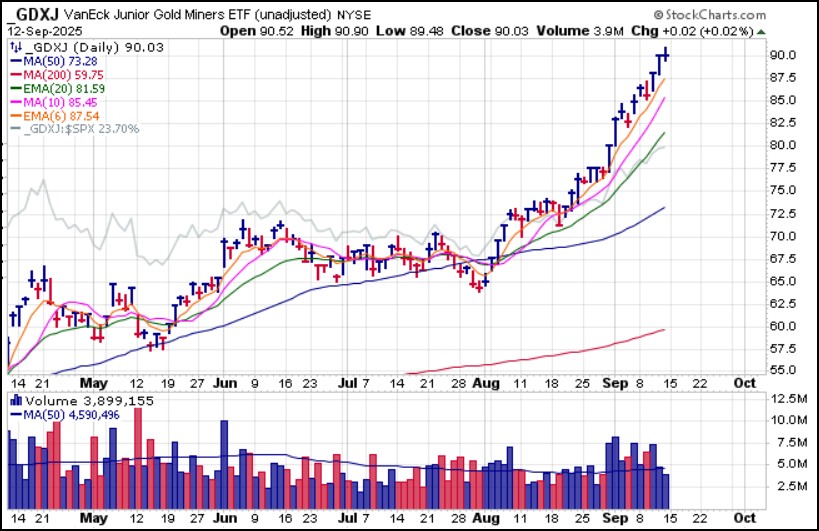

The optimal long entry in silver was discussed in this report when it was previously named the Focus List Report when silver posted an actionable MAU&R on August 15th. At that time silver Spot Silver was trading at $38.00 an ounce. Gold miners follow gold's lead, with many gold miners posting all-time or new 52-week highs or better. The VanEck Junior Gold Miners (GDXJ) ETF expresses the extreme outperformance of the group as it trends sharply higher and along the steeply rising 6-day exponential moving average.

Gold miners follow gold's lead, with many gold miners posting all-time or new 52-week highs or better. The VanEck Junior Gold Miners (GDXJ) ETF expresses the extreme outperformance of the group as it trends sharply higher and along the steeply rising 6-day exponential moving average. Silver miners also continue to trend sharply higher. The Amplify Junior Silver Miners (SILJ) ETF, like the GDXJ, continues to trend along the steeply rising 6-day exponential moving average (6-dema). At some point, the group will correct and consolidate these tremendous price gains as they potentially begin building new bases at higher levels, but for now the sharp trends in gold and silver miners remain in force.

Silver miners also continue to trend sharply higher. The Amplify Junior Silver Miners (SILJ) ETF, like the GDXJ, continues to trend along the steeply rising 6-day exponential moving average (6-dema). At some point, the group will correct and consolidate these tremendous price gains as they potentially begin building new bases at higher levels, but for now the sharp trends in gold and silver miners remain in force. Bitcoin ($BTCUSD) has regained its 50-dma, but has not done so while posting pocket pivots, and it spent far too much time to trigger a moving average undercut & rally (MAU&R) at the 50-day line. That said, volume has been above average on the move back above the 50-dma. It would be constructive to see $BTCUSD hold 50-dma support on any pause as we see so far this weekend.

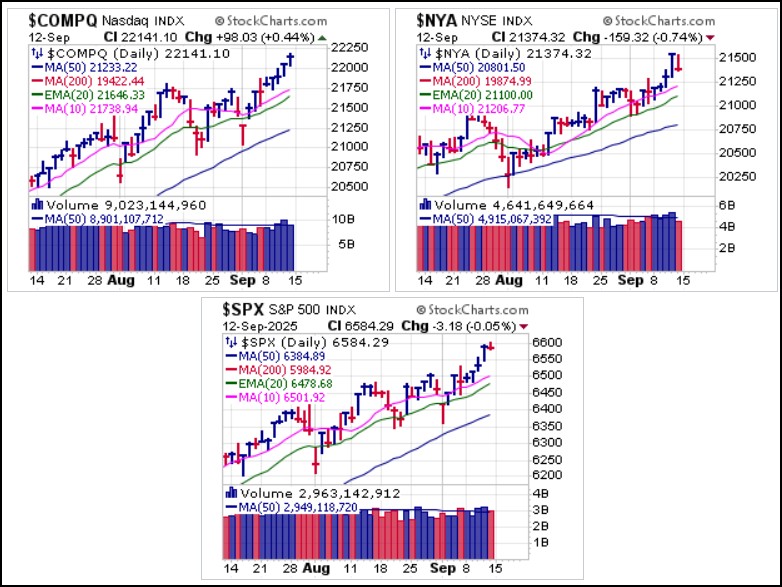

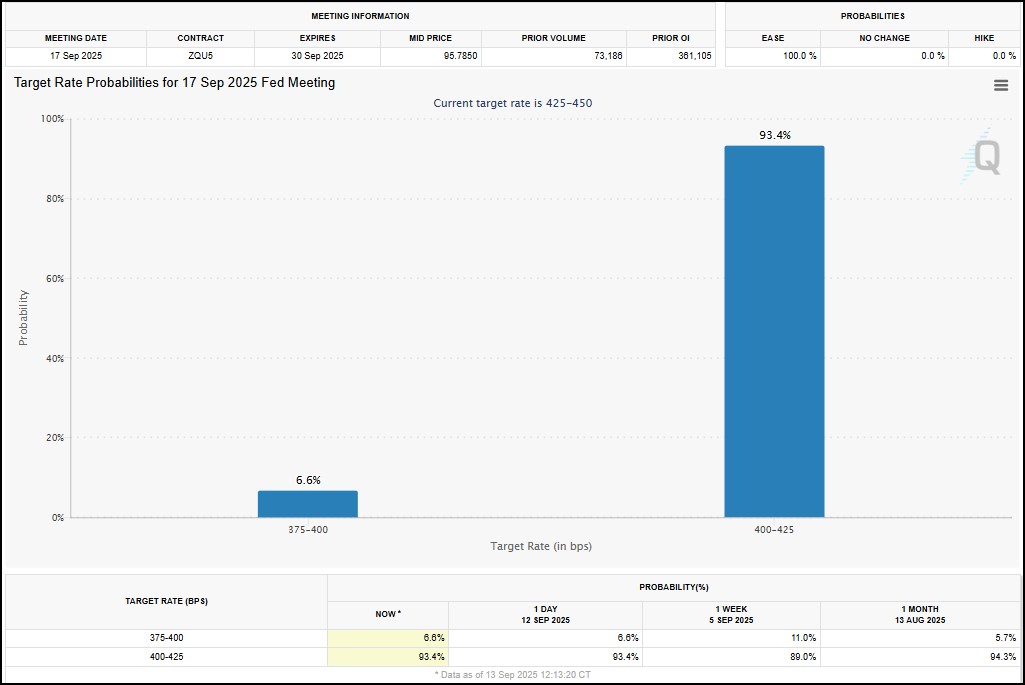

Bitcoin ($BTCUSD) has regained its 50-dma, but has not done so while posting pocket pivots, and it spent far too much time to trigger a moving average undercut & rally (MAU&R) at the 50-day line. That said, volume has been above average on the move back above the 50-dma. It would be constructive to see $BTCUSD hold 50-dma support on any pause as we see so far this weekend. The latest Fed policy announcement will be out on Wednesday, and currently Fed Funds Futures traders are pricing in a 93.4% probability of a 1/4% rate cut and a 6.6% probability of a 1/2% rate cut. Market analysts and punditry have cited recently weak employment data as they argue for a 1/2% rate cut on Wednesday. Whatever the Fed does, expect plenty of volatility in either direction whether they cut 1/4% or 1/2%. This has changed from Friday when these odds showed a 3% higher 96.4% chance of a 1/4% rate cut and 3% lower 3.6% chance of a 1/2% rate cut.

The latest Fed policy announcement will be out on Wednesday, and currently Fed Funds Futures traders are pricing in a 93.4% probability of a 1/4% rate cut and a 6.6% probability of a 1/2% rate cut. Market analysts and punditry have cited recently weak employment data as they argue for a 1/2% rate cut on Wednesday. Whatever the Fed does, expect plenty of volatility in either direction whether they cut 1/4% or 1/2%. This has changed from Friday when these odds showed a 3% higher 96.4% chance of a 1/4% rate cut and 3% lower 3.6% chance of a 1/2% rate cut. For this reason we advise keeping plenty of dry powder available as opportunities may arise while reviewing risk-management strategies for any long positions currently held. Making fresh commitments of capital ahead of the Fed meeting carries the risk of quick failure depending on how the market reacts to Wednesday's Fed policy announcement.

For this reason we advise keeping plenty of dry powder available as opportunities may arise while reviewing risk-management strategies for any long positions currently held. Making fresh commitments of capital ahead of the Fed meeting carries the risk of quick failure depending on how the market reacts to Wednesday's Fed policy announcement.The Market Direction Model remains on a BUY signal.